Answered step by step

Verified Expert Solution

Question

1 Approved Answer

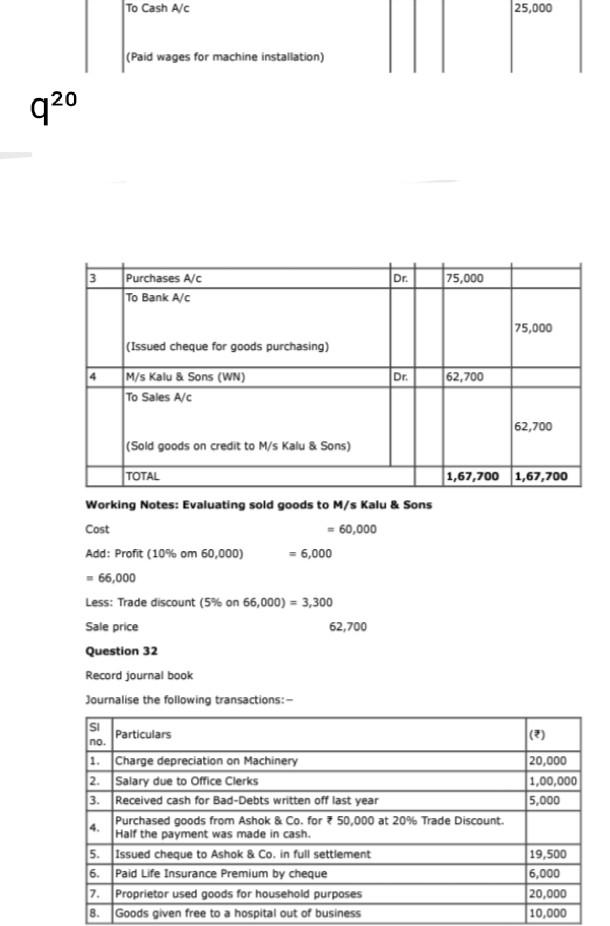

To Cash A/C 25,000 (Paid wages for machine installation) 920 13 Dr. 75,000 Purchases A/C To Bank A/C 75,000 (Issued cheque for goods purchasing) M/s

To Cash A/C 25,000 (Paid wages for machine installation) 920 13 Dr. 75,000 Purchases A/C To Bank A/C 75,000 (Issued cheque for goods purchasing) M/s Kalu & Sons (WN) To Sales Alc Dr. 62,700 62,700 (Sold goods on credit to M/s Kalu & Sons) TOTAL 1,67,700 1,67,700 Working Notes: Evaluating sold goods to M/s Kalu & Sons Cost = 60,000 Add: Profit (10% om 60,000) - 6,000 - 66,000 Less: Trade discount (5% on 66,000) = 3,300 Sale price 62,700 Question 32 Record journal book Journalise the following transactions:- SI Particulars no. (2) 1. Charge depreciation