Question

To begin with, lets disregard the COVID-19 pandemic and its aftermath on the global economy. Prior to the pandemic, the majority of global economic disruptions

To begin with, let’s disregard the COVID-19 pandemic and its aftermath on the global economy. Prior to the pandemic, the majority of global economic disruptions over the past decades have been caused by fluctuations in the global oil market. Why are these disruptions significant events in the economic history, what causes them, and how does the market respond to them? These questions have their roots in the simple concept of elasticity.

The members of the OPEC abruptly increased the oil price in the early 1970s, primarily to boost their own incomes. Since OPEC is an oligopoly that behaves like a monopoly (when making important decisions), the only way they could increase prices was by indirectly regulating the supply of oil. So even after adjusting for inflation, the oil price increased by as much as 50% from 1973 to 1974. Then, a few years later, OPEC repeated the same process, causing the oil prices to double between 1979 and 1980.

Later on, however, OPEC found it difficult to maintain the same level of price increases. From 1982 to 1985, the price of oil steadily declined at a rate of 10% per year. There was a lack of cooperation and dissatisfaction among the OPEC members. By 1986, the price of oil had dropped down by nearly 45%; and by 1990, the price of oil (adjusted for inflation) had recovered to where it had begun in 1970. It also remained low for much of the 1990s. In the early 2000s, it rose again, which was driven mostly by a large and rapidly growing Chinese economy, but it never increased to that extent again.

Figure 1. Fluctuations in the crude oil prices over the decades.

Figure 2. Short and Long run demand and supply of oil.

What is the key observation from the preceding events? The key observation is that supply and demand behave differently in the short and long run. Why do they behave differently? It behaves in a particular manner because the elasticities of demand and supply are different in the short run and long run. Let’s examine this more clearly. Both supply and demand for oil are inelastic, or relatively inelastic, in the short run. The supply is inelastic because neither new areas can be discovered to extract oil nor new technologies can be developed to extract oil efficiently in the short run. The demand is inelastic because the purchasing habits do not react as quickly as the price fluctuations (considering the limited alternatives for oil supply back then). Therefore, the demand and supply curves for oil in the short run are steeper. As a result, when the supply curve shifts, the impact on oil prices becomes greater.

In contrast, the supply and demand become more elastic in the long run which can be due to many reasons. In the long run, the supply is fairly more elastic because the suppliers have discovered more efficient ways to extract oil, thus increasing supply and lowering costs. There may also be a scenario in which more than one economy or company are now taking advantage of the newly discovered oil reserves in their regions. The demand is more elastic in the long run maybe because people have eventually developed new ideas and substitutes for oil. Alternatively, they may have realised that rather than driving their own vehicles, they have other cheaper options available that can transport them from one place to the other. In either case, any shift in the supply curve will have little effect on price, like the ones observed in the first part of this case study.

Thus for the short term, the OPEC’s decision to reduce supply resulted in a significant increase in prices and hence higher incomes for the OPEC members. While for the long term, the same decision by the OPEC to reduce supply did not result in higher incomes for them, as the impact on price was insignificant.

OPEC is still active today, and it has influenced the global oil prices by reducing the oil supply from time to time. However, as you can see, the prices never returned to those of the 1970s. It is all due to the long-term elasticities of oil demand and supply.

Questions

Q1. We saw in the case study that the Organisation of Petroleum Exporting Countries (OPEC) raised the price of crude oil in 1973 for the global market. We also noticed that because the supply and demand for crude oil was inelastic in the short run, the impact on the global market in terms of price and the output supplied was greater. Based on this context, please give a brief explanation for the following questions:

1a. What impact would OPEC’s reduction in the supply of crude oil have on the price of oil in the global market and the subsequent quantity of crude oil demand in the short run? Please explain the shifts in demand and supply curves with help of a relevant graph.

1b. Consider the possibility of a war in the Middle East in the coming months. In this scenario, the labour market is facing constraints as a large number of migrant workers in the Middle East are returning back to their home countries. To prevent reverse migration, the government has decided to increase the wages for the migrants workers. Considering this phenomenon, explain the effect of the speculated war on labour demand and supply, as well as the price of labour in the OPEC with help of a graph.

Q2. Answer the following questions:

2a. While OPEC was successful in raising the price of crude oil in the 1970s, it was unable to do so in the 1980s. Mention any two factors that prevented OPEC from sustaining this high price in the 1980s. Provide a well-researched answer, you may use the internet to strengthen your reasons.

