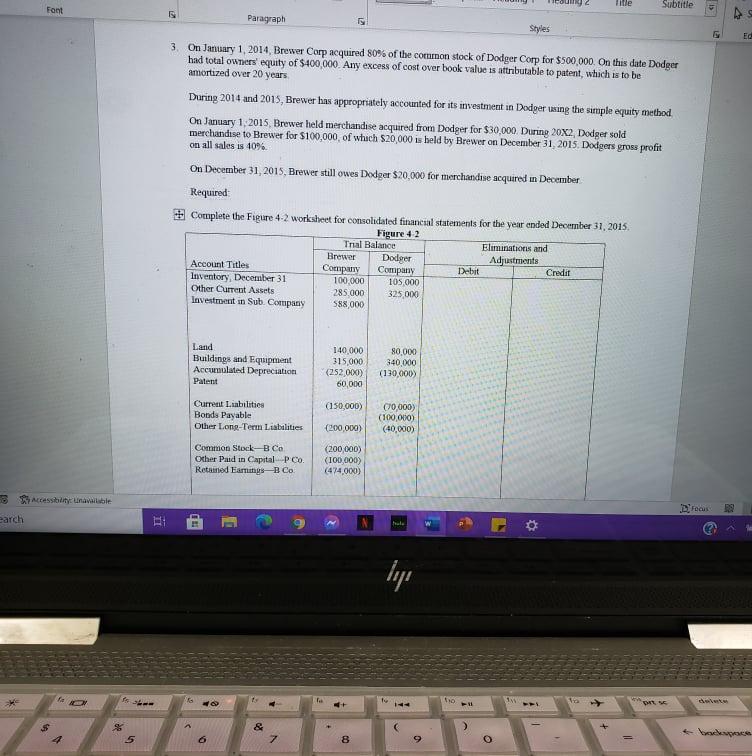

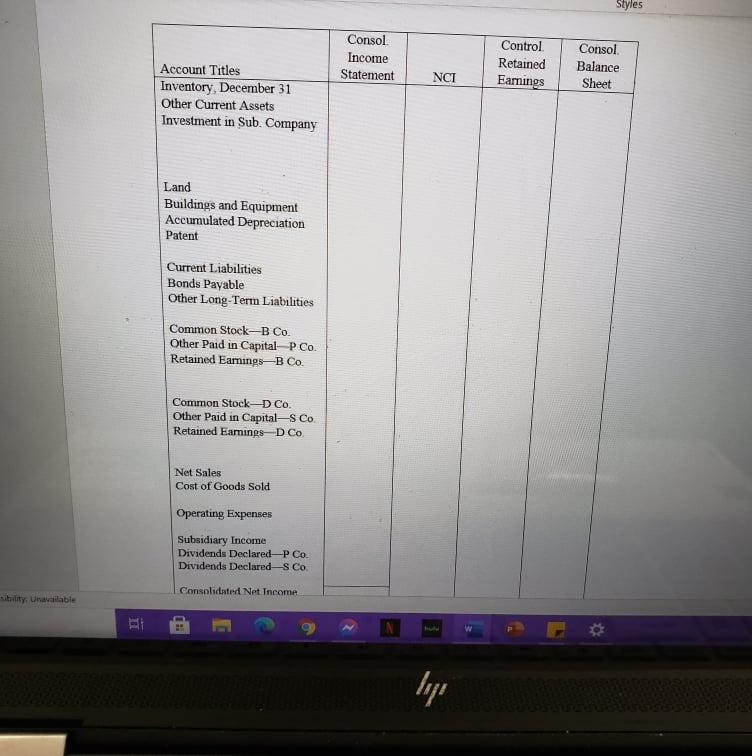

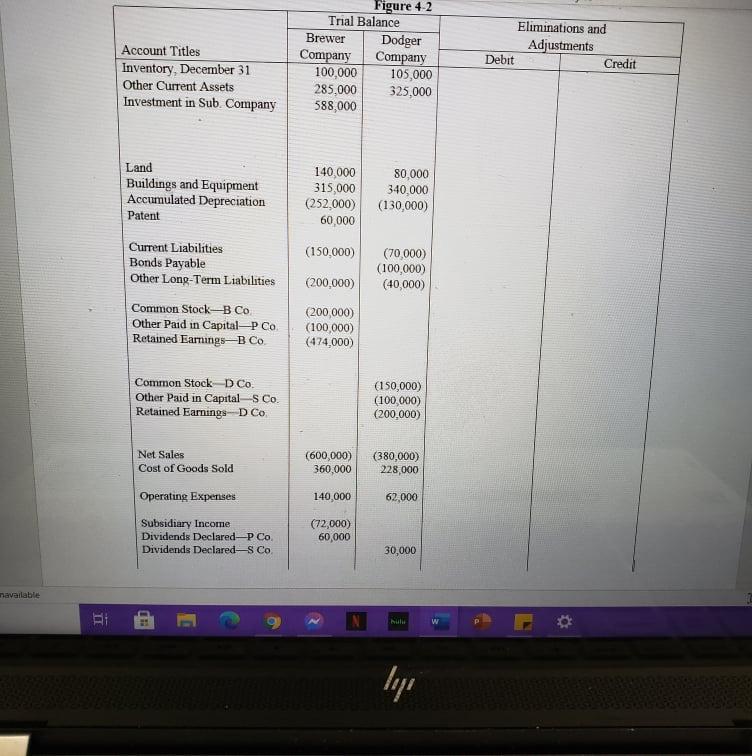

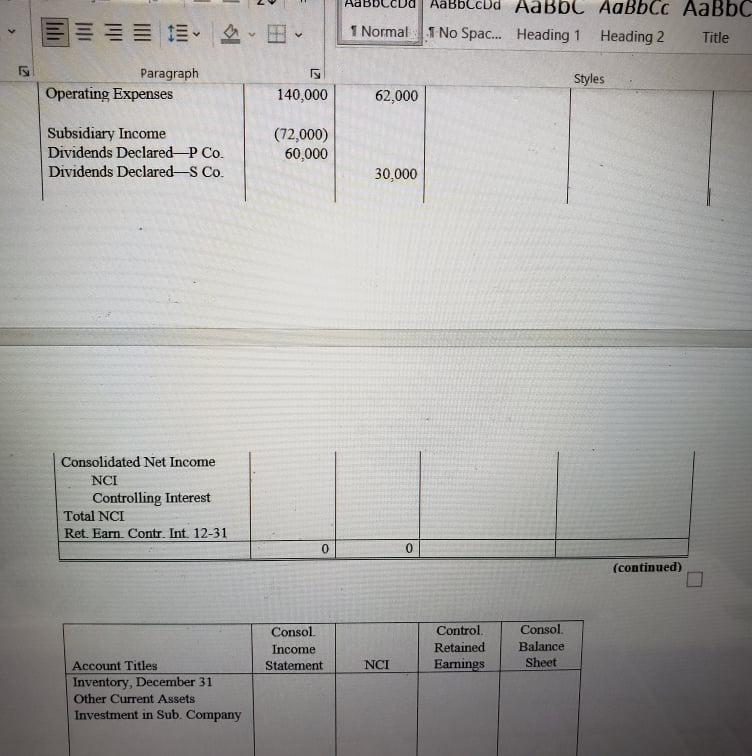

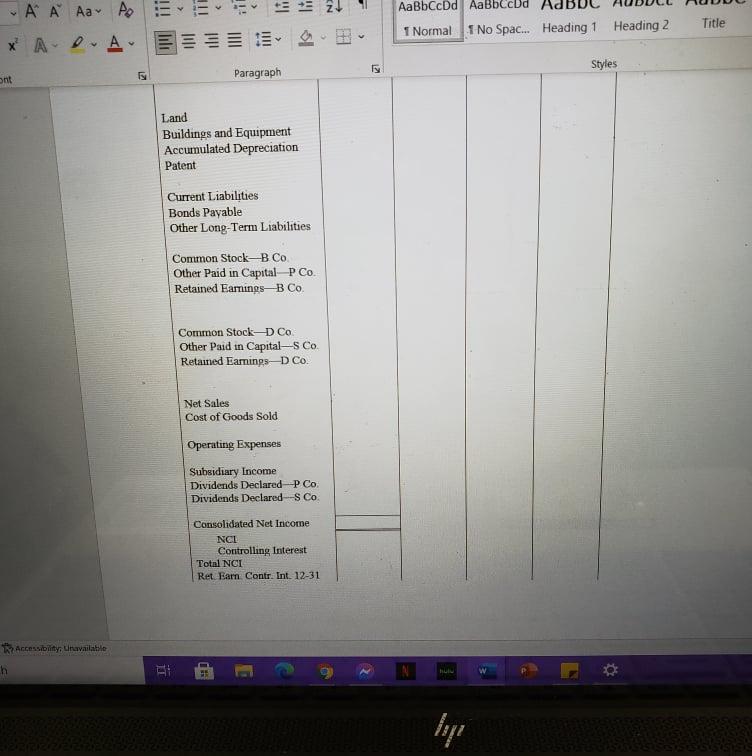

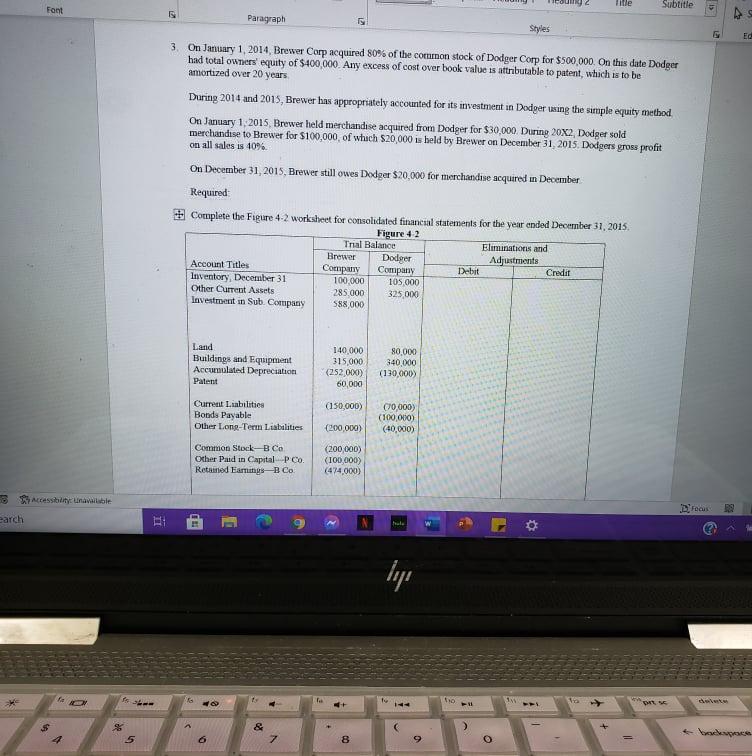

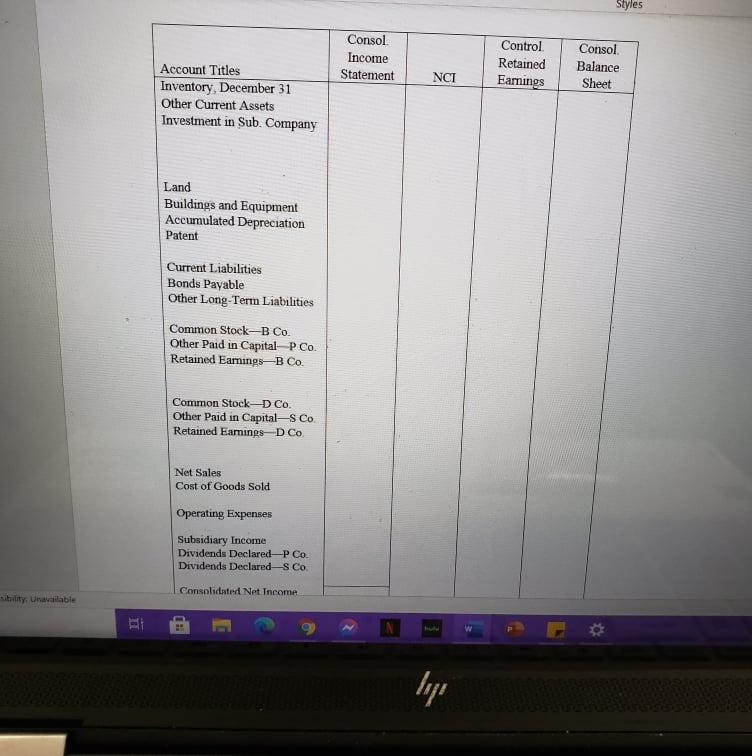

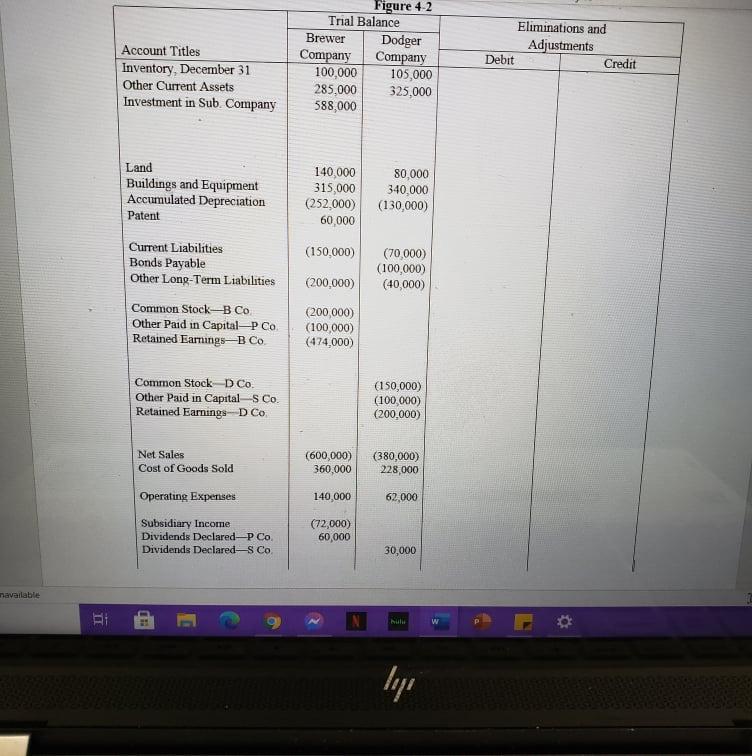

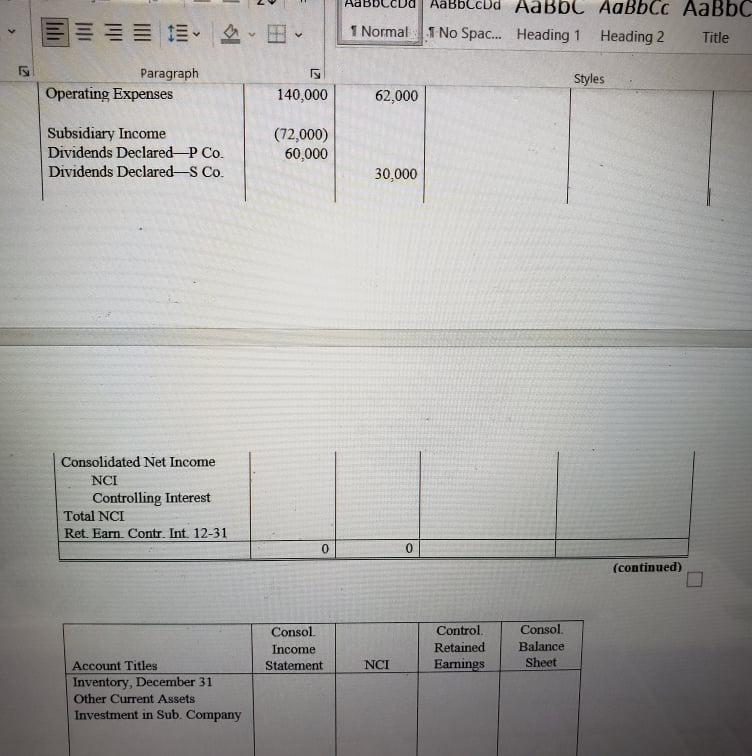

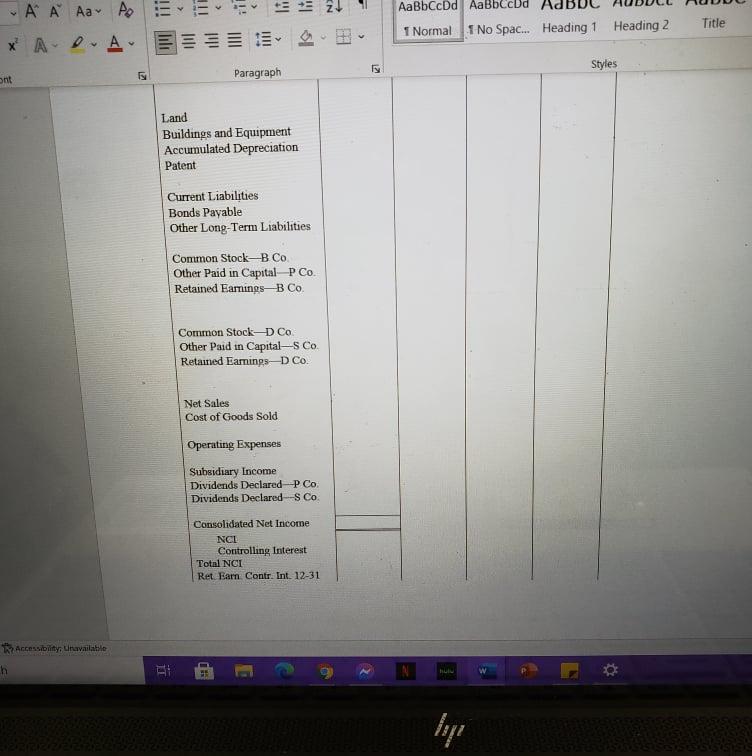

Title Subtitle Font 15 S Paragraph Styles Ed 3. On January 1, 2014 Brewer Corp acquired 80% of the common stock of Dodger Corp for $500,000. On this date Dodger had total owners' equity of $400,000. Any excess of cost over book value is attributable to patent, which is to be amortized over 20 years During 2014 and 2015, Brewer has appropriately accounted for its investment in Dodger using the simple equity method On January 1:2015, Brewer held merchandise acquired from Dodger for $30,000. During 20X2, Dodget sold merchandise to Brewer for $100,000, of whach $20,000 is held by Brewer on December 31, 2015. Dodgers gross profit on all sales is 10% On December 31, 2015, Brewer still owes Dodget $20.000 for merchandise acquired in December Required Complete the Figure 4-2 