Question

Tipton Processing maintains its internal inventory records using average cost under a perpetual inventory system. The following information relates to its inventory during the year:

Tipton Processing maintains its internal inventory records using average cost under a perpetual inventory system. The following information relates to its inventory during the year:

| Jan. | 1 | Inventory on hand91,000 units; cost $4.00 each. | ||

| Feb. | 14 | Purchased 109,000 units for $5.00 each. | ||

| Mar. | 5 | Sold 161,000 units for $14.00 each. | ||

| Aug. | 27 | Purchased 61,000 units for $6.00 each. | ||

| Sep. | 12 | Sold 71,000 units for $14.00 each. | ||

| Dec. | 31 | Inventory on hand29,000 units. |

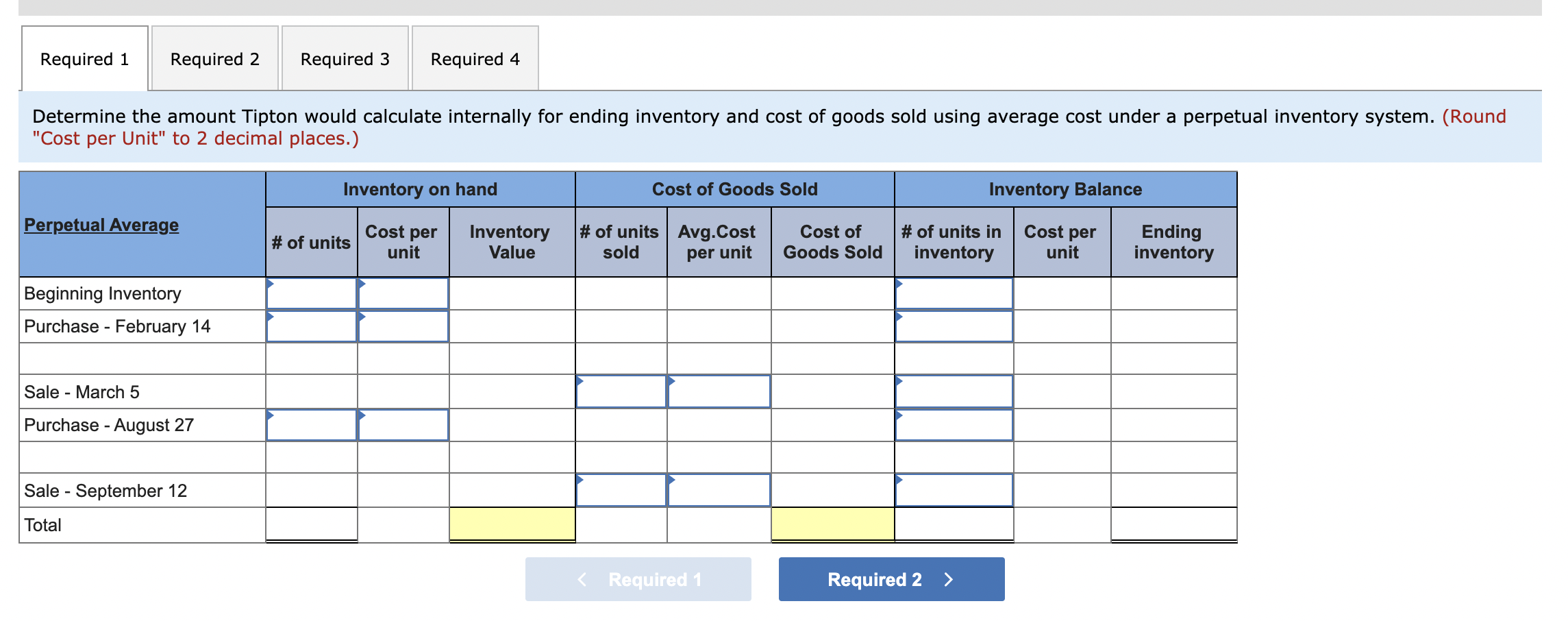

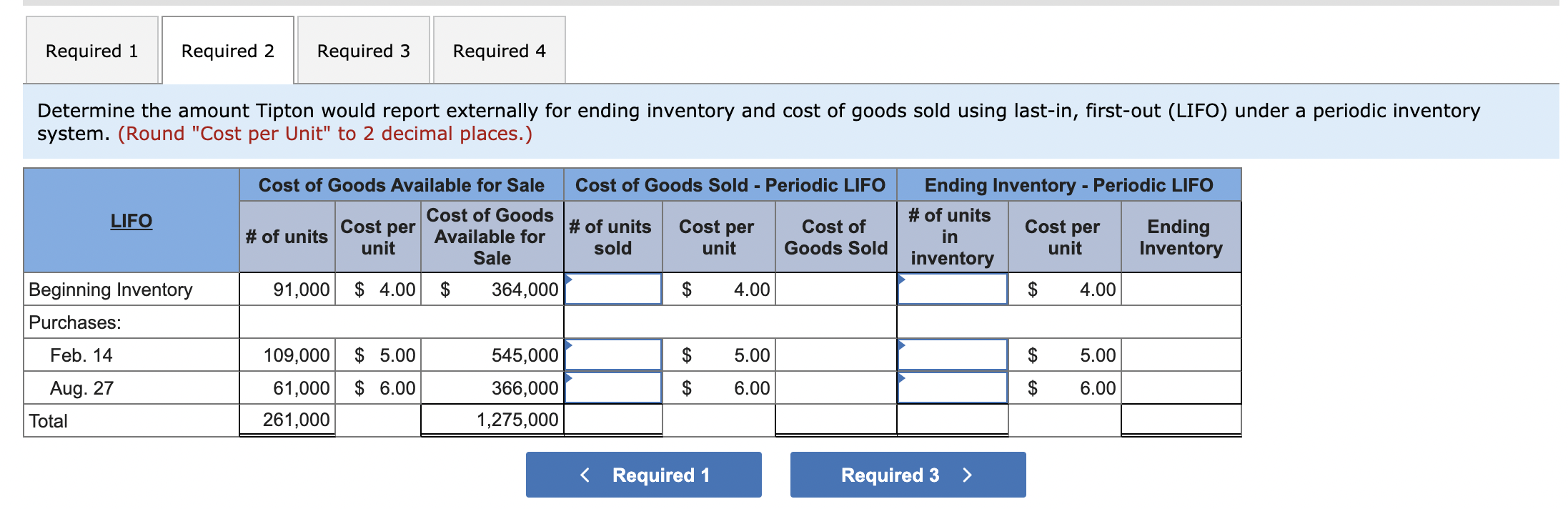

Required: 1. Determine the amount Tipton would calculate internally for ending inventory and cost of goods sold using average cost under a perpetual inventory system. 2. Determine the amount Tipton would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. 3. Determine the amount Tipton would report for its LIFO reserve at the end of the year. 4. Record the year-end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the year was $9,100.

Required 1 Required 2 Required 3 Required 4 Determine the amount Tipton would calculate internally for ending inventory and cost of goods sold using average cost under a perpetual inventory system. (Round "Cost per Unit" to 2 decimal places.) Inventory on hand Cost of Goods Sold Inventory Balance Perpetual Average Cost per # of units Cost per unit Inventory Value # of units Avg.Cost sold Cost of Goods Sold # of units in inventory Ending inventory per unit unit Beginning Inventory Purchase - February 14 Sale - March 5 Purchase - August 27 Sale - September 12 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started