Answered step by step

Verified Expert Solution

Question

1 Approved Answer

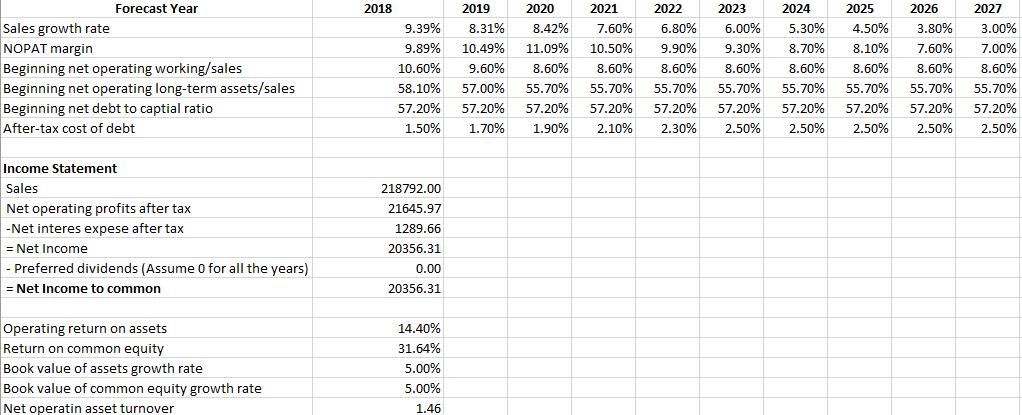

Complete income statement Forecast Year Sales growth rate NOPAT margin Beginning net operating working/sales Beginning net operating long-term assets/sales Beginning net debt to captial ratio

Complete income statement

Forecast Year Sales growth rate NOPAT margin Beginning net operating working/sales Beginning net operating long-term assets/sales Beginning net debt to captial ratio After-tax cost of debt Income Statement Sales Net operating profits after tax -Net interes expese after tax = Net Income - Preferred dividends (Assume 0 for all the years) = Net Income to common Operating return on assets Return on common equity Book value of assets growth rate Book value of common equity growth rate Net operatin asset turnover 2018 2024 2025 9.39% 3.00% 2019 2020 2021 2022 2023 2026 8.31% 8.42% 7.60% 6.80% 6.00% 5.30% 4.50% 3.80% 9.89% 10.49% 11.09% 10.50% 9.90% 9.30% 8.70% 8.10% 7.60% 7.00% 10.60% 9.60% 8.60% 8.60% 8.60% 8.60% 8.60% 8.60% 8.60% 8.60% 58.10% 57.00% 55.70% 55.70% 55.70% 55.70% 55.70% 55.70% 55.70% 55.70% 57.20% 57.20% 57.20% 57.20% 57.20% 57.20% 57.20% 57.20% 57.20% 57.20% 1.50% 1.70% 1.90% 2.10% 2.30% 2.50% 2.50% 2.50% 2.50% 2.50% 218792.00 21645.97 1289.66 20356.31 0.00 20356.31 14.40% 31.64% 5.00% 5.00% 1.46 2027

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To complete the cash flow data we will calculate the values for each year based on the provided information Heres the completed cash flow data 2018 Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started