To answer:

To answer:

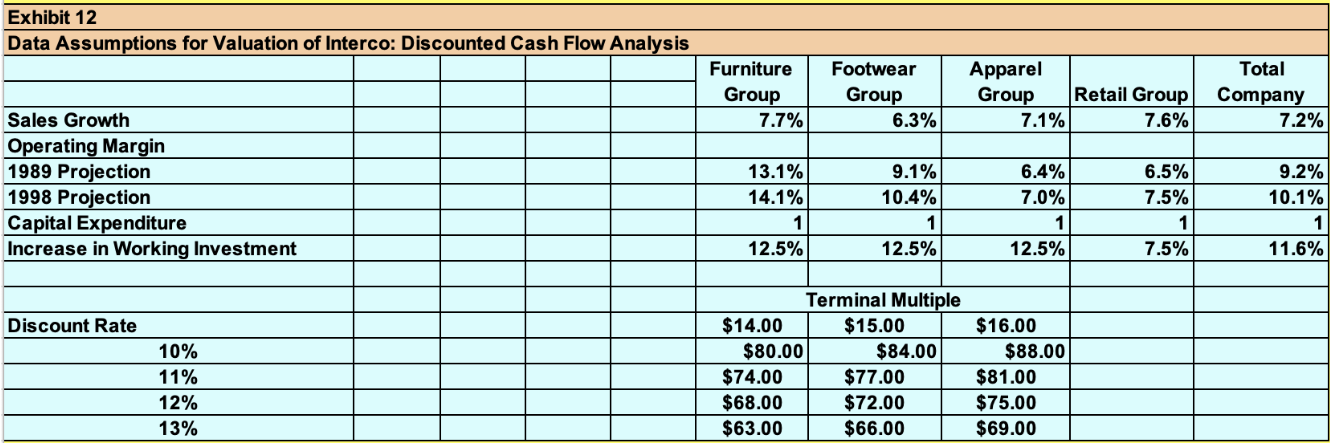

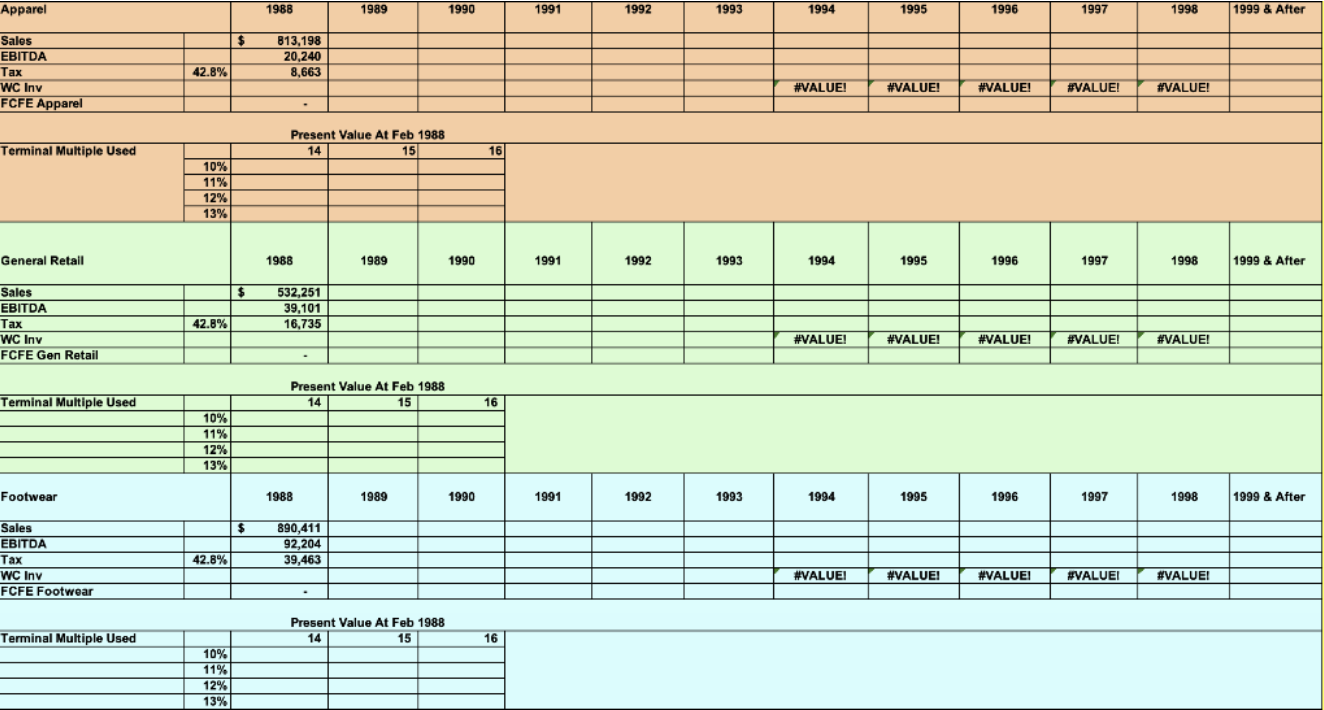

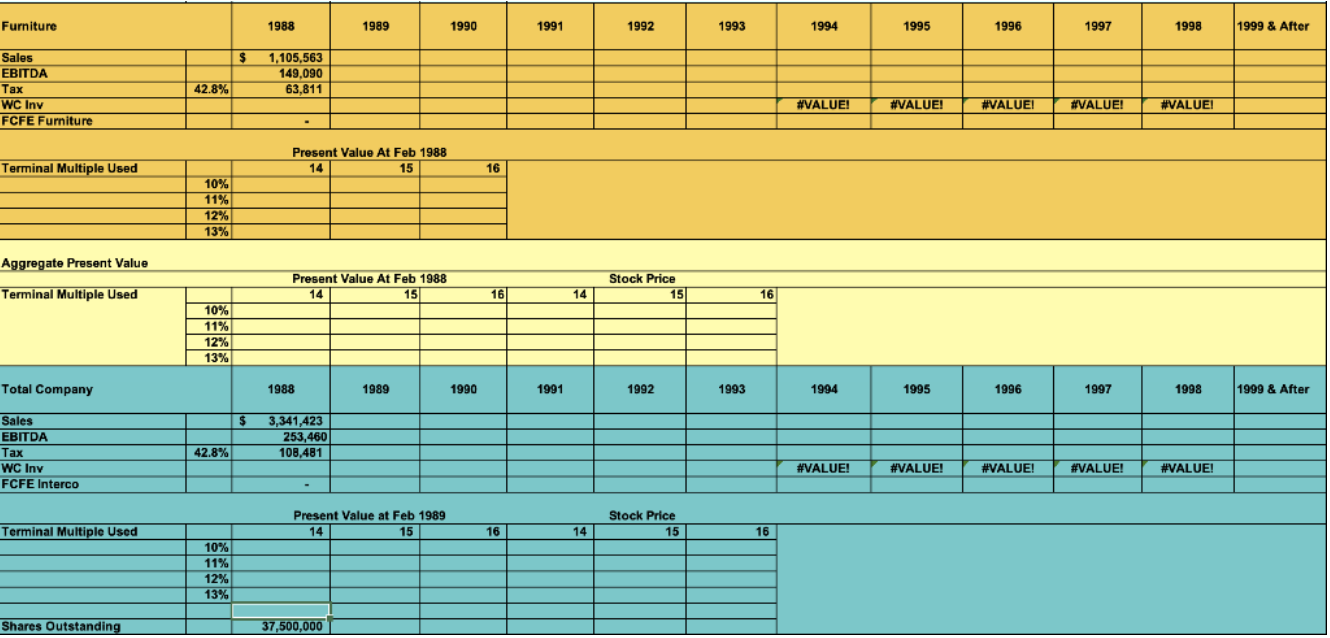

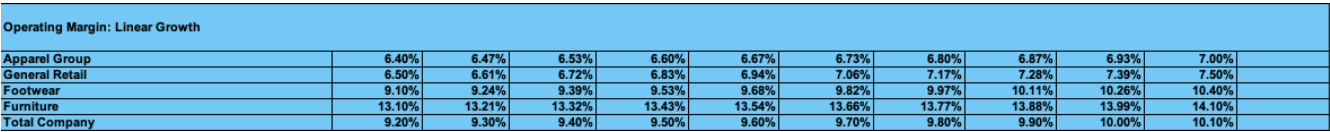

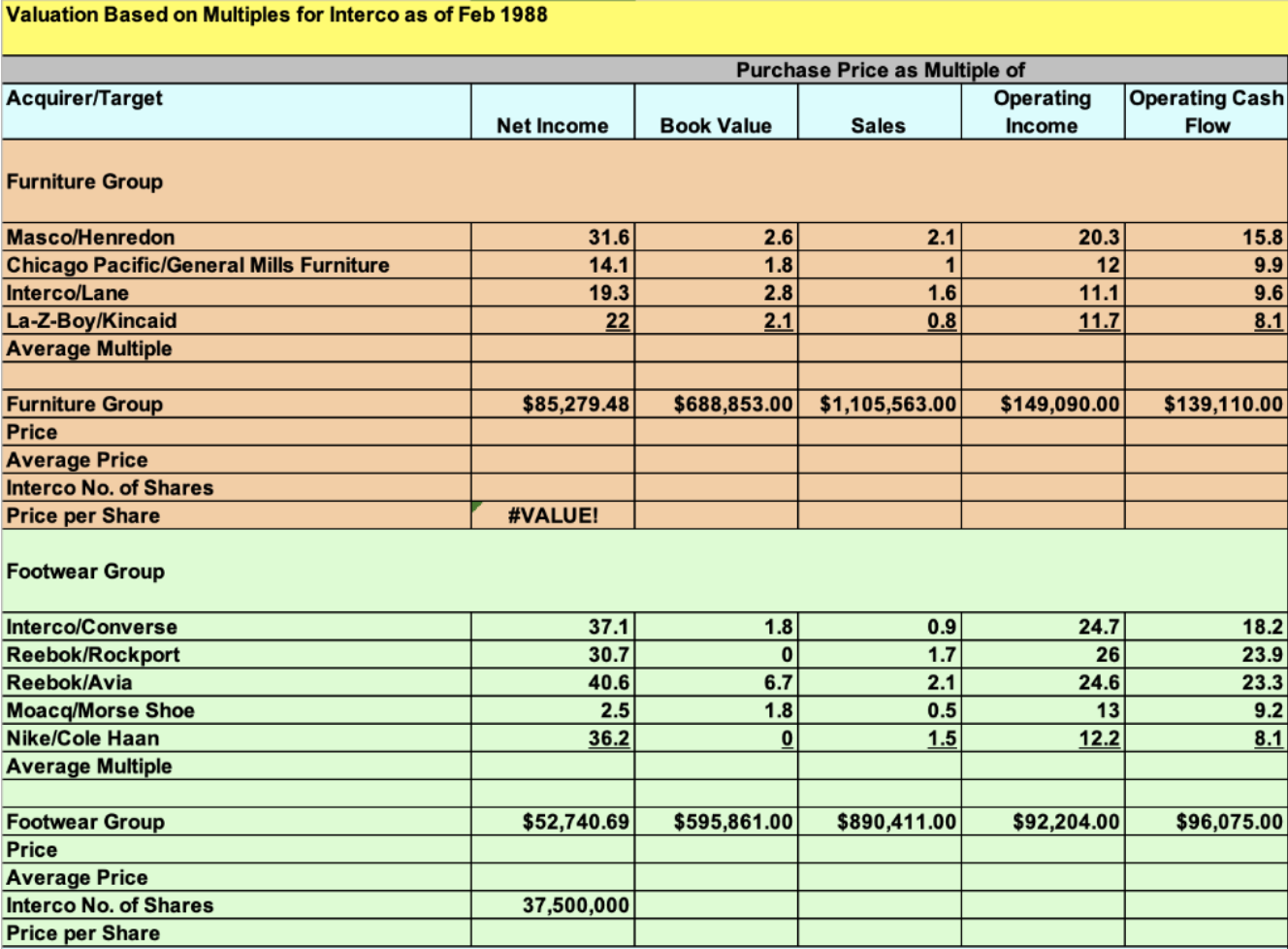

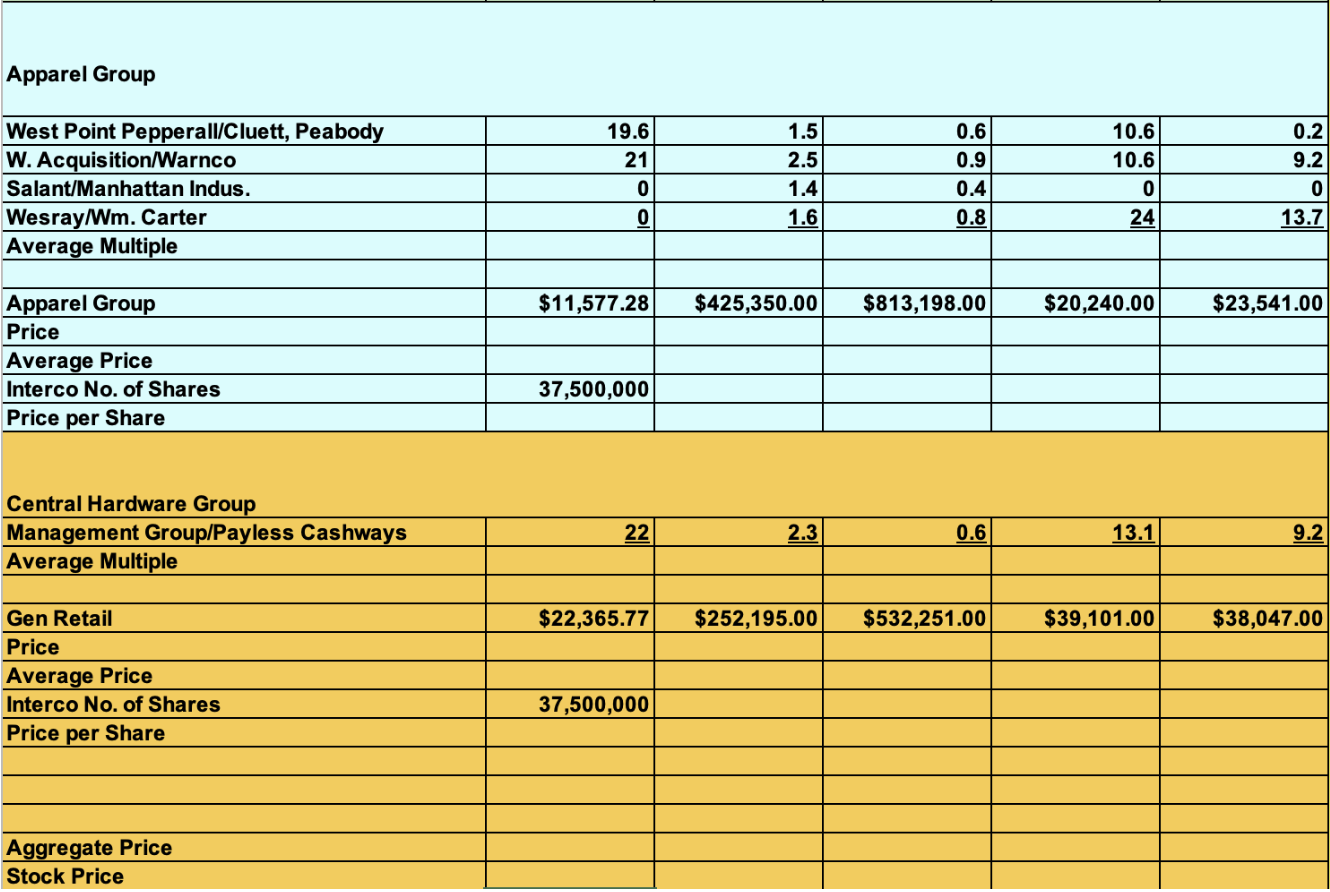

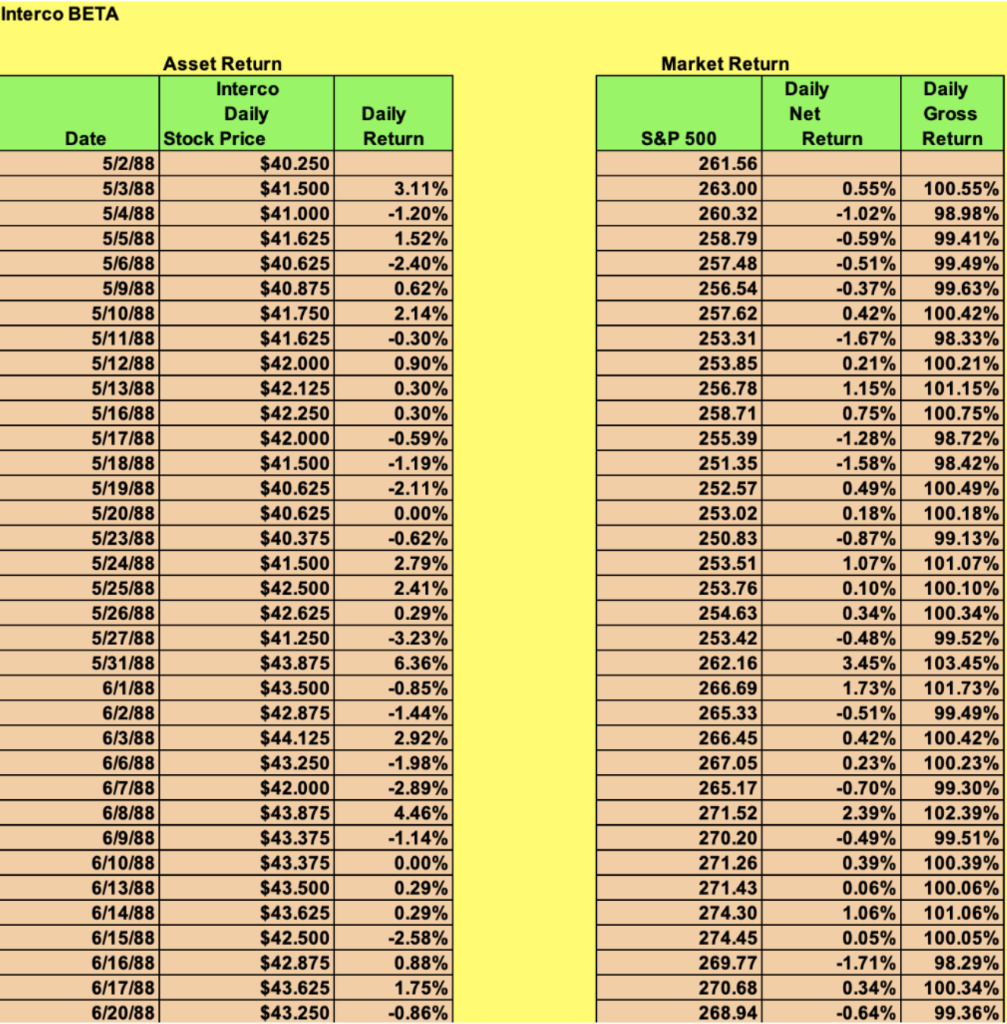

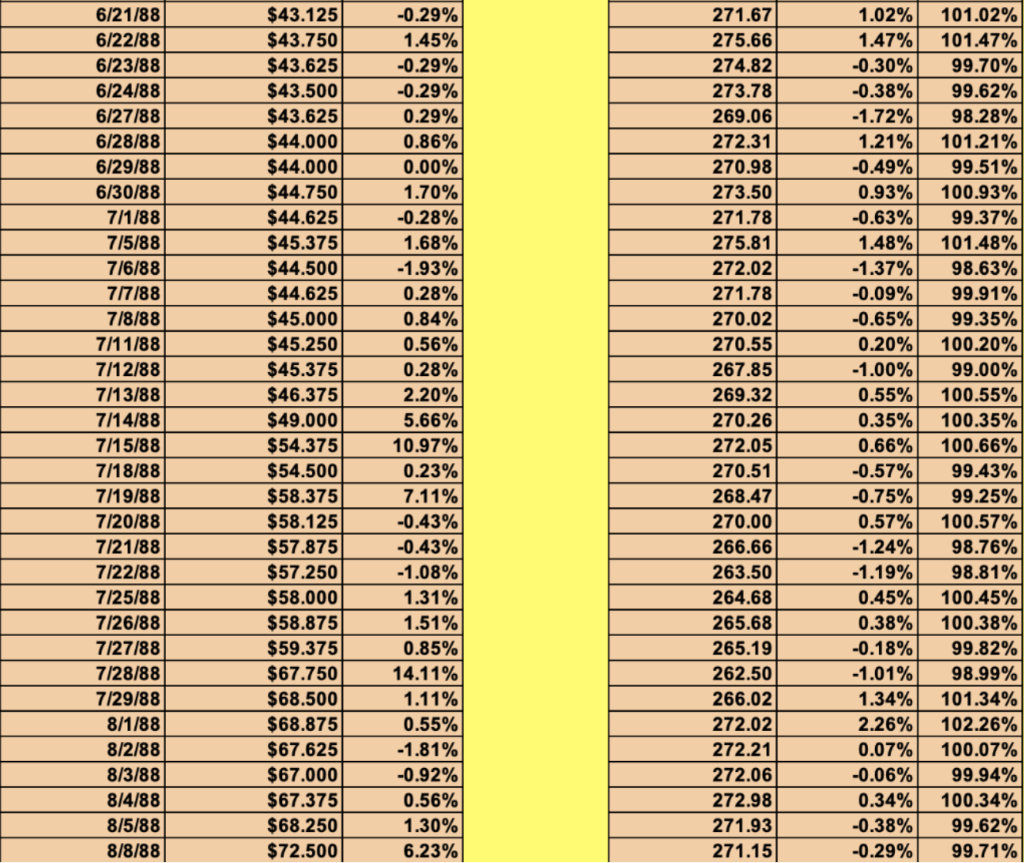

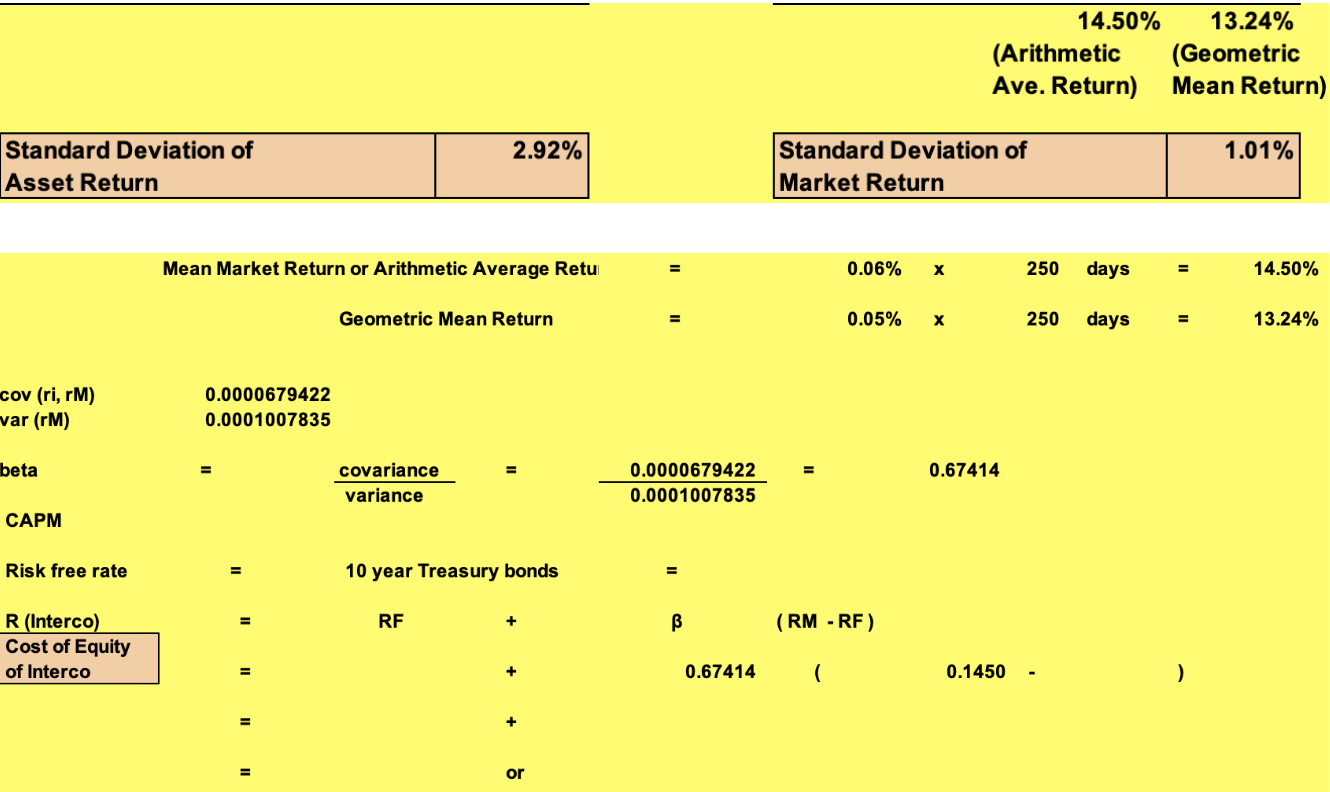

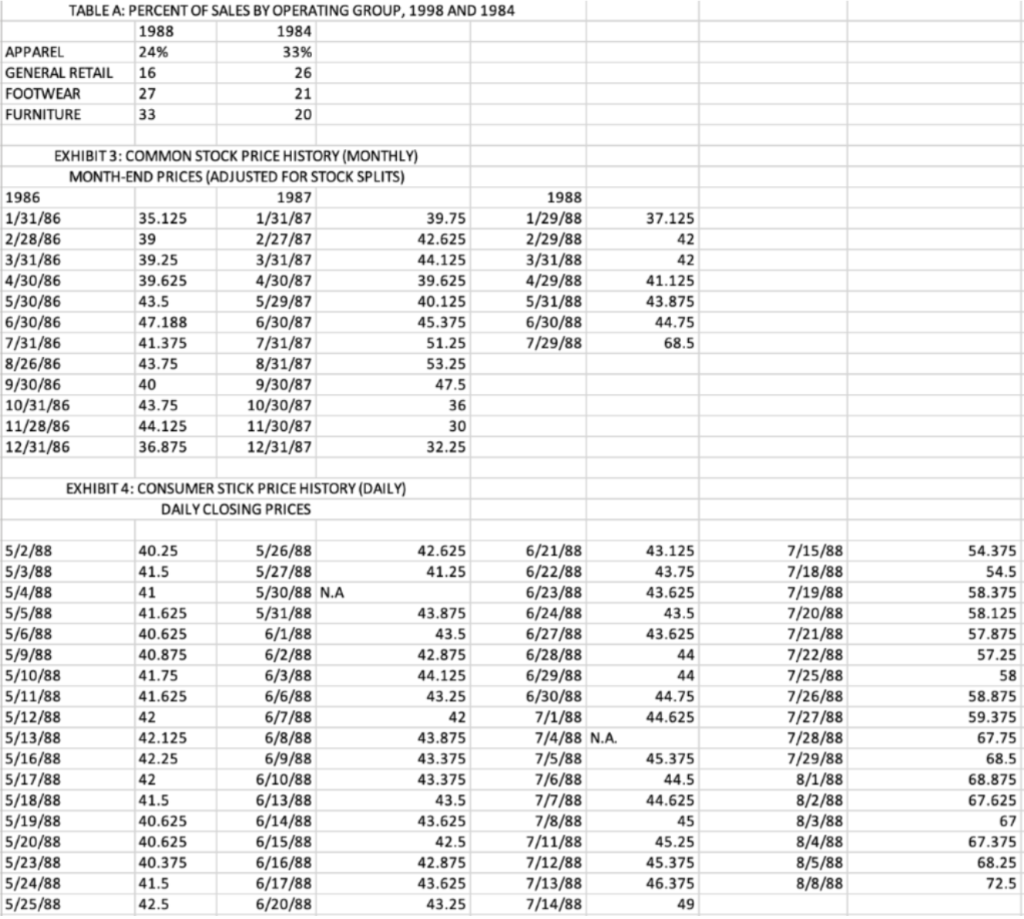

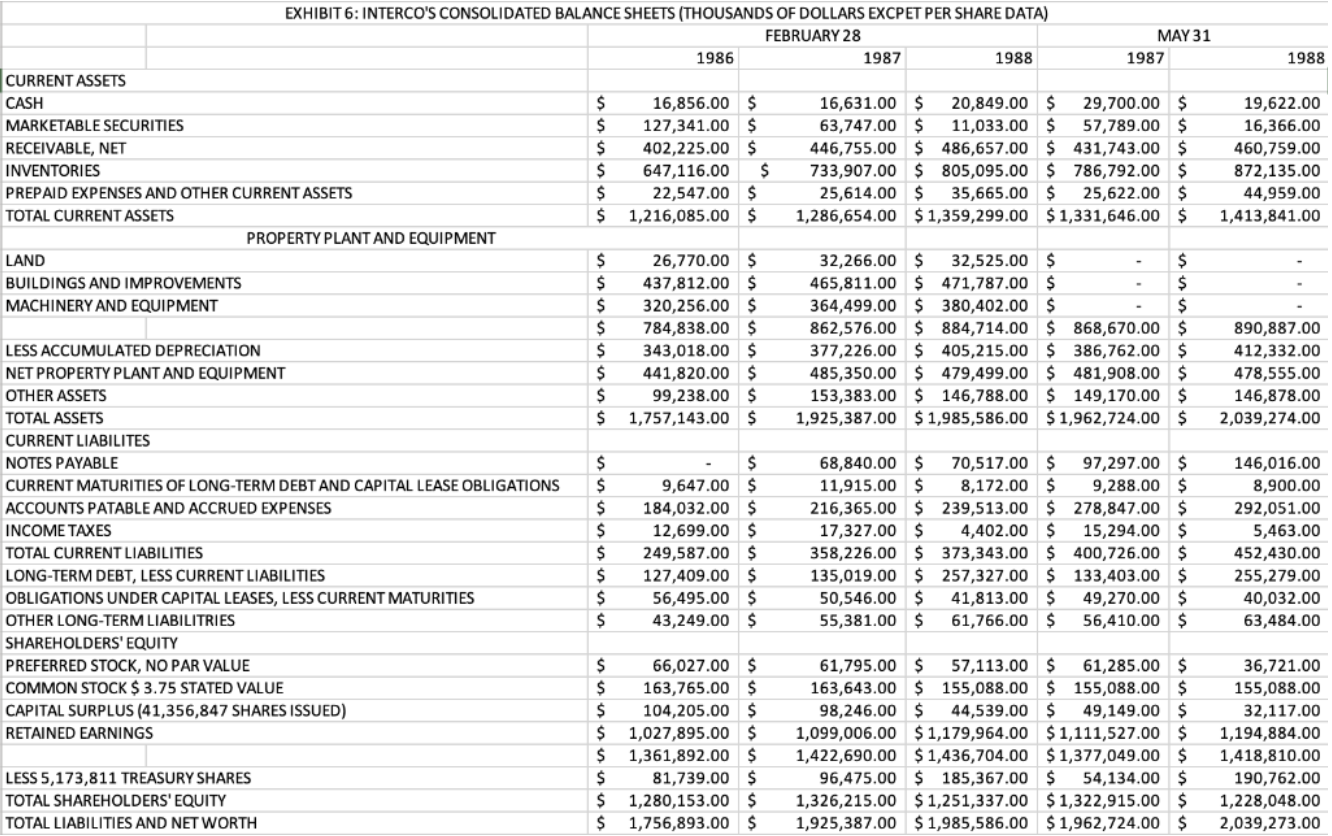

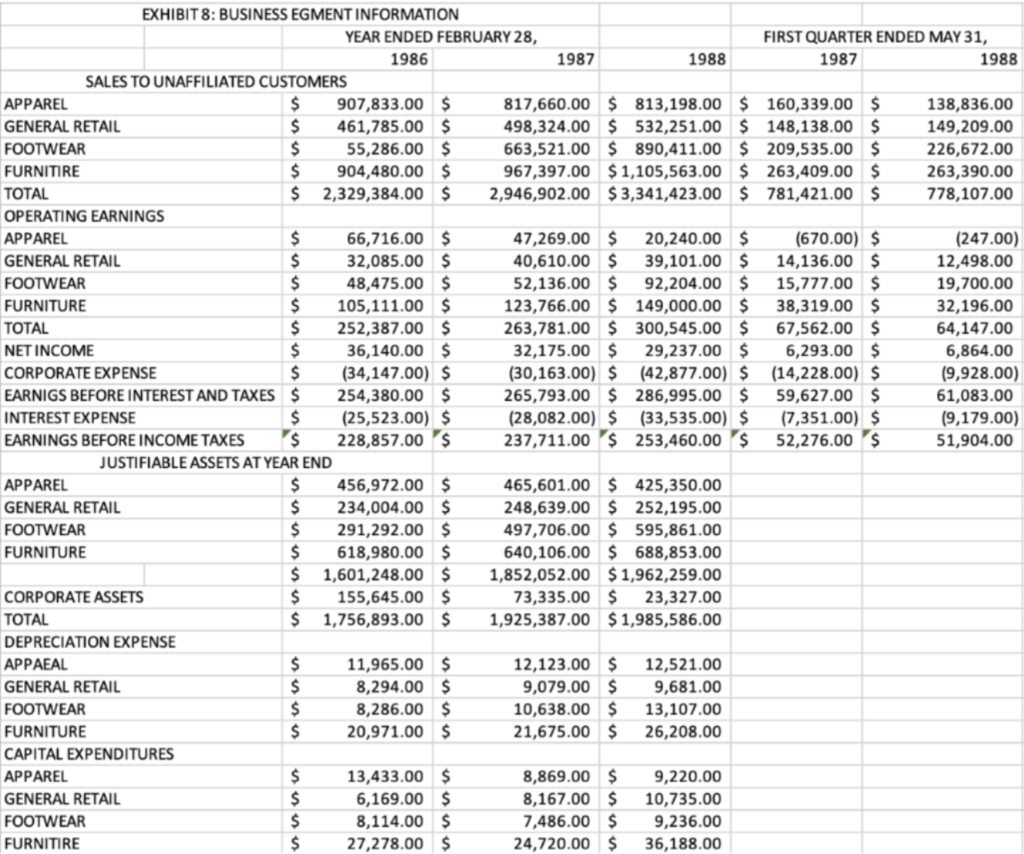

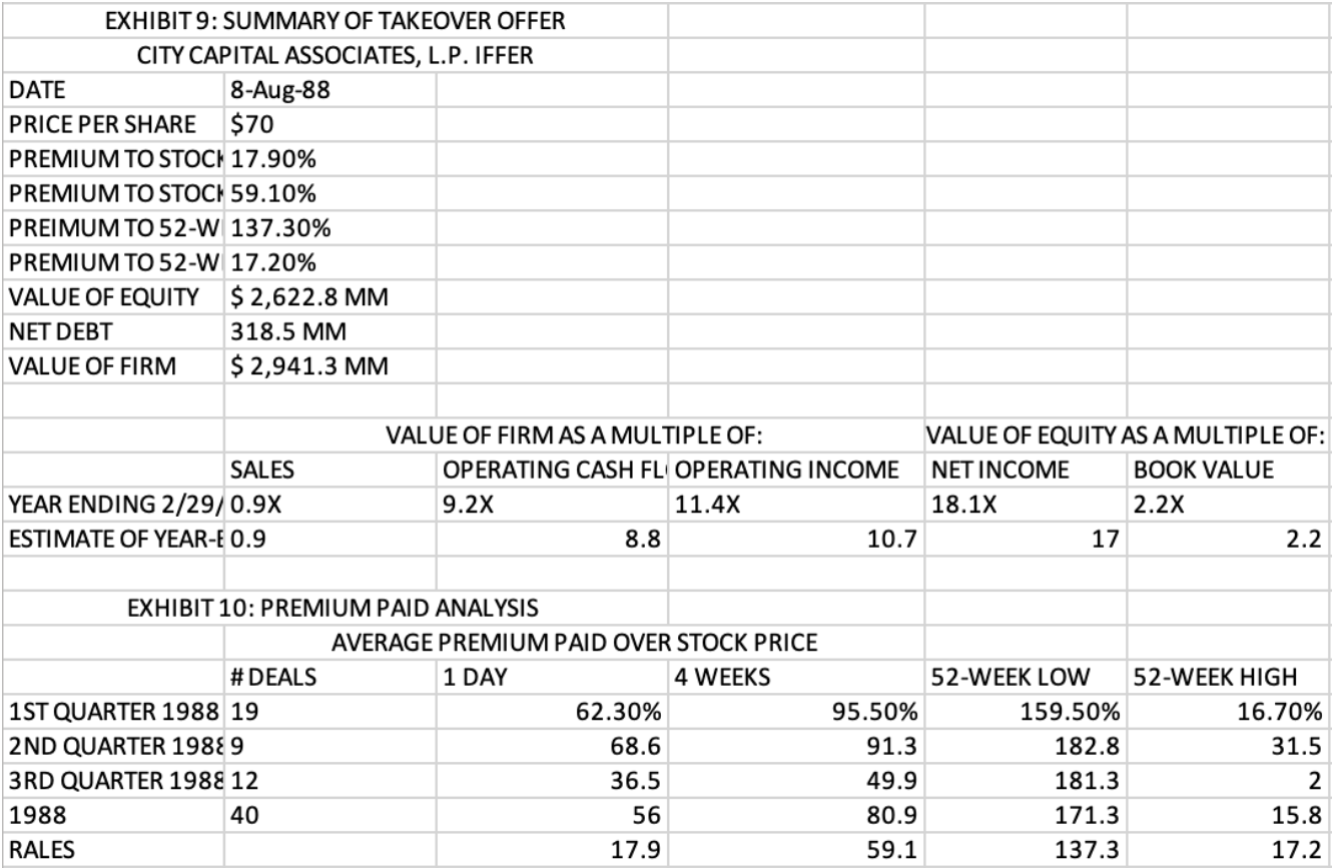

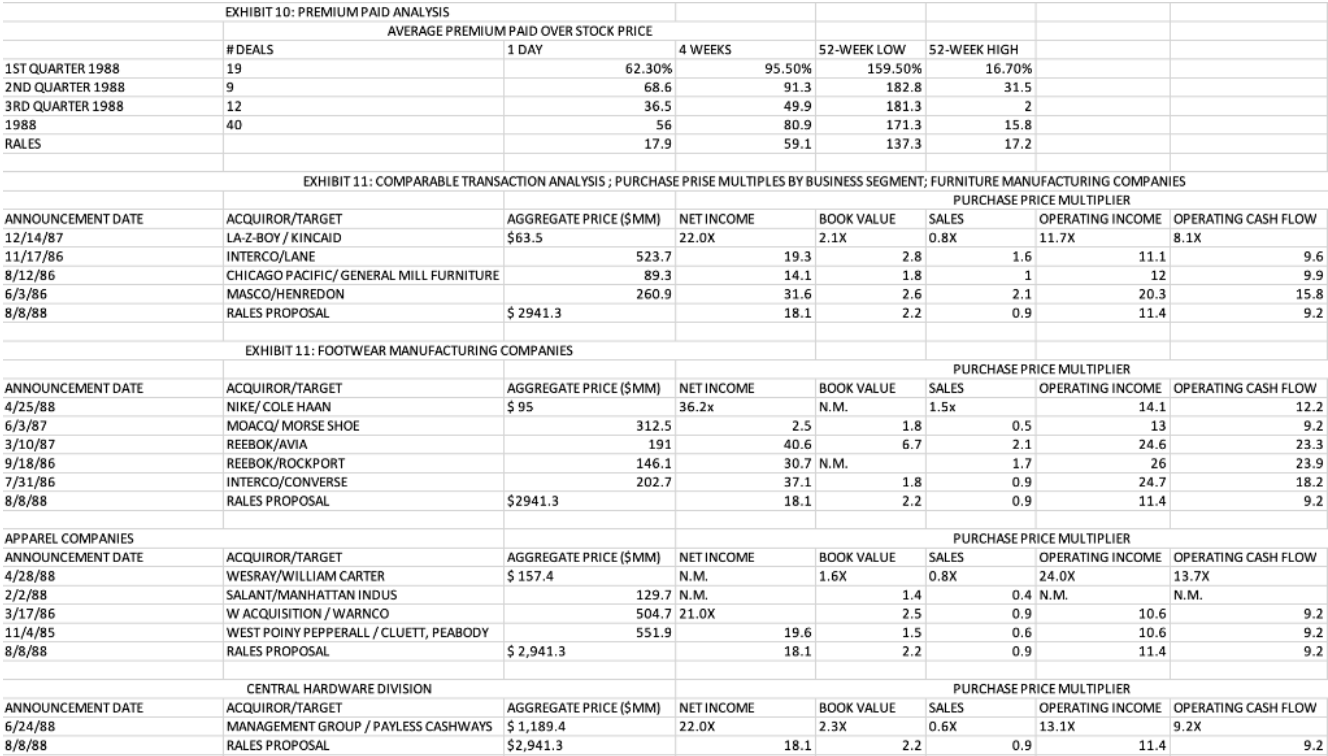

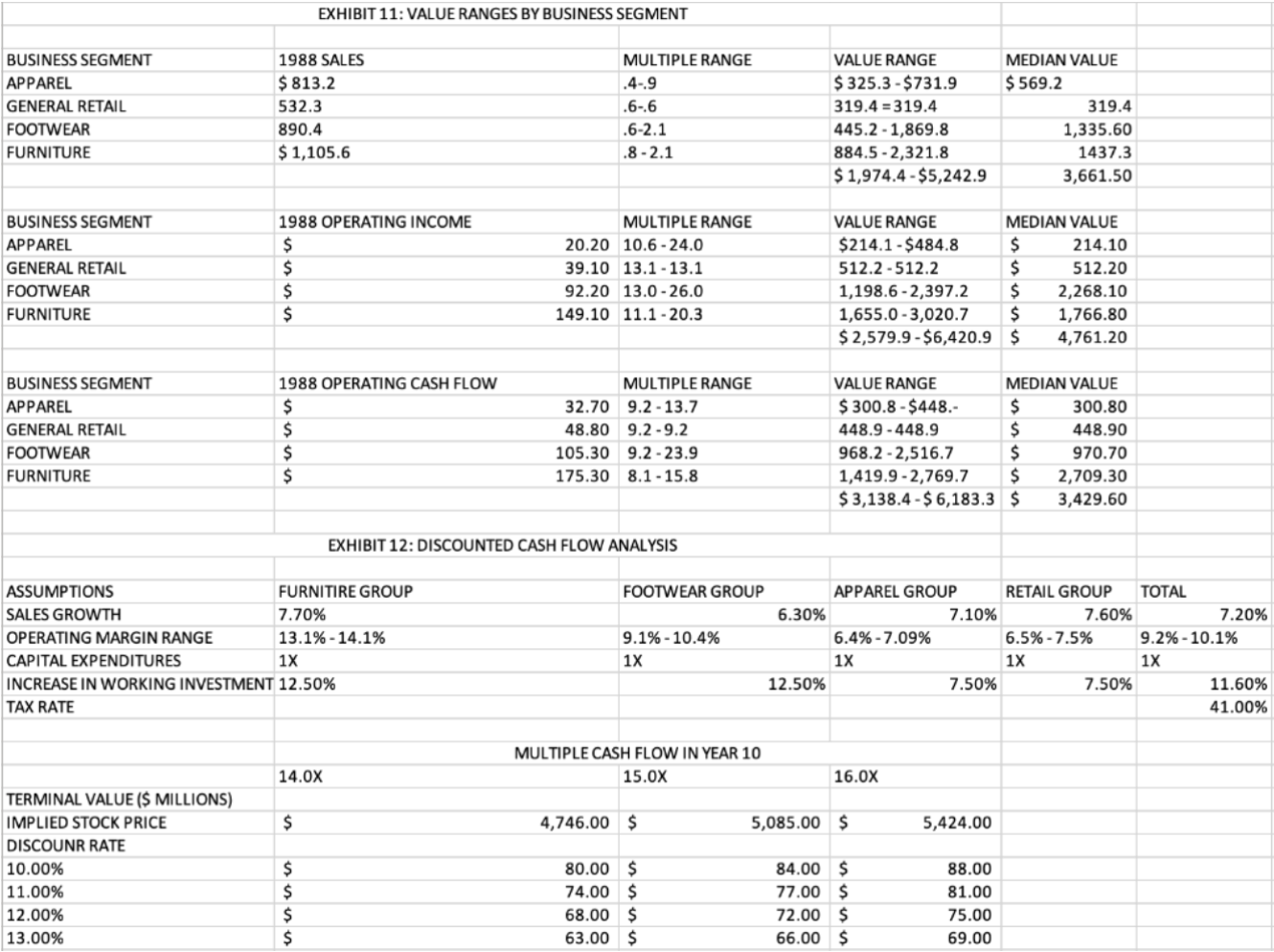

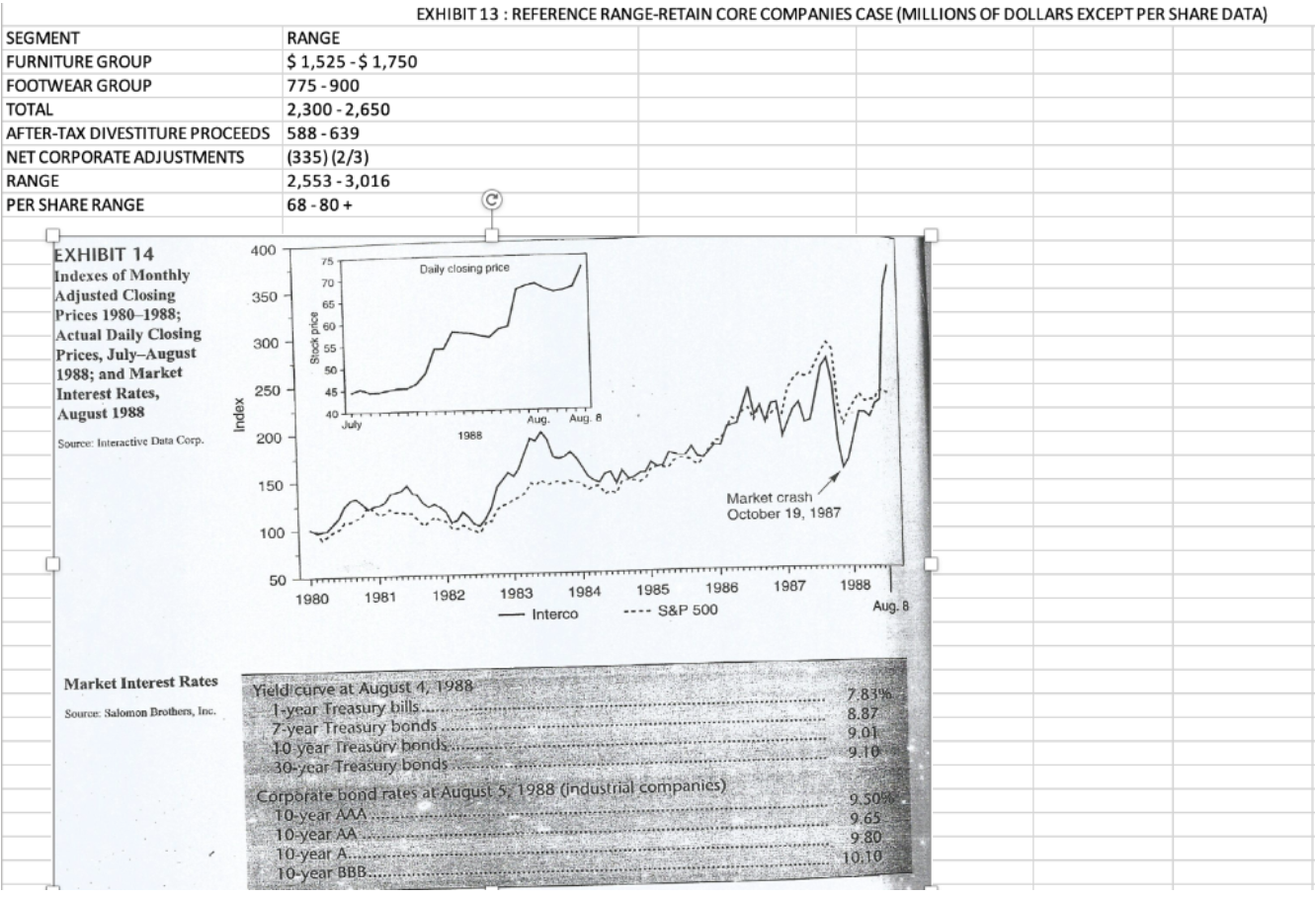

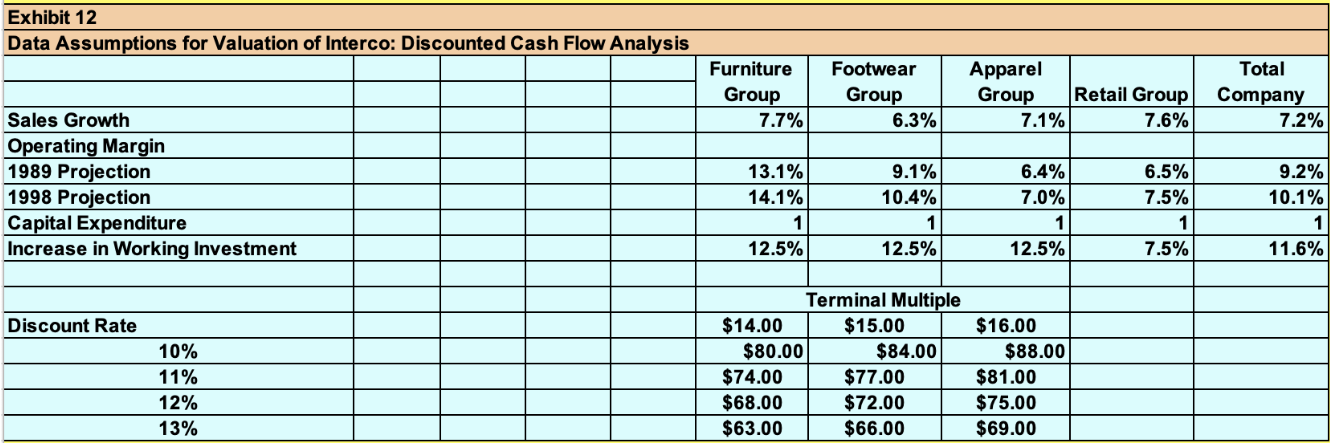

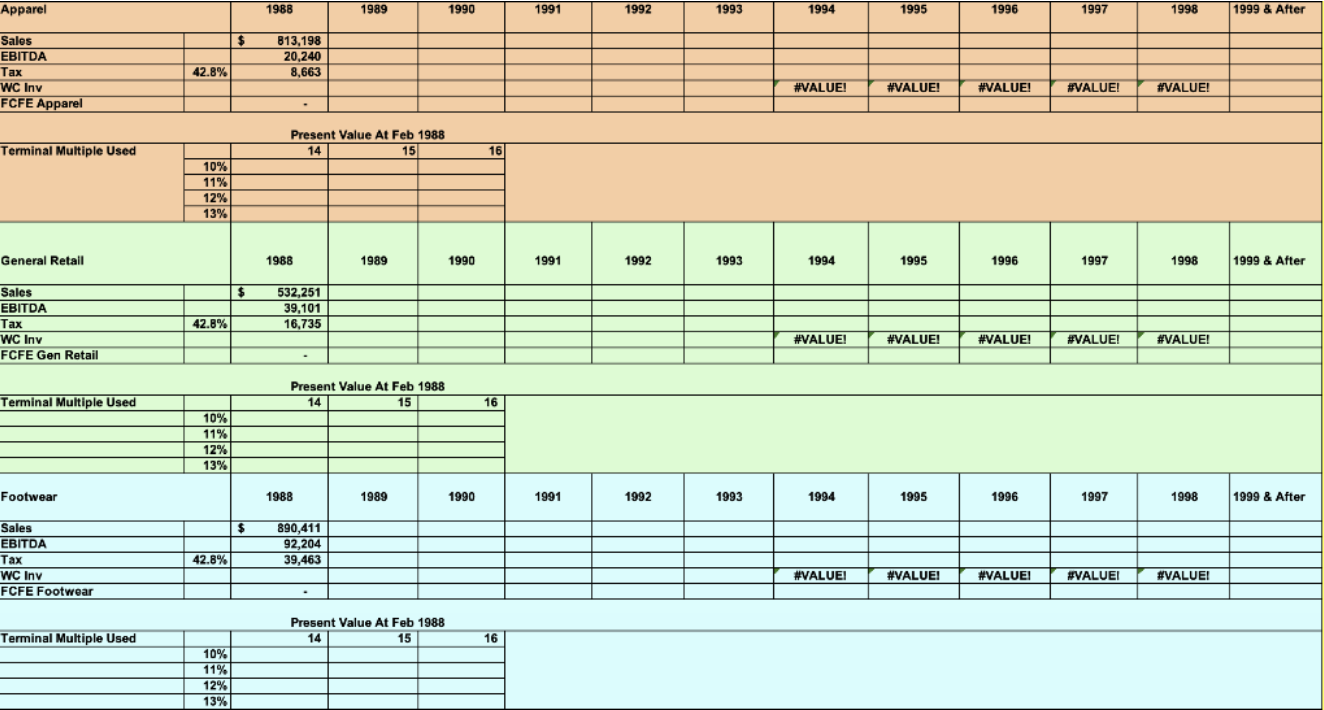

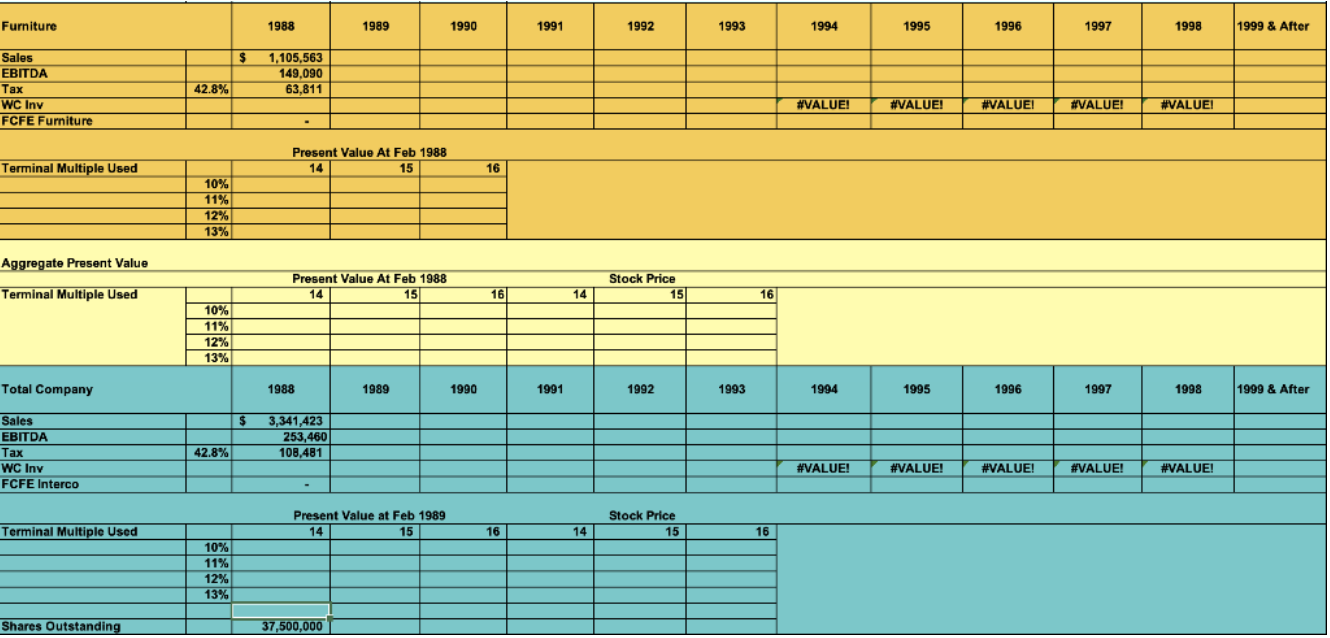

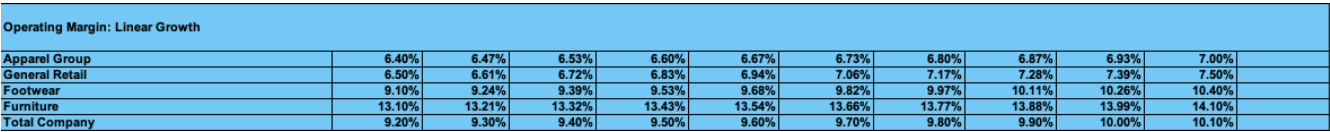

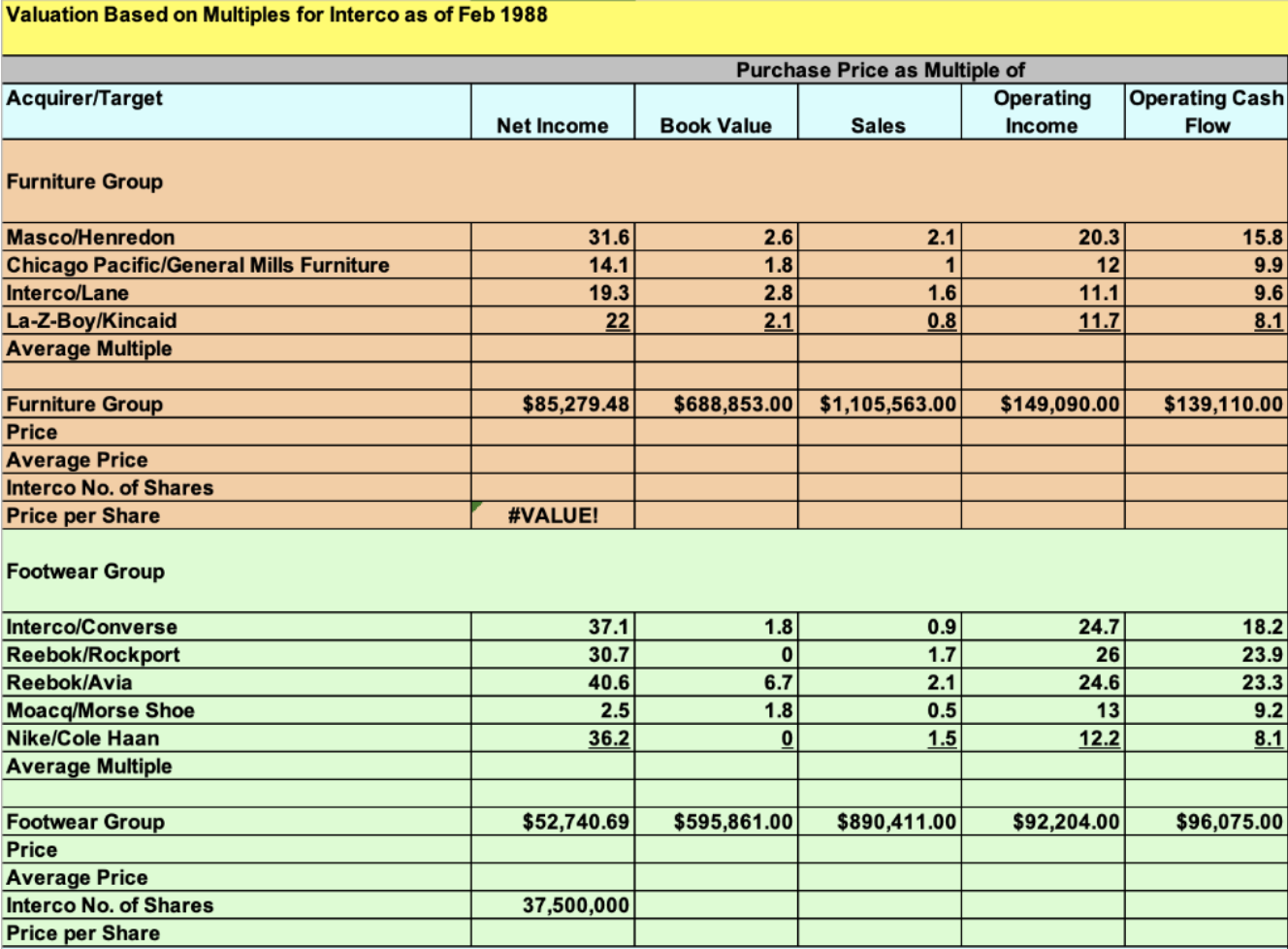

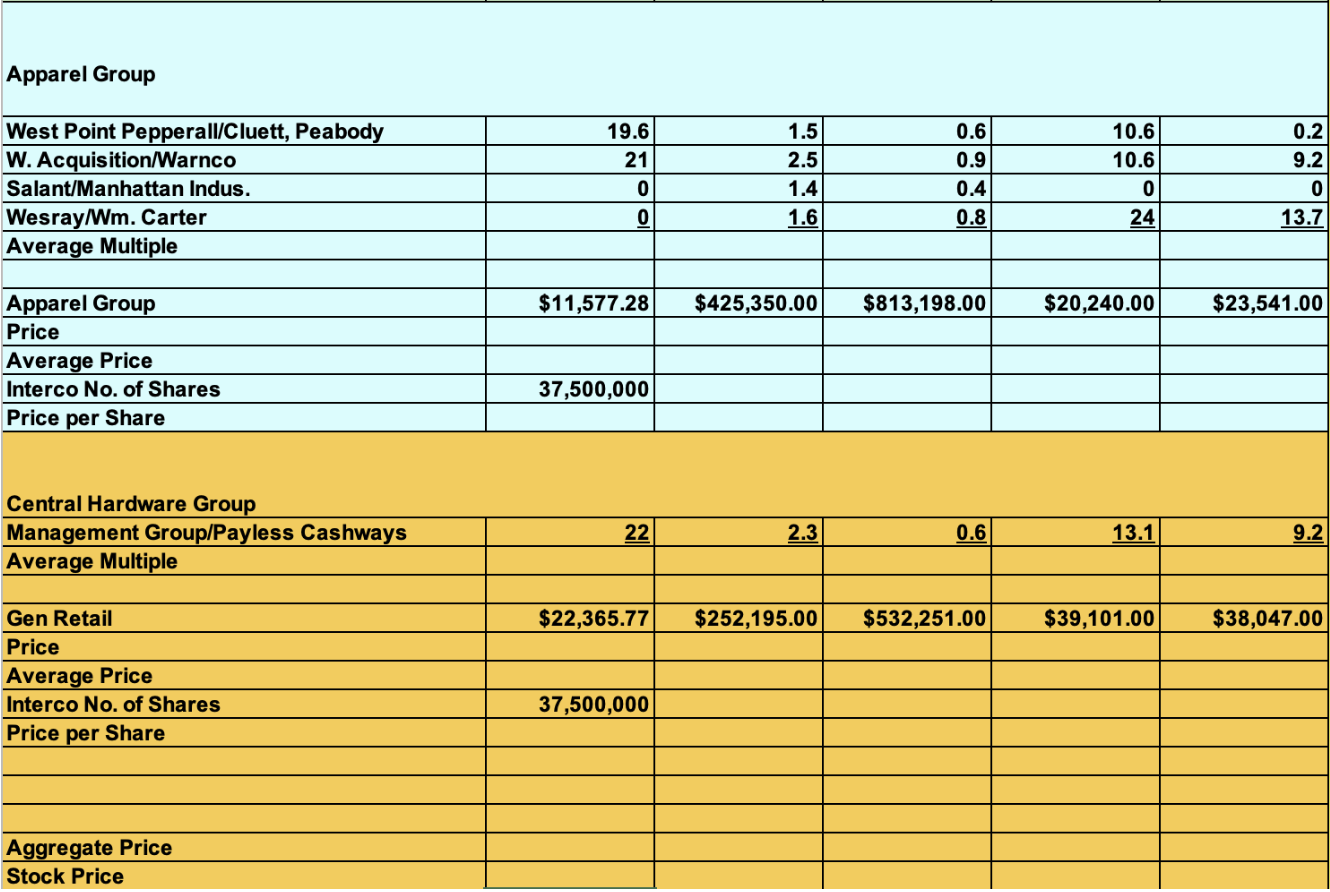

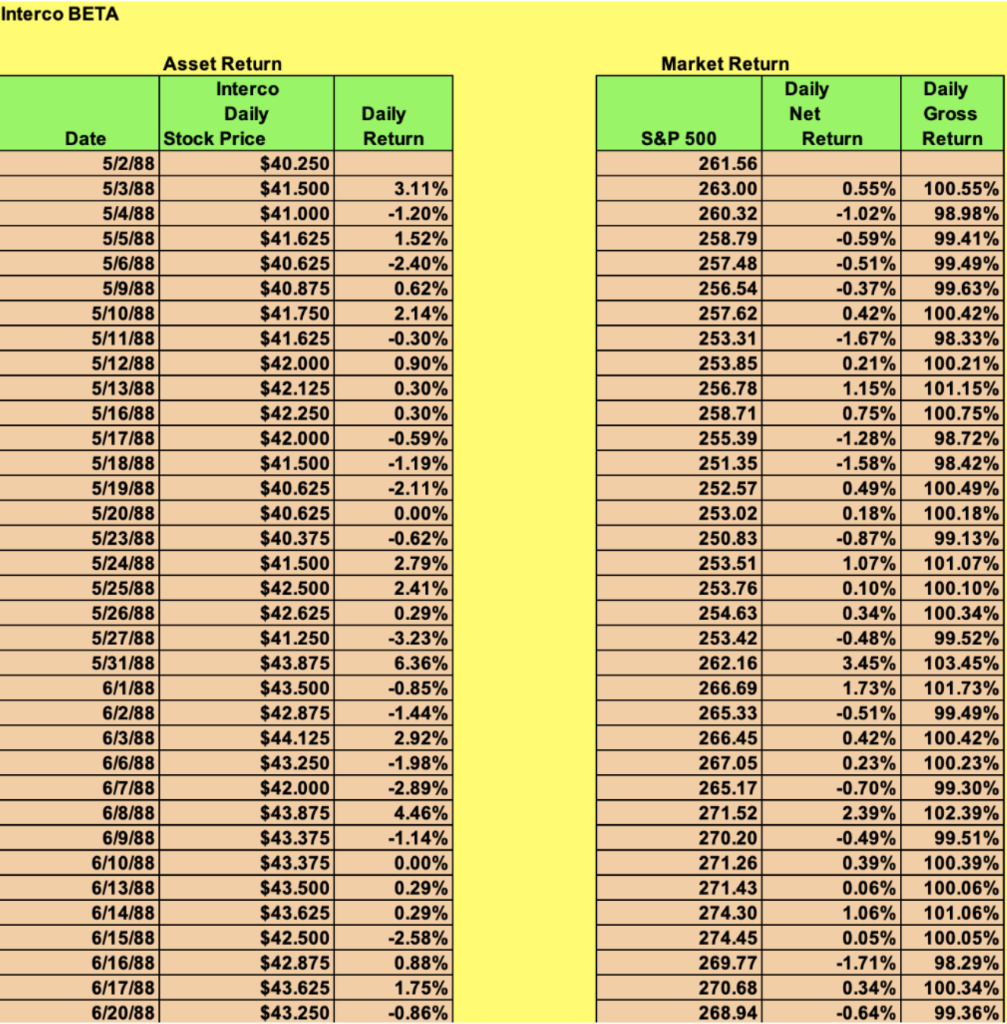

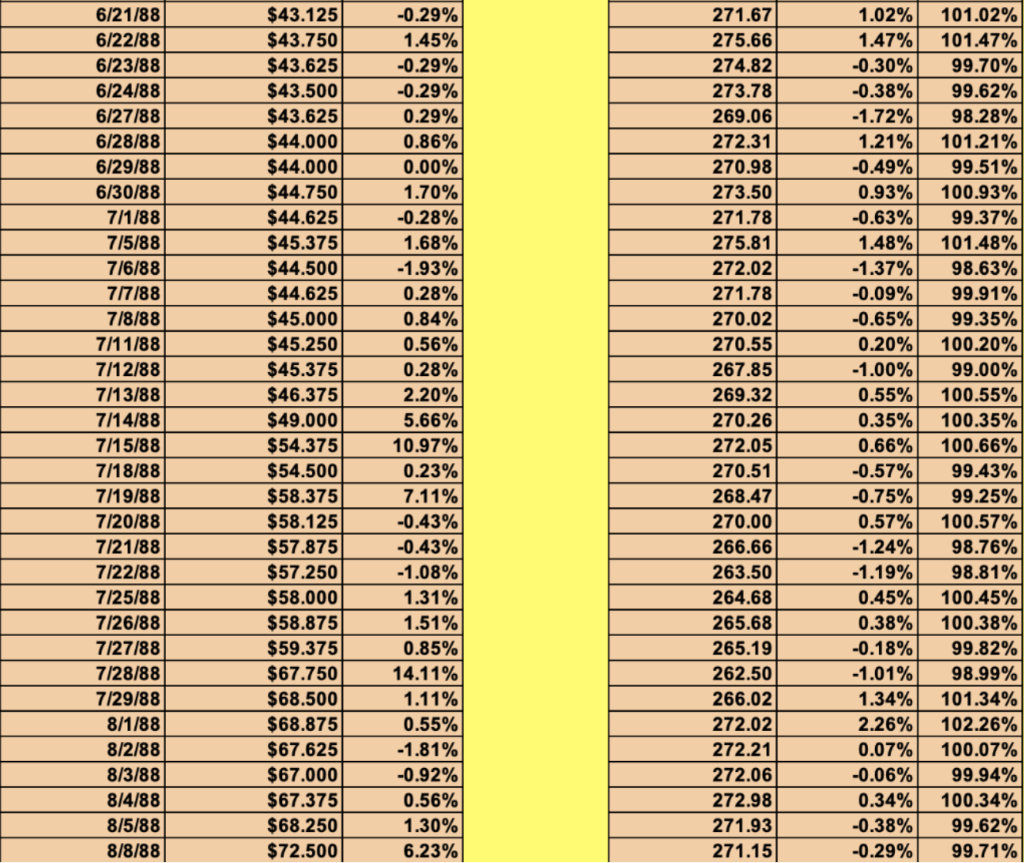

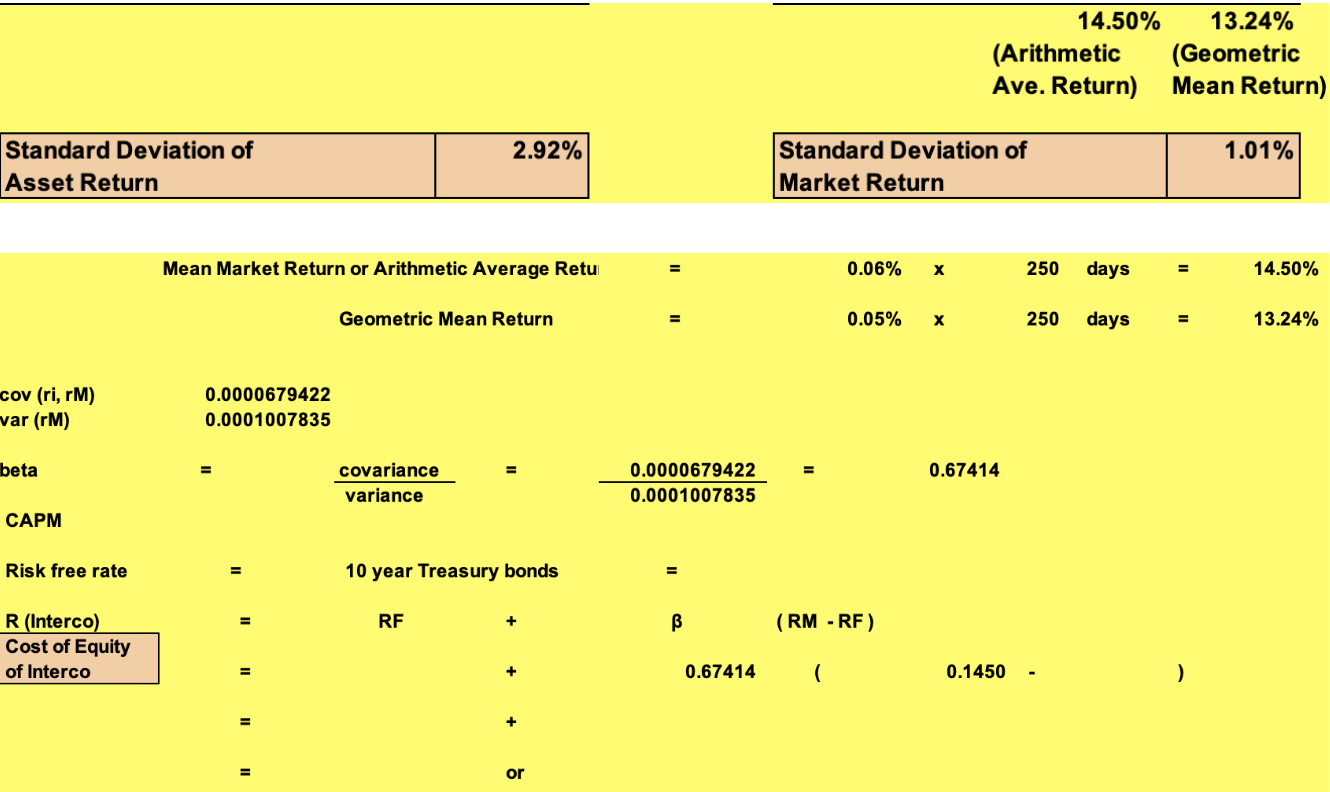

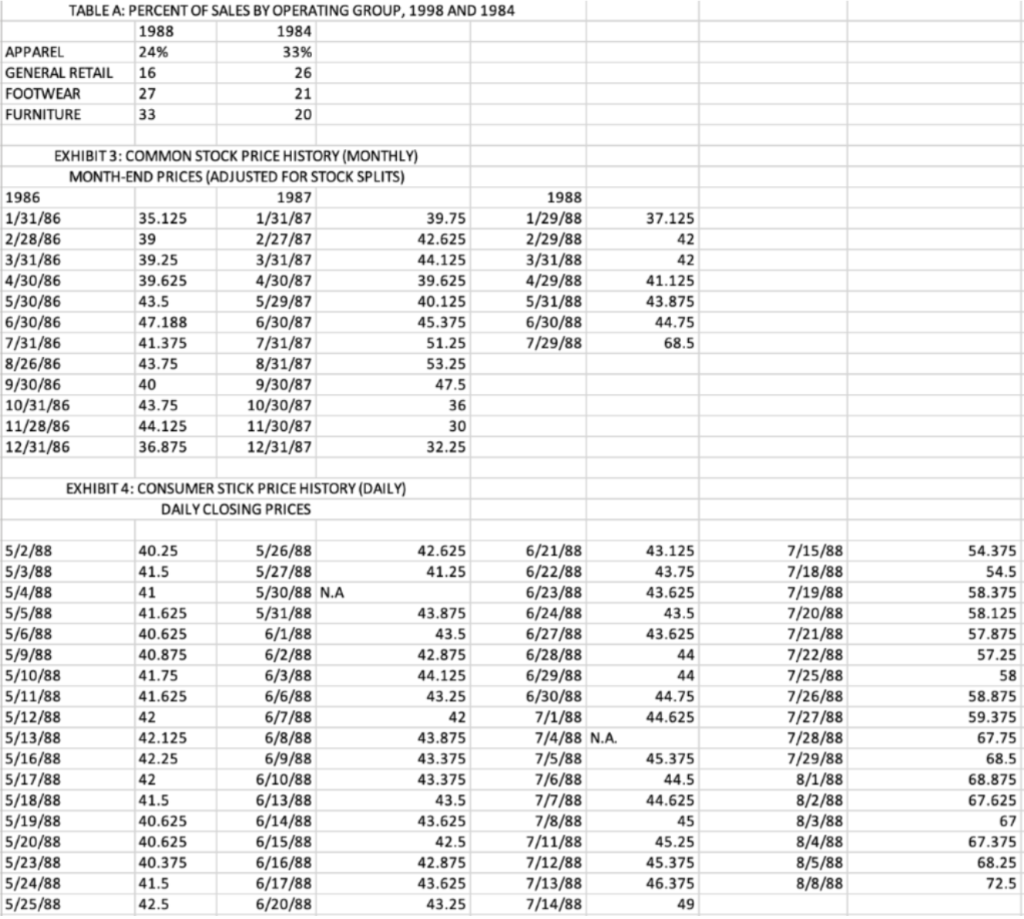

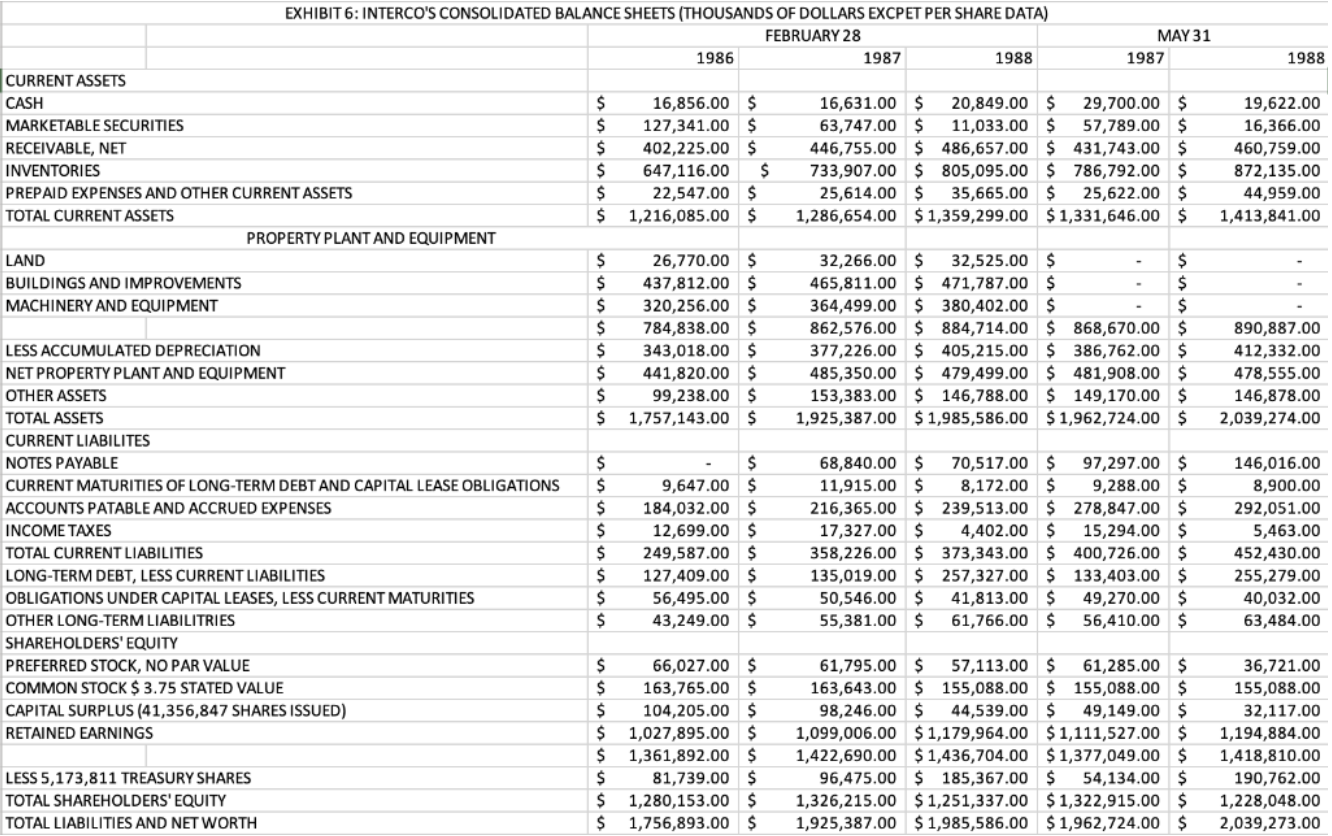

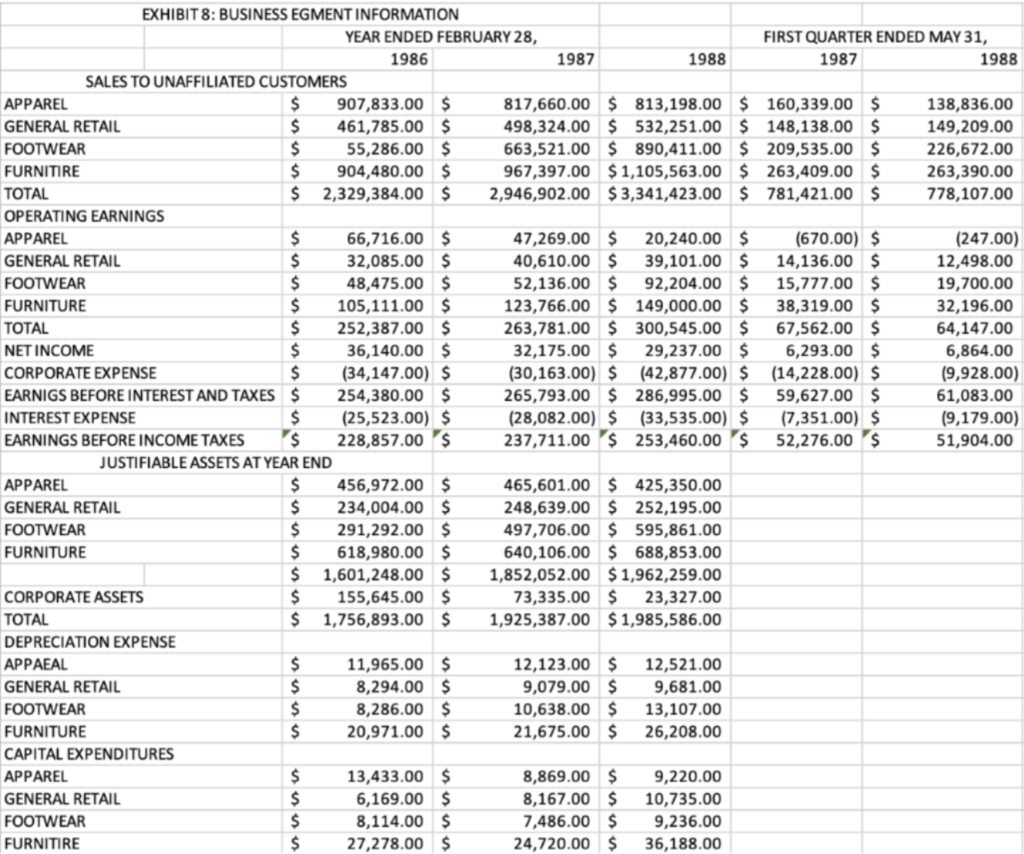

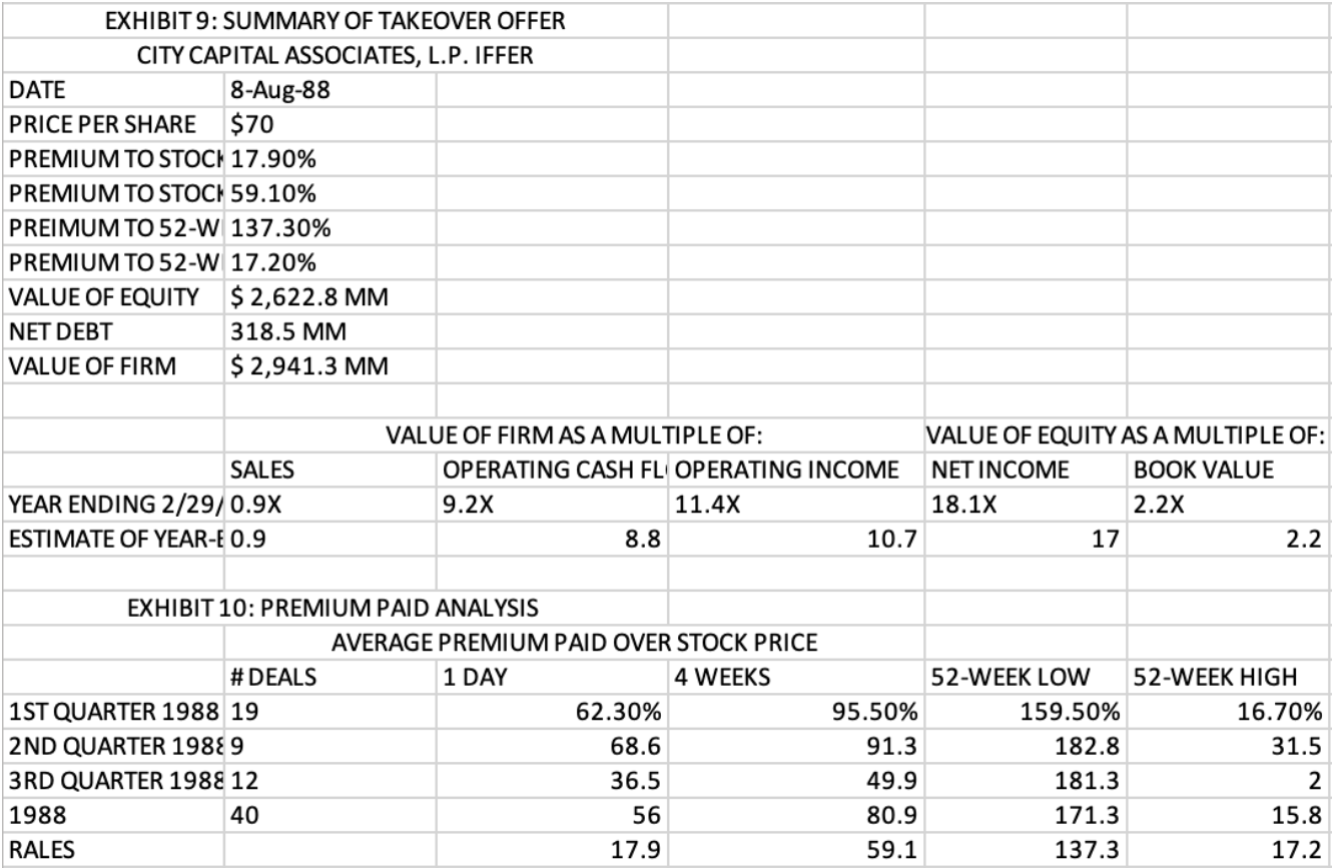

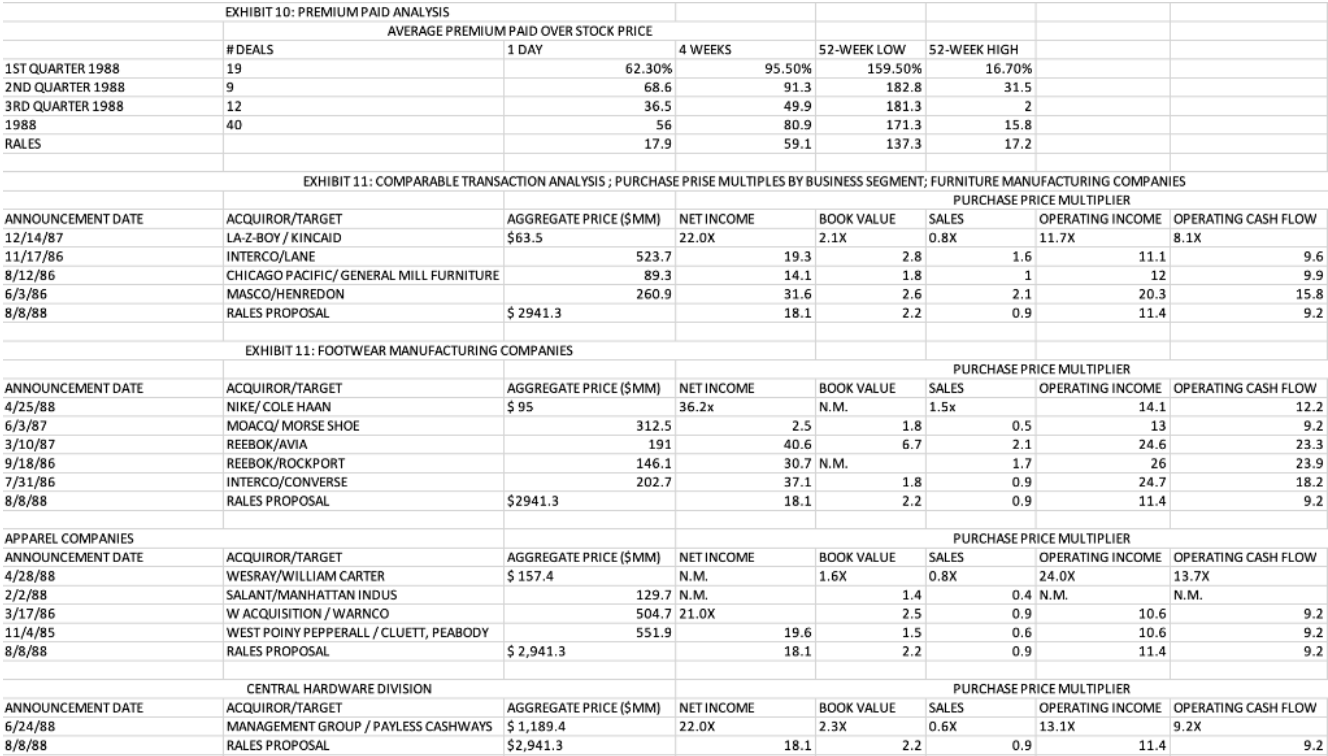

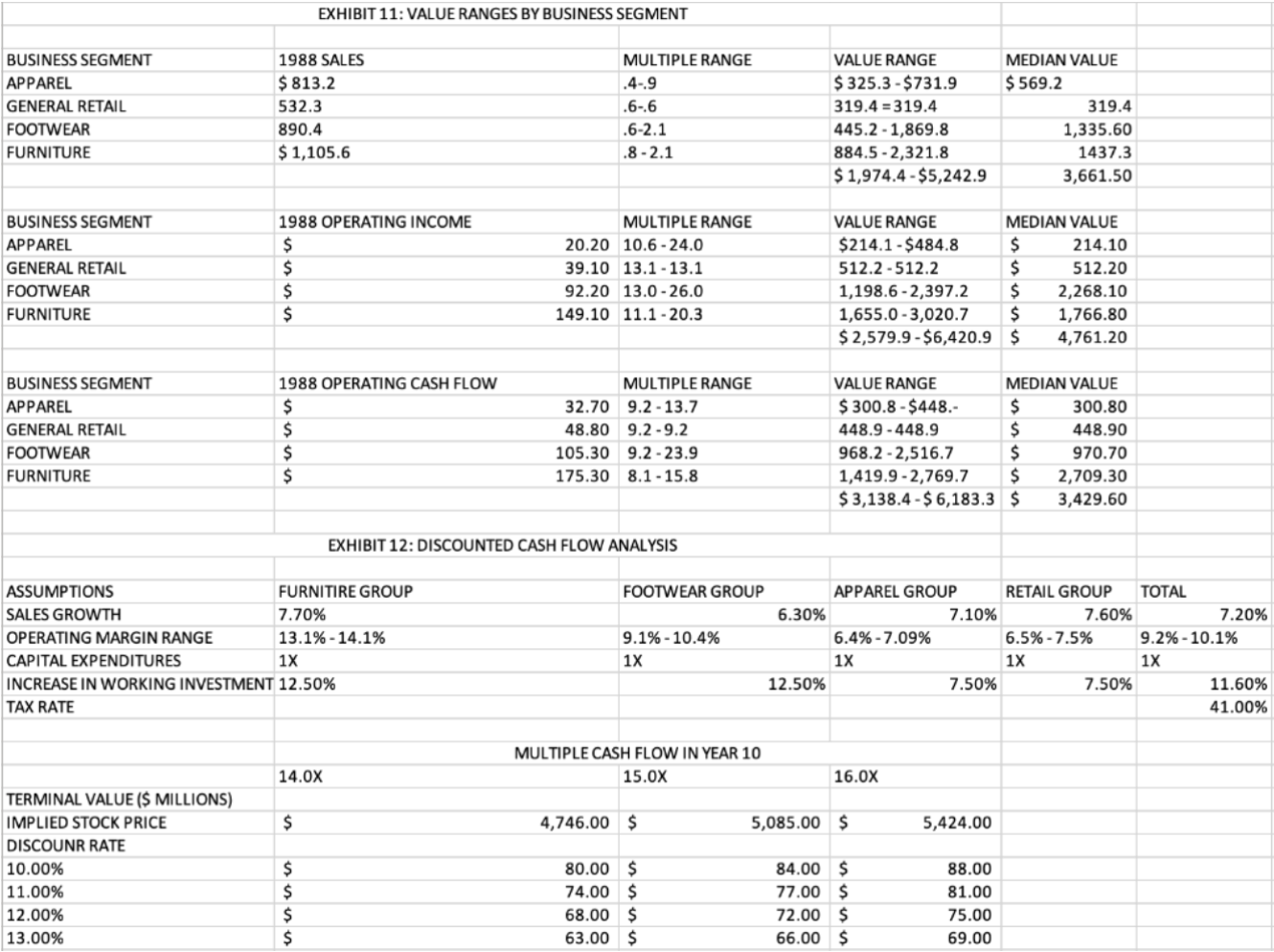

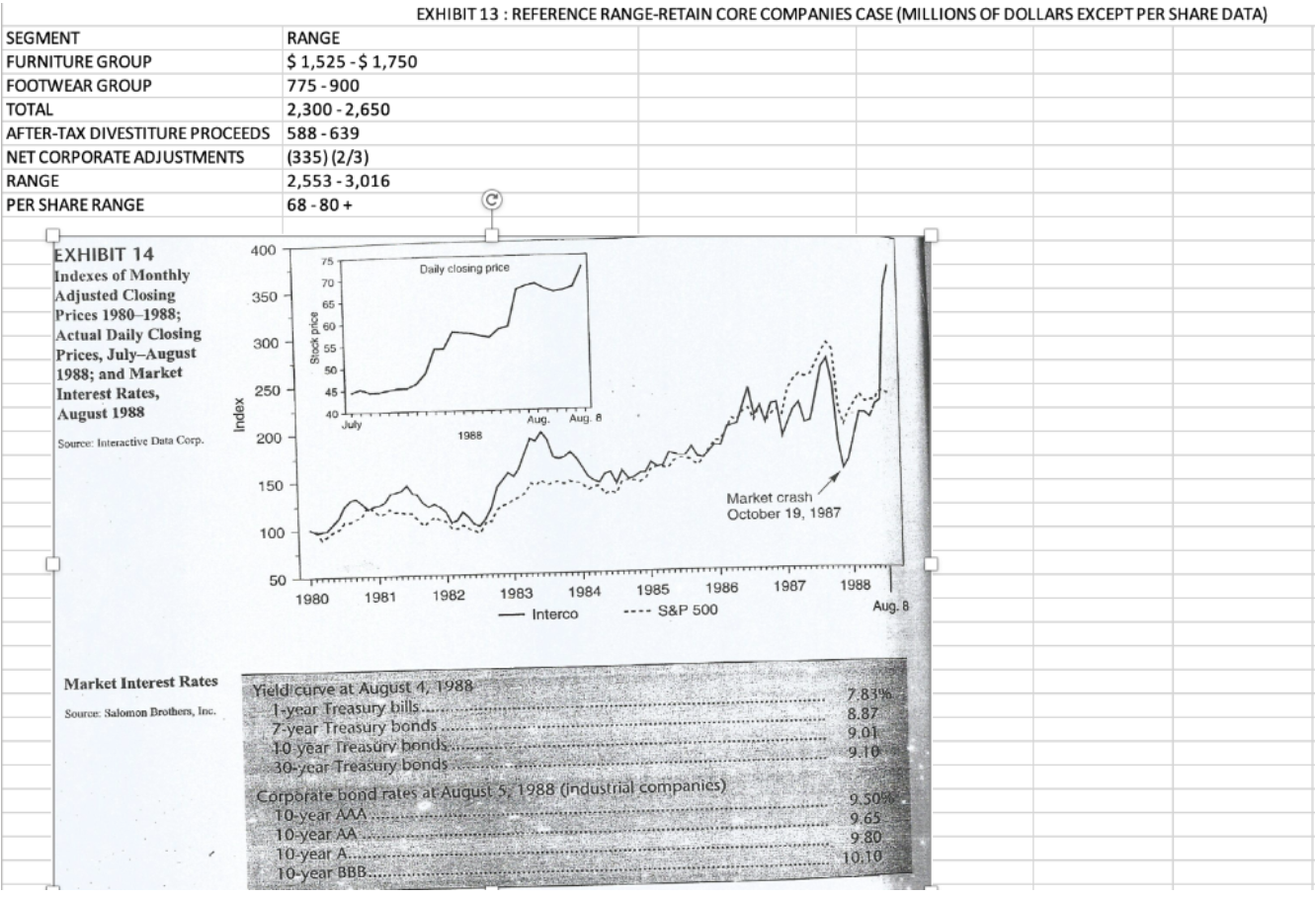

TABLE A: PERCENT OF SALES BY OPERATING GROUP, 1998 AND 1984 1988 1984 APPAREL 24% 33% GENERAL RETAIL 16 26 FOOTWEAR 27 21 FURNITURE 33 20 EXHIBIT 3: COMMON STOCK PRICE HISTORY (MONTHLY) MONTH-END PRICES (ADJUSTED FOR STOCK SPLITS) 1986 1987 1/31/86 35.125 1/31/87 39.75 2/28/86 39 2/27/87 42.625 3/31/86 39.25 3/31/87 44.125 4/30/86 39.625 4/30/87 39.625 5/30/86 43.5 5/29/87 40.125 6/30/86 47.188 6/30/87 45.375 7/31/86 41.375 7/31/87 51.25 8/26/86 43.75 8/31/87 53.25 9/30/86 40 9/30/87 47.5 10/31/86 43.75 10/30/87 36 11/28/86 44.125 11/30/87 30 12/31/86 36.875 12/31/87 32.25 1988 1/29/88 2/29/88 3/31/88 4/29/88 5/31/88 6/30/88 7/29/88 37.125 42 42 41.125 43.875 44.75 68.5 EXHIBIT 4: CONSUMER STICK PRICE HISTORY (DAILY) DAILY CLOSING PRICES 42.625 41.25 43.125 43.75 43.625 43.5 43.625 44 44 44.75 44.625 5/2/88 5/3/88 5/4/88 5/5/88 5/6/88 5/9/88 5/10/88 5/11/88 5/12/88 5/13/88 5/16/88 5/17/88 5/18/88 5/19/88 5/20/88 5/23/88 5/24/88 5/25/88 40.25 41.5 41 41.625 40.625 40.875 41.75 41.625 42 42.125 42.25 42 41.5 40.625 40.625 40.375 41.5 42.5 5/26/88 5/27/88 5/30/88 N.A 5/31/88 6/1/88 6/2/88 6/3/88 6/6/88 6/7/88 6/8/88 6/9/88 6/10/88 6/13/88 6/14/88 6/15/88 6/16/88 6/17/88 6/20/88 43.875 43.5 42.875 44.125 43.25 42 43.875 43.375 43.375 43.5 43.625 42.5 42.875 43.625 43.25 6/21/88 6/22/88 6/23/88 6/24/88 6/27/88 6/28/88 6/29/88 6/30/88 7/1/88 7/4/88 N.A. 7/5/88 7/6/88 7/7/88 7/8/88 7/11/88 7/12/88 7/13/88 7/14/88 7/15/88 7/18/88 7/19/88 7/20/88 7/21/88 7/22/88 7/25/88 7/26/88 7/27/88 7/28/88 7/29/88 8/1/88 8/2/88 8/3/88 8/4/88 8/5/88 8/8/88 54.375 54.5 58.375 58.125 57.875 57.25 58 58.875 59.375 67.75 68.5 68.875 67.625 67 67.375 68.25 72.5 45.375 44.5 44.625 45 45.25 45.375 46.375 49 EXHIBIT 6: INTERCO'S CONSOLIDATED BALANCE SHEETS (THOUSANDS OF DOLLARS EXCPET PER SHARE DATA) FEBRUARY 28 MAY 31 1986 1987 1988 1987 1988 CURRENT ASSETS CASH $ 16,856.00 $ 16,631.00 $ 20,849.00 $ 29,700.00 $ 19,622.00 MARKETABLE SECURITIES $ 127,341.00 $ 63,747.00 $ 11,033.00 $ 57,789.00 $ 16,366.00 RECEIVABLE, NET $ $ 402,225.00 $ 446,755.00 $ 486,657.00 $ 431,743.00 $ 460,759.00 INVENTORIES $ 647,116.00 $ 733,907.00 $ 805,095.00 $ 786,792.00 $ 872,135.00 PREPAID EXPENSES AND OTHER CURRENT ASSETS $ 22,547.00 $ 25,614.00 $ 35,665.00 $ 25,622.00 $ 44,959.00 TOTAL CURRENT ASSETS $ 1,216,085.00 $ 1,286,654.00 $ 1,359,299.00 $ 1,331,646.00 $ 1,413,841.00 PROPERTY PLANT AND EQUIPMENT LAND $ 26,770.00 $ 32,266.00 $ 32,525.00 $ $ BUILDINGS AND IMPROVEMENTS $ 437,812.00 $ 465,811.00 $ 471,787.00 $ $ MACHINERY AND EQUIPMENT $ $ 320,256.00 $ 364,499.00 $ 380,402.00 $ $ $ 784,838.00 $ 862,576.00 $ 884,714.00 $ 868,670.00 $ 890,887.00 LESS ACCUMULATED DEPRECIATION $ 343,018.00 $ 377,226.00 $ 405,215.00 $ 386,762.00 $ 412,332.00 NET PROPERTY PLANT AND EQUIPMENT $ 441,820.00 $ 485,350.00 $ 479,499.00 $ 481,908.00 $ 478,555.00 OTHER ASSETS $ 99,238.00 $ 153,383.00 $ 146,788.00 $ 149,170.00 $ 146,878.00 TOTAL ASSETS $ 1,757,143.00 $ 1,925,387.00 $ 1,985,586.00 $ 1,962,724.00 $ 2,039,274.00 CURRENT LIABILITES NOTES PAYABLE $ $ 68,840.00 $ 70,517.00 $ 97,297.00 $ 146,016.00 CURRENT MATURITIES OF LONG-TERM DEBT AND CAPITAL LEASE OBLIGATIONS $ 9,647.00 $ 11,915.00 $ 8,172.00 $ 9,288.00 $ 8,900.00 ACCOUNTS PATABLE AND ACCRUED EXPENSES $ 184,032.00 $ 216,365.00 $ 239,513.00 $ 278,847.00 $ 292,051.00 INCOME TAXES $ 12,699.00 $ 17,327.00 $ 4,402.00 $ 15,294.00 $ 5,463.00 TOTAL CURRENT LIABILITIES $ 249,587.00 $ 358,226.00 $ 373,343.00 $ 400,726.00 $ 452,430.00 LONG-TERM DEBT, LESS CURRENT LIABILITIES $ $ 127,409.00 $ 135,019.00 $ 257,327.00 $ 133,403.00 $ 255,279.00 OBLIGATIONS UNDER CAPITAL LEASES, LESS CURRENT MATURITIES $ 56,495.00 $ 50,546.00 $ 41,813.00 $ 49,270.00 $ 40,032.00 OTHER LONG-TERM LIABILITRIES $ 43,249.00 $ 55,381.00 $ 61,766.00 $ 56,410.00 $ 63,484.00 SHAREHOLDERS' EQUITY PREFERRED STOCK, NO PAR VALUE $ 66,027.00 $ 61,795.00 $ 57,113.00 $ 61,285.00 $ 36,721.00 COMMON STOCK $ 3.75 STATED VALUE $ 163,765.00 $ 163,643.00 $ 155,088.00 $ 155,088.00 $ 155,088.00 CAPITAL SURPLUS (41,356,847 SHARES ISSUED) $ 104,205.00 $ 98,246.00 $ 44,539.00 $ 49,149.00 $ 32,117.00 RETAINED EARNINGS $ 1,027,895.00 $ 1,099,006.00 $ 1,179,964.00 $ 1,111,527.00 $ 1,194,884.00 $ 1,361,892.00 $ 1,422,690.00 $ 1,436,704.00 $ 1,377,049.00 $ 1,418,810.00 LESS 5,173,811 TREASURY SHARES $ 81,739.00 $ 96,475.00 $ 185,367.00 $ 54,134.00 $ 190,762.00 TOTAL SHAREHOLDERS' EQUITY $ 1,280,153.00 $ 1,326,215.00 $ 1,251,337.00 $ 1,322,915.00 $ 1,228,048.00 TOTAL LIABILITIES AND NET WORTH $ 1,756,893.00 $ 1,925,387.00 $ 1,985,586.00 $ 1,962,724.00 $ 2,039,273.00 EXHIBIT 8: BUSINESS EGMENT INFORMATION YEAR ENDED FEBRUARY 28, FIRST QUARTER ENDED MAY 31, 1986 1987 1988 1987 1988 SALES TO UNAFFILIATED CUSTOMERS APPAREL $ 907,833.00 $ 817,660.00 $ 813,198.00 $ 160,339.00 $ 138,836.00 GENERAL RETAIL $ 461,785.00 $ 498,324.00 $ 532,251.00 $ 148,138.00 $ 149,209.00 FOOTWEAR $ 55,286.00 $ 663,521.00 $ 890,411.00 $ 209,535.00 $ 226,672.00 FURNITIRE $ 904,480.00 $ 967,397.00 $ 1,105,563.00 $ 263,409.00 $ 263,390.00 TOTAL $ 2,329,384.00 $ 2,946,902.00 $3,341,423.00 $ 781,421.00 $ 778,107.00 OPERATING EARNINGS APPAREL $ 66,716.00 $ 47,269.00 $ 20,240.00 $ (670.00) $ (247.00) GENERAL RETAIL $ 32,085.00 $ 40,610.00 $ 39,101.00 $ 14,136.00 $ 12,498.00 FOOTWEAR $ 48,475.00 $ 52,136.00 $ 92,204.00 $ 15,777.00 $ 19,700.00 FURNITURE $ 105,111.00 $ 123,766.00 $ 149,000.00 $ 38,319.00 $ 32,196.00 TOTAL $ 252,387.00 $ 263,781.00 $ 300,545.00 $ 67,562.00 $ 64,147.00 NET INCOME $ 36,140.00 $ 32,175.00 $ 29,237.00 $ 6,293.00 $ 6,864.00 CORPORATE EXPENSE $ (34,147.00) $ (30,163.00) $ (42,877.00) $ (14,228.00) $ (9,928.00) EARNIGS BEFORE INTEREST AND TAXES $ 254,380.00 $ 265,793.00 $ 286,995.00 $ 59,627.00 $ 61,083.00 INTEREST EXPENSE $ (25,523.00) $ (28,082.00) $ (33,535.00) $ (7,351.00) $ (9,179.00) EARNINGS BEFORE INCOME TAXES $ 228,857.00 $ 237,711.00 $ 253,460.00 $ 52,276.00 $ 51,904.00 JUSTIFIABLE ASSETS AT YEAR END APPAREL $ 456,972.00 $ 465,601.00 $ 425,350.00 GENERAL RETAIL $ 234,004.00 $ 248,639.00 $ 252,195.00 FOOTWEAR $ 291,292.00 $ 497,706.00 $ 595,861.00 FURNITURE $ 618,980.00 $ 640,106.00 $ 688,853.00 $ 1,601,248.00 $ 1,852,052.00 $1,962,259.00 CORPORATE ASSETS $ 155,645.00 $ 73,335.00 $ 23,327.00 TOTAL $ 1,756,893.00 $ 1,925,387.00 $ 1,985,586.00 DEPRECIATION EXPENSE APPAEAL $ 11,965.00 $ 12,123.00 $ 12,521.00 GENERAL RETAIL $ 8,294.00 $ 9,079.00 $ 9,681.00 FOOTWEAR $ 8,286.00 $ 10,638.00 $ 13,107.00 FURNITURE $ 20,971.00 $ 21,675.00 $ 26,208.00 CAPITAL EXPENDITURES APPAREL $ 13,433.00 $ 8,869.00 $ 9,220.00 GENERAL RETAIL $ 6,169.00 $ 8,167.00 $ 10,735.00 FOOTWEAR $ 8,114.00 $ 7,486.00 $ 9,236.00 FURNITIRE $ 27,278.00 $ 24,720.00 $ 36,188.00 EXHIBIT 9: SUMMARY OF TAKEOVER OFFER CITY CAPITAL ASSOCIATES, L.P. IFFER DATE 8-Aug-88 PRICE PER SHARE $70 PREMIUM TO STOCK 17.90% PREMIUM TO STOCK 59.10% PREIMUM TO 52-W 137.30% PREMIUM TO 52-W 17.20% VALUE OF EQUITY $ 2,622.8 MM NET DEBT 318.5 MM VALUE OF FIRM $ 2,941.3 MM SALES YEAR ENDING 2/29/0.9X ESTIMATE OF YEAR-E 0.9 VALUE OF FIRM AS A MULTIPLE OF: VALUE OF EQUITY AS A MULTIPLE OF: OPERATING CASH FL OPERATING INCOME NET INCOME BOOK VALUE 9.2x 11.4x 18.1X 2.2X 8.8 10.7 17 2.2 EXHIBIT 10: PREMIUM PAID ANALYSIS AVERAGE PREMIUM PAID OVER STOCK PRICE #DEALS 1 DAY 4 WEEKS 52-WEEK LOW 52-WEEK HIGH 1ST QUARTER 1988 19 62.30% 95.50% 159.50% 16.70% 2ND QUARTER 1988 9 68.6 91.3 182.8 31.5 3RD QUARTER 1988 12 36.5 49.9 181.3 2 1988 40 56 80.9 171.3 15.8 RALES 17.9 59.1 137.3 17.2 1ST QUARTER 1988 2ND QUARTER 1988 3RD QUARTER 1988 1988 RALES EXHIBIT 10: PREMIUM PAID ANALYSIS AVERAGE PREMIUM PAID OVER STOCK PRICE #DEALS 1 DAY 4 WEEKS 19 62.30% 9 68.6 12 36.5 40 17.9 52-WEEK LOW 52-WEEK HIGH 95.50% 159.50% 16.70% 91.3 182.8 31.5 49.9 181.3 2 80.9 171.3 15.8 59.1 137.3 17.2 56 ANNOUNCEMENT DATE 12/14/87 11/17/86 8/12/86 6/3/86 8/8/88 EXHIBIT 11: COMPARABLE TRANSACTION ANALYSIS; PURCHASE PRISE MULTIPLES BY BUSINESS SEGMENT; FURNITURE MANUFACTURING COMPANIES PURCHASE PRICE MULTIPLIER ACQUIROR/TARGET AGGREGATE PRICE (SMM) NETINCOME BOOK VALUE SALES OPERATING INCOME OPERATING CASH FLOW LA-Z-BOY/KINCAID $63.5 22.0x 2.1x 0.8x 11.7x 8.1x INTERCO/LANE 523.7 19.3 2.8 1.6 11.1 9.6 CHICAGO PACIFIC/ GENERAL MILL FURNITURE 89.3 14.1 1.8 1 12 9.9 MASCO/HENREDON 260.9 31.6 2.6 2.1 20.3 15.8 RALES PROPOSAL $ 2941.3 18.1 2.2 0.9 11.4 9.2 EXHIBIT 11: FOOTWEAR MANUFACTURING COMPANIES 1.8 ANNOUNCEMENT DATE 4/25/88 6/3/87 3/10/87 9/18/86 7/31/86 8/8/88 ACQUIROR/TARGET NIKE/COLE HAAN MOACQ/ MORSE SHOE REEBOK/AVIA REEBOK/ROCKPORT INTERCO/CONVERSE RALES PROPOSAL AGGREGATE PRICE (SMM) NET INCOME $95 36.2x 312.5 191 146.1 202.7 $2941.3 PURCHASE PRICE MULTIPLIER BOOK VALUE SALES OPERATING INCOME OPERATING CASH FLOW N.M. 1.5x 14.1 12.2 2.5 0.5 13 9.2 40.6 6.7 2.1 24.6 23.3 30.7 N.M. 1.7 26 23.9 37.1 1.8 0.9 24.7 18.2 18.1 2.2 0.9 11.4 9.2 BOOK VALUE 1.6X APPAREL COMPANIES ANNOUNCEMENT DATE 