Question

To build a sustainable competitive advantage, Carvana must strengthen internal controls and operational efficiency while continuing to invest in technology and enhance the customer journey.

To build a sustainable competitive advantage, Carvana must strengthen internal controls and operational efficiency while continuing to invest in technology and enhance the customer journey. The following strategy aims to achieve this balance over the next 4 years through targeted initiatives and close management oversight:

Initiative 1 (Y1-Y2): Implement a revised accounting and title transfer process with audits and controls at key checkpoints. Estimated cost savings of $5M.

Initiative 2 (Y2-Y3): Launch a Operational Excellence program including Lean Six Sigma projects, process mapping, and employee empowerment. Aim for 10-15% improvement in key metrics (vehicle reconditioning time, delivery logistics, etc.). Estimated cost savings of $25-30M

Initiative 3 (Y3-Y4): Continue investing 10-15% of revenues in new technologies like AI pricing optimization, AR for remote walkarounds, and automated inspections. Revenue growth of 25-30% Please create an accurate and factual cash flow sheet that represents this data in relation to Carvana's current financials.

Please create an accurate and factual cash flow sheet that represents these strategies plugged into Carvana's current financials from ttm-2024

.

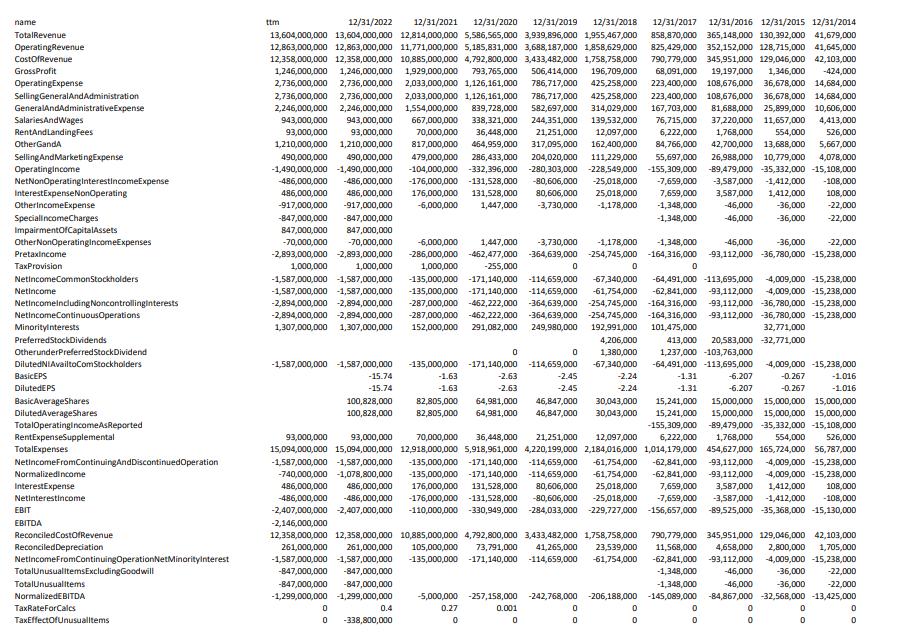

name TotalRevenue OperatingRevenue CostOfRevenue GrossProfit OperatingExpense Selling GeneralAndAdministration GeneralAndAdministrativeExpense SalariesAndWages RentAnd LandingFees OtherGandA Selling And MarketingExpense OperatingIncome NetNonOperating InterestincomeExpense InterestExpenseNonOperating OtherIncomeExpense Special incomeCharges ImpairmentOfCapitalAssets Other NonOperatingIncomeExpenses Pretaxincome TaxProvision NetIncomeCommonStockholders NetIncome NetIncomeIncluding Noncontrollinginterests NetIncomeContinuousOperations MinorityInterests PreferredStockDividends OtherunderPreferredStock Dividend DilutedNIAvailtoComStockholders BasicEPS DilutedEPS BasicAverageShares DilutedAverageShares TotalOperatingIncomeAsReported RentExpenseSupplemental TotalExpenses NetIncomeFromContinuingAndDiscontinued Operation Normalizedincome InterestExpense Netinterestincome EBIT EBITDA ReconciledCostOfRevenue ReconciledDepreciation NetIncomeFromContinuing OperationNetMinorityInterest TotalUnusualitemsExcludingGoodwill TotalUnusualitems NormalizedEBITDA TaxRateForCalcs TaxEffectOfUnusualltems 12/31/2017 12/31/2016 12/31/2015 12/31/2014 858,870,000 365,148,000 130,392,000 41,679,000 825,429,000 352,152,000 128,715,000 41,645,000 790,779,000 345,951,000 129,046,000 42,103,000 68,091,000 19,197,000 1,346,000 -424,000 12/31/2022 12/31/2021 12/31/2020 12/31/2019 12/31/2018 13,604,000,000 13,604,000,000 12,814,000,000 5,586,565,000 3,939,896,000 1,955,467,000 12,863,000,000 12,863,000,000 11,771,000,000 5,185,831,000 3,688,187,000 1,858,629,000 12,358,000,000 12,358,000,000 10,885,000,000 4,792,800,000 3,433,482,000 1,758,758,000 1,246,000,000 1,246,000,000 1,929,000,000 793,765,000 506,414,000 196,709,000 2,736,000,000 2,736,000,000 2,033,000,000 1,126,161,000 786,717,000 425,258,000 223,400,000 108,676,000 36,678,000 14,684,000 2,736,000,000 2,736,000,000 2,033,000,000 1,126,161,000 786,717,000 425,258,000 223,400,000 108,676,000 36,678,000 14,684,000 2,246,000,000 2,246,000,000 1,554,000,000 839,728,000 582,697,000 314,029,000 167,703,000 81,688,000 25,899,000 10,606,000 943,000,000 943,000,000 667,000,000 338,321,000 244,351,000 139,532,000 76,715,000 37,220,000 11,657,000 4,413,000 93,000,000 93,000,000 70,000,000 36,448,000 21,251,000 12,097,000 6,222,000 1,768,000 554,000 526,000 1,210,000,000 1,210,000,000 817,000,000 