Answered step by step

Verified Expert Solution

Question

1 Approved Answer

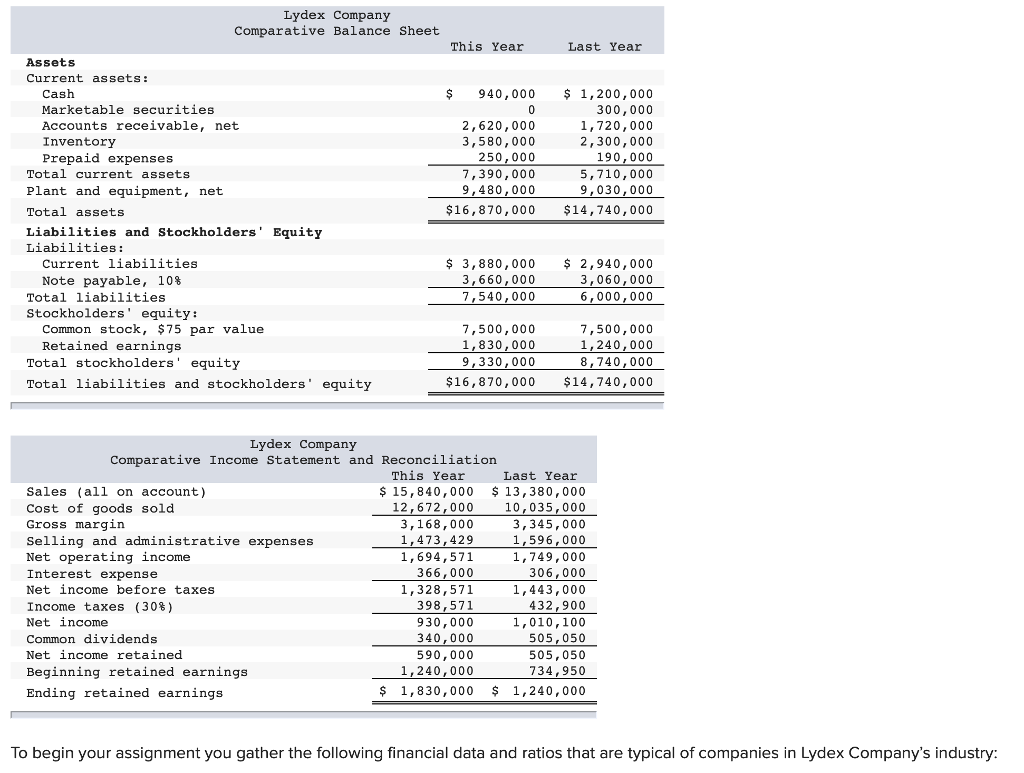

To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Companys industry: Current ratio 2.4 Acid-test

To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Companys industry:

| Current ratio | 2.4 | |

| Acid-test ratio | 1.2 | |

| Average collection period | 40 | days |

| Average sale period | 60 | days |

| Return on assets | 9.1 | % |

| Debt-to-equity ratio | 0.69 | |

| Times interest earned ratio | 5.7 | |

| Price-earnings ratio | 10 | |

Required:

1. Present the balance sheet in common-size format.

2. Present the income statement in common-size format down through net income.

| Lydex Company | ||||

| Common-Size Balance Sheets | ||||

| This Year | Last Year | |||

| Assets | ||||

| Current assets: | ||||

| Cash | % | % | ||

| Marketable securities | ||||

| Accounts receivable, net | ||||

| Inventory | ||||

| Prepaid expenses | ||||

| Total current assets | 0.0 | 0.0 | ||

| Plant and equipment, net | ||||

| Total assets | 0.0 | % | 0.0 | % |

| Liabilities and Stockholders' Equity | ||||

| Liabilities: | ||||

| Current liabilities | % | % | ||

| Note payable, 10% | ||||

| Total liabilities | 0.0 | 0.0 | ||

| Stockholders equity: | ||||

| Common stock, $75 par value | ||||

| Retained earnings | ||||

| Total stockholders equity | 0.0 | 0.0 | ||

| Total liabilities and equity | 0.0 | % | 0.0 | % |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started