4/28/88 2/2/88 3/17/86 11/4/85 8/8/88 ACQUIROR/TARGET WESRAY/WILLIAM CARTER SALANT/MANHATTAN INDUS W ACQUISITION / WARNCO WEST POINY PEPPERALL / CLUETT, PEABODY / RALES PROPOSAL AGGREGATE PRICE (SMM) NET INCOME $ 157.4 N.M. 129.7 N.M. 504.7 21.0x 551.9 $ 2,941.3 PURCHASE PRICE MULTIPLIER SALES OPERATING INCOME OPERATING CASH FLOW 0.8x 24.0x 13.7% 1.4 0.4 N.M. N.M. 2.5 0.9 10.6 9.2 1.5 0.6 10.6 9.2 2.2 0.9 11.4 9.2 19.6 18.1 ANNOUNCEMENT DATE 6/24/88 8/8/88 CENTRAL HARDWARE DIVISION ACQUIROR/TARGET AGGREGATE PRICE (SMM) NET INCOME MANAGEMENT GROUP / PAYLESS CASHWAYS $ 1,189.4 22.0x RALES PROPOSAL $2,941.3 PURCHASE PRICE MULTIPLIER BOOK VALUE SALES OPERATING INCOME OPERATING CASH FLOW 2.3x 0.6% 13.1x 9.2x 2.2 0.9 11.4 9.2 18.1 EXHIBIT 11: VALUE RANGES BY BUSINESS SEGMENT BUSINESS SEGMENT APPAREL GENERAL RETAIL FOOTWEAR FURNITURE 1988 SALES $813.2 532.3 890.4 $ 1,105.6 MULTIPLE RANGE .4-9 .6-6 .6-2.1 .8 - 2.1 VALUE RANGE $325.3 - $731.9 319.4 = 319.4 445.2 - 1,869.8 884.5-2,321.8 $ 1,974.4 - $5,242.9 MEDIAN VALUE $569.2 319.4 1,335.60 1437.3 3,661.50 BUSINESS SEGMENT APPAREL GENERAL RETAIL FOOTWEAR FURNITURE 1988 OPERATING INCOME $ $ $ $ MULTIPLE RANGE 20.20 10.6 - 24.0 39.10 13.1 - 13.1 92.20 13.0-26.0 149.10 11.1 -20.3 VALUE RANGE MEDIAN VALUE $214.1 - $484.8 $ 214.10 512.2-512.2 $ 512.20 1,198.6 -2,397.2 $ 2,268.10 1,655.0 -3,020.7 $ 1,766.80 $ 2,579.9 - $6,420.9 $ 4,761.20 BUSINESS SEGMENT APPAREL GENERAL RETAIL FOOTWEAR FURNITURE 1988 OPERATING CASH FLOW $ $ $ $ MULTIPLE RANGE 32.70 9.2 - 13.7 48.80 9.2-9.2 105.30 9.2-23.9 175.30 8.1 - 15.8 VALUE RANGE MEDIAN VALUE $ 300.8 - $448. $ 300.80 448.9-448.9 $ 448.90 968.2 - 2,516.7 $ 970.70 1,419.9 -2,769.7 $ 2,709.30 $ 3,138.4 - $ 6,183.3 $ 3,429.60 EXHIBIT 12: DISCOUNTED CASH FLOW ANALYSIS ASSUMPTIONS FURNITIRE GROUP SALES GROWTH 7.70% OPERATING MARGIN RANGE 13.1% - 14.1% CAPITAL EXPENDITURES 1X INCREASE IN WORKING INVESTMENT 12.50% TAX RATE FOOTWEAR GROUP APPAREL GROUP RETAIL GROUP TOTAL 6.30% 7.10% 7.60% 7.20% 9.1% - 10.4% 6.4% -7.09% 6.5% -7.5% 9.2% - 10.1% 1x 1x 1x 1x 12.50% 7.50% 7.50% 11.60% 41.00% MULTIPLE CASH FLOW IN YEAR 10 15.0X 14.0X 16.0X $ 4,746.00 $ 5,085.00 $ 5,424.00 TERMINAL VALUE ($ MILLIONS) IMPLIED STOCK PRICE DISCOUNR RATE 10.00% 11.00% 12.00% 13.00% $ $ $ $ 80.00 $ 74.00 $ 68.00 $ 63.00 $ 84.00 $ 77.00 $ 72.00 $ 66.00 $ 88.00 81.00 75.00 69.00 EXHIBIT 13 : REFERENCE RANGE-RETAIN CORE COMPANIES CASE (MILLIONS OF DOLLARS EXCEPT PER SHARE DATA) SEGMENT RANGE FURNITURE GROUP $1,525 - $ 1,750 FOOTWEAR GROUP 775-900 TOTAL 2,300 -2,650 AFTER-TAX DIVESTITURE PROCEEDS 588-639 NET CORPORATE ADJUSTMENTS (335) (2/3) RANGE 2,553 -3,016 PER SHARE RANGE 68-80+ 400 75 Daily closing price 70 350 65 EXHIBIT 14 Indexes of Monthly Adjusted Closing Prices 1980-1988; Actual Daily Closing Prices, July-August 1988; and Market Interest Rates, 60 300 - 55 50 250 45 August 1988 40LT July Aug. Aug. M 1988 200 - with Source: Interactive Data Corp. 150 Market crash October 19, 1987 100 50 1980 1987 1981 1982 1983 1984 Interco 1985 1986 - P S&P 500 1988 Aug. 8 Market Interest Rates Source: Salomon Brothers, Inc. 7,83% 8.87 9.01 9.10 Yield curve at August 1, 1988 1-year Treasury bills... 7-year Treasury bonds................... 10 year Treasury bonds 30-year Treasury bonds ... Corporate bond rates at August 5, 1988 (industrial companies) 10-year AAA.. 10-year AAA... 10-year A.............. 10-year BBB........ 9.5098 9.65 9.80 10.10 ***** SV.V. Exhibit 12 Data Assumptions for Valuation of Interco: Discounted Cash Flow Analysis Furniture Group 7.7% Footwear Group 6.3% Apparel Group Retail Group 7.1% 7.6% Total Company 7.2% Sales Growth Operating Margin 1989 Projection 1998 Projection Capital Expenditure Increase in Working Investment 13.1% 14.1% 1 12.5% 9.1% 10.4% 1 12.5% 6.4% 7.0% 1 12.5% 6.5% 7.5% 1 7.5% 9.2% 10.1% 1 11.6% Discount Rate 10% 11% 12% 13% Terminal Multiple $14.00 $15.00 $80.00 $84.00 $74.00 $77.00 $68.00 $72.00 $63.00 $66.00 $16.00 $88.00 $81.00 $75.00 $69.00 Apparel 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Salos EBITDA Tax WC Inv FCFE Apparel 813,198 20,240 8,663 42.8% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Present Value At Feb 1988 14 15 Terminal Multiple Used 16 10% 11% 12% 13% General Retail 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Sales EBITDA Tax WC Inv FCFE Gen Retail 532,251 39,101 16,735 42.8% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Present Value At Feb 1988 14 15 Terminal Multiple Used 16 10% 11% 12% 13% Footwear 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Sales EBITDA Tax WC Inv FCFE Footwear 890,411 92,204 39,463 42.8% #VALUE! #VALUE! #VALUE! #VALUEI #VALUE! Present Value At Feb 1988 14 15 Terminal Multiple Used 16 10% 11% 12% 13% Furniture 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Sales EBITDA Tax WC Iny FCFE Furniture 1,105,563 149,090 63,811 42.8% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Terminal Multiple Used Present Value At Feb 1988 14 15 16 10% 11% 12% 13% Aggregate Present Value Present Value At Feb 1988 14 15 Stock Price 15 Terminal Multiple Used 16 14 16 10% 11% 12% 13% Total