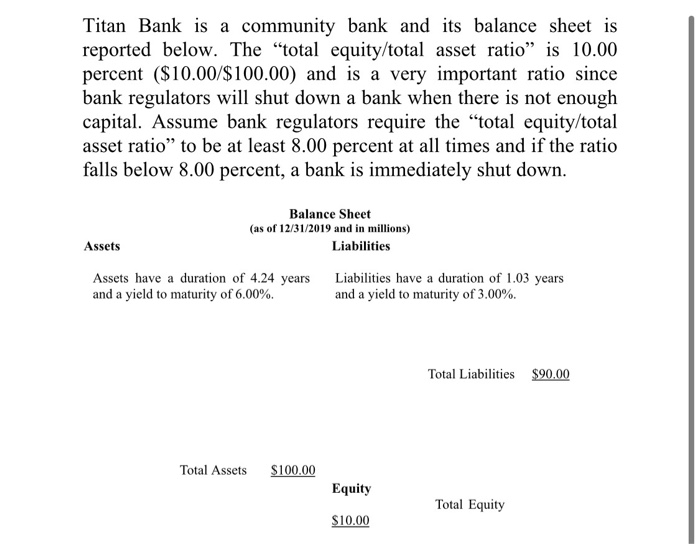

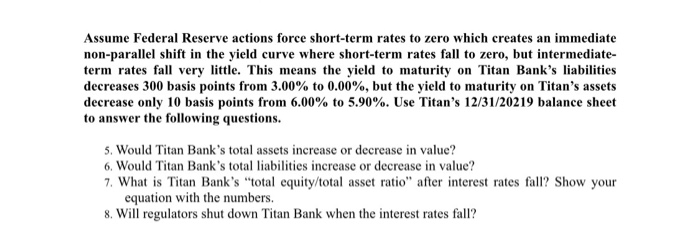

Titan Bank is a community bank and its balance sheet is reported below. The total equity/total asset ratio" is 10.00 percent ($10.00/$100.00) and is a very important ratio since bank regulators will shut down a bank when there is not enough capital. Assume bank regulators require the total equity/total asset ratio" to be at least 8.00 percent at all times and if the ratio falls below 8.00 percent, a bank is immediately shut down. Balance Sheet (as of 12/31/2019 and in millions) Liabilities Assets Assets have a duration of 4.24 years and a yield to maturity of 6.00%. Liabilities have a duration of 1.03 years and a yield to maturity of 3.00%. Total Liabilities $90.00 Total Assets $100.00 Equity Total Equity $10.00 Assume Federal Reserve actions force short-term rates to zero which creates an immediate non-parallel shift in the yield curve where short-term rates fall to zero, but intermediate term rates fall very little. This means the yield to maturity on Titan Bank's liabilities decreases 300 basis points from 3.00% to 0.00%, but the yield to maturity on Titan's assets decrease only 10 basis points from 6.00% to 5.90%. Use Titan's 12/31/20219 balance sheet to answer the following questions. 5. Would Titan Bank's total assets increase or decrease in value? 6. Would Titan Bank's total liabilities increase or decrease in value? 7. What is Titan Bank's "total equity/total asset ratio" after interest rates fall? Show your equation with the numbers. 8. Will regulators shut down Titan Bank when the interest rates fall? Is a parallel shift or non-parallel shift in the yield curve more likely to occur in the real world? You do not need to explain your answer. Titan Bank is a community bank and its balance sheet is reported below. The total equity/total asset ratio" is 10.00 percent ($10.00/$100.00) and is a very important ratio since bank regulators will shut down a bank when there is not enough capital. Assume bank regulators require the total equity/total asset ratio" to be at least 8.00 percent at all times and if the ratio falls below 8.00 percent, a bank is immediately shut down. Balance Sheet (as of 12/31/2019 and in millions) Liabilities Assets Assets have a duration of 4.24 years and a yield to maturity of 6.00%. Liabilities have a duration of 1.03 years and a yield to maturity of 3.00%. Total Liabilities $90.00 Total Assets $100.00 Equity Total Equity $10.00 Assume Federal Reserve actions force short-term rates to zero which creates an immediate non-parallel shift in the yield curve where short-term rates fall to zero, but intermediate term rates fall very little. This means the yield to maturity on Titan Bank's liabilities decreases 300 basis points from 3.00% to 0.00%, but the yield to maturity on Titan's assets decrease only 10 basis points from 6.00% to 5.90%. Use Titan's 12/31/20219 balance sheet to answer the following questions. 5. Would Titan Bank's total assets increase or decrease in value? 6. Would Titan Bank's total liabilities increase or decrease in value? 7. What is Titan Bank's "total equity/total asset ratio" after interest rates fall? Show your equation with the numbers. 8. Will regulators shut down Titan Bank when the interest rates fall? Is a parallel shift or non-parallel shift in the yield curve more likely to occur in the real world? You do not need to explain your