worksheet for consolidated financial statements for the year ended December 31, 2015 Figure 42 Trial Balance Eliminations and Brewer Dodger Adjustments Account Titles Company Company Debit Credit Inventory, December 31 100.000 105.000 Other Current Assets 285.000 325 000 lavestment in Sub Company 588,000 Land Buildings and Equipment Accumulated Depreciation Patent 140,000 315,000 (252.000) 60,000 80,000 340,000 (130,000) (150,000) Current Liabilities Bonds Payable Other Long-Term Liabilities 00,000) (100,000) (40,000) (200.000) Common Stock B co Other Paid in Capital PC. Retained Emin B Co. (200,000) (IO0,000) (474,000) Focus earch TE GU E M Frale ? ly 2- 1 $ 5 8 Styles Consol Income Statement Control Retained Earnings Consol Balance Sheet NCI Account Titles Inventory, December 31 Other Current Assets Investment in Sub. Company Land Buildings and Equipment Accumulated Depreciation Patent Current Liabilities Bonds Payable Other Long-Term Liabilities Common Stock-B Co. Other Paid in Capital P Co. Retained Earnings-B Co. Common Stock-D Co. Other Paid in Capitals Co. Retained Eamings D Co Net Sales Cost of Goods Sold Operating Expenses Subsidiary Income Dividends Declared P