Company 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Sales EBITDA Tax WC Inv FCFE Interco 3,341,423 253,460 108,481 42.8% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Present Value at Feb 1989 14 15 Stock Price 15 Terminal Multiple Used 16 14 16 10% 11% 12% 13% Shares Outstanding 37,500,000 Operating Margin: Linear Growth Apparel Group General Retail Footwear Furniture Total Company 6.40% 6.50% 9.10% 13.10% 9.20% 6.47% 6.61% 9.24% 13.21% 9.30% 6.53% 6.72% 9.39% 13.32% 9.40% 6.60% 6.83% 9.53% 13.43% 9.50% 6.67% 6.94% 9.68% 13.54% 9.60% 6.73% 7.06% 9.82% 13.66% 9.70% 6.80% 7.17% % 9.97% 13.77% 9.80% 6.87% 7.28% 10.11% 13.88% 9.90% 6.93% 7.39% 10.26% 13.99% 10.00% 7.00% 7.50% 10.40% 14.10% 10.10% Valuation Based on Multiples for Interco as of Feb 1988 Acquirer/Target Purchase Price as Multiple of Operating Book Value Sales Income Operating Cash Flow Net Income Furniture Group Masco/Henredon Chicago Pacific/General Mills Furniture Interco/Lane La-Z-Boy/Kincaid Average Multiple 31.6 14.1 19.3 22 2.6 1.8 2.8 2.1 1000 2.1 1 1.6 0.8 20.3 12 11.1 11.7 15.8 9.9 9.6 8.1 $85,279.48 $688,853.00 $1,105,563.00 $149,090.00 $139,110.00 Furniture Group Price Average Price Interco No. of Shares Price per Share #VALUE! Footwear Group 1.8 0 Interco/Converse Reebok/Rockport Reebok/Avia Moacq/Morse Shoe Nike/Cole Haan Average Multiple 37.1 30.7 40.6 2.5 36.2 0.9 1.7 2.1 0.5 1.5 18.2 23.9 23.3 6.7 1.8 0 24.7 26 24.6 13 12.2 9.2 8.1 $52,740.69 $595,861.00 $890,411.00 $92,204.00 $96,075.00 Footwear Group Price Average Price Interco No. of Shares Price per Share 37,500,000 Apparel Group 19.6 21 1.5 2.5 1.4 10.6 10.6 Oo West Point Pepperall/Cluett, Peabody W. Acquisition/Warnco Salant/Manhattan Indus. Wesray/Wm. Carter Average Multiple 0.2 9.2 0.6 0.9 0.4 0.8 6000 0 0 0 0 1.6 24 13.7 $11,577.28 $425,350.00 $813,198.00 $20,240.00 $23,541.00 Apparel Group Price Average Price Interco No. of Shares Price per Share 37,500,000 Central Hardware Group Management Group/Payless Cashways Average Multiple 22 2.3 0.6 13.1 9.2 $22,365.77 $252,195.00 $532,251.00 $39,101.00 $38,047.00 Gen Retail Price Average Price Interco No. of Shares Price per Share 37,500,000 Aggregate Price Stock Price Interco BETA Daily Return Daily Gross Return Asset Return Interco Daily Date Stock Price 5/2/88 $40.250 5/3/88 $41.500 5/4/88 $41.000 5/5/88 $41.625 5/6/88 $40.625 5/9/88 $40.875 5/10/88 $41.750 5/11/88 $41.625 5/12/88 $42.000 5/13/88 $42.125 5/16/88 $42.250 5/17/88 $42.000 5/18/88 $41.500 5/19/88 $40.625 5/20/88 $40.625 5/23/88 $40.375 5/24/88 $41.500 5/25/88 $42.500 5/26/88 $42.625 5/27/88 $41.250 5/31/88 $43.875 6/1/88 $43.500 6/2/88 $42.875 6/3/88 $44.125 6/6/88 $43.250 6/7/88 $42.000 6/8/88 $43.875 6/9/88 $43.375 6/10/88 $43.375 6/13/88 $43.500 6/14/88 $43.625 6/15/88 $42.500 6/16/88 $42.875 6/17/88 $43.625 6/20/88 $43.250 3.11% -1.20% 1.52% -2.40% 0.62% 2.14% -0.30% 0.90% 0.30% 0.30% -0.59% -1.19% -2.11% 0.00% -0.62% 2.79% 2.41% 0.29% -3.23% 6.36% -0.85% -1.44% 2.92% -1.98% -2.89% 4.46% -1.14% 0.00% 0.29% 0.29% -2.58% 0.88% 1.75% -0.86% Market Return Daily Net S&P 500 Return 261.56 263.00 0.55% 260.32 -1.02% 258.79 -0.59% 257.48 -0.51% 256.54 -0.37% 257.62 0.42% 253.31 -1.67% 253.85 0.21% 256.78 1.15% 258.71 0.75% 255.39 -1.28% 251.35 -1.58% 252.57 0.49% 253.02 0.18% 250.83 -0.87% 253.51 1.07% 253.76 0.10% 254.63 0.34% 253.42 -0.48% 262.16 3.45% 266.69 1.73% 265.33 -0.51% 266.45 0.42% 267.05 0.23% 265.17 -0.70% 271.52 2.39% 270.20 -0.49% 271.26 0.39% 271.43 0.06% 274.30 1.06% 274.45 0.05% 269.77 -1.71% 270.68 0.34% 268.94 -0.64% 100.55% 98.98% 99.41% 99.49% 99.63% 100.42% 98.33% 100.21% 101.15% 100.75% 98.72% 98.42% 100.49% 100.18% 99.13% 101.07% 100.10% 100.34% 99.52% 103.45% 101.73% 99.49% 100.42% 100.23% 99.30% 102.39% 99.51% 100.39% 100.06% 101.06% 100.05% 98.29% 100.34% 99.36% 6/21/88 6/22/88 6/23/88) 6/24/88 6/27/88) 6/28/88 6/29/88 6/30/88 7/1/88 7/5/88 7/6/88 7/7/88 7/8/88 7/11/88 7/12/88 7/13/88 7/14/88 7/15/88 7/18/88 7/19/88) 7/20/88 7/21/88 7/22/88 7/25/88 7/26/88 7/27/88 7/28/88) 7/29/88 8/1/88 8/2/88 8/3/88 8/4/88 8/5/88 8/8/88 $43.125 $43.750 $43.625 $43.500 $43.625 $44.000 $44.000 $44.750 $44.625 $45.375 $44.500 $44.625 $45.000 $45.250 $45.375 $46.375 $49.000 $54.375 $54.500 $58.375 $58.125 $57.875 $57.250 $58.000 $58.875 $59.375 $67.750 $68.500 $68.875 $67.625 $67.000 $67.375 $68.250 $72.500 -0.29% 1.45% -0.29% -0.29% 0.29% 0.86% 0.00% 1.70% -0.28% 1.68% -1.93% 0.28% 0.84% 0.56% 0.28% 2.20% 5.66% 10.97% 0.23% 7.11% -0.43% -0.43% -1.08% 1.31% 1.51% 0.85% 14.11% 1.11% 0.55% -1.81% -0.92% 0.56% 1.30% 6.23% 271.67 275.66 274.82 273.78 269.06 272.31 270.98 273.50 271.78 275.81 272.02 271.78 270.02 270.55 267.85) 269.32 270.26 272.05 270.51 268.47 270.00 266.66 263.50 264.68 265.68 265.19 262.50 266.02 272.02 272.21 272.06 272.98 271.93 271.15 1.02% 1.47% -0.30% -0.38% -1.72% 1.21% -0.49% 0.93% -0.63% 1.48% -1.37% -0.09% -0.65% 0.20% -1.00% 0.55% 0.35% 0.66% -0.57% -0.75% 0.57% -1.24% -1.19% 0.45% 0.38% -0.18% -1.01% 1.34% 2.26% 0.07% -0.06% 0.34% -0.38% -0.29% 101.02% 101.47% 99.70% 99.62% 98.28% 101.21% 99.51% 100.93% 99.37% 101.48% 98.63% 99.91% 