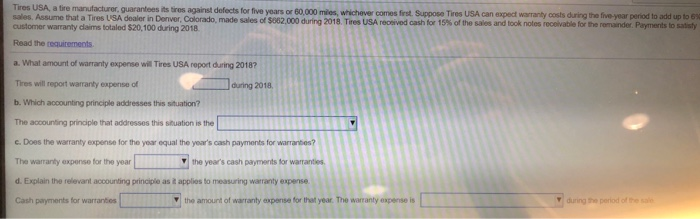

Tires USA, a tire manufacturer, guarantees its tires against defects for five years or 60,000 miles, whichever comes first. Suppose Tires USA can expect warranty costs during the five-year period to add up to 63 sales. Assume that a Tires USA dealer in Denver. Colorado, made sales of $862.000 during 2018. Tires USA repeived cash for 15% of the sales and took notes recelvable for the remainder. Payments to satisty customer warranty claims totaled $20,100 during 2018 Read the requirements a. What amount of warranty expense will Tires USA report during 2018? Tires will report warranty expense of during 2018 b. Which accounting principle addresses this situation? The accounting principle that dresses this situation is the c. Does the warranty expense for the year equal the year's cash payments for warranbes? The warranty expense for the year the year's cash payments for warranties. d. Explain the relevant accounting principle as it applies to measuring warranty expense. Cash payments for warranties the amount of warranty expense for that year. The warranty expense is Y during the period of the sale Tires USA, a tire manufacturer, guarantees its tires against defects for five years or 60,000 miles, whichever comes first. Suppose Tires USA can expect warranty costs during the five-year period to add up to 63 sales. Assume that a Tires USA dealer in Denver. Colorado, made sales of $862.000 during 2018. Tires USA repeived cash for 15% of the sales and took notes recelvable for the remainder. Payments to satisty customer warranty claims totaled $20,100 during 2018 Read the requirements a. What amount of warranty expense will Tires USA report during 2018? Tires will report warranty expense of during 2018 b. Which accounting principle addresses this situation? The accounting principle that dresses this situation is the c. Does the warranty expense for the year equal the year's cash payments for warranbes? The warranty expense for the year the year's cash payments for warranties. d. Explain the relevant accounting principle as it applies to measuring warranty expense. Cash payments for warranties the amount of warranty expense for that year. The warranty expense is Y during the period of the sale