Co. Dividends Declared S Co. Consolidated Net Income sibility, Unilable lui Figure 42 Trial Balance Brewer Dodger Company Company 100,000 105,000 285,000 325,000 588,000 Eliminations and Adjustments Debit Credit Account Titles Inventory, December 31 Other Current Assets Investment in Sub Company Land Buildings and Equipment Accumulated Depreciation Patent 140,000 80,000 315,000 340,000 (252,000) (130,000) 60,000 (150.000) (70,000) (100,000) (40,000) (200,000) Current Liabilities Bonds Payable Other Long-Term Liabilities Common Stock-B Co Other Paid in Capital-P Co Retained Earnings-B Co (200,000) (100,000) (474,000) Common Stock D Co. Other Paid in Capitals Co. Retained Earnings D Co. (150,000) (100,000) (200,000) Net Sales Cost of Goods Sold (600,000) 360.000 (380,000) 228,000 Operating Experises 140,000 62,000 Subsidiary Income Dividends DeclaredP Co. Dividends Declared-S Co. (72,000) 60,000 30,000 navailable ( IL lyi HabbCCL 1 Normal 1 No Spac... Heading 1 Heading 2 Title > w ES Paragraph Operating Expenses Styles 140,000 62,000 Subsidiary Income Dividends DeclaredP Co. Dividends DeclaredS Co. (72,000) 60,000 30,000 Consolidated Net Income NCI Controlling Interest Total NCI