Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Titan Bank is a community bank and its balance sheet is reported below. The total equity/total asset ratio is 10.00 percent ($10.00/$100.00) and is

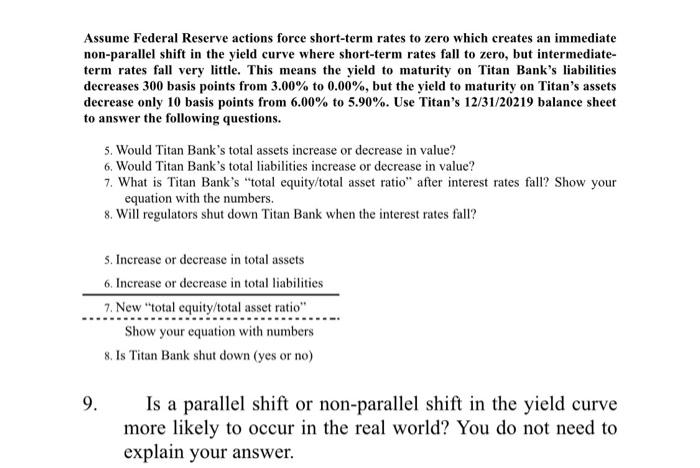

Titan Bank is a community bank and its balance sheet is reported below. The "total equity/total asset ratio" is 10.00 percent ($10.00/$100.00) and is a very important ratio since bank regulators will shut down a bank when there is not enough capital. Assume bank regulators require the "total equity/total asset ratio" to be at least 8.00 percent at all times and if the ratio falls below 8.00 percent, a bank is immediately shut down. Assets Balance Sheet (as of 12/31/2019 and in millions) Liabilities Assets have a duration of 4.24 years and a yield to maturity of 6.00% Total Assets $100.00 Liabilities have a duration of 1.03 years and a yield to maturity of 3.00%. Equity $10.00 3. New "total equity/total asset ratio" Show your equation with numbers 4. Is Titan Bank shut down (yes or no) Total Liabilities $90.00 Assume the government releases new economic numbers and there is an immediate parallel shift in the yield curve and all interest rates increase 100 basis points. This means the yield to maturity on Titan's liabilities increases 100 basis points from 3.00% to 4.00% and the yield to maturity on Titan's assets increases 100 basis points from 6.00% to 7.00. 1. Increase or decrease in value of total assets 2. Increase or decrease in value total liabilities Total Equity 1. Would Titan Bank's total assets increase or decrease in value? 2. Would Titan Bank's total liabilities increase or decrease in value? 3. What is Titan Bank's "total equity/total asset ratio" after interest rates increase? Show your equation with the numbers. 4. Will regulators shut down Titan Bank when the interest rates increase? Assume Federal Reserve actions force short-term rates to zero which creates an immediate non-parallel shift in the yield curve where short-term rates fall to zero, but intermediate- term rates fall very little. This means the yield to maturity on Titan Bank's liabilities decreases 300 basis points from 3.00% to 0.00%, but the yield to maturity on Titan's assets decrease only 10 basis points from 6.00% to 5.90%. Use Titan's 12/31/20219 balance sheet to answer the following questions. 9. 5. Would Titan Bank's total assets increase or decrease in value? 6. Would Titan Bank's total liabilities increase or decrease in value? 7. What is Titan Bank's "total equity/total asset ratio" after interest rates fall? Show your equation with the numbers. 8. Will regulators shut down Titan Bank when the interest rates fall? 5. Increase or decrease in total assets 6. Increase or decrease in total liabilities 7. New "total equity/total asset ratio" Show your equation with numbers 8. Is Titan Bank shut down (yes or no) Is a parallel shift or non-parallel shift in the yield curve more likely to occur in the real world? You do not need to explain your answer.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Would Titan Banks total assets increase or decrease in value When interest rates increase the value of fixedrate assets typically decreases In this ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started