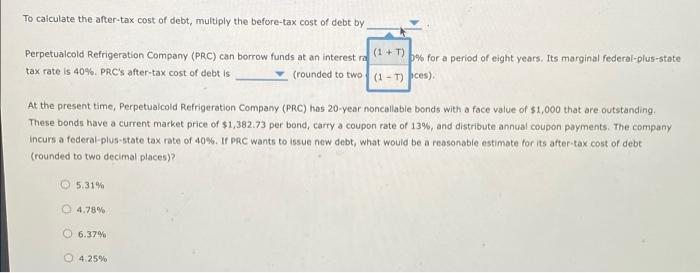

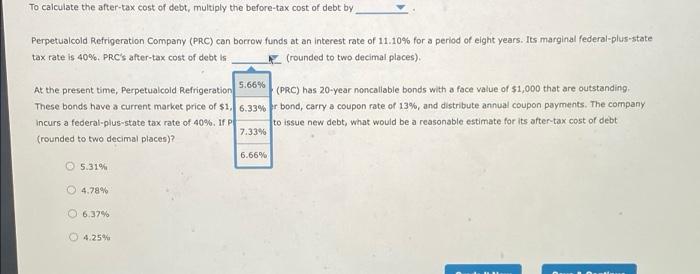

To calculate the after-tax cost of debt, multiply the before-tax cost of debt by Perpetualcold Refrigeration Company (PRC) can borrow funds at an interest rate of 11.10% for a period of eight years. Its marginal federal-plus-state tax rate is 40%. PRC's after-tax cost of debt is (rounded to two decimal places) At the present time, Perpetualcold Refrigeration Company (PRC) has 20-year noncallable bonds with a face value of $1,000 that are outstanding These bonds have a current market price of $1,382.73 per bond, carry a coupon rate of 13%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 40%. IF PRC wants to Issue new debt, what would be a reasonable estimate for its after tax cost of debt (rounded to two decimal places)? 5.31% 4.78% 6.37% 4.25% To calculate the after-tax cost of debt, multiply the before-tax cost of debt by Perpetualcold Refrigeration Company (PRC) can borrow funds at an interest ra (1 T) b% for a period of eight years. Its marginal federal-plus-state tax rate is 40%. PRC's after-tax cost of debt is (rounded to two (1 - 1) ces). At the present time, Perpetualcold Refrigeration Company (PRC) has 20-year noncollable bonds with a face value of $1,000 that are outstanding These bonds have a current market price of $1,382.73 per bond, carry a coupon rate of 13%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 40%. IF PRC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? 5.31% 4.78% 6.37% 4.25% To calculate the after-tax cost of debt, multiply the before-tax cost of debt by Perpetualcold Refrigeration Company (PRC) can borrow funds at an interest rate of 11.10% for a period of eight years. Its marginal federal-plus-state tax rate is 40%. PRC's after-tax cost of debt is (rounded to two decimal places) At the present time, Perpetualcold Refrigeration 5.66% (PRC) has 20-year noncallable bonds with a face value of $1,000 that are outstanding These bonds have a current market price of $1,6.33% Ir bond, carry a coupon rate of 13%, and distribute annual coupon payments. The company Incurs a federal-plus-state tax rate of 40%. IfP to issue new debt, what would be a reasonable estimate for its after tax cost of debt 7.33% (rounded to two decimal places)? 6.66% 5.31% 4.78% 6.37% 4.25%