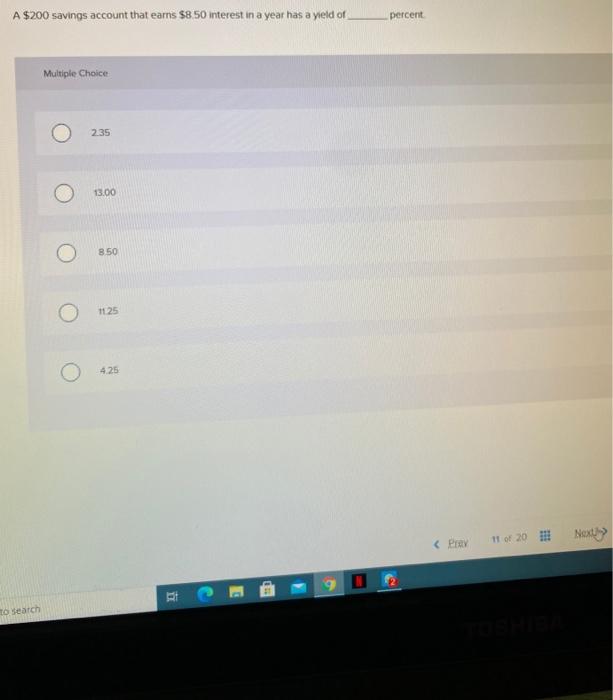

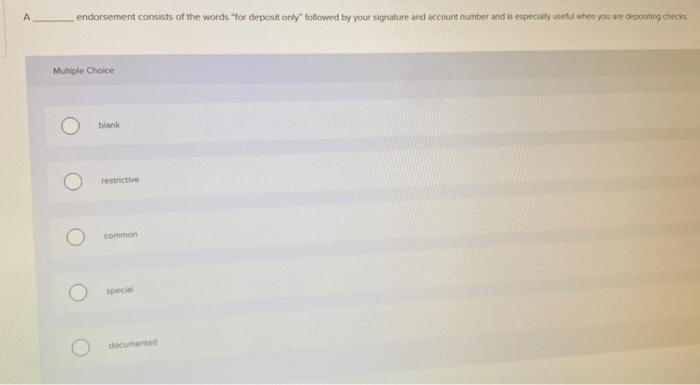

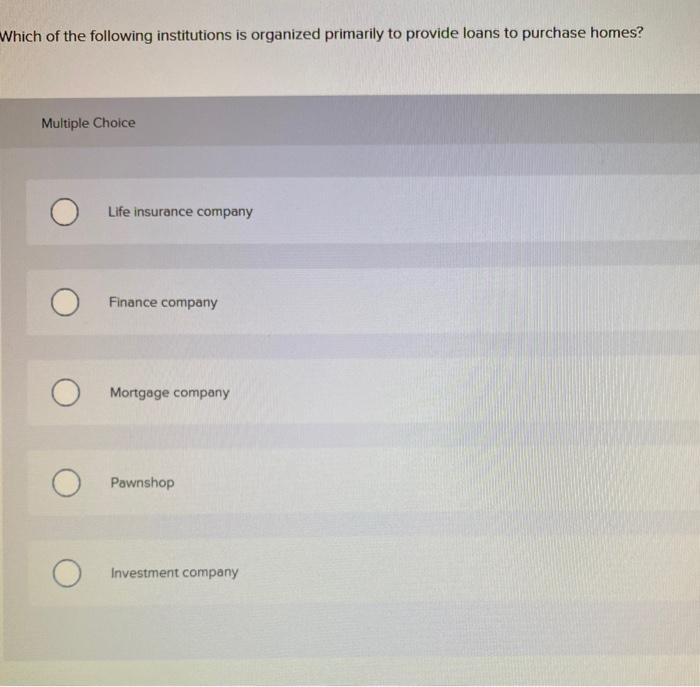

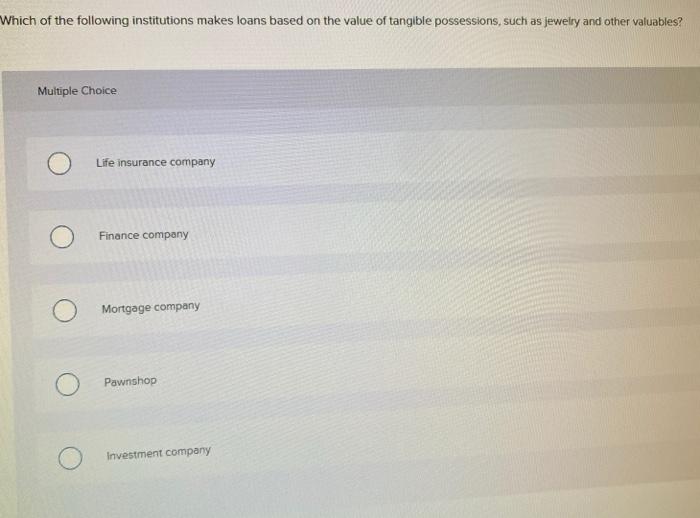

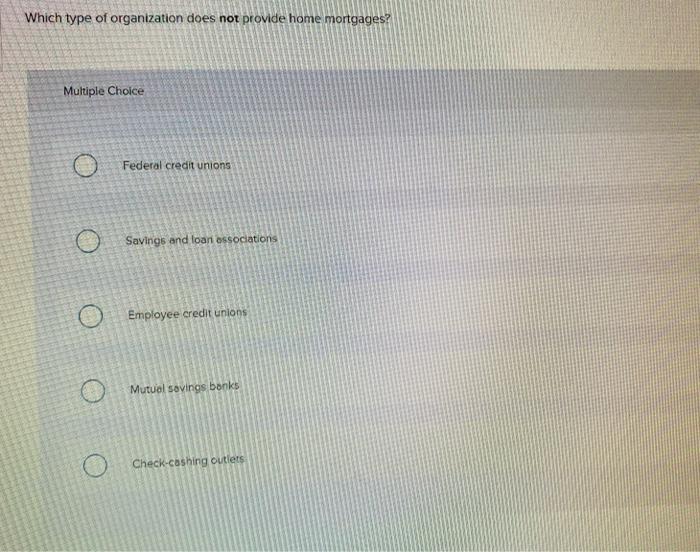

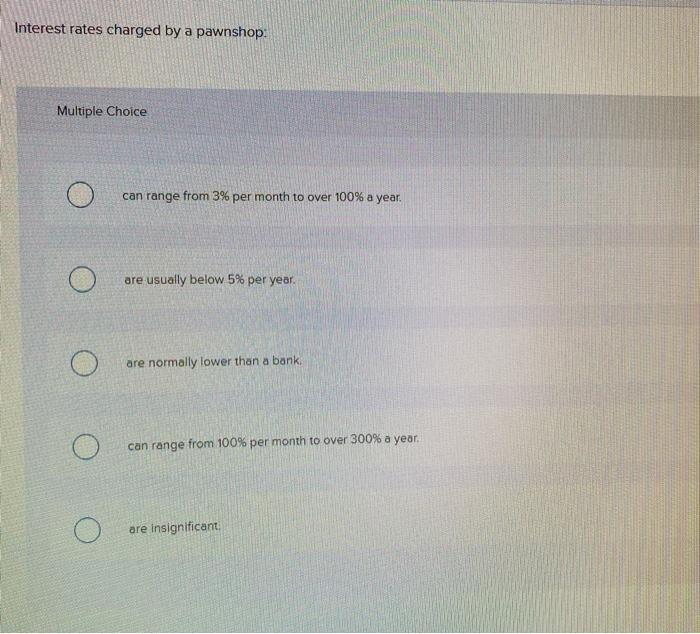

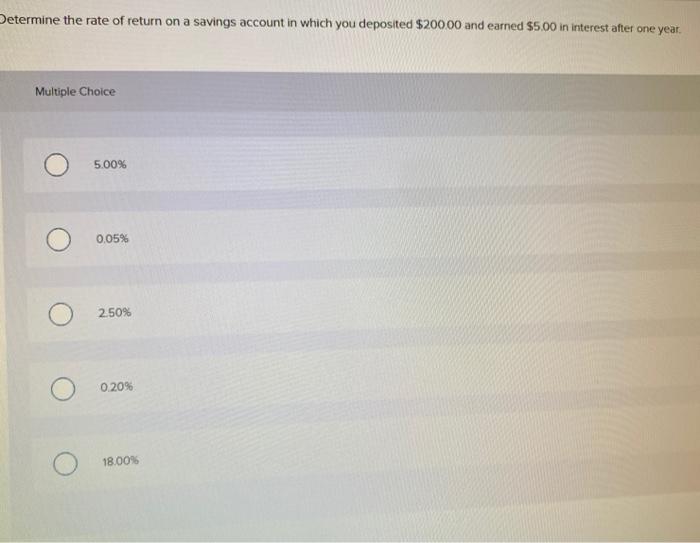

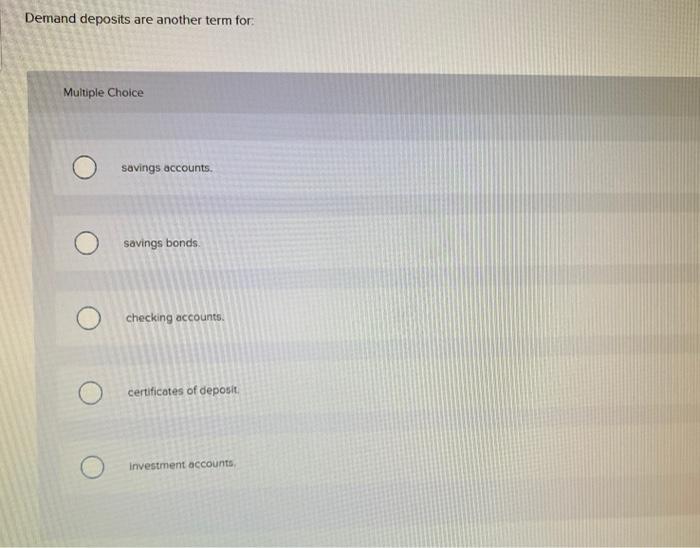

To avoid high fees for cash loans, a person should avoid borrowing from a Multiple Choice credit union savings and loan asociation pownshop commercial bank musavio be In recent years, membership in credit unions has: Multiple Choice become more difficult due to higher taxes. become more flexible been limited to government employees declined due to poor credit union management stayed at about the same level The business hours and ATM locations of a financial institution refer to the feature when selecting a financial institution Multiple Choice safety cout compounding liquidity convenience A saver will usually receive higher earnings with which one of the