Answered step by step

Verified Expert Solution

Question

1 Approved Answer

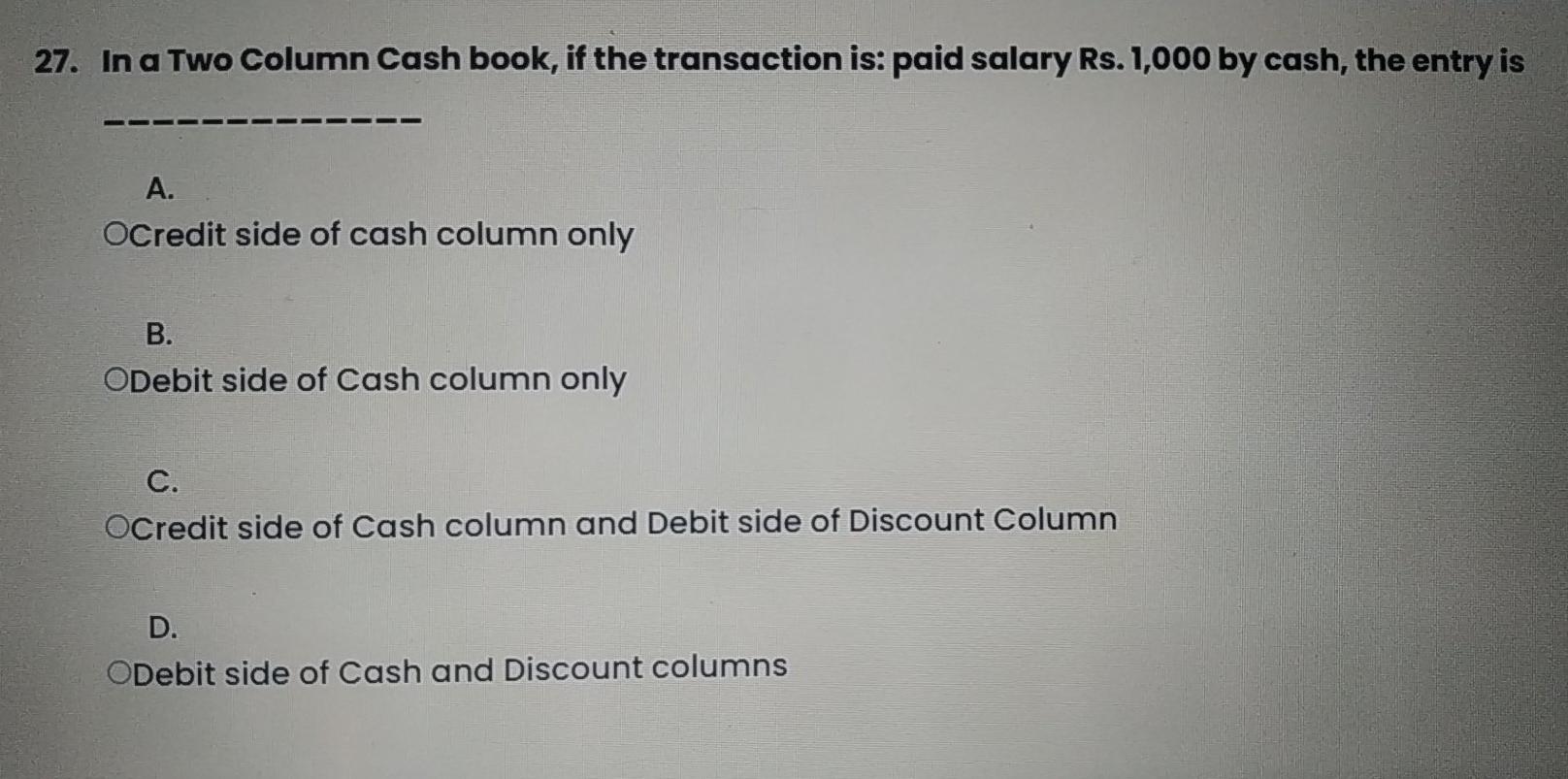

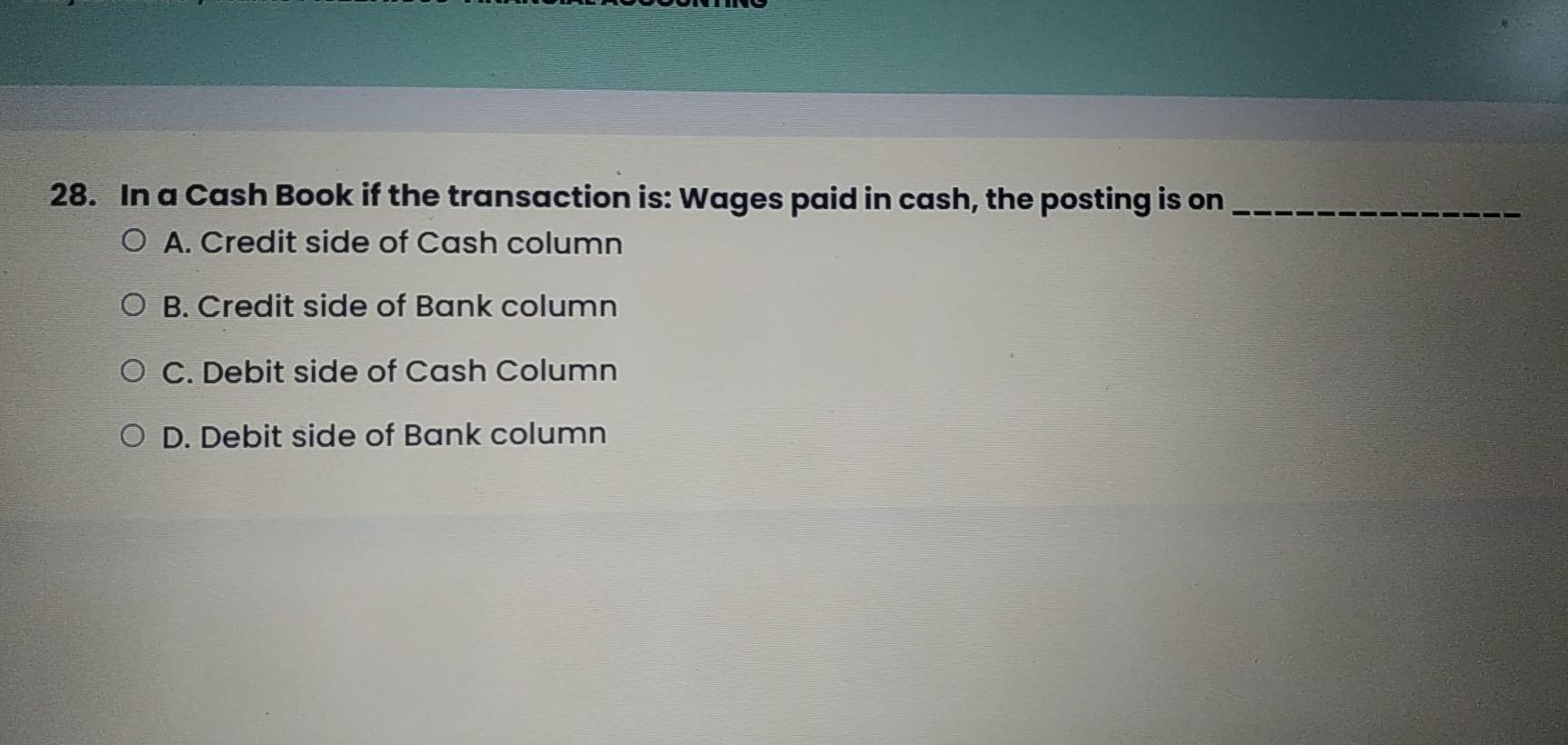

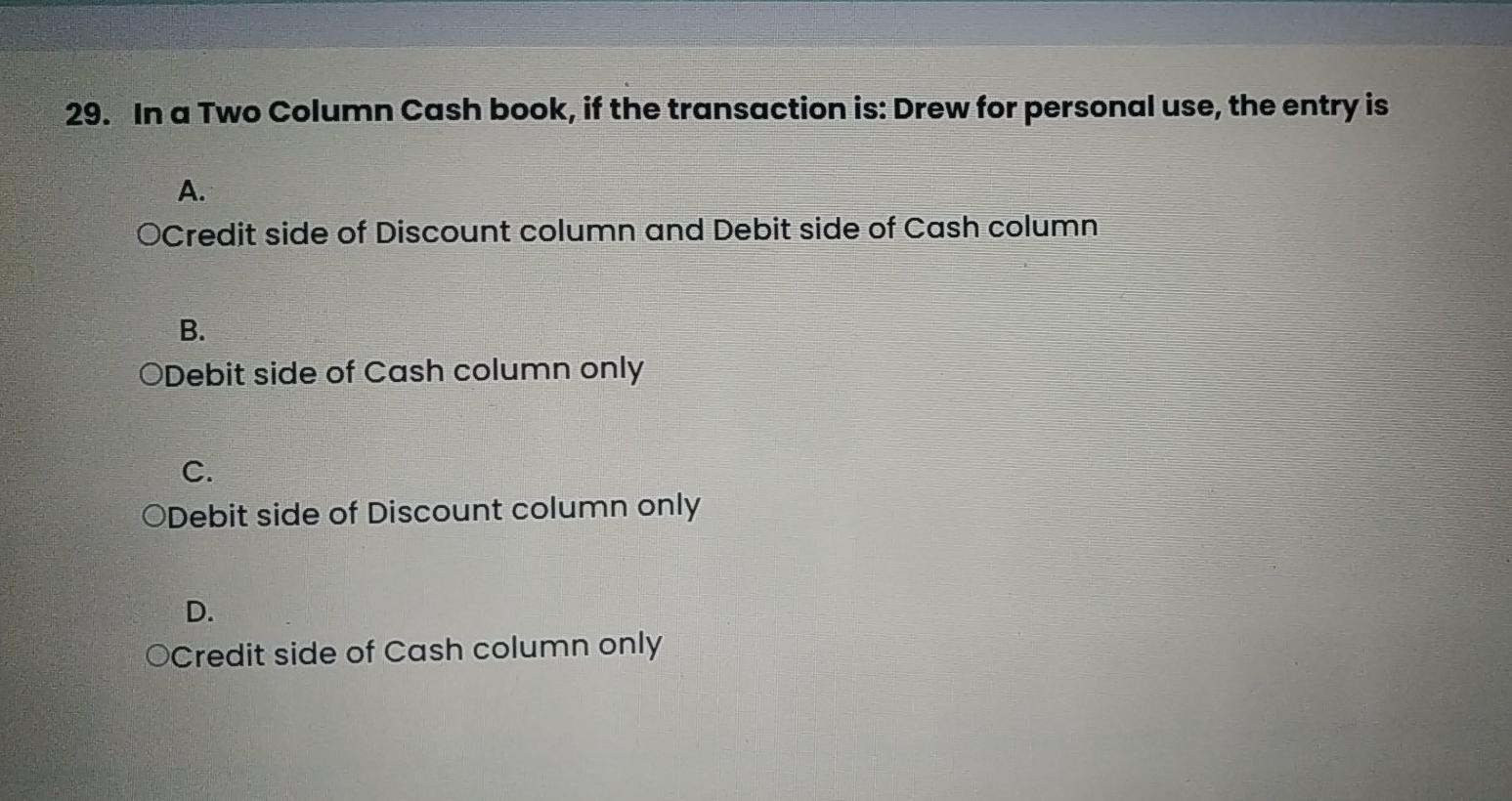

tive given to a debtor for making early payment is called as_ h Discount de Discount Je wave off hey wave off 27. In a

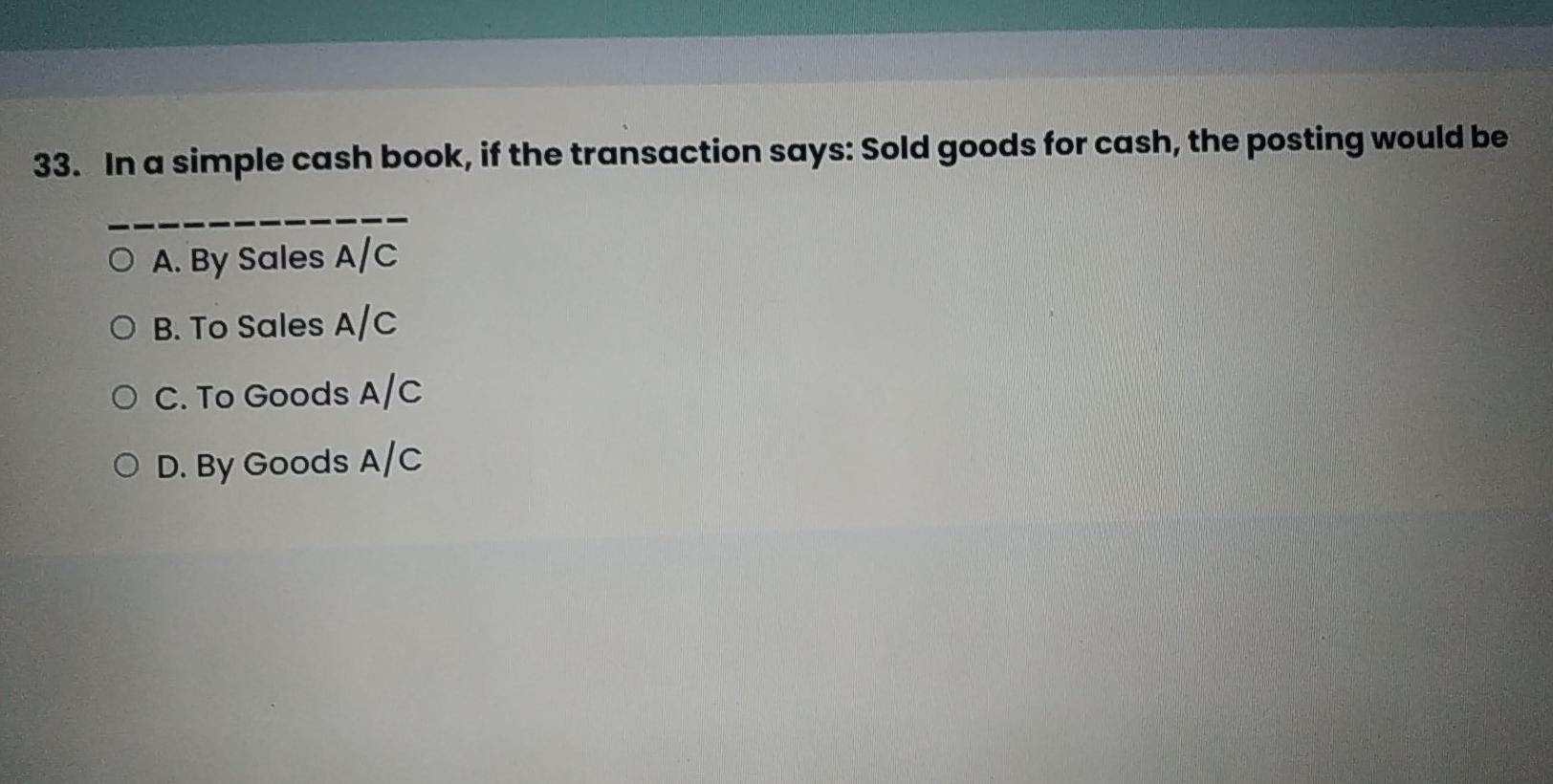

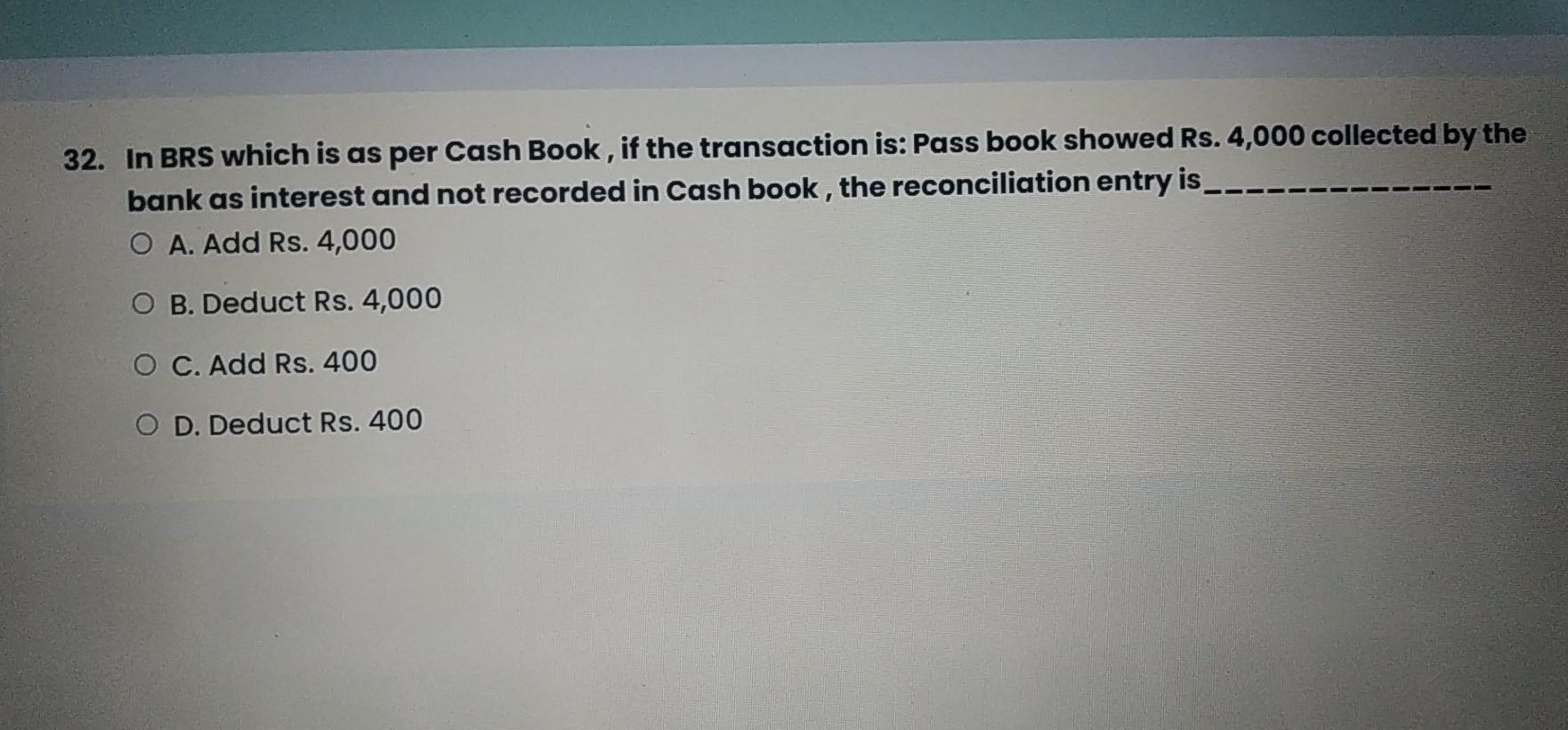

