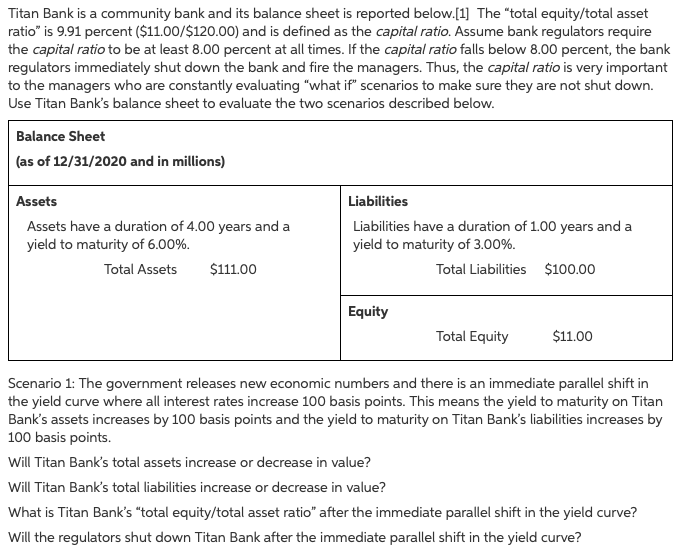

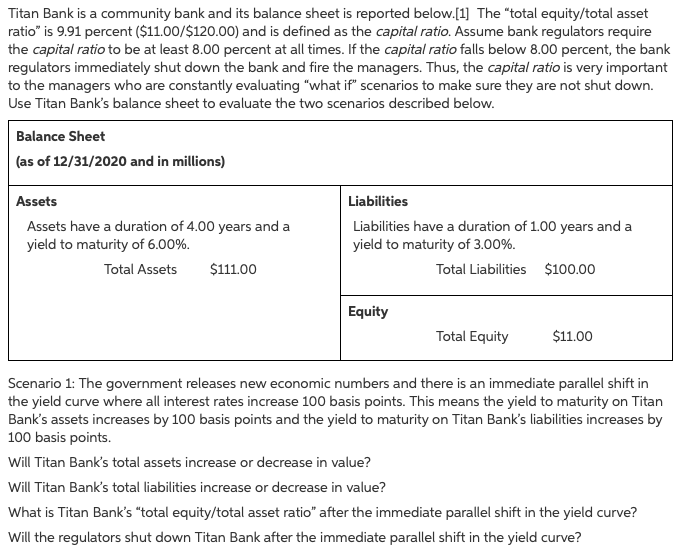

Titan Bank is a community bank and its balance sheet is reported below.[1] The total equity/total asset ratio" is 9.91 percent ($11.00/$120.00) and is defined as the capital ratio. Assume bank regulators require the capital ratio to be at least 8.00 percent at all times. If the capital ratio falls below 8.00 percent, the bank regulators immediately shut down the bank and fire the managers. Thus, the capital ratio is very important to the managers who are constantly evaluating "what if" scenarios to make sure they are not shut down. Use Titan Bank's balance sheet to evaluate the two scenarios described below. Balance Sheet (as of 12/31/2020 and in millions) Assets Assets have a duration of 4.00 years and a yield to maturity of 6.00%. Total Assets $111.00 Liabilities Liabilities have a duration of 1.00 years and a yield to maturity of 3.00%. Total Liabilities $100.00 Equity Total Equity $11.00 Scenario 1: The government releases new economic numbers and there is an immediate parallel shift in the yield curve where all interest rates increase 100 basis points. This means the yield to maturity on Titan Bank's assets increases by 100 basis points and the yield to maturity on Titan Bank's liabilities increases by 100 basis points. Will Titan Bank's total assets increase or decrease in value? Will Titan Bank's total liabilities increase or decrease in value? What is Titan Bank's total equity/total asset ratio" after the immediate parallel shift in the yield curve? Will the regulators shut down Titan Bank after the immediate parallel shift in the yield curve? Titan Bank is a community bank and its balance sheet is reported below.[1] The total equity/total asset ratio" is 9.91 percent ($11.00/$120.00) and is defined as the capital ratio. Assume bank regulators require the capital ratio to be at least 8.00 percent at all times. If the capital ratio falls below 8.00 percent, the bank regulators immediately shut down the bank and fire the managers. Thus, the capital ratio is very important to the managers who are constantly evaluating "what if" scenarios to make sure they are not shut down. Use Titan Bank's balance sheet to evaluate the two scenarios described below. Balance Sheet (as of 12/31/2020 and in millions) Assets Assets have a duration of 4.00 years and a yield to maturity of 6.00%. Total Assets $111.00 Liabilities Liabilities have a duration of 1.00 years and a yield to maturity of 3.00%. Total Liabilities $100.00 Equity Total Equity $11.00 Scenario 1: The government releases new economic numbers and there is an immediate parallel shift in the yield curve where all interest rates increase 100 basis points. This means the yield to maturity on Titan Bank's assets increases by 100 basis points and the yield to maturity on Titan Bank's liabilities increases by 100 basis points. Will Titan Bank's total assets increase or decrease in value? Will Titan Bank's total liabilities increase or decrease in value? What is Titan Bank's total equity/total asset ratio" after the immediate parallel shift in the yield curve? Will the regulators shut down Titan Bank after the immediate parallel shift in the yield curve