following types of savings plans? Multiple Choice Certificate of deposit Debit account Regular savings account Share account Credit account A $200 savings account that earns $8.50 interest in a year has a yield of percent Multiple Choice 235 13.00 850 1125 4.25 Prev 1 of 20 # i E to search A endorsement consists of the words "for deposit only followed by your signature and account number and is especially useful when you are deporting checks Multiple Choice blank o restrictive common documented Wich of the following te autrednorocooperative function e como owne Which of the following institutions is organized primarily to provide loans to purchase homes? Multiple Choice Life insurance company Finance company O Mortgage company O Pawnshop Investment company Which of the following institutions makes loans based on the value of tangible possessions, such as jewelry and other valuables? Multiple Choice Life insurance company Finance company Mortgage company Pawnshop Investment company Which type of organization does not provide home mortgages? Multiple Choice Federal credit unions Savings and loan associations Employee credit unions Mutual savings banks Check-cashing outlets Interest rates charged by a pawnshop: Multiple Choice can range from 3% per month to over 100% a year. are usually below 5% per year. are normally lower than a bank can range from 100% per month to over 300% a year. are insignificant Determine the rate of return on a savings account in which you deposited $200.00 and earned $5.00 in interest after one year. Multiple Choice 5.00% 0.05% 250% 0 20% 18.00% Demand deposits are another term for Multiple Choice savings accounts. savings bonds checking accounts certificates of deposit Investment accounts Which one of the following is true for an interest-earning account? Multiple Choice It usually requires a minimum balance. It is an account that charges a fee for each check written It does not earn interest It does not require a minimum balance. None of these are true