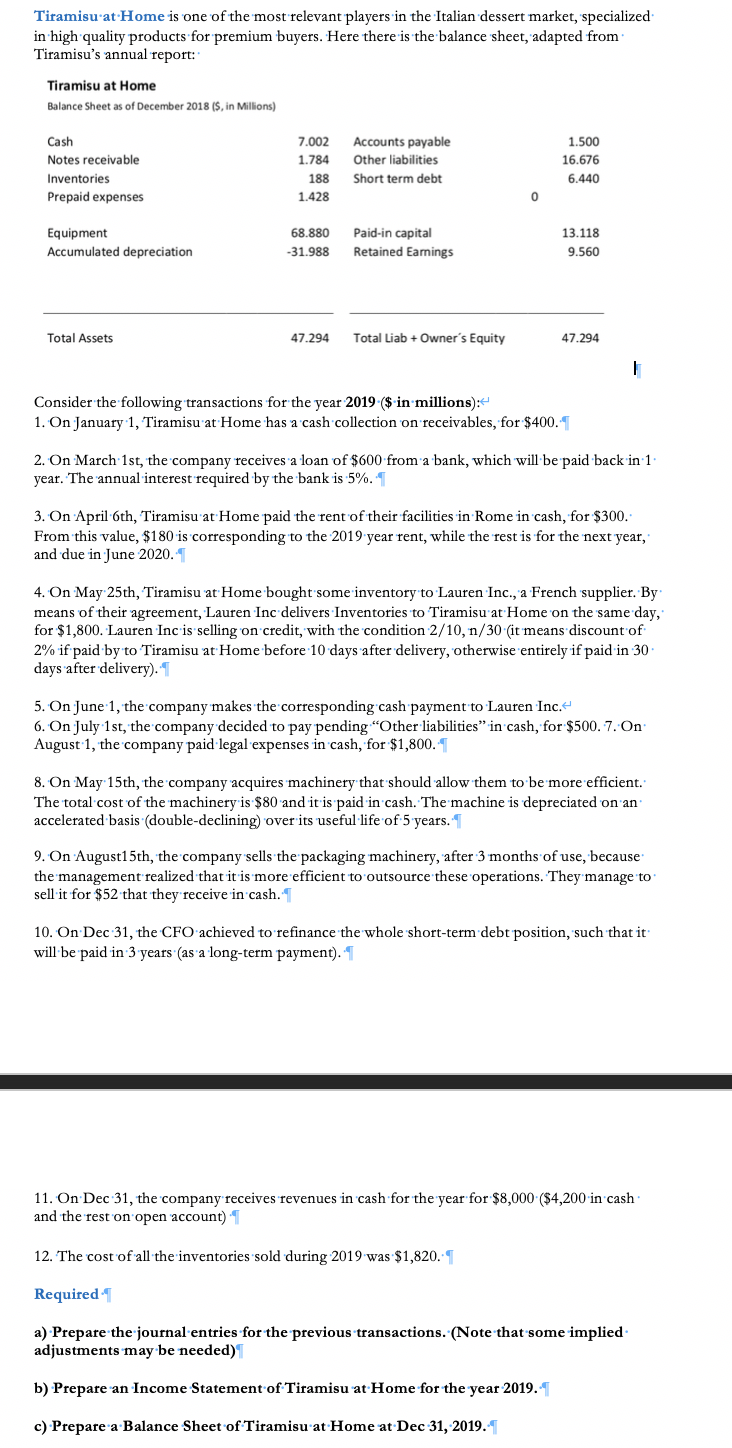

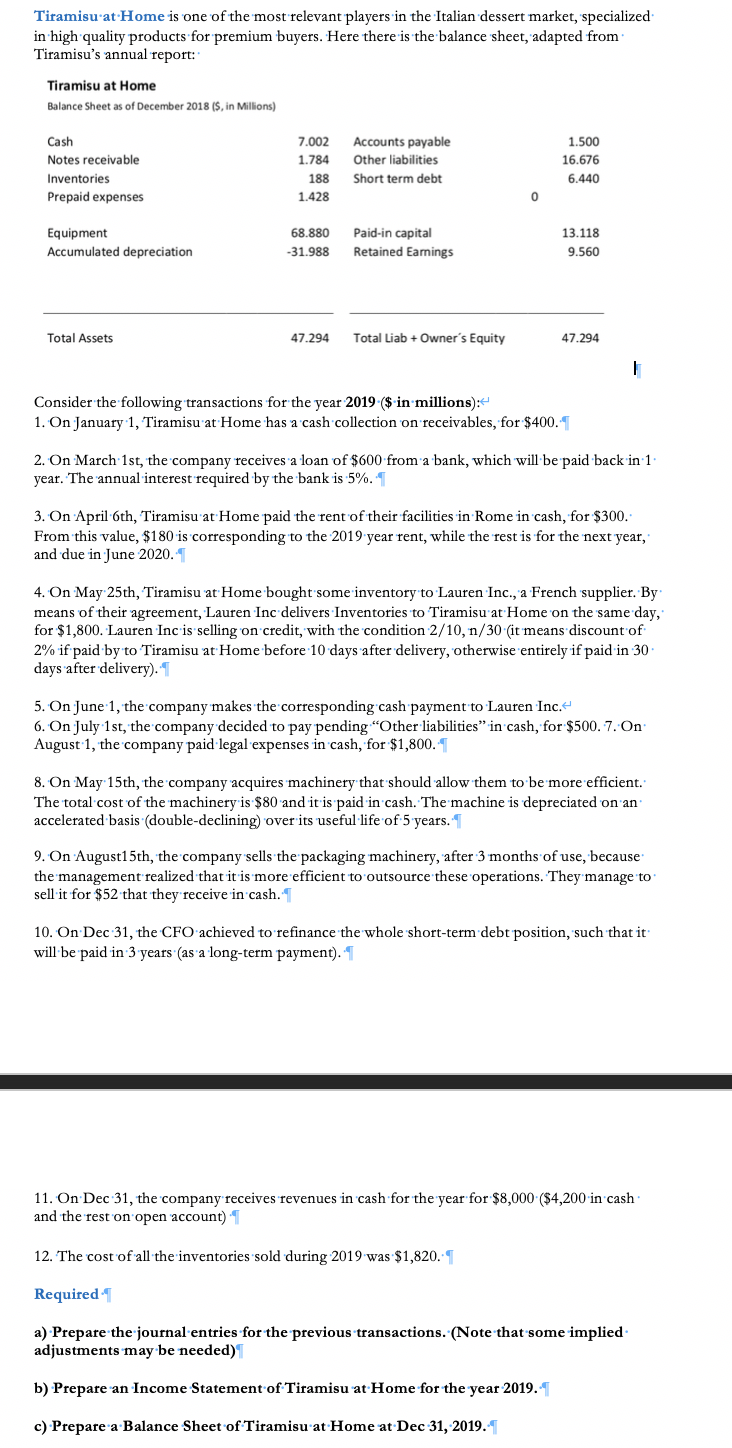

Tiramisu at Home is one of the most relevant players in the Italian dessert market, specialized in high quality products for premium buyers. Here there is the balance sheet, adapted from Tiramisu's annual report: Tiramisu at Home Balance Sheet as of December 2018 (S, in Millions) Cash Notes receivable Inventories Prepaid expenses 7.002 1.784 188 1.428 Accounts payable Other liabilities Short term debt 1.500 16.676 6.440 0 Equipment Accumulated depreciation 68.880 -31.988 Paid-in capital Retained Earnings 13.118 9.560 Total Assets 47.294 Total Liab + Owner's Equity 47.294 - Consider the following transactions for the year 2019 ($ in millions): 1. On January 1, Tiramisu at Home has a cash collection on receivables, for $400.1 2. On March 1st, the company receives a loan of $600 from a bank, which will be paid back in 1 year. The annual interest required by the bank is 5%. 1 3. On April 6th, Tiramisu at Home paid the rent of their facilities in Rome in cash, for $300. From this value, $180 is corresponding to the 2019 year rent, while the rest is for the next year, and due in June 2020. 1 4. On May 25th, Tiramisu at Home bought some inventory to Lauren Inc., a French supplier. By means of their agreement, Lauren Inc delivers Inventories to Tiramisu at Home on the same day, for $1,800. Lauren Inc is selling on credit, with the condition 2/10,n/30 (it means discount of 2% if paid by to Tiramisu at Home before 10 days after delivery, otherwise entirely if paid in 30 days after delivery). 1 5. On June 1, the company makes the corresponding cash payment to Lauren Inc.- 6. On July 1st, the company decided to pay pending Other liabilities in cash, for $500. 7. On August 1, the company paid legal expenses in cash, for $1,800.