99.35% 100.20% 99.00% 100.55% 100.35% 100.66% 99.43% 99.25% 100.57% 98.76% 98.81% 100.45% 100.38% 99.82% 98.99% 101.34% 102.26% 100.07% 99.94% 100.34% 99.62% 99.71% 14.50% 13.24% (Arithmetic (Geometric Ave. Return) Mean Return) 2.92% 1.01% Standard Deviation of Asset Return Standard Deviation of Market Return Mean Market Return or Arithmetic Average Retu 0.06% 250 days = 14.50% Geometric Mean Return 0.05% 250 days = 13.24% cov (ri, rM) var (rM) 0.0000679422 0.0001007835 beta 0.67414 covariance variance 0.0000679422 0.0001007835 CAPM Risk free rate = 10 year Treasury bonds = = RF + B (RM -RF) R (Interco) Cost of Equity of Interco = + 0.67414 ( 0.1450 ) + or TABLE A: PERCENT OF SALES BY OPERATING GROUP, 1998 AND 1984 1988 1984 APPAREL 24% 33% GENERAL RETAIL 16 26 FOOTWEAR 27 21 FURNITURE 33 20 EXHIBIT 3: COMMON STOCK PRICE HISTORY (MONTHLY) MONTH-END PRICES (ADJUSTED FOR STOCK SPLITS) 1986 1987 1/31/86 35.125 1/31/87 39.75 2/28/86 39 2/27/87 42.625 3/31/86 39.25 3/31/87 44.125 4/30/86 39.625 4/30/87 39.625 5/30/86 43.5 5/29/87 40.125 6/30/86 47.188 6/30/87 45.375 7/31/86 41.375 7/31/87 51.25 8/26/86 43.75 8/31/87 53.25 9/30/86 40 9/30/87 47.5 10/31/86 43.75 10/30/87 36 11/28/86 44.125 11/30/87 30 12/31/86 36.875 12/31/87 32.25 1988 1/29/88 2/29/88 3/31/88 4/29/88 5/31/88 6/30/88 7/29/88 37.125 42 42 41.125 43.875 44.75 68.5 EXHIBIT 4: CONSUMER STICK PRICE HISTORY (DAILY) DAILY CLOSING PRICES 42.625 41.25 43.125 43.75 43.625 43.5 43.625 44 44 44.75 44.625 5/2/88 5/3/88 5/4/88 5/5/88 5/6/88 5/9/88 5/10/88 5/11/88 5/12/88 5/13/88 5/16/88 5/17/88 5/18/88 5/19/88 5/20/88 5/23/88 5/24/88 5/25/88 40.25 41.5 41 41.625 40.625 40.875 41.75 41.625 42 42.125 42.25 42 41.5 40.625 40.625 40.375 41.5 42.5 5/26/88 5/27/88 5/30/88 N.A 5/31/88 6/1/88 6/2/88 6/3/88 6/6/88 6/7/88 6/8/88 6/9/88 6/10/88 6/13/88 6/14/88 6/15/88 6/16/88 6/17/88 6/20/88 43.875 43.5 42.875 44.125 43.25 42 43.875 43.375 43.375 43.5 43.625 42.5 42.875 43.625 43.25 6/21/88 6/22/88 6/23/88 6/24/88 6/27/88 6/28/88 6/29/88 6/30/88 7/1/88 7/4/88 N.A. 7/5/88 7/6/88 7/7/88 7/8/88 7/11/88 7/12/88 7/13/88 7/14/88 7/15/88 7/18/88 7/19/88 7/20/88 7/21/88 7/22/88 7/25/88 7/26/88 7/27/88 7/28/88 7/29/88 8/1/88 8/2/88 8/3/88 8/4/88 8/5/88 8/8/88 54.375 54.5 58.375 58.125 57.875 57.25 58 58.875 59.375 67.75 68.5 68.875 67.625 67 67.375 68.25 72.5 45.375 44.5 44.625 45 45.25 45.375 46.375 49 EXHIBIT 6: INTERCO'S CONSOLIDATED BALANCE SHEETS (THOUSANDS OF DOLLARS EXCPET PER SHARE DATA) FEBRUARY 28 MAY 31 1986 1987 1988 1987 1988 CURRENT ASSETS CASH $ 16,856.00 $ 16,631.00 $ 20,849.00 $ 29,700.00 $ 19,622.00 MARKETABLE SECURITIES $ 127,341.00 $ 63,747.00 $ 11,033.00 $ 57,789.00 $ 16,366.00 RECEIVABLE, NET $ $ 402,225.00 $ 446,755.00 $ 486,657.00 $ 431,743.00 $ 460,759.00 INVENTORIES $ 647,116.00 $ 733,907.00 $ 805,095.00 $ 786,792.00 $ 872,135.00 PREPAID EXPENSES AND OTHER CURRENT ASSETS $ 22,547.00 $ 25,614.00 $ 35,665.00 $ 25,622.00 $ 44,959.00 TOTAL CURRENT ASSETS $ 1,216,085.00 $ 1,286,654.00 $ 1,359,299.00 $ 1,331,646.00 $ 1,413,841.00 PROPERTY PLANT AND EQUIPMENT LAND $ 26,770.00 $ 32,266.00 $ 32,525.00 $ $ BUILDINGS AND IMPROVEMENTS $ 437,812.00 $ 465,811.00 $ 471,787.00 $ $ MACHINERY AND EQUIPMENT $ $ 320,256.00 $ 364,499.00 $ 380,402.00 $ $ $ 784,838.00 $ 862,576.00 $ 884,714.00 $ 868,670.00 $ 890,887.00 LESS ACCUMULATED DEPRECIATION $ 343,018.00 $ 377,226.00 $ 405,215.00 $ 386,762.00 $ 412,332.00 NET PROPERTY PLANT AND EQUIPMENT $ 441,820.00 $ 485,350.00 $ 479,499.00 $ 481,908.00 $ 478,555.00 OTHER ASSETS $ 99,238.00 $ 153,383.00 $ 146,788.00 $ 149,170.00 $ 146,878.00 TOTAL ASSETS $ 1,757,143.00 $ 1,925,387.00 $ 1,985,586.00 $ 1,962,724.00 $ 2,039,274.00 CURRENT LIABILITES NOTES PAYABLE $ $ 68,840.00 $ 70,517.00 $ 97,297.00 $ 146,016.00 CURRENT MATURITIES OF LONG-TERM DEBT AND CAPITAL LEASE OBLIGATIONS $ 9,647.00 $ 11,915.00 $ 8,172.00 $ 9,288.00 $ 8,900.00 ACCOUNTS PATABLE AND ACCRUED EXPENSES $ 184,032.00 $ 216,365.00 $ 239,513.00 $ 278,847.00 $ 292,051.00 INCOME TAXES $ 12,699.00 $ 17,327.00 $ 4,402.00 $ 15,294.00 $ 5,463.00 TOTAL CURRENT LIABILITIES $ 249,587.00 $ 358,226.00 $ 373,343.00 $ 400,726.00 $ 452,430.00 LONG-TERM DEBT, LESS CURRENT LIABILITIES $ $ 127,409.00 $ 135,019.00 $ 257,327.00 $ 133,403.00 $ 255,279.00 OBLIGATIONS UNDER CAPITAL LEASES, LESS CURRENT MATURITIES $ 56,495.00 $ 50,546.00 $ 41,813.00 $ 49,270.00 $ 40,032.00 OTHER LONG-TERM LIABILITRIES $ 43,249.00 $ 55,381.00 $ 61,766.00 $ 56,410.00 $ 63,484.00 SHAREHOLDERS' EQUITY PREFERRED STOCK, NO PAR VALUE $ 66,027.00 $ 61,795.00 $ 57,113.00 $ 61,285.00 $ 36,721.00 COMMON STOCK $ 3.75 STATED VALUE $ 163,765.00 $ 163,643.00 $ 155,088.00 $ 155,088.00 $ 155,088.00 CAPITAL SURPLUS (41,356,847 SHARES ISSUED) $ 104,205.00 $ 98,246.00 $ 44,539.00 $ 49,149.00 $ 32,117.00 RETAINED EARNINGS $ 1,027,895.00 $ 1,099,006.00 $ 1,179,964.00 $ 1,111,527.00 $ 1,194,884.00 $ 1,361,892.00 $ 1,422,690.00 $ 1,436,704.00 $ 1,377,049.00 $ 1,418,810.00 LESS 5,173,811 TREASURY SHARES $ 81,739.00 $ 96,475.00 $ 185,367.00 $ 54,134.00 $ 190,762.00 TOTAL SHAREHOLDERS' EQUITY $ 1,280,153.00 $ 1,326,215.00 $ 1,251,337.00 $ 1,322,915.00 $ 