Question

To answer this question, please read the Alpine Bags Case before. Base Threshold (%) Profit before tax 5.0. Revenues 1.0. Total assets 1.0. Equity 3.0.

To answer this question, please read the Alpine Bags Case before.

Base Threshold (%) Profit before tax 5.0. Revenues 1.0. Total assets 1.0. Equity 3.0.

Typically, profit before tax is used; however, it cannot be used if the entity is reporting a loss for the year or if profitability is not consistent. 10 Alpine Bags Ltd. An Audit Case Study When calculating PM based on interim figures, it may be necessary to annualize the results. This allows the auditor to properly plan the audit based on an approximate projected year-end balance. Then, at year end, the figure is adjusted, if necessary, to reflect the actual results.

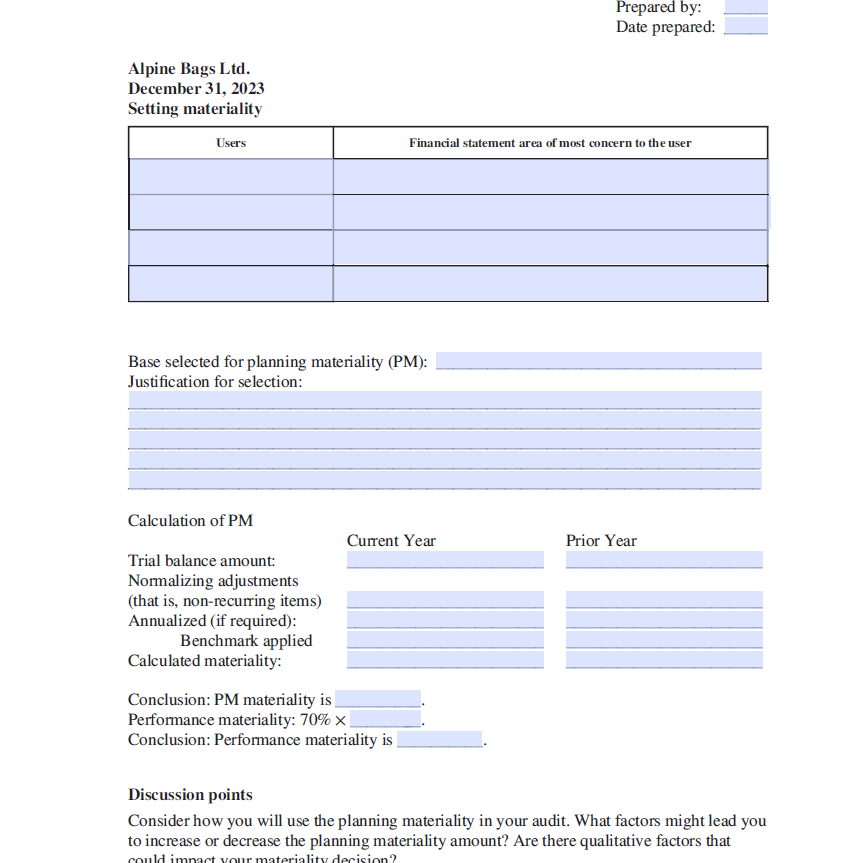

Note: Adjustments to the starting points are made by an experienced auditor using their professional judgement. The aim is to set PM at a high enough level that appropriately balances the amount of testing, while still keeping the audit risk to an acceptable level.

W&S Partners also dictates that performance materiality be determined for each audit engagement. Performance materiality is an amount less than planning materiality that reduces the likelihood that any uncorrected and undetected misstatements within a class of transactions, account balances, or disclosures in aggregate exceed overall planning materiality. W&S Partners policy is to use 70 percent of planning materiality to determine performance materiality.

Using the working paper provided (A21): Select the basis for planning materiality that you believe is most appropriate. Justify your selection. Calculate the planning materiality (PM) using the December 31, 2023, trial balance and draft Statement of Income in Appendix 2. Based on your determination of PM, calculate and conclude on performance

materiality.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started