Answered step by step

Verified Expert Solution

Question

1 Approved Answer

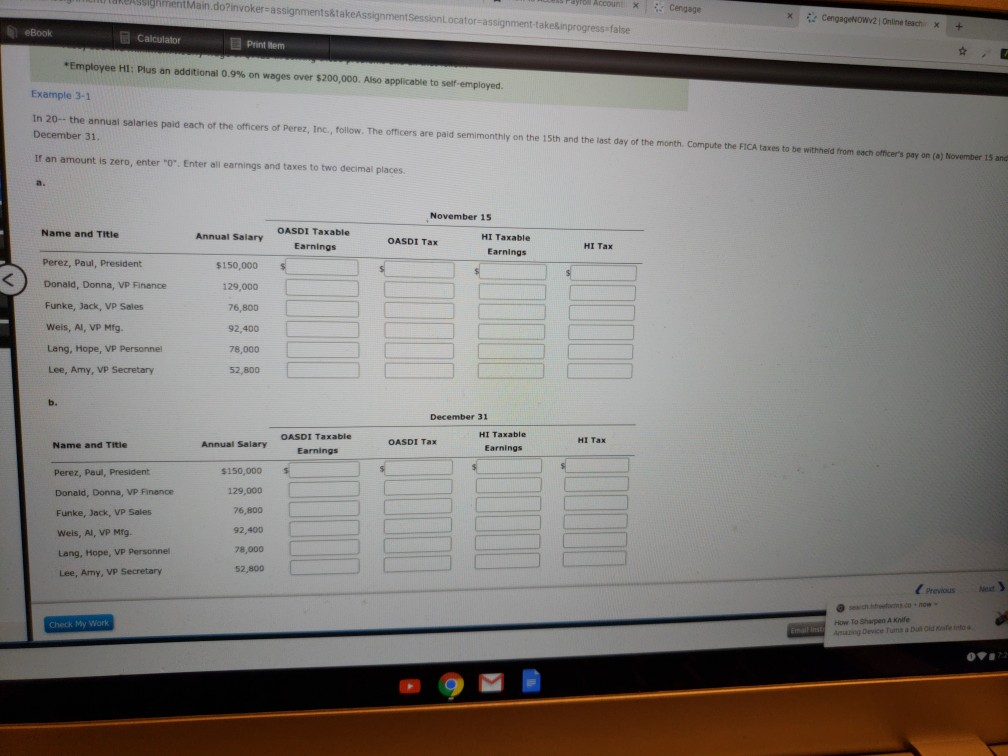

tMain.do?invoker-assignments&ta keAssig Locator-assignment-t akekinprogress false eBook Calculator Print tem *Employee HI: pus an additional 0.9% on wages over $200,000. Also applicable to self-employed. Example 3-1

tMain.do?invoker-assignments&ta keAssig Locator-assignment-t akekinprogress false eBook Calculator Print tem *Employee HI: pus an additional 0.9% on wages over $200,000. Also applicable to self-employed. Example 3-1 In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withhed from each officer's pay on (a) November 15 and December 31 If an amount is zero, enter "0". Enter all earnings and taxes to two decimal places November 15 OASDI Taxable Earnings Name nd Title Annual Salary HI Taxable OASDI Tax HI Tax Earnings Perez, Paul, President Donald, Donna, VP Finence Funke, Jack, VP Sales Weis, Al, VP Mfg. Lang, Hope, VP Personnel Lee, Amy, VP Secretary $150,000 129,000 76,800 92,400 78,000 52,800 b. OASDI Taxable HI Taxable Name a Perez, Paul, President Donald, Donna, VP Finence Funke, Jack, VP Sales Weis, AI, VP Mig. Lang, Hope, VP Personnel Lee, Amy, VP Secretary and Title Annual Salary OASDI Tax HI Tax Earnings $150,000 $ 129,000 76,800 92,400 78,000 52,800 Previcus Knife Check My Work How To Sharpen A ng Device uma

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started