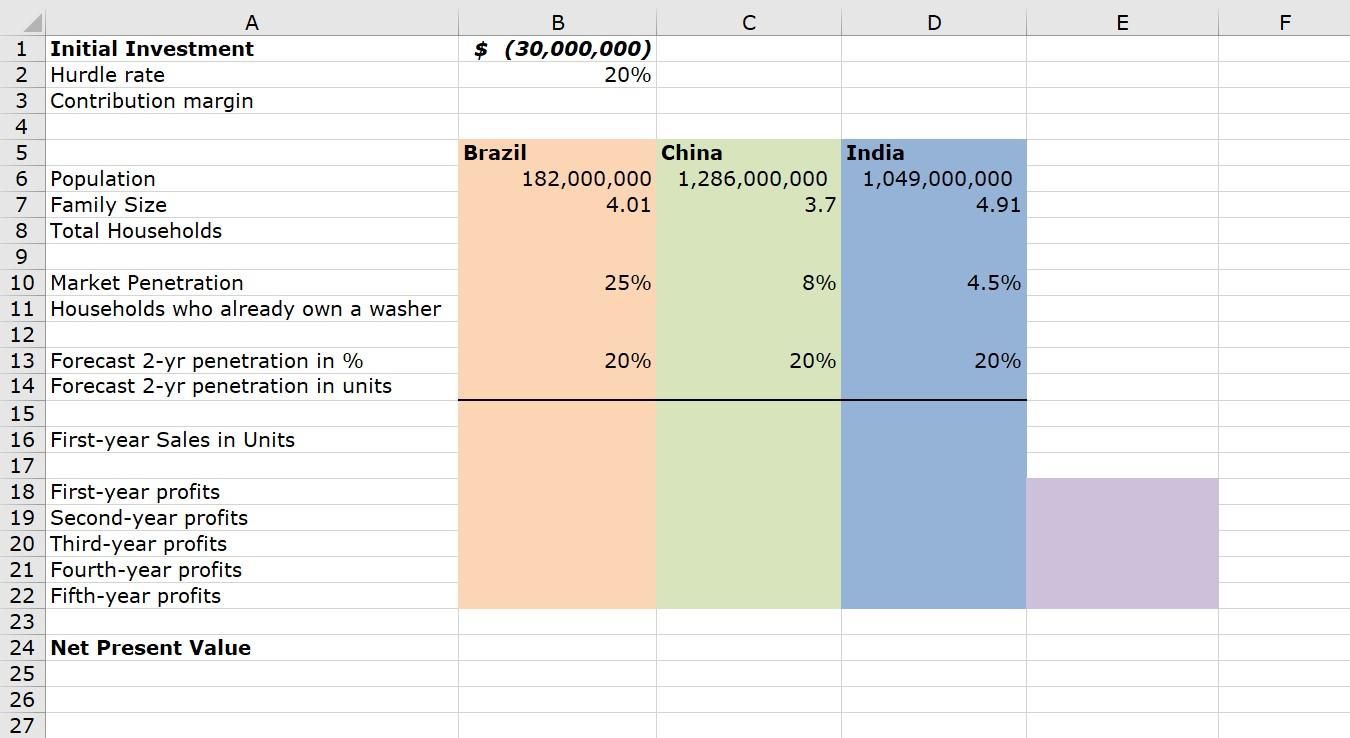

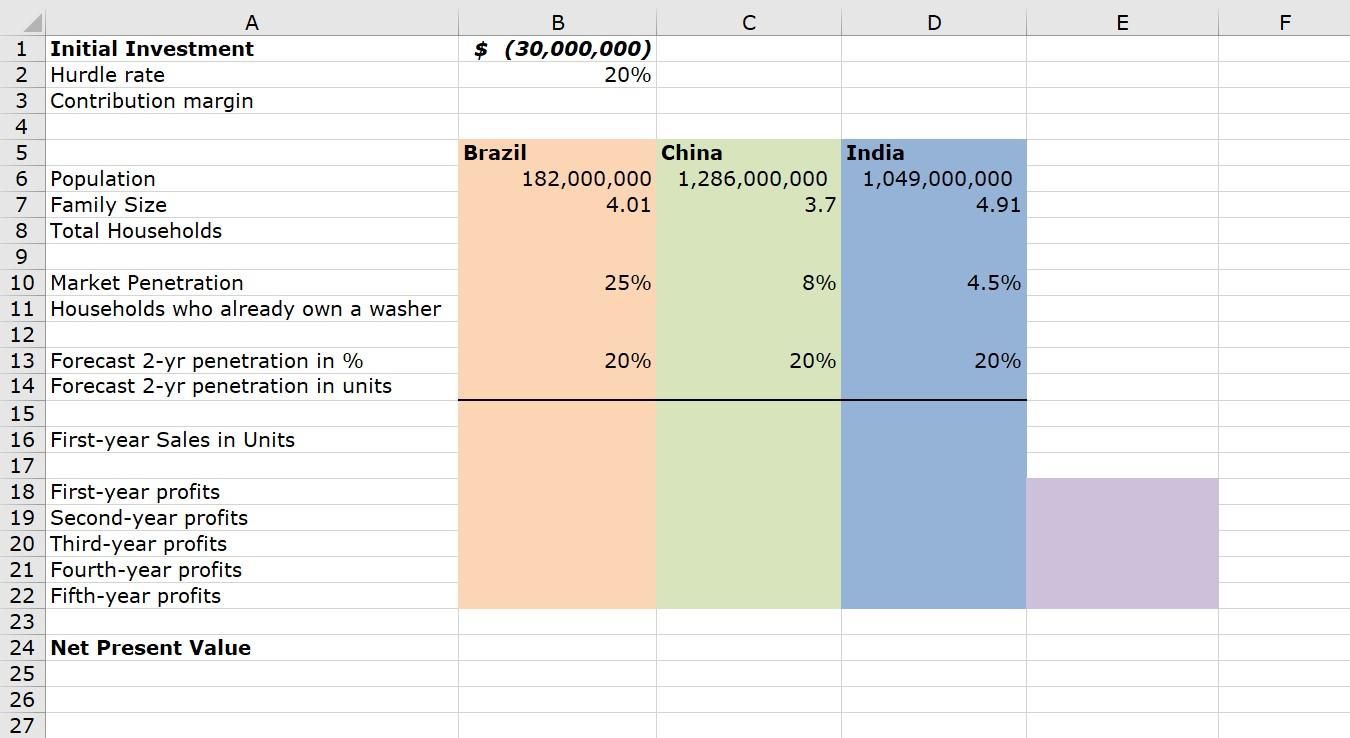

To answer this question, follow these steps: First, calculate the profit Whirlpool makes by selling one machine. This is called the profit margin or contribution. Recall that Whirlpool is a manufacturer of washing machines and sells its products through retailers. The sales price to consumers is the retail price. You need to work backward from the retail price to determine the wholesale price, i.e., the price at which Whirlpool sells to the retailers. Whirlpool's contribution margin is a percentage (given in the case) of the wholesale price. Next, calculate a sales forecast for years 1 through 5 for each country. This is the number of machines Whirlpool expects to sell in each country for each year. To do so, first calculate how many households already have an automatic washing machine in India, in China and in Brazil. This is the current market penetration. These household will not buy the Ideale because they already have an automatic washing machine but the sales forecasts for the Ideale are given as percentages of the current market penetration. You are given the sales forecast for the first two years and the information to calculate the distribution of sales between Year 1 and Year 2. The case contains all the information you need. The sales forecast must be converted into a profit forecast for year 1 through 5 using the profit margin and sales forecasts calculated previously. These are the future cashflows in dollars. Finally, you can calculate the NPV but calculating the discounted cash flows for years 1 through 5 and then subtracting the initial development cost for the Ideale product, which, we are told, is $30 million. The net present value is calculated for all three countries combined since the same product was developed for all three markets. A 1 Initial Investment 2 Hurdle rate 3 Contribution margin 4 5 6 Population 7 Family Size 8 Total Households 9 10 Market Penetration 11 Households who already own a washer 12 13 Forecast 2-yr penetration in % 14 Forecast 2-yr penetration in units 15 16 First-year Sales in Units 17 18 First-year profits 19 Second-year profits 20 Third-year profits 21 Fourth-year profits 22 Fifth-year profits 23 24 Net Present Value 25 26 27 B $ (30,000,000) 20% Brazil China India 182,000,000 1,286,000,000 1,049,000,000 4.01 