- 8. On May 15th, the company acquires machinery that should allow them to be more efficient. The total cost of the machinery is $80 and it is paid in cash. The machine is depreciated on an accelerated basis (double-declining) over its useful life of 5 years. I 9. On August15th, the company sells the packaging machinery, after 3 months of use, because the management realized that it is more efficient to outsource these operations. They manage to sell-it for $52 that they receive in cash. I 10. On Dec 31, the CFO achieved to refinance the whole short-term debt position, such that it will be paid in 3 years (as a long-term payment). I 11. On Dec 31, the company receives revenues in cash for the year for $8,000 ($4,200 in cash and the rest on open account) 12. The cost of all the inventories 'sold during 2019 was $1,820.1 Required a) Prepare the journal entries for the previous transactions. (Note that some implied adjustments may be needed) b) Prepare an Income Statement of Tiramisu at Home for the year 2019. c) Prepare a Balance Sheet of Tiramisu at Home at Dec 31, 2019. Tiramisu at Home is one of the most relevant players in the Italian dessert market, specialized in high quality products for premium buyers. Here there is the balance sheet, adapted from Tiramisu's annual report: Tiramisu at Home Balance Sheet as of December 2018 (S, in Millions) Cash Notes receivable Inventories Prepaid expenses 7.002 1.784 188 1.428 Accounts payable Other liabilities Short term debt 1.500 16.676 6.440 0 Equipment Accumulated depreciation 68.880 -31.988 Paid-in capital Retained Earnings 13.118 9.560 Total Assets 47.294 Total Liab + Owner's Equity 47.294 - Consider the following transactions for the year 2019 ($ in millions): 1. On January 1, Tiramisu at Home has a cash collection on receivables, for $400.1 2. On March 1st, the company receives a loan of $600 from a bank, which will be paid back in 1 year. The annual interest required by the bank is 5%. 