Answered step by step

Verified Expert Solution

Question

1 Approved Answer

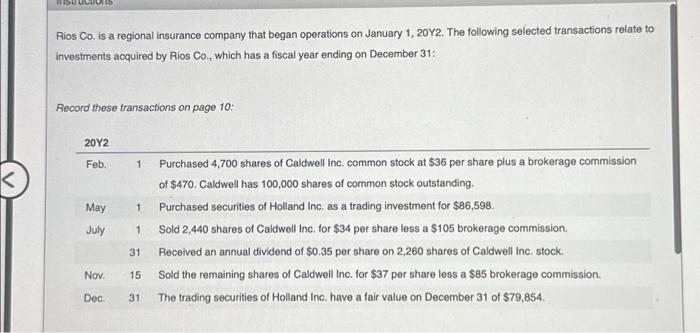

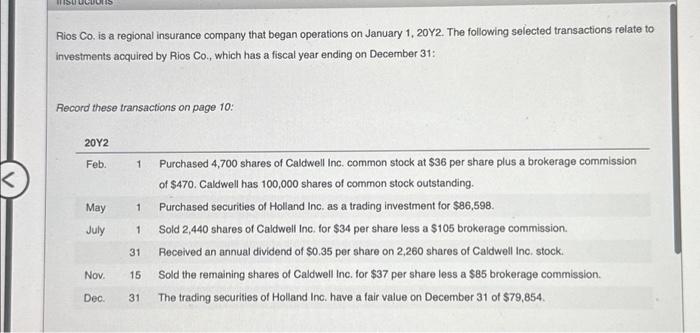

TIS Rios Co. is a regional insurance company that began operations on January 1, 20Y2. The following selected transactions relate to investments acquired by Rios

TIS Rios Co. is a regional insurance company that began operations on January 1, 20Y2. The following selected transactions relate to investments acquired by Rios Co., which has a fiscal year ending on December 31: Record these transactions on page 10: 20Y2 Feb. May July Nov. Dec. 1 Purchased 4,700 shares of Caldwell Inc. common stock at $36 per share plus a brokerage commission of $470. Caldwell has 100,000 shares of common stock outstanding. 1 Purchased securities of Holland Inc. as a trading investment for $86,598. 1 Sold 2,440 shares of Caldwell Inc. for $34 per share less a $105 brokerage commission. Received an annual dividend of $0.35 per share on 2,260 shares of Caldwell Inc. stock. 15 Sold the remaining shares of Caldwell Inc. for $37 per share less a $85 brokerage commission. 31 The trading securities of Holland Inc. have a fair value on December 31 of $79,854. 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started