1,228,048.00 TOTAL LIABILITIES AND NET WORTH $ 1,756,893.00 $ 1,925,387.00 $ 1,985,586.00 $ 1,962,724.00 $ 2,039,273.00 EXHIBIT 8: BUSINESS EGMENT INFORMATION YEAR ENDED FEBRUARY 28, FIRST QUARTER ENDED MAY 31, 1986 1987 1988 1987 1988 SALES TO UNAFFILIATED CUSTOMERS APPAREL $ 907,833.00 $ 817,660.00 $ 813,198.00 $ 160,339.00 $ 138,836.00 GENERAL RETAIL $ 461,785.00 $ 498,324.00 $ 532,251.00 $ 148,138.00 $ 149,209.00 FOOTWEAR $ 55,286.00 $ 663,521.00 $ 890,411.00 $ 209,535.00 $ 226,672.00 FURNITIRE $ 904,480.00 $ 967,397.00 $ 1,105,563.00 $ 263,409.00 $ 263,390.00 TOTAL $ 2,329,384.00 $ 2,946,902.00 $3,341,423.00 $ 781,421.00 $ 778,107.00 OPERATING EARNINGS APPAREL $ 66,716.00 $ 47,269.00 $ 20,240.00 $ (670.00) $ (247.00) GENERAL RETAIL $ 32,085.00 $ 40,610.00 $ 39,101.00 $ 14,136.00 $ 12,498.00 FOOTWEAR $ 48,475.00 $ 52,136.00 $ 92,204.00 $ 15,777.00 $ 19,700.00 FURNITURE $ 105,111.00 $ 123,766.00 $ 149,000.00 $ 38,319.00 $ 32,196.00 TOTAL $ 252,387.00 $ 263,781.00 $ 300,545.00 $ 67,562.00 $ 64,147.00 NET INCOME $ 36,140.00 $ 32,175.00 $ 29,237.00 $ 6,293.00 $ 6,864.00 CORPORATE EXPENSE $ (34,147.00) $ (30,163.00) $ (42,877.00) $ (14,228.00) $ (9,928.00) EARNIGS BEFORE INTEREST AND TAXES $ 254,380.00 $ 265,793.00 $ 286,995.00 $ 59,627.00 $ 61,083.00 INTEREST EXPENSE $ (25,523.00) $ (28,082.00) $ (33,535.00) $ (7,351.00) $ (9,179.00) EARNINGS BEFORE INCOME TAXES $ 228,857.00 $ 237,711.00 $ 253,460.00 $ 52,276.00 $ 51,904.00 JUSTIFIABLE ASSETS AT YEAR END APPAREL $ 456,972.00 $ 465,601.00 $ 425,350.00 GENERAL RETAIL $ 234,004.00 $ 248,639.00 $ 252,195.00 FOOTWEAR $ 291,292.00 $ 497,706.00 $ 595,861.00 FURNITURE $ 618,980.00 $ 640,106.00 $ 688,853.00 $ 1,601,248.00 $ 1,852,052.00 $1,962,259.00 CORPORATE ASSETS $ 155,645.00 $ 73,335.00 $ 23,327.00 TOTAL $ 1,756,893.00 $ 1,925,387.00 $ 1,985,586.00 DEPRECIATION EXPENSE APPAEAL $ 11,965.00 $ 12,123.00 $ 12,521.00 GENERAL RETAIL $ 8,294.00 $ 9,079.00 $ 9,681.00 FOOTWEAR $ 8,286.00 $ 10,638.00 $ 13,107.00 FURNITURE $ 20,971.00 $ 21,675.00 $ 26,208.00 CAPITAL EXPENDITURES APPAREL $ 13,433.00 $ 8,869.00 $ 9,220.00 GENERAL RETAIL $ 6,169.00 $ 8,167.00 $ 10,735.00 FOOTWEAR $ 8,114.00 $ 7,486.00 $ 9,236.00 FURNITIRE $ 27,278.00 $ 24,720.00 $ 36,188.00 EXHIBIT 9: SUMMARY OF TAKEOVER OFFER CITY CAPITAL ASSOCIATES, L.P. IFFER DATE 8-Aug-88 PRICE PER SHARE $70 PREMIUM TO STOCK 17.90% PREMIUM TO STOCK 59.10% PREIMUM TO 52-W 137.30% PREMIUM TO 52-W 17.20% VALUE OF EQUITY $ 2,622.8 MM NET DEBT 318.5 MM VALUE OF FIRM $ 2,941.3 MM SALES YEAR ENDING 2/29/0.9X ESTIMATE OF YEAR-E 0.9 VALUE OF FIRM AS A MULTIPLE OF: VALUE OF EQUITY AS A MULTIPLE OF: OPERATING CASH FL OPERATING INCOME NET INCOME BOOK VALUE 9.2x 11.4x 18.1X 2.2X 8.8 10.7 17 2.2 EXHIBIT 10: PREMIUM PAID ANALYSIS AVERAGE PREMIUM PAID OVER STOCK PRICE #DEALS 1 DAY 4 WEEKS 52-WEEK LOW 52-WEEK HIGH 1ST QUARTER 1988 19 62.30% 95.50% 159.50% 16.70% 2ND QUARTER 1988 9 68.6 91.3 182.8 31.5 3RD QUARTER 1988 12 36.5 49.9 181.3 2 1988 40 56 80.9 171.3 15.8 RALES 17.9 59.1 137.3 17.2 1ST QUARTER 1988 2ND QUARTER 1988 3RD QUARTER 1988 1988 RALES EXHIBIT 10: PREMIUM PAID ANALYSIS AVERAGE PREMIUM PAID OVER STOCK PRICE #DEALS 1 DAY 4 WEEKS 19 62.30% 9 68.6 12 36.5 40 17.9 52-WEEK LOW 52-WEEK HIGH 95.50% 159.50% 16.70% 91.3 182.8 31.5 49.9 181.3 2 80.9 171.3 15.8 59.1 137.3 17.2 56 ANNOUNCEMENT DATE 12/14/87 11/17/86 8/12/86 6/3/86 8/8/88 EXHIBIT 11: COMPARABLE TRANSACTION ANALYSIS; PURCHASE PRISE MULTIPLES BY BUSINESS SEGMENT; FURNITURE MANUFACTURING COMPANIES PURCHASE PRICE MULTIPLIER ACQUIROR/TARGET AGGREGATE PRICE (SMM) NETINCOME BOOK VALUE SALES OPERATING INCOME OPERATING CASH FLOW LA-Z-BOY/KINCAID $63.5 22.0x 2.1x 0.8x 11.7x 8.1x INTERCO/LANE 523.7 19.3 2.8 1.6 11.1 9.6 CHICAGO PACIFIC/ GENERAL MILL FURNITURE 89.3 14.1 1.8 1 12 9.9 MASCO/HENREDON 260.9 31.6 2.6 2.1 20.3 15.8 RALES PROPOSAL $ 2941.3 18.1 2.2 0.9 11.4 9.2 EXHIBIT 11: FOOTWEAR MANUFACTURING COMPANIES 1.8 ANNOUNCEMENT DATE 4/25/88 6/3/87 3/10/87 9/18/86 7/31/86 8/8/88 ACQUIROR/TARGET NIKE/COLE HAAN MOACQ/ MORSE SHOE REEBOK/AVIA REEBOK/ROCKPORT INTERCO/CONVERSE RALES PROPOSAL AGGREGATE PRICE (SMM) NET INCOME $95 36.2x 312.5 191 146.1 202.7 $2941.3 PURCHASE PRICE MULTIPLIER BOOK VALUE SALES OPERATING INCOME OPERATING CASH FLOW N.M. 1.5x 14.1 12.2 2.5 0.5 13 9.2 40.6 6.7 2.1 24.6 23.3 30.7 N.M. 1.7 26 23.9 37.1 1.8 0.9 24.7 18.2 18.1 2.2 0.9 11.4 9.2 BOOK VALUE 1.6X APPAREL COMPANIES ANNOUNCEMENT DATE 4/28/88 2/2/88 3/17/86 11/4/85 8/8/88 ACQUIROR/TARGET WESRAY/WILLIAM CARTER SALANT/MANHATTAN INDUS W ACQUISITION / WARNCO WEST POINY PEPPERALL / CLUETT, PEABODY / RALES PROPOSAL AGGREGATE PRICE (SMM) NET INCOME $ 157.4 N.M. 129.7 N.M. 504.7 21.0x 551.9 $ 2,941.3 PURCHASE PRICE MULTIPLIER SALES OPERATING INCOME OPERATING CASH FLOW 0.8x 24.0x 13.7% 1.4 0.4 N.M. N.M. 2.5 0.9 10.6 9.2 1.5 0.6 10.6 9.2 2.2 0.9 11.4 9.2 19.6 18.1 ANNOUNCEMENT DATE 6/24/88 8/8/88 CENTRAL HARDWARE DIVISION ACQUIROR/TARGET AGGREGATE PRICE (SMM) NET INCOME MANAGEMENT GROUP / PAYLESS CASHWAYS $ 1,189.4 22.0x RALES PROPOSAL $2,941.3 PURCHASE PRICE MULTIPLIER BOOK VALUE SALES OPERATING INCOME OPERATING CASH FLOW 2.3x 0.6% 