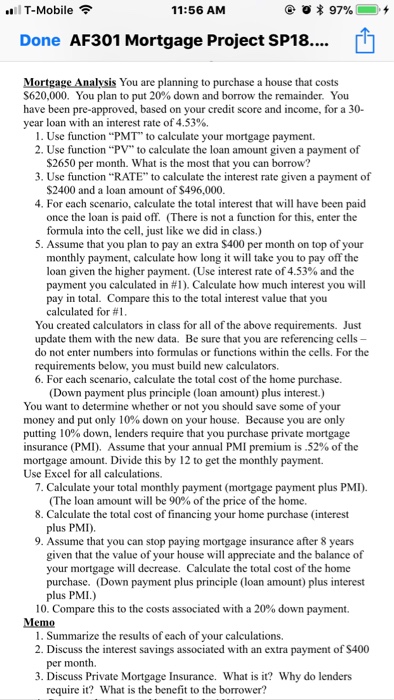

T-Mobile 11:56 AM Done AF301 Mortgage Project SP18... Mortgage Analysis You are planning to purchase a house that costs $620,000. You plan to put 20% down and borrow the remainder. You have been pre-approved, based on your credit score and income, for a 30 year loan with an interest rate of4.53% 1. Use function "PMT" to calculate your mortgage payment. 2. Use function "PV" to calculate the loan amount given a payment of S2650 per month. What is the most that you can borrow? 3. Use function "RATE" to calculate the interest rate given a payment of $2400 and a loan amount of $496,000. 4. For each scenario, calculate the total interest that will have been paid once the loan is paid off. (There is not a function for this, enter the formula into the cell, just like we did in class.) 5. Assume that you plan to pay an extra $400 per month on top of your monthly payment, calculate how long it will take you to pay off the loan given the higher payment. (Use interest rate of 4.53% and the payment you calculated in #1). Calculate how much interest you will pay in total. Compare this to the total interest value that you calculated for #1 You created calculators in class for all of the above requirements. Just update them with the new data. Be sure that you are referencing cells do not enter numbers into formulas or functions within the cells. For the requirements below, you must build new calculators. 6. For each scenario, calculate the total cost of the home purchase. (Down payment plus principle (loan amount) plus interest.) You want to determine whether or not you should save some of your money and put only 10% down on your house. Because you are only putting 10% down, lenders require that you purchase private mortgage insurance (PMI). Assume that your annual PMI premium is ,52% of the mortgage amount. Divide this by 12 to get the monthly payment. Use Excel for all calculations. 7. Calculate your total monthly payment (mortgage payment plus PMI) (The loan amount will be 90% of the price of the home. 8. Calculate the total cost of financing your home purchase (interest plus PMI) 9. Assume that you can stop paying mortgage insurance after 8 years given that the value of your house will appreciate and the balance of your mortgage will decrease. Calculate the total cost of the home purchase. (Down payment plus principle (loan amount) plus interest plus PMI.) 10. Compare this to the costs associated with a 20% down payment. Memo 1. Summarize the results of each of your calculations 2. Discuss the interest savings associated with an extra payment of S400 r month. 3. Discuss Private Mortgage Insurance. What is it? Why do lenders require it? What is the benefit to the borrower