3.7 4.91 25% 8% 4.5% 20% 20% 20% C D E F To answer this question, follow these steps: First, calculate the profit Whirlpool makes by selling one machine. This is called the profit margin or contribution. Recall that Whirlpool is a manufacturer of washing machines and sells its products through retailers. The sales price to consumers is the retail price. You need to work backward from the retail price to determine the wholesale price, i.e., the price at which Whirlpool sells to the retailers. Whirlpool's contribution margin is a percentage (given in the case) of the wholesale price. Next, calculate a sales forecast for years 1 through 5 for each country. This is the number of machines Whirlpool expects to sell in each country for each year. To do so, first calculate how many households already have an automatic washing machine in India, in China and in Brazil. This is the current market penetration. These household will not buy the Ideale because they already have an automatic washing machine but the sales forecasts for the Ideale are given as percentages of the current market penetration. You are given the sales forecast for the first two years and the information to calculate the distribution of sales between Year 1 and Year 2. The case contains all the information you need. The sales forecast must be converted into a profit forecast for year 1 through 5 using the profit margin and sales forecasts calculated previously. These are the future cashflows in dollars. Finally, you can calculate the NPV but calculating the discounted cash flows for years 1 through 5 and then subtracting the initial development cost for the Ideale product, which, we are told, is $30 million. The net present value is calculated for all three countries combined since the same product was developed for all three markets. A 1 Initial Investment 2 Hurdle rate 3 Contribution margin 4 5 6 Population 7 Family Size 8 Total Households 9 10 Market Penetration 11 Households who already own a washer 12 13 Forecast 2-yr penetration in % 14 Forecast 2-yr penetration in units 15 16 First-year Sales in Units 17 18 First-year profits 19 Second-year profits 20 Third-year profits 21 Fourth-year profits 22 Fifth-year profits 23 24 Net Present Value 25 26 27 B $ (30,000,000) 20% Brazil China India 182,000,000 1,286,000,000 1,049,000,000 4.01 3.7 4.91 25% 8% 4.5% 20% 20% 20% C D E F