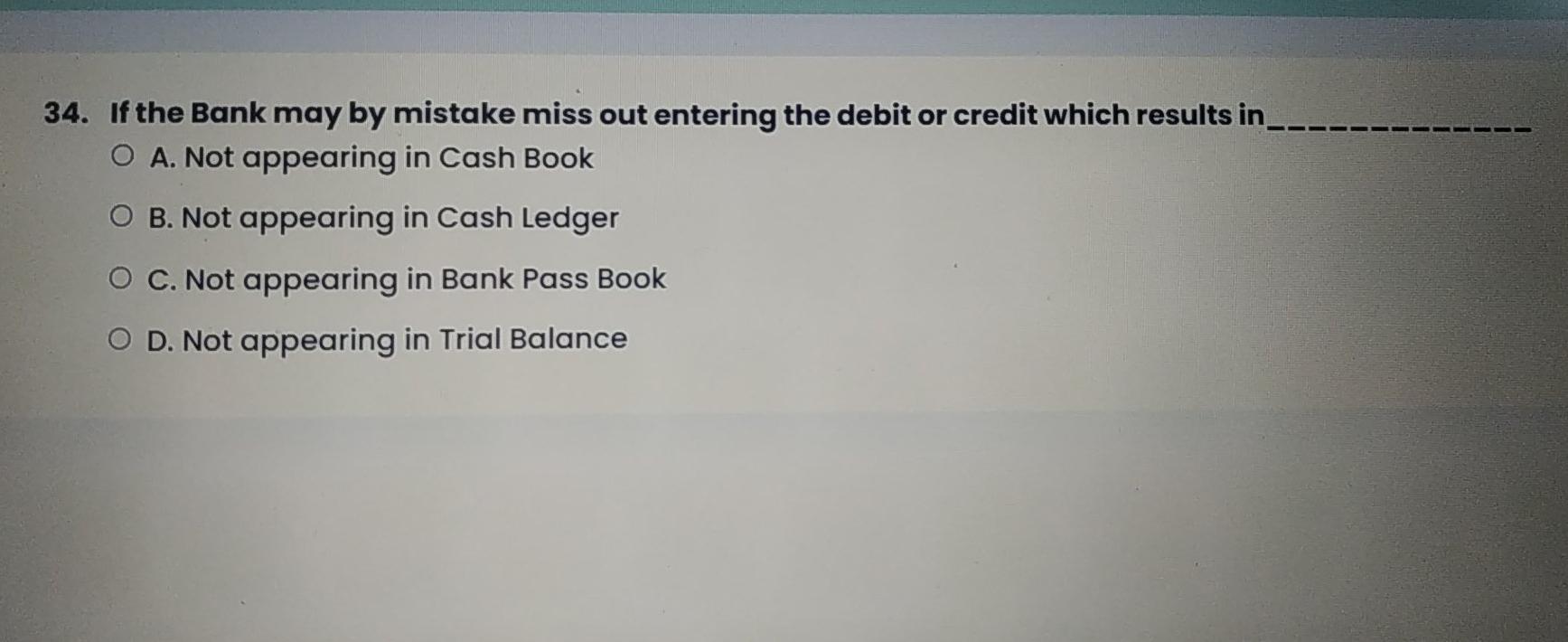

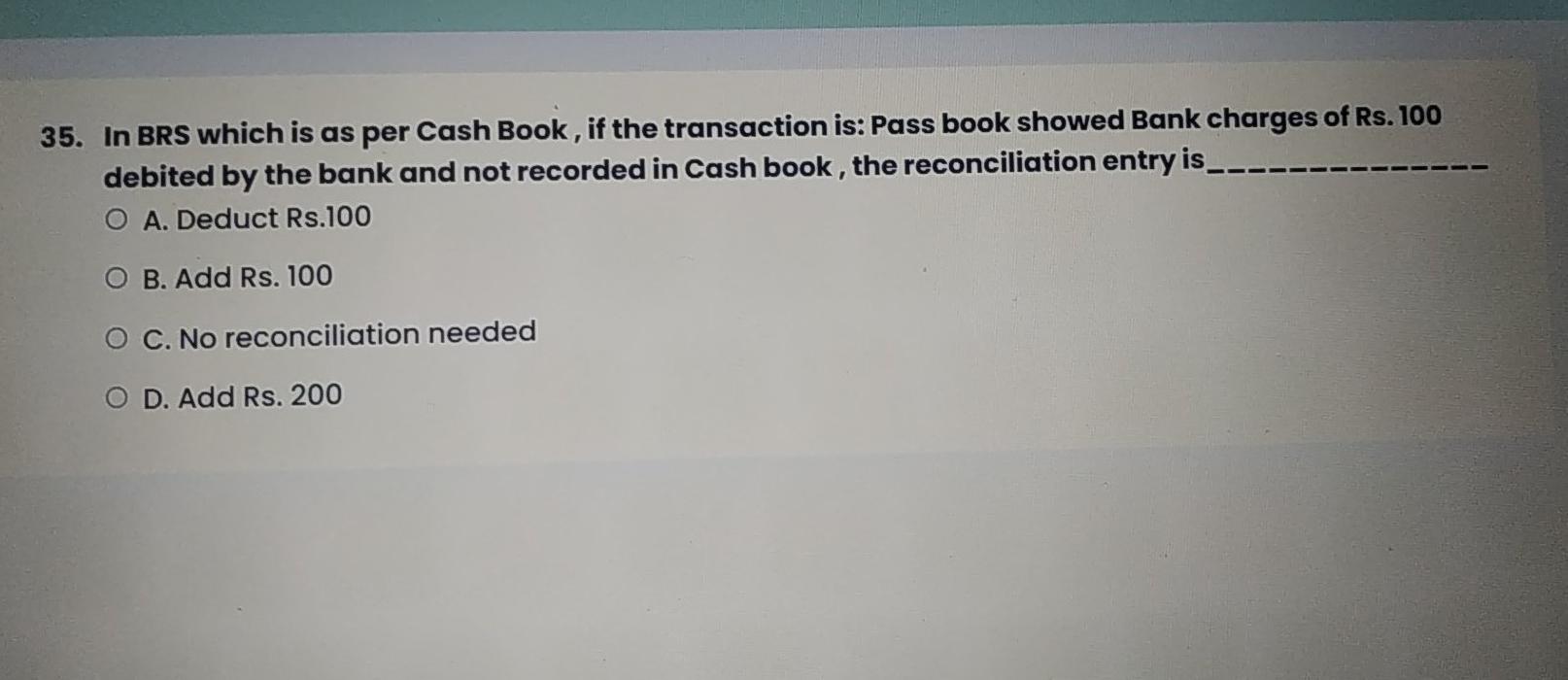

tive given to a debtor for making early payment is called as_ h Discount de Discount Je wave off hey wave off 27. In a Two Column Cash book, if the transaction is: paid salary Rs. 1,000 by cash, the entry is A. OCredit side of cash column only B. ODebit side of Cash column only C. OCredit side of Cash column