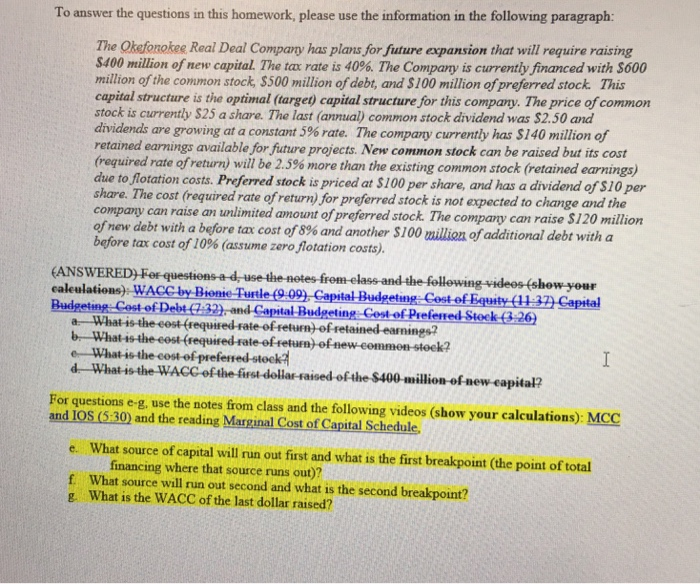

To answer the questions in this homework, please use the information in the following paragraph: The Okefonokee Real Deal Compary has plans for future expansion that will require raising $400 million of new capital. The tax rate is 40%. The Company is currently financed with $600 million of the common stock, S500 million of debt, and $100 million of preferred stock This capital structure is the optimal (target) capital structure for this company. The price of common stock is currently S25 a share. The last (annual) common stock dividend was $2.50 and dividends are growing at a constant 5% rate. The company currently has $140 million of retained earnings available for fiuture projects. New common stock can be raised but its cost (required rate of return) will be 2.5% more than the existing common stock (retained earnings) due to flotation costs. Preferred stock is priced at $100 per share, and has a dividend of $10 per share. The cost (required rate of return) for preferred stock is not expected to change and the company can raise an unlimited amount of preferred stock. The compary can raise $120 million of new debt with a before tax cost of 8% and another $100 million of additional debt with a before tax cost of 10% (assume zero flotation costs). (ANSWERED) For-questions-a-d-use the-netes-from-elass-and-the following videos fs caleulations) WACC by Bionie Turle (9.09) Capital Budgeting Cost of Equsity (11:3) Capital Budgeting: Cost of Debt (2.:32)-and Capital Budgeting Cost of Preferred Stock 3.26 a What is-the eost (required-rate ofreturn) of retained-earnings? b What-is-the-cest-(required-rate efreturn) of new-common-steek? d What-is-the WAGC of the first-dollar-raised of the $400-million-of new eapital? For questions e-g, use the notes from class and the following videos (show your calculations): MCC and IOS (5:30) and the reading Marginal Cost of Capital Schedule e. What source of capital will run out first and what is the first breakpoint (the point of total financing where that source runs out)? f. What source will run out second and what is the second breakpoint? g. What is the WACC of the last dollar raised