2b. Why is the supply elasticity usually greater than 1, in the short run or the long run? Please provide two examples of goods (other than oil) or services that have a greater supply elasticity in the long run.

Q3. What type of market structure does OPEC operate in? Let’s assume that OPEC has added 23 new nations to its list of oil producers and exporters, what type of market will OPEC operate in now? Support your answer with a brief explanation.

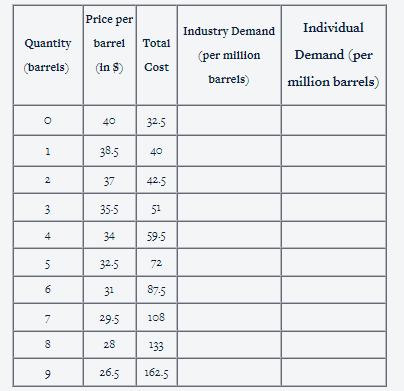

Q4. Alabama Oil Ltd. is a company that extracts and exports crude oil. Let’s consider that it incurs costs on machineries, rents, salaries, and transportation, and that the total cost accounts for both variable and fixed costs. The industry demands are 4 million barrels of oil until the price falls below or equals $32 per barrel. Following that, the industry’s demand drops down by 15%. The individual demands are 2.5 million barrels until the price falls below or equals $34 per barrel. Thereafter, the individual demand drops down by 20%.

4a. Considering Alabama Oil Ltd. operates with the sole motive of profit maximisation, at what level of production output does Alabama Oil Ltd. maximise their profit? What is the overall level of sales revenue at profit maximisation output? (Write the final answer based on the calculations)

4b. Plot the cost schedule (table) into a well-labelled graph. Identify the point of profit maximisation.

4c. At what profit level does the industry demands rise? At what profit level does the individual demands rise?

Q5. Two major factors can cause a rise in crude oil prices in the global market. These include a rise in global demand, especially from China; as well as cost shocks, such as the Iraq war or Hurricane Katrina (in 2005). Inflation rates in countries are generally raised by such price increases. Answer the following questions.

5a. What type of inflation would be triggered by an increase in oil prices, and give a brief description about the factors that would trigger such inflation? Provide two past real-life examples when such an inflation was witnessed.

5b. Explain the aggregate demand–aggregate supply (AD–AS) model in the context of the events mentioned in the case study. Describe and include the type of unemployment caused in any economy that is heavily dependent on oil import in your response.

Q6. Answer the following questions:

6a. A large increase in inflation causes a drop in the overall output of any economy, which is referred to as a ‘short-term recessionary phase’. It is not a desired phenomenon by any government in the world. Describe two resources that the Reserve Bank of India (RBI) can adopt to help the country recover from such a short run recession phase in the country.

6b. Take a look at this excerpt from the news, “India is one of the largest importers of oil in the world. It imports nearly 80% of its total oil requirements. This accounts for one-third of the country’s overall imports. As a result, the price of oil has a major impact on India, according to a report by Livemint.” Consider the scenario of low oil prices. What are the effects of falling oil prices on fiscal balance? Mention two fiscal tools adopted by the government in such a scenario.

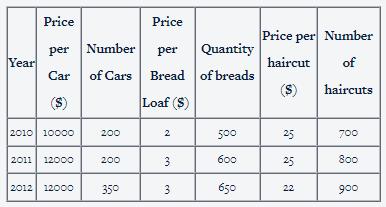

6c. Consider the following data from the country Baliga:

Considering 2010 as the base year calculate the nominal and real GDP for 2011 and 2012. For each year.

Q7. The pound sterling depreciated after the Brexit referendum in June 2016, resulting in significant impacts on trade flows between the United Kingdom and the European Union. The currency depreciation lowers the purchasing power and has an impact on imports and exports. Mention two advantages and two disadvantages of the depreciated pound on the British economy.

Price per Quantity barrel (barrels) (in $) O 1 N 3 + 5 60 7 8 9 40 38.5 37 35-5 34 32.5 31 29-5 28 26.5 Total Cost 32.5 40 42.5 51 59-5 72 87.5 108 133 162.5 Industry Demand (per million barrels) Individual Demand (per million barrels)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q1a OPECs reduction in the supply of crude oil will lead to a decrease in the quantity of crude oil supplied in the global market This will cause the price of oil to increase The demand curve for oil ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started