Question

Tis the Season for Planting- Case study Nicole sat at the kitchen table contemplating the offer that her parents had extended to her. Graduation was

Tis the Season for Planting- Case study

Nicole sat at the kitchen table contemplating the offer that her parents had extended to her. Graduation was coming in June, six months away. Like the rest of her class in Agricultural Management, there were many job opportunities available working in the agriculture industry extending from equipment manufacturers, seed suppliers, other input suppliers primarily in marketing but also in the finance field with the banks and leasing companies. Wages ranged from $45 thousand to $60 thousand to start in the Agriculture industry. But like many of her class there was also the opportunity to return home to the family business. In Nicoles case her family farm located approximately 45 minutes north-east of Toronto was a mixed vegetable and fruit producer complimented by the market that the family ran selling not only their fresh produce but also organic meat from neighbours who also rented a pasture from them, and some locally sourced crafts, canned produce and baked goods. The Ball family farm had been in the family for over 3 generations and Nicole and her older sister would be the next generation. But her parents were not about to retire just yet. At 55 and 54, Nicoles parents planned to work for another 5 to 10 years and required a continuing income from the farm and market. Nicoles older sister was managing the market and distributing some produce to other local farmers markets closer to Toronto generating a reasonable income for herself. Currently, her income was complimented by her husbands income from working at a local farm supply firm. The farm and market currently faced a complete shutdown from Halloween until the Summer

Agricultural workers arrived in April from Mexico. At that time about $50,000 was spent on the travel arrangements, accommodations and wages for the staff and for new plants such as strawberries, tomatoes and peppers. The market would commence limited sales usually around the middle of May and preferably before the May long weekend. Full sales would start to occur in early June with produce such as radishes and peas and the baking and meat products. Other farm expenses and family living expenses had to funded from the cash that had been realized from the sales during the previous year. The Family was reluctant to borrow any money except for large ticket items such as buildings, land or equipment. The opportunity for Nicole was a new venture for the family. The pasture at the back of the farm, considered poor land for crops, generated revenue of $250 per year per acre on 10 acres. But there was another possibility. Recently it had become apparent that the farmers market was in a good location to sell Christmas trees. Customers would face a nice drive from Toronto and its environs, to come and cut a tree each year or buy a tree precut by the farm staff (Nicole). And in the past few years prices had been climbing to over 40 dollars per tree. Nicole wondered if the Christmas tree market would do more than just sell trees but also extend the season for the farmers market beyond the Halloween season. Crafts, canned goods, meat and other products could be continued to be offered and provide income for Emily her sister, the market assistant and their local suppliers. Nicole looked at her parents financial statements and realized that her skills from her degree would help her assess the potential for the opportunity. But she would also have to consider other issues such as the cost of planting the trees, purchasing the trees, the opportunity costs of the lost revenue, other costs such as annual management of the field of trees all while recognizing that the first tree to reach the market from seedling plantings would not occur for at least 5 and more likely 6 or 7 years. Trees if one was lucky would grow upwards of 30 cm per year and the seedlings started between 20 and 30 cm in height. The seedlings were priced at $1 each but if the costs were in line with most tree plantings in commercial settings the total cost would be $10 per tree including labour. It had been estimated by the local nursery that they could plant upwards of 2000 trees per acre. Three to four times a year the plantings would require shaping with a trimmer and that process would take an experienced individual 5 10 minutes per tree. Some trees would die each year and when a tree was cut another would need to be planted to replace the sold or dead tree to ensure a sustainable venture. Other costs would also apply such as pesticides, fertilizer and eventually equipment to wrap trees and the use of the farm tractor and trailer for weekly watering in the first year of planting. Maintenance would be necessary to keep the weeds cut and that would take at least one day a week during the growing season from late April to late September, again using the farm tractor with the PTO weed cutter. Over the past few summers and when home from school at Christmas and reading week, Nicole had earned income at a local goat farm that milked 800 does a day and had another 200 to 250 kids and bucks for breeding requiring caring. But like most farms in her county, Hillside Farms was a family business and Floyd the owner was honest in expressing there would only be hourly wages available as his daughters also wanted to return home to manage their family business. Still, Floyd had said that Nicole could work there anytime she wanted as labour was scarce in the rural market and Nicole was not afraid to do the work that was needed. Her current wages were $17 per hour but Floyd offered $18 per hour if she would work full-time year-round. It was time to make sense of the numbers.

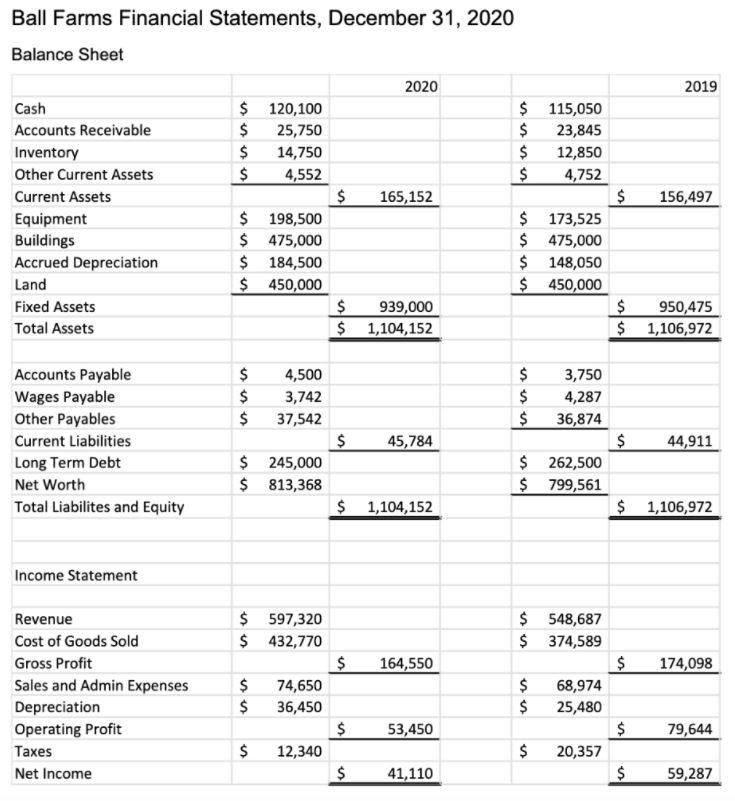

1) Create a Statement of Cash Flows based on the data (where "change in the cash account on the balance sheet from 2019 to 2020 is $5,050?") (also add depreciation but only the change or last year's depreciation).

2) Calculate:

a) Average Collection Period (= divided Accounts receivable/Total sales X 365)

b) Capital asset turnover (accumulated depreciation subtracted from total capital assets (PPE))?

3) Should Nicole accept a Agricultural job of the $50 000 salary, or should she work on the family farm and start the Christmas tree business, or should she work on the sheep farm full-time for $18 per hour in 40 hour work weeks?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started