Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TMGT 2 0 1 0 - Master Budget Exercise - Merchandising Business Your Mission... to prepare a Master Budget Big Banana Sport Drinks Sales Budget

TMGT Master Budget Exercise Merchandising

Business

Your Mission... to prepare a Master Budget Big Banana Sport Drinks

Sales Budget

Merchandise Purchases Budget

Selling and Administrative Expense Budget

Capital Expenditures Budget

Collections and payments Budget

ProForma Budgeted Income Statement

Cash Budget

ProForma Budgeted Balance Sheet

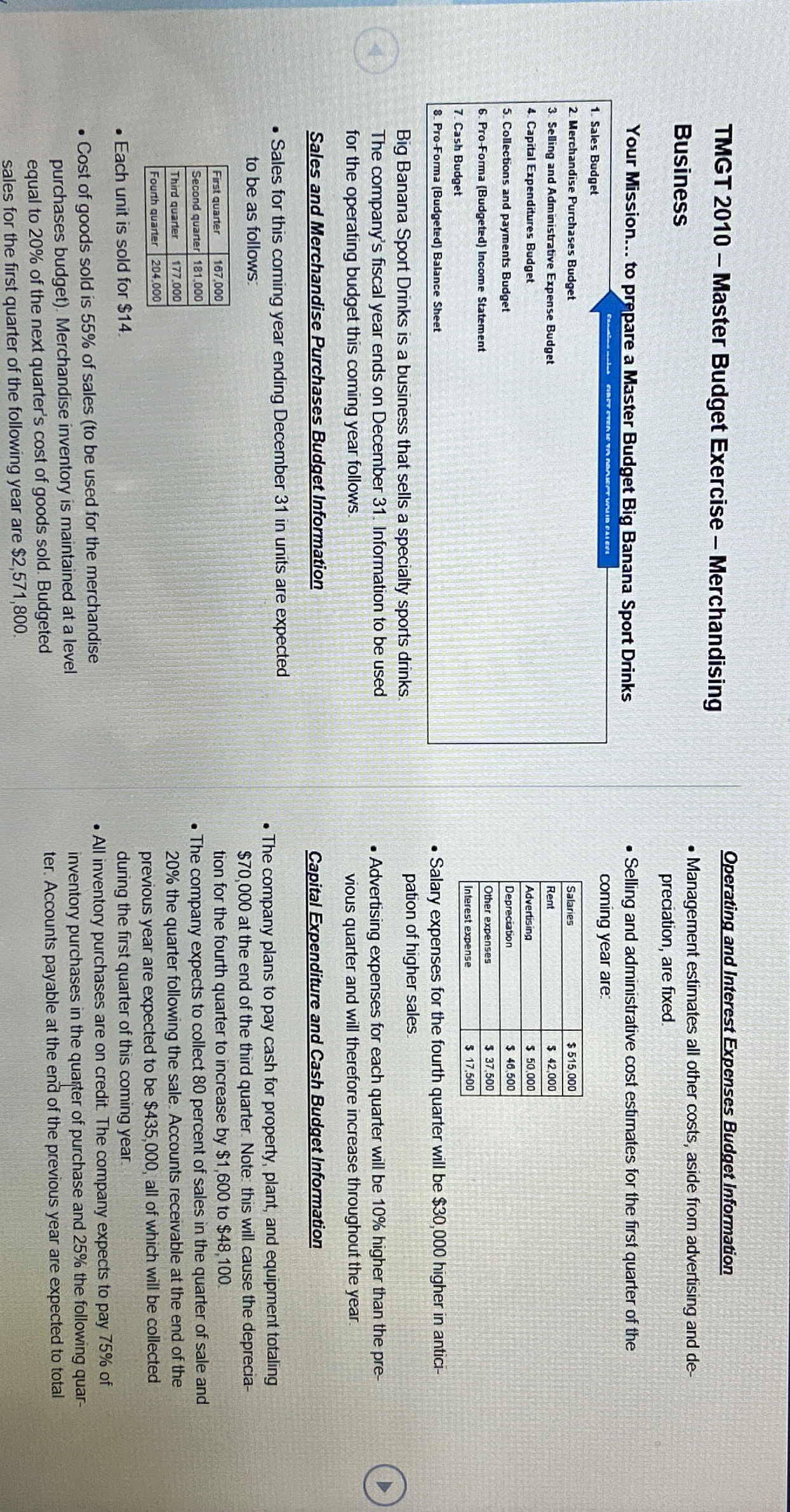

Big Banana Sport Drinks is a business that sells a specialty sports drinks

The company's fiscal year ends on December Information to be used for the operating budget this coming year follows.

Sales and Merchandise Purchases Budget Information

Sales for this coming year ending December in units are expected to be as follows:

tableFirst quarter,Second quarter,Third quarter,Fourth quarter,

Each unit is sold for $

Cost of goods sold is of sales to be used for the merchandise purchases budget Merchandise inventory is maintained at a level equal to of the next quarter's cost of goods sold. Budgeted sales for the first quarter of the following year are $

Operating and Interest Expenses Budget Information

Management estimates all other costs, aside from advertising and depreciation, are fixed.

Selling and administrative cost estimates for the first quarter of the coming year are expected to total $ all of which will be paid during the first quarter of the coming year.

The cash balanxe at the begining of this coming year expected to be $

A dividend payment of $ will be paid in each quarter to owners of the business

$ of the long term debt will be repaid at the end of Q

Budget balance sheet and invome statement ingormation. Big banana started the year with long term debt of $ expected account balances at the end of the fourthe quarter are property, plant and equipment common stock The companys income is taxed at the rate of Actual retained earnings at the end od the last year titalled $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started