and Debit side of Discount Column D. Debit side of Cash and Discount columns 28. In a Cash Book if the transaction is: Wages paid in cash, the posting is on O A. Credit side of Cash column O B. Credit side of Bank column O C. Debit side of Cash Column O D. Debit side of Bank column 29. In a Two Column Cash book, if the transaction is: Drew for personal use, the entry is A. OCredit side of Discount column and Debit side of Cash column B. ODebit side of Cash column only C. ODebit side of Discount column only D. OCredit side of Cash column only 33. In a simple cash book, if the transaction says: Sold goods for cash, the posting would be O A. By Sales A/C O B.To Sales A/C O C. To Goods A/C O D. By Goods A/C 32. In BRS which is as per Cash Book, if the transaction is: Pass book showed Rs. 4,000 collected by the bank as interest and not recorded in Cash book, the reconciliation entry is O A. Add Rs. 4,000 O B. Deduct Rs. 4,000 O C. Add Rs. 400 O D. Deduct Rs. 400 34. If the Bank may by mistake miss out entering the debit or credit which results in O A. Not appearing in Cash Book O B. Not appearing in Cash Ledger O C. Not appearing in Bank Pass Book O D. Not appearing in Trial Balance 35. In BRS which is as per Cash Book, if the transaction is: Pass book showed Bank charges of Rs. 100 debited by the bank and not recorded in Cash book, the reconciliation entry is _-- A. Deduct Rs.100 O B. Add Rs. 100 O C. No reconciliation needed O D. Add Rs. 200 36. In BRS, as per Cash Book as on 31st Dec. 2019, if the transaction is: Cheques sent for collection, but were collected and credited in January 2020 Rs. 3,000, the reconciliation entry is_-_ A. ODeduct Rs. 3,000 B. OAdd Rs. 3,000 C. Add: 300 D. ODeduct Rs. 300 40. Which financial statement displays the revenues and expenses of a company for a period of time? O A. Income and expenditure Statement O B. Balance Sheet O C. Cash flow statement O D. Statement of stock holder's equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started