Ret. Earn. Contr. Int. 12-31 0 0 (continued) Consol Income Statement Control Retained Earnings Consol. Balance Sheet NCI Account Titles Inventory, December 31 Other Current Assets Investment in Sub. Company - A Aar A ++ 2+ AaBbCcDd AaBbCcbd A 1 Normal 1 No Spac... Heading 1 Heading 2 Title X A - A Styles ES Paragraph ant Land Buildings and Equipment Accumulated Depreciation Patent Current Liabilities Bonds Payable Other Long-Term Liabilities Common Stock-B Co Other Paid in Capital P Co. Retained Eamings B Co Common Stock D Co Other Paid in CapitalCo. Retamed Eamings-D Co. Net Sales Cost of Goods Sold Operating Expenses Subsidiary Income Dividends Declared P Co. Dividends Declared S Co. Consolidated Net Income NCI Controlling Interest Total NCI Ret. Earn Contr. Int. 12-31 Accessibility Unavailable . loy Title Subtitle Font 15 S Paragraph Styles Ed 3. On January 1, 2014 Brewer Corp acquired 80% of the common stock of Dodger Corp for $500,000. On this date Dodger had total owners' equity of $400,000. Any excess of cost over book value is attributable to patent, which is to be amortized over 20 years During 2014 and 2015, Brewer has appropriately accounted for its investment in Dodger