13.1x 9.2x 2.2 0.9 11.4 9.2 18.1 EXHIBIT 11: VALUE RANGES BY BUSINESS SEGMENT BUSINESS SEGMENT APPAREL GENERAL RETAIL FOOTWEAR FURNITURE 1988 SALES $813.2 532.3 890.4 $ 1,105.6 MULTIPLE RANGE .4-9 .6-6 .6-2.1 .8 - 2.1 VALUE RANGE $325.3 - $731.9 319.4 = 319.4 445.2 - 1,869.8 884.5-2,321.8 $ 1,974.4 - $5,242.9 MEDIAN VALUE $569.2 319.4 1,335.60 1437.3 3,661.50 BUSINESS SEGMENT APPAREL GENERAL RETAIL FOOTWEAR FURNITURE 1988 OPERATING INCOME $ $ $ $ MULTIPLE RANGE 20.20 10.6 - 24.0 39.10 13.1 - 13.1 92.20 13.0-26.0 149.10 11.1 -20.3 VALUE RANGE MEDIAN VALUE $214.1 - $484.8 $ 214.10 512.2-512.2 $ 512.20 1,198.6 -2,397.2 $ 2,268.10 1,655.0 -3,020.7 $ 1,766.80 $ 2,579.9 - $6,420.9 $ 4,761.20 BUSINESS SEGMENT APPAREL GENERAL RETAIL FOOTWEAR FURNITURE 1988 OPERATING CASH FLOW $ $ $ $ MULTIPLE RANGE 32.70 9.2 - 13.7 48.80 9.2-9.2 105.30 9.2-23.9 175.30 8.1 - 15.8 VALUE RANGE MEDIAN VALUE $ 300.8 - $448. $ 300.80 448.9-448.9 $ 448.90 968.2 - 2,516.7 $ 970.70 1,419.9 -2,769.7 $ 2,709.30 $ 3,138.4 - $ 6,183.3 $ 3,429.60 EXHIBIT 12: DISCOUNTED CASH FLOW ANALYSIS ASSUMPTIONS FURNITIRE GROUP SALES GROWTH 7.70% OPERATING MARGIN RANGE 13.1% - 14.1% CAPITAL EXPENDITURES 1X INCREASE IN WORKING INVESTMENT 12.50% TAX RATE FOOTWEAR GROUP APPAREL GROUP RETAIL GROUP TOTAL 6.30% 7.10% 7.60% 7.20% 9.1% - 10.4% 6.4% -7.09% 6.5% -7.5% 9.2% - 10.1% 1x 1x 1x 1x 12.50% 7.50% 7.50% 11.60% 41.00% MULTIPLE CASH FLOW IN YEAR 10 15.0X 14.0X 16.0X $ 4,746.00 $ 5,085.00 $ 5,424.00 TERMINAL VALUE ($ MILLIONS) IMPLIED STOCK PRICE DISCOUNR RATE 10.00% 11.00% 12.00% 13.00% $ $ $ $ 80.00 $ 74.00 $ 68.00 $ 63.00 $ 84.00 $ 77.00 $ 72.00 $ 66.00 $ 88.00 81.00 75.00 69.00 EXHIBIT 13 : REFERENCE RANGE-RETAIN CORE COMPANIES CASE (MILLIONS OF DOLLARS EXCEPT PER SHARE DATA) SEGMENT RANGE FURNITURE GROUP $1,525 - $ 1,750 FOOTWEAR GROUP 775-900 TOTAL 2,300 -2,650 AFTER-TAX DIVESTITURE PROCEEDS 588-639 NET CORPORATE ADJUSTMENTS (335) (2/3) RANGE 2,553 -3,016 PER SHARE RANGE 68-80+ 400 75 Daily closing price 70 350 65 EXHIBIT 14 Indexes of Monthly Adjusted Closing Prices 1980-1988; Actual Daily Closing Prices, July-August 1988; and Market Interest Rates, 60 300 - 55 50 250 45 August 1988 40LT July Aug. Aug. M 1988 200 - with Source: Interactive Data Corp. 150 Market crash October 19, 1987 100 50 1980 1987 1981 1982 1983 1984 Interco 1985 1986 - P S&P 500 1988 Aug. 8 Market Interest Rates Source: Salomon Brothers, Inc. 7,83% 8.87 9.01 9.10 Yield curve at August 1, 1988 1-year Treasury bills... 7-year Treasury bonds................... 10 year Treasury bonds 30-year Treasury bonds ... Corporate bond rates at August 5, 1988 (industrial companies) 10-year AAA.. 10-year AAA... 10-year A.............. 10-year BBB........ 9.5098 9.65 9.80 10.10 ***** SV.V. Exhibit 12 Data Assumptions for Valuation of Interco: Discounted Cash Flow Analysis Furniture Group 7.7% Footwear Group 6.3% Apparel Group Retail Group 7.1% 7.6% Total Company 7.2% Sales Growth Operating Margin 1989 Projection 1998 Projection Capital Expenditure Increase in Working Investment 13.1% 14.1% 1 12.5% 9.1% 10.4% 1 12.5% 6.4% 7.0% 1 12.5% 6.5% 7.5% 1 7.5% 9.2% 10.1% 1 11.6% Discount Rate 10% 11% 12% 13% Terminal Multiple $14.00 $15.00 $80.00 $84.00 $74.00 $77.00 $68.00 $72.00 $63.00 $66.00 $16.00 $88.00 $81.00 $75.00 $69.00 Apparel 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Salos EBITDA Tax WC Inv FCFE Apparel 813,198 20,240 8,663 42.8% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Present Value At Feb 1988 14 15 Terminal Multiple Used 16 10% 11% 12% 13% General Retail 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Sales EBITDA Tax WC Inv FCFE Gen Retail 532,251 39,101 16,735 42.8% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Present Value At Feb 1988 14 15 Terminal Multiple Used 16 10% 11% 12% 13% Footwear 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Sales EBITDA Tax WC Inv FCFE Footwear 890,411 92,204 39,463 42.8% #VALUE! #VALUE! #VALUE! #VALUEI #VALUE! Present Value At Feb 1988 14 15 Terminal Multiple Used 16 10% 11% 12% 13% Furniture 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Sales EBITDA Tax WC Iny FCFE Furniture 1,105,563 149,090 63,811 42.8% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Terminal Multiple Used Present Value At Feb 1988 14 15 16 10% 11% 12% 13% Aggregate Present Value Present Value At Feb 1988 14 15 Stock Price 15 Terminal Multiple Used 16 14 16 10% 11% 12% 13% Total Company 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 & After $ Sales EBITDA Tax WC Inv FCFE Interco 3,341,423 253,460 108,481 42.8% #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Present Value at Feb 1989 14 15 Stock Price 15 Terminal Multiple Used 16 14 16 10% 11% 12% 13% Shares Outstanding 37,500,000 Operating Margin: Linear Growth Apparel Group General Retail Footwear Furniture Total Company 6.40% 6.50% 9.10% 13.10% 9.20% 6.47% 6.61% 9.24% 13.21% 9.30% 6.53% 6.72% 9.39% 13.32% 9.40% 6.60% 6.83% 9.53% 13.43% 9.50% 6.67% 6.94% 9.68% 13.54% 9.60% 6.73% 7.06% 9.82% 13.66% 9.70% 6.80% 7.17% % 9.97% 13.77% 9.80% 6.87% 7.28% 10.11% 13.88% 9.90% 6.93% 7.39% 10.26% 13.99% 10.00% 