1 3. On April 6th, Tiramisu at Home paid the rent of their facilities in Rome in cash, for $300. From this value, $180 is corresponding to the 2019 year rent, while the rest is for the next year, and due in June 2020. 1 4. On May 25th, Tiramisu at Home bought some inventory to Lauren Inc., a French supplier. By means of their agreement, Lauren Inc delivers Inventories to Tiramisu at Home on the same day, for $1,800. Lauren Inc is selling on credit, with the condition 2/10,n/30 (it means discount of 2% if paid by to Tiramisu at Home before 10 days after delivery, otherwise entirely if paid in 30 days after delivery). 1 5. On June 1, the company makes the corresponding cash payment to Lauren Inc.- 6. On July 1st, the company decided to pay pending Other liabilities in cash, for $500. 7. On August 1, the company paid legal expenses in cash, for $1,800.- 8. On May 15th, the company acquires machinery that should allow them to be more efficient. The total cost of the machinery is $80 and it is paid in cash. The machine is depreciated on an accelerated basis (double-declining) over its useful life of 5 years. I 9. On August15th, the company sells the packaging machinery, after 3 months of use, because the management realized that it is more efficient to outsource these operations. They manage to sell-it for $52 that they receive in cash. I 10. On Dec 31, the CFO achieved to refinance the whole short-term debt position, such that it will be paid in 3 years (as a long-term payment). I 11. On Dec 31, the company receives revenues in cash for the year for $8,000 ($4,200 in cash and the rest on open account) 12. The cost of all the inventories 'sold during 2019 was $1,820.1 Required a) Prepare the journal entries for the previous transactions. (Note that some implied adjustments may be needed) b) Prepare an Income Statement of Tiramisu at Home for the year 2019. c) Prepare a Balance Sheet of Tiramisu at Home at Dec 31, 2019