Question

Tirthe Ltd sells a range of indoor and outdoor furniture by recycling and reinterpreting old furniture and other wood, metal, glass and plastic products obtained

Tirthe Ltd sells a range of indoor and outdoor furniture by recycling and reinterpreting old furniture and other wood, metal, glass and plastic products obtained from a variety of sources such as derelict buildings, deceased estate auctions and so on. Revenue comes from sales to the general public and businesses such as hotels and restaurants. Some small items are collected by customers but generally goods are delivered by Tirthe Ltd. The directors have reported that it has been another good year for the organisation and that they expect the coming year to be successful.

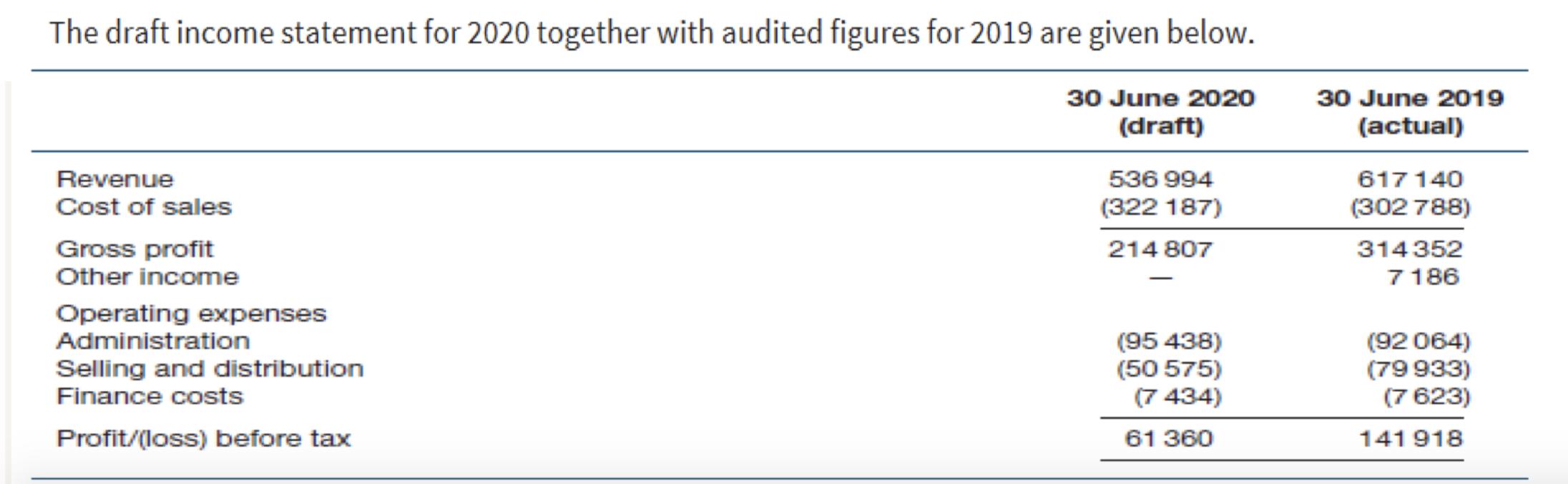

The draft income statement for 2020 together with audited figures for 2019 are given below:

Required:

You are planning the audit of Tirthe Ltd for the year ended 30 June 2020, discuss the issues to be considered in your audit planning from the information contained in the income statements.

List the steps performed by an auditor before accepting a new audit appointment.

What is the purpose of touring operating facilities and offices?

Discuss the steps involved in the audit planning process.

Explain the incentives, opportunities and attitudes the auditor should be aware of in considering the risk of misappropriation of asset fraud.

Define the term 'working papers' and indicate their main function in auditing

Cleanway Ltd is a public company that competes in the highly competitive market for manufactured household products. The company is dominated by Rob Bigbucks, the chairman and chief executive officer, who has guided the company since it was a private company and has extensive influence on all aspects of company operations. Rob is known to have a short temper and, in the past, has threatened individuals in the accounting department with no pay rise if they failed to help him achieve company goals. Furthermore, the company has extended its influence over customers and has dictated terms of sale to ensure that customers are able to obtain desired quantities of their most popular products. Bonuses based on sales are a significant component of the compensation package for individual product sales managers. Sales managers who do not meet sales targets three successive quarters are often replaced. The company has performed well up until a recent recession, but now the company is having difficulty moving inventory in most product lines as retailers have difficulty selling in a down economy.

- Identify the fraud risks factors that are present in the case.

- Identify the accounts and assertions that are most likely to be misstated based on the fraud risk factors noted in the case.

What are the auditor's responsibilities in relation to fraud?

The draft income statement for 2020 together with audited figures for 2019 are given below. 30 June 2020 (draft) Revenue Cost of sales Gross profit Other income Operating expenses Administration Selling and distribution Finance costs Profit/(loss) before tax 536 994 (322 187) 214 807 (95 438) (50 575) (7 434) 61 360 30 June 2019 (actual) 617 140 (302 788) 314352 7186 (92 064) (79 933) (7 623) 141 918

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Issues to be considered in audit planning for Tirthe Ltd a Revenue recognition Given that Tirthe Ltd sells a range of indoor and outdoor furniture by recycling and reinterpreting old furniture and oth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started