7.00% 7.50% 10.40% 14.10% 10.10% Valuation Based on Multiples for Interco as of Feb 1988 Acquirer/Target Purchase Price as Multiple of Operating Book Value Sales Income Operating Cash Flow Net Income Furniture Group Masco/Henredon Chicago Pacific/General Mills Furniture Interco/Lane La-Z-Boy/Kincaid Average Multiple 31.6 14.1 19.3 22 2.6 1.8 2.8 2.1 1000 2.1 1 1.6 0.8 20.3 12 11.1 11.7 15.8 9.9 9.6 8.1 $85,279.48 $688,853.00 $1,105,563.00 $149,090.00 $139,110.00 Furniture Group Price Average Price Interco No. of Shares Price per Share #VALUE! Footwear Group 1.8 0 Interco/Converse Reebok/Rockport Reebok/Avia Moacq/Morse Shoe Nike/Cole Haan Average Multiple 37.1 30.7 40.6 2.5 36.2 0.9 1.7 2.1 0.5 1.5 18.2 23.9 23.3 6.7 1.8 0 24.7 26 24.6 13 12.2 9.2 8.1 $52,740.69 $595,861.00 $890,411.00 $92,204.00 $96,075.00 Footwear Group Price Average Price Interco No. of Shares Price per Share 37,500,000 Apparel Group 19.6 21 1.5 2.5 1.4 10.6 10.6 Oo West Point Pepperall/Cluett, Peabody W. Acquisition/Warnco Salant/Manhattan Indus. Wesray/Wm. Carter Average Multiple 0.2 9.2 0.6 0.9 0.4 0.8 6000 0 0 0 0 1.6 24 13.7 $11,577.28 $425,350.00 $813,198.00 $20,240.00 $23,541.00 Apparel Group Price Average Price Interco No. of Shares Price per Share 37,500,000 Central Hardware Group Management Group/Payless Cashways Average Multiple 22 2.3 0.6 13.1 9.2 $22,365.77 $252,195.00 $532,251.00 $39,101.00 $38,047.00 Gen Retail Price Average Price Interco No. of Shares Price per Share 37,500,000 Aggregate Price Stock Price Interco BETA Daily Return Daily Gross Return Asset Return Interco Daily Date Stock Price 5/2/88 $40.250 5/3/88 $41.500 5/4/88 $41.000 5/5/88 $41.625 5/6/88 $40.625 5/9/88 $40.875 5/10/88 $41.750 5/11/88 $41.625 5/12/88 $42.000 5/13/88 $42.125 5/16/88 $42.250 5/17/88 $42.000 5/18/88 $41.500 5/19/88 $40.625 5/20/88 $40.625 5/23/88 $40.375 5/24/88 $41.500 5/25/88 $42.500 5/26/88 $42.625 5/27/88 $41.250 5/31/88 $43.875 6/1/88 $43.500 6/2/88 $42.875 6/3/88 $44.125 6/6/88 $43.250 6/7/88 $42.000 6/8/88 $43.875 6/9/88 $43.375 6/10/88 $43.375 6/13/88 $43.500 6/14/88 $43.625 6/15/88 $42.500 6/16/88 $42.875 6/17/88 $43.625 6/20/88 $43.250 3.11% -1.20% 1.52% -2.40% 0.62% 2.14% -0.30% 0.90% 0.30% 0.30% -0.59% -1.19% -2.11% 0.00% -0.62% 2.79% 2.41% 0.29% -3.23% 6.36% -0.85% -1.44% 2.92% -1.98% -2.89% 4.46% -1.14% 0.00% 0.29% 0.29% -2.58% 0.88% 1.75% -0.86% Market Return Daily Net S&P 500 Return 261.56 263.00 0.55% 260.32 -1.02% 258.79 -0.59% 257.48 -0.51% 256.54 -0.37% 257.62 0.42% 253.31 -1.67% 253.85 0.21% 256.78 1.15% 258.71 0.75% 255.39 -1.28% 251.35 -1.58% 252.57 0.49% 253.02 0.18% 250.83 -0.87% 253.51 1.07% 253.76 0.10% 254.63 0.34% 253.42 -0.48% 262.16 3.45% 266.69 1.73% 265.33 -0.51% 266.45 0.42% 267.05 0.23% 265.17 -0.70% 271.52 2.39% 270.20 -0.49% 271.26 0.39% 271.43 0.06% 274.30 1.06% 274.45 0.05% 269.77 -1.71% 270.68 0.34% 268.94 -0.64% 100.55% 98.98% 99.41% 99.49% 99.63% 100.42% 98.33% 100.21% 101.15% 100.75% 98.72% 98.42% 100.49% 100.18% 99.13% 101.07% 100.10% 100.34% 99.52% 103.45% 101.73% 99.49% 100.42% 100.23% 99.30% 102.39% 99.51% 100.39% 100.06% 101.06% 100.05% 98.29% 100.34% 99.36% 6/21/88 6/22/88 6/23/88) 6/24/88 6/27/88) 6/28/88 6/29/88 6/30/88 7/1/88 7/5/88 7/6/88 7/7/88 7/8/88 7/11/88 7/12/88 7/13/88 7/14/88 7/15/88 7/18/88 7/19/88) 7/20/88 7/21/88 7/22/88 7/25/88 7/26/88 7/27/88 7/28/88) 7/29/88 8/1/88 8/2/88 8/3/88 8/4/88 8/5/88 8/8/88 $43.125 $43.750 $43.625 $43.500 $43.625 $44.000 $44.000 $44.750 $44.625 $45.375 $44.500 $44.625 $45.000 $45.250 $45.375 $46.375 $49.000 $54.375 $54.500 $58.375 $58.125 $57.875 $57.250 $58.000 $58.875 $59.375 $67.750 $68.500 $68.875 $67.625 $67.000 $67.375 $68.250 $72.500 -0.29% 1.45% -0.29% -0.29% 0.29% 0.86% 0.00% 1.70% -0.28% 1.68% -1.93% 0.28% 0.84% 0.56% 0.28% 2.20% 5.66% 10.97% 0.23% 7.11% -0.43% -0.43% -1.08% 1.31% 1.51% 0.85% 14.11% 1.11% 0.55% -1.81% -0.92% 0.56% 1.30% 6.23% 271.67 275.66 274.82 273.78 269.06 272.31 270.98 273.50 271.78 275.81 272.02 271.78 270.02 270.55 267.85) 269.32 270.26 272.05 270.51 268.47 270.00 266.66 263.50 264.68 265.68 265.19 262.50 266.02 272.02 272.21 272.06 272.98 271.93 271.15 1.02% 1.47% -0.30% -0.38% -1.72% 1.21% -0.49% 0.93% -0.63% 1.48% -1.37% -0.09% -0.65% 0.20% -1.00% 0.55% 0.35% 0.66% -0.57% -0.75% 0.57% -1.24% -1.19% 0.45% 0.38% -0.18% -1.01% 1.34% 2.26% 0.07% -0.06% 0.34% -0.38% -0.29% 101.02% 101.47% 99.70% 99.62% 98.28% 101.21% 99.51% 100.93% 99.37% 101.48% 98.63% 99.91% 99.35% 100.20% 99.00% 100.55% 100.35% 100.66% 99.43% 99.25% 100.57% 98.76% 98.81% 100.45% 100.38% 99.82% 98.99% 101.34% 102.26% 100.07% 99.94% 100.34% 99.62% 99.71% 14.50% 13.24% (Arithmetic (Geometric Ave. Return) Mean Return) 2.92% 1.01% Standard Deviation of Asset Return Standard Deviation of Market Return Mean Market Return or Arithmetic Average Retu 0.06% 250 days = 14.50% Geometric Mean Return 0.05% 250 days = 13.24% cov (ri, rM) var (rM) 0.0000679422 0.0001007835 beta 0.67414 covariance variance 0.0000679422 0.0001007835 CAPM Risk free rate = 10 year Treasury bonds = = RF + B (RM -RF) R (Interco) Cost of Equity of Interco = + 0.67414 ( 0.1450 ) + or

To answer:

To answer: