Question

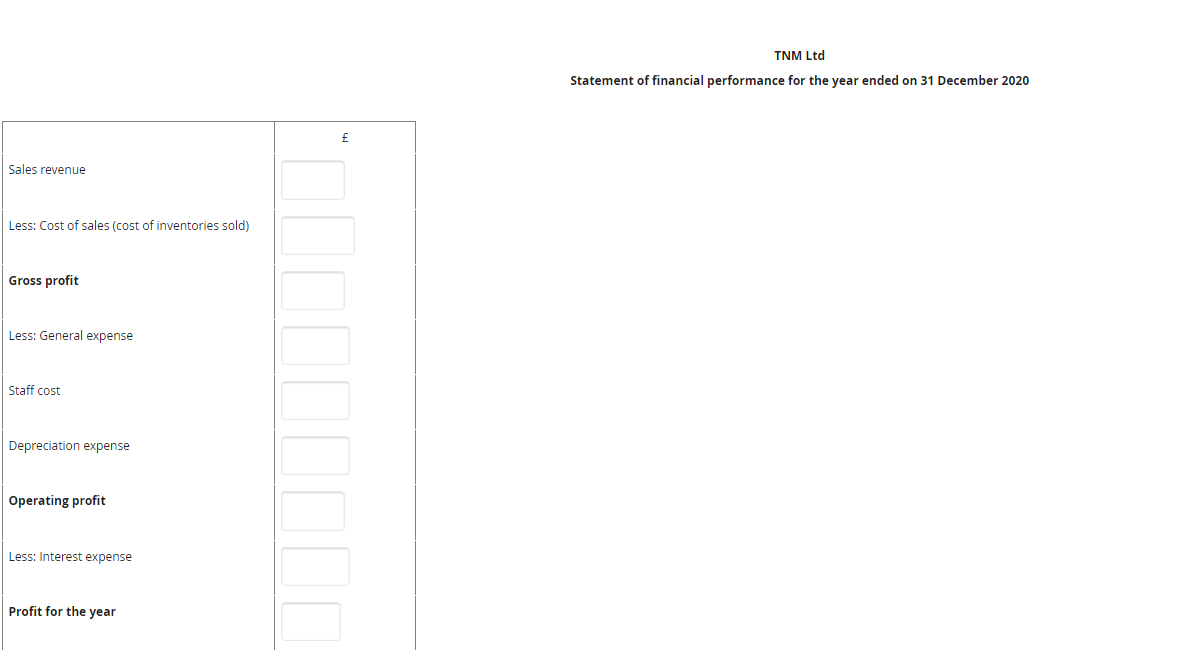

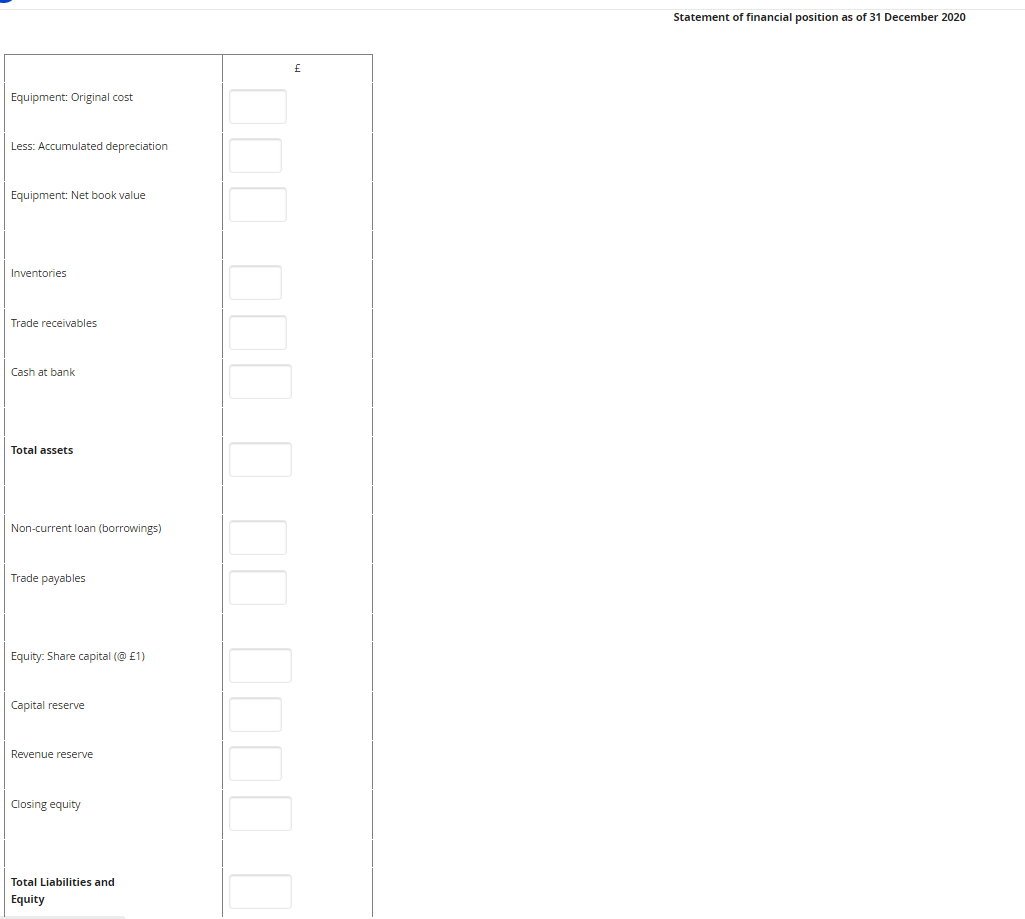

TNM Ltd, a new company, was established as at 1 January 2020. The following transactions took place during 2020. (a) issued 100,000 shares to the

TNM Ltd, a new company, was established as at 1 January 2020. The following transactions took place during 2020.

(a) issued 100,000 shares to the initial investors at the nominal value of 1.00, received 100,000 in cash.

(b) bought equipment on 1 January 2020, valued at 55,000, and paid the full amount in cash. The company depreciates the equipment using the reducing balance method at a rate of 8%.

(c) bought inventories costing 42,000 on credit.

(d) earned sales revenue of 65,000. The inventories sold cost 39,000. 31,000 of this sales revenue was for cash and the remaining was made on credit.

(e) took a non-current loan of 50,000 from a commercial bank.

(f) paid trade payables 25,000.

(g) received cash totalling 13,000 from trade receivables.

(h) paid wages totalling 5,900.

(i) paid interest of 1,000 on the borrowings from the commercial bank.

(j) paid general expenses of 5,400.

Required:

Based on the above transactions or events, prepare a statement of financial position for the business as at 31 December 2020 and an income statement for the year.

Enter your answer in the table below. Values to be subtracted should be entered with parentheses. Enter the values only, without a comma (,) and pound sign (). Enter values in integer, without any decimals. Do not enter any spaces. For example, to subtract expense 1000, enter (1000)

TNM Ltd Statement of financial performance for the year ended on 31 December 2020 Sales revenue Less: Cost of sales (cost of inventories sold) Gross profit Less: General expense Staff cost Depreciation expense Operating profit Less: Interest expense Profit for the year Statement of financial position as of 31 December 2020 Equipment: Original cost Less: Accumulated depreciation Equipment: Net book value Inventories Trade receivables Cash at bank Total assets Non-current loan (borrowings) Trade payables Equity: Share capital (@1) Capital reserve Revenue reserve Closing equity Total Liabilities and Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started