Answered step by step

Verified Expert Solution

Question

1 Approved Answer

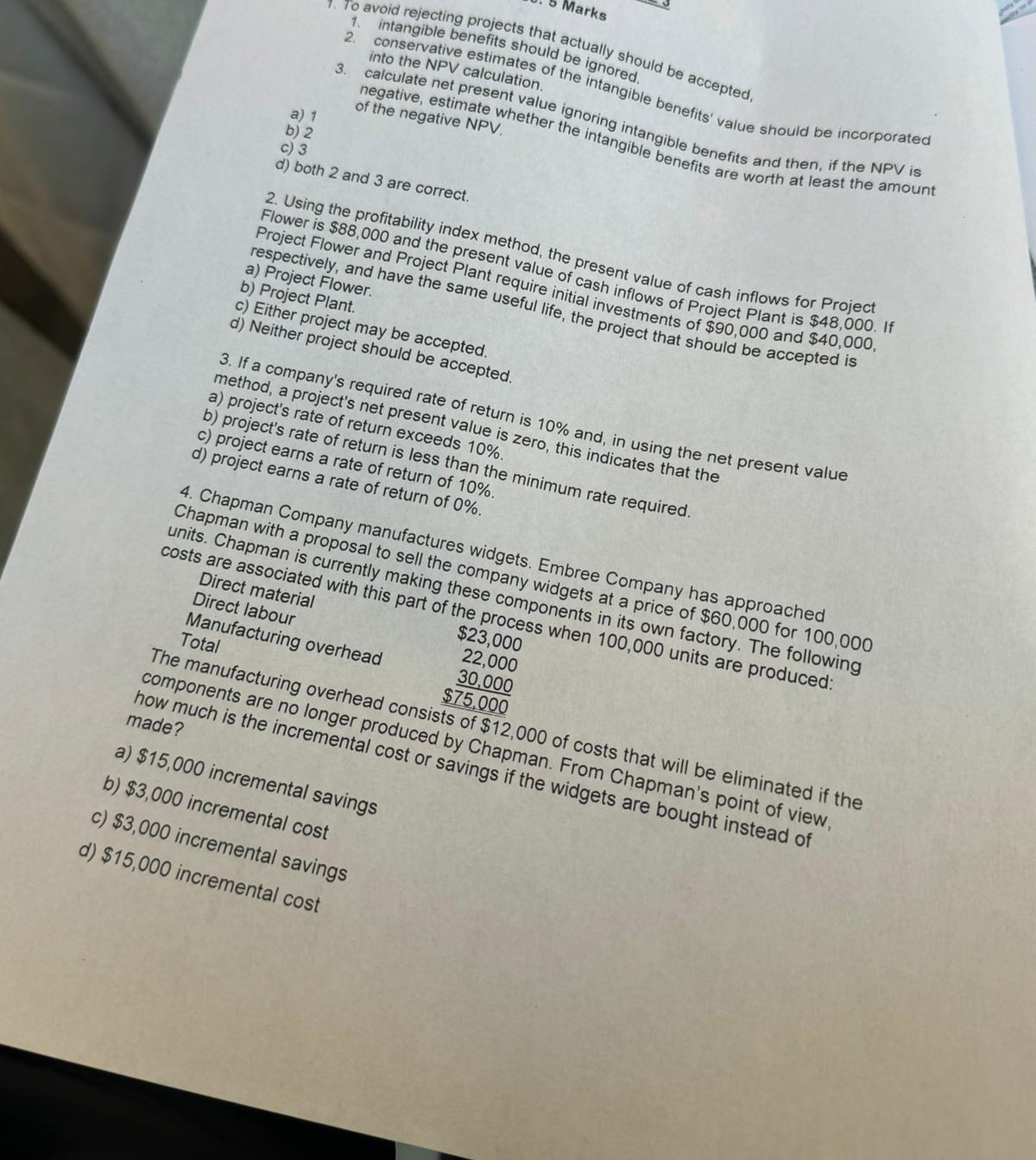

To avoid rejecting projects that actually should be accepted, 1 . intangible benefits should be ignored. 2 . conservative estimates of the ignored. 3 .

To avoid rejecting projects that actually should be accepted, intangible benefits should be ignored.

conservative estimates of the ignored.

into the NPV calculation.

a

b negative, estimate whether the intangible bele benefits and then, if the NPV is of the negative NPV

c

d both and are correct.

Using the profitability index method, the present value of cash inflows for Project Flower is $ and the present value of cash inflows of Project Plant is $ If respectively, and Project Plant require initial investments of $ and $ a Project Flower.

b Project Plant

c Either project may be accepted

d Neither project should be accepted.

If a company's required rate of return is and, in using the net present value a prod, a project's net present value is zero, this indicates that the

a project's rate of return exceeds

c project's rate of return is less than the rearns a rate of return of

d project earns a rate of return of

Chapman with a proposal to units. Chapman is currently to sell the company widgets at a price of $ for costs are associated with this making these components in its own factory. The following

Direct labour Manufacturing overn

tableTotalmanufacturing overhead consist $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started