464,959,000 317,095,000 162,400,000 84,766,000 42,700,000 13,688,000 5,667,000 490,000,000 490,000,000 479,000,000 286,433,000 204,020,000 111,229,000 55,697,000 26,988,000 10,779,000 4,078,000 -1,490,000,000 -1,490,000,000 -104,000,000 -332,396,000 -280,303,000 -228,549,000 -155,309,000 -89,479,000 -35,332,000 -15,108,000 -486,000,000 -486,000,000 -176,000,000 -131,528,000 -80,606,000 -25,018,000 -7,659,000 -3,587,000 -1,412,000 -108,000 486,000,000 486,000,000 176,000,000 131,528,000 80,606,000 25,018,000 7,659,000 3,587,000 1,412,000 108,000 -917,000,000 -917,000,000 -6,000,000 1,447,000 -3,730,000 -1,178,000 -1,348,000 -46,000 -36,000 -22,000 -847,000,000 -847,000,000 -1,348,000 -46,000 -36,000 -22,000 847,000,000 847,000,000 -70,000,000 -70,000,000 -6,000,000 1,447,000 -3,730,000 -1,178,000 -1,348,000 -46,000 -36,000 -22,000 -2,893,000,000 -2,893,000,000 -286,000,000 -462,477,000 -364,639,000 -254,745,000 -164,316,000 -93,112,000 -36,780,000 -15,238,000 1,000,000 1,000,000 1,000,000 -255,000 -1,587,000,000 -1,587,000,000 -135,000,000 -171,140,000 -114,659,000 -67,340,000 -64,491,000 -113,695,000 -4,009,000 -15,238,000 -1,587,000,000 -1,587,000,000 -135,000,000 -171,140,000 -114,659,000 -61,754,000 -62,841,000 -93,112,000 -4,009,000 -15,238,000 -2,894,000,000 -2,894,000,000 -287,000,000 -462,222,000 -364,639,000 -254,745,000 -164,316,000 -93,112,000 -36,780,000 -15,238,000 -2,894,000,000 -2,894,000,000 -287,000,000 -462,222,000 -364,639,000 -254,745,000 -164,316,000 -93,112,000 -36,780,000 -15,238,000 1,307,000,000 1,307,000,000 152,000,000 291,082,000 249,980,000 192,991,000 101,475,000 32,771,000 413,000 20,583,000 -32,771,000 1,237,000 -103,763,000 -64,491,000 -113,695,000 -1.31 -6.207 -1.016 -6.207 -0.267 -1.016 15,241,000 15,000,000 15,000,000 15,000,000 15,241,000 15,000,000 15,000,000 15,000,000 -155,309,000 -89,479,000 -35,332,000 -15,108,000 6,222,000 1,768,000 554,000 526,000 15,094,000,000 15,094,000,000 12,918,000,000 5,918,961,000 4,220,199,000 2,184,016,000 1,014,179,000 454,627,000 165,724,000 56,787,000 -1,587,000,000 -1,587,000,000 -135,000,000 -171,140,000 -114,659,000 -61,754,000 -62,841,000 -93,112,000 -4,009,000 -15,238,000 -740,000,000 -1,078,800,000 -135,000,000 -171,140,000 -114,659,000 -61,754,000 -62,841,000 -93,112,000 -4,009,000 -15,238,000 486,000,000 486,000,000 176,000,000 131,528,000 80,606,000 25,018,000 7,659,000 3,587,000 1,412,000 108,000 -486,000,000 -486,000,000 -176,000,000 -131,528,000 -80,606,000 -25,018,000 -7,659,000 -3,587,000 -1,412,000 -108,000 -2,407,000,000 -2,407,000,000 -110,000,000 -330,949,000 -284,033,000 -229,727,000 -156,657,000 -89,525,000 -35,368,000 -15,130,000 -2,146,000,000 4,206,000 1,380,000 -67,340,000 -2.24 -2.24 -4,009,000 -15,238,000 -0.267 -1.31 93,000,000 93,000,000 70,000,000 36,448,000 1,251,000 12,097,000 12,358,000,000 12,358,000,000 10,885,000,000 4,792,800,000 3,433,482,000 1,758,758,000 790,779,000 345,951,000 129,046,000 42,103,000 261,000,000 261,000,000 105,000,000 73,791,000 41,265,000 23,539,000 11,568,000 4,658,000 2,800,000 1,705,000 -1,587,000,000 -1,587,000,000 -135,000,000 -171,140,000 -114,659,000 -61,754,000 -62,841,000 -93,112,000 -4,009,000 -15,238,000 -1,348,000 -46,000 -36,000 -22,000 -1,348,000 -46,000 -847,000,000 -847,000,000 -36,000 -22,000 -847,000,000 -847,000,000 -1,299,000,000 -1,299,000,000 -5,000,000 -257,158,000 -242,768,000 -206,188,000 -145,089,000 -84,867,000 -32,568,000 -13,425,000 0.27 0 ttm -1,587,000,000 -1,587,000,000 -15.74 -15.74 100,828,000 100,828,000 0 0 0.4 -338,800,000 0 0 0.001 0 0 -135,000,000 -171,140,000 -114,659,000 -1.63 -2.63 -2.45 -1.63 -2.63 -2.45 82,805,000 64,981,000 46,847,000 30,043,000 82,805,000 64,981,000 46,847,000 30,043,000 0 0 0 0 0 0 0 0 0 0 0 0 0

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started