using the simple equity method On January 1:2015, Brewer held merchandise acquired from Dodger for $30,000. During 20X2, Dodget sold merchandise to Brewer for $100,000, of whach $20,000 is held by Brewer on December 31, 2015. Dodgers gross profit on all sales is 10% On December 31, 2015, Brewer still owes Dodget $20.000 for merchandise acquired in December Required Complete the Figure 4-2 worksheet for consolidated financial statements for the year ended December 31, 2015 Figure 42 Trial Balance Eliminations and Brewer Dodger Adjustments Account Titles Company Company Debit Credit Inventory, December 31 100.000 105.000 Other Current Assets 285.000 325 000 lavestment in Sub Company 588,000 Land Buildings and Equipment Accumulated Depreciation Patent 140,000 315,000 (252.000) 60,000 80,000 340,000 (130,000) (150,000) Current Liabilities Bonds Payable Other Long-Term Liabilities 00,000) (100,000) (40,000) (200.000) Common Stock B co Other Paid in Capital PC. Retained Emin B Co. (200,000) (IO0,000) (474,000) Focus earch TE GU E M Frale ? ly 2- 1 $ 5 8 Styles Consol Income Statement Control Retained Earnings Consol Balance Sheet NCI Account Titles Inventory, December 31 Other Current Assets Investment in Sub. Company Land Buildings and Equipment Accumulated Depreciation Patent Current Liabilities Bonds Payable Other Long-Term Liabilities Common Stock-B Co. Other Paid in Capital P Co. Retained Earnings-B Co. Common Stock-D Co. Other Paid in Capitals Co. Retained Eamings D Co Net Sales Cost of Goods Sold Operating Expenses Subsidiary Income Dividends Declared P Co. Dividends Declared S Co. Consolidated Net Income sibility, Unilable lui Figure 42 Trial Balance Brewer Dodger Company Company 100,000 105,000 285,000 325,000 588,000 Eliminations and Adjustments Debit Credit Account Titles Inventory, December 31 Other Current Assets Investment in Sub Company Land Buildings and Equipment Accumulated Depreciation Patent 140,000 80,000 315,000 340,000 (252,000) (130,000) 60,000 (150.000) (70,000) (100,000) (40,000) (200,000) Current Liabilities Bonds Payable Other Long-Term Liabilities Common Stock-B Co Other Paid in Capital-P Co Retained Earnings-B Co (200,000) (100,000) (474,000) Common Stock D Co. Other Paid in Capitals Co. Retained Earnings D Co. (150,000) (100,000) (200,000) Net Sales Cost of Goods Sold (600,000) 360.000 (380,000) 228,000 Operating Experises 140,000 62,000 Subsidiary Income Dividends DeclaredP Co. Dividends Declared-S Co. (72,000) 60,000 30,000 navailable ( IL lyi HabbCCL 1 Normal 1 No Spac... Heading 1 Heading 2 Title > w ES Paragraph Operating Expenses Styles 140,000 62,000 Subsidiary Income Dividends DeclaredP Co. Dividends DeclaredS Co. (72,000) 60,000 30,000 Consolidated Net Income NCI Controlling Interest Total NCI Ret. Earn. Contr. Int. 12-31 0 0 (continued) Consol Income Statement Control Retained Earnings Consol. Balance Sheet NCI Account Titles Inventory, December 31 Other Current Assets Investment in Sub. Company - A Aar A ++ 2+ AaBbCcDd AaBbCcbd A 1 Normal 1 No Spac... Heading 1 Heading 2 Title X A - A Styles ES Paragraph ant Land Buildings and Equipment Accumulated Depreciation Patent Current Liabilities Bonds Payable Other Long-Term Liabilities Common Stock-B Co Other Paid in Capital P Co. Retained Eamings B Co Common Stock D Co Other Paid in CapitalCo. Retamed Eamings-D Co. Net Sales Cost of Goods Sold Operating Expenses Subsidiary Income Dividends Declared P Co. Dividends Declared S Co. Consolidated Net Income NCI Controlling Interest Total NCI Ret. Earn Contr. Int. 12-31 Accessibility Unavailable . loy