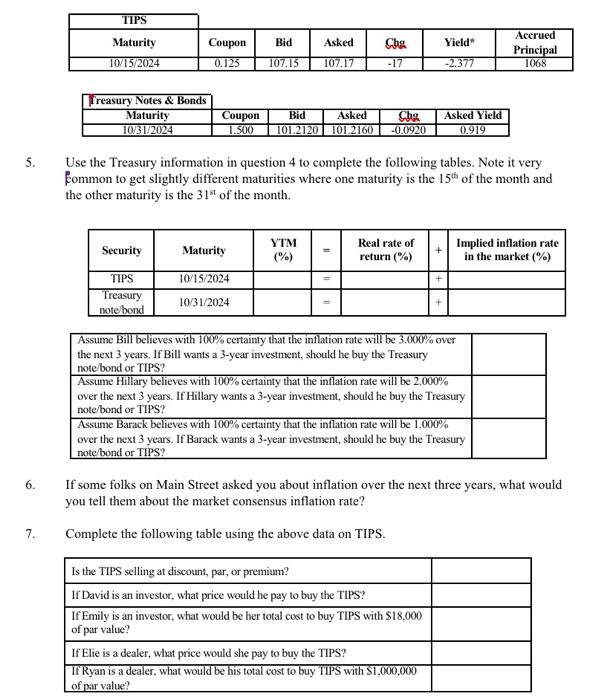

TIPS Bid Asked Yield Maturity 10/15/2024 Coupon 0.125 Accrued Principal 1068 107.15 107.17 -17 -2.377 Treasury Notes & Bonds Maturity 10/31/2024 Bid Coupon 1.500 Asked Cha 1012120 1012160 -0.0920 Asked Yield 0919 5. Use the Treasury information in question 4 to complete the following tables. Note it very fcommon to get slightly different maturities where one maturity is the 15th of the month and the other maturity is the 31" of the month. Security Maturity YTM (%) Real rate of return (%) Implied inflation rate in the market (%) 10/15/2024 TIPS Treasury notebond 10/31/2024 Assume Bill believes with 100% certainty that the inflation rate will be 3.000% over the next 3 years. If Bill wants a 3-year investment, should he buy the Treasury note bond or TIPS? Assume Hillary believes with 100% certainty that the inflation rate will be 2.000% over the next 3 years. If Hillary wants a 3-year investment, should he buy the Treasury note/bond or TIPS? Assume Barack believes with 100% certainty that the inflation rate will be 1.000% over the next 3 years. If Barack wants a 3-year investment, should he buy the Treasury note bond or TIPS? 6. If some folks on Main Street asked you about inflation over the next three years, what would you tell them about the market consensus inflation rate? 7. Complete the following table using the above data on TIPS. Is the TIPS selling at discount, par, or premium? If David is an investor, what price would he pay to buy the TIPS? If Emily is an investor, what would be her total cost to buy TIPS with $18.000 of par value? If Elie is a dealer, what price would she pay to buy the TIPS? If Ryan is a dealer, what would be his total cost to buy TIPS with $1,000,000 of par value? TIPS Bid Asked Yield Maturity 10/15/2024 Coupon 0.125 Accrued Principal 1068 107.15 107.17 -17 -2.377 Treasury Notes & Bonds Maturity 10/31/2024 Bid Coupon 1.500 Asked Cha 1012120 1012160 -0.0920 Asked Yield 0919 5. Use the Treasury information in question 4 to complete the following tables. Note it very fcommon to get slightly different maturities where one maturity is the 15th of the month and the other maturity is the 31" of the month. Security Maturity YTM (%) Real rate of return (%) Implied inflation rate in the market (%) 10/15/2024 TIPS Treasury notebond 10/31/2024 Assume Bill believes with 100% certainty that the inflation rate will be 3.000% over the next 3 years. If Bill wants a 3-year investment, should he buy the Treasury note bond or TIPS? Assume Hillary believes with 100% certainty that the inflation rate will be 2.000% over the next 3 years. If Hillary wants a 3-year investment, should he buy the Treasury note/bond or TIPS? Assume Barack believes with 100% certainty that the inflation rate will be 1.000% over the next 3 years. If Barack wants a 3-year investment, should he buy the Treasury note bond or TIPS? 6. If some folks on Main Street asked you about inflation over the next three years, what would you tell them about the market consensus inflation rate? 7. Complete the following table using the above data on TIPS. Is the TIPS selling at discount, par, or premium? If David is an investor, what price would he pay to buy the TIPS? If Emily is an investor, what would be her total cost to buy TIPS with $18.000 of par value? If Elie is a dealer, what price would she pay to buy the TIPS? If Ryan is a dealer, what would be his total cost to buy TIPS with $1,000,000 of par value