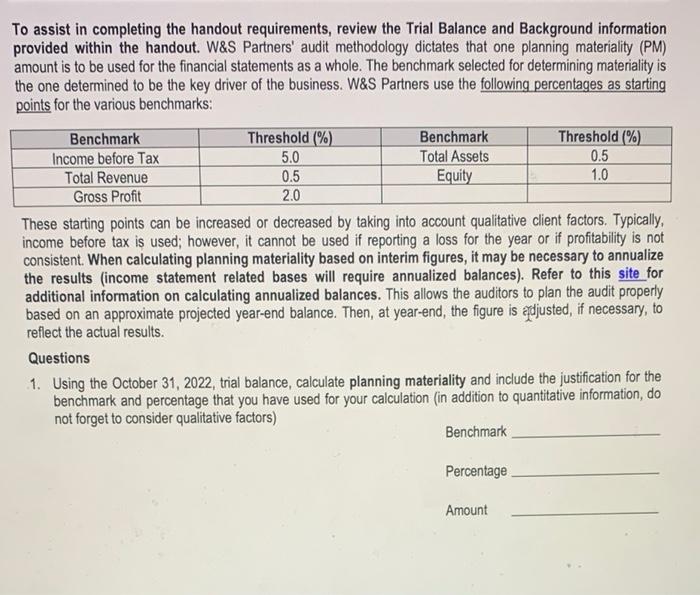

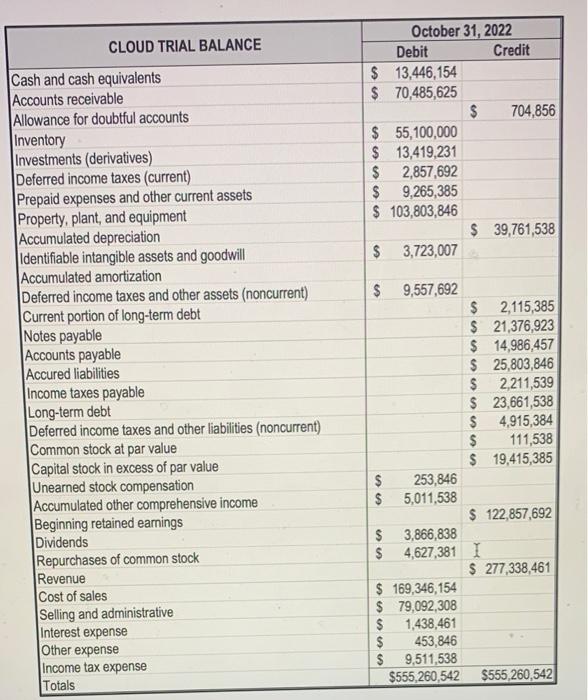

To assist in completing the handout requirements, review the Trial Balance and Background information provided within the handout. W\&S Partners' audit methodology dictates that one planning materiality (PM) amount is to be used for the financial statements as a whole. The benchmark selected for determining materiality is the one determined to be the key driver of the business. W\&S Partners use the following percentages as starting points for the various benchmarks: These starting points can be increased or decreased by taking into account qualitative client factors. Typically, income before tax is used; however, it cannot be used if reporting a loss for the year or if profitability is not consistent. When calculating planning materiality based on interim figures, it may be necessary to annualize the results (income statement related bases will require annualized balances). Refer to this site for additional information on calculating annualized balances. This allows the auditors to plan the audit properly based on an approximate projected year-end balance. Then, at year-end, the figure is redjusted, if necessary, to reflect the actual results. Questions 1. Using the October 31,2022 , trial balance, calculate planning materiality and include the justification for the benchmark and percentage that you have used for your calculation (in addition to quantitative information, do not forget to consider qualitative factors) Benchmark Percentage Amount To assist in completing the handout requirements, review the Trial Balance and Background information provided within the handout. W\&S Partners' audit methodology dictates that one planning materiality (PM) amount is to be used for the financial statements as a whole. The benchmark selected for determining materiality is the one determined to be the key driver of the business. W\&S Partners use the following percentages as starting points for the various benchmarks: These starting points can be increased or decreased by taking into account qualitative client factors. Typically, income before tax is used; however, it cannot be used if reporting a loss for the year or if profitability is not consistent. When calculating planning materiality based on interim figures, it may be necessary to annualize the results (income statement related bases will require annualized balances). Refer to this site for additional information on calculating annualized balances. This allows the auditors to plan the audit properly based on an approximate projected year-end balance. Then, at year-end, the figure is redjusted, if necessary, to reflect the actual results. Questions 1. Using the October 31,2022 , trial balance, calculate planning materiality and include the justification for the benchmark and percentage that you have used for your calculation (in addition to quantitative information, do not forget to consider qualitative factors) Benchmark Percentage Amount