Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Title:project appraisal kindly give all answer just tell option correct no need reasons Case 2: Oman Trading Co. has a budget of OMR 93,000 for

Title:project appraisal kindly give all answer just tell option correct no need reasons

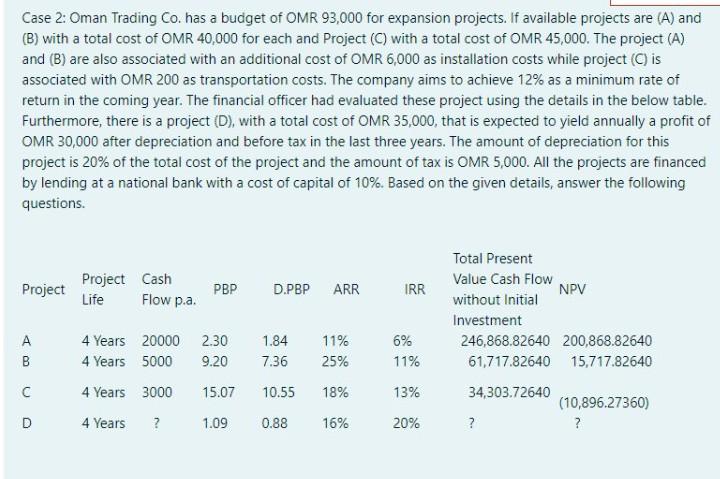

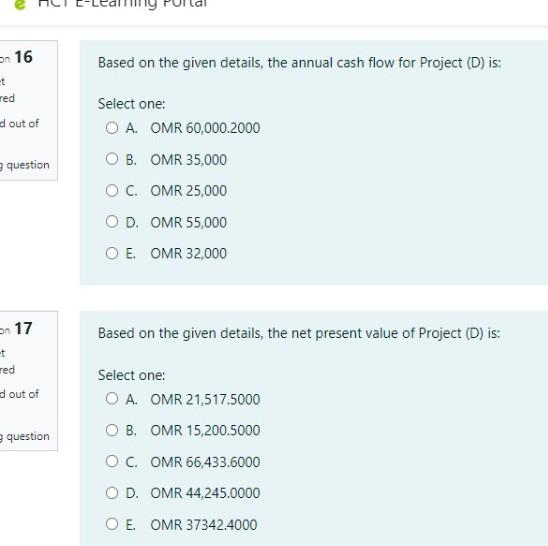

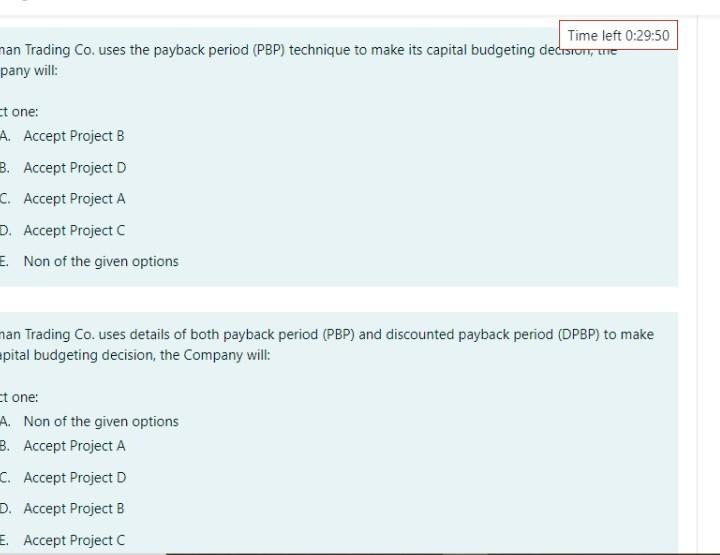

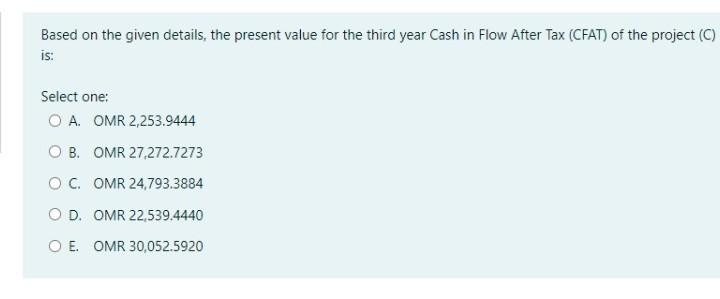

Case 2: Oman Trading Co. has a budget of OMR 93,000 for expansion projects. If available projects are (A) and (B) with a total cost of OMR 40,000 for each and Project (C) with a total cost of OMR 45,000. The project (A) and (B) are also associated with an additional cost of OMR 6,000 as installation costs while project (C) is associated with OMR 200 as transportation costs. The company aims to achieve 12% as a minimum rate of return in the coming year. The financial officer had evaluated these project using the details in the below table. Furthermore, there is a project (D), with a total cost of OMR 35,000, that is expected to yield annually a profit of OMR 30,000 after depreciation and before tax in the last three years. The amount of depreciation for this project is 20% of the total cost of the project and the amount of tax is OMR 5,000. All the projects are financed by lending at a national bank with a cost of capital of 10%. Based on the given details, answer the following questions. Total Present Project Project Cash Life Flow p.a. PBP D.PBP ARR IRR Value Cash Flow NPV without Initial Investment 2.30 1.84 11% 6% 246,868.82640 200,868.82640 COD 4 Years 20000 4 Years 5000 9.20 7.36 25% 11% 61,717.82640 15,717.82640 C 4 Years 3000 15.07 10.55 18% 13% 34,303.72640 (10,896.27360) D 4 Years ? 1.09 0.88 16% 20% ? ? on 16 Based on the given details, the annual cash flow for Project (D) is: et red Select one: d out of O A. OMR 60,000.2000 question OB. OMR 35,000 O C. OMR 25,000 OD. OMR 55,000 O E. OMR 32,000 on 17 Based on the given details, the net present value of Project (D) is: -t red Select one: d out of O A. OMR 21,517.5000 O B. OMR 15,200.5000 question O C. OMR 66,433.6000 OD. OMR 44,245.0000 O E. OMR 37342.4000 Time left 0:29:50 nan Trading Co. uses the payback period (PBP) technique to make its capital budgeting decision, LIIC pany will: ct one: A. Accept Project B B. Accept Project D C. Accept Project A D. Accept Project C E. Non of the given options nan Trading Co. uses details of both payback period (PBP) and discounted payback period (DPBP) to make =pital budgeting decision, the Company will: et one: A. Non of the given options B. Accept Project A C. Accept Project D D. Accept Project B E Accept Project C Based on the given details, the present value for the third year Cash in Flow After Tax (CFAT) of the project (C) is: Select one: O A. OMR 2,253.9444 O B. OMR 27,272.7273 OC. OMR 24,793.3884 OD. OMR 22,539.4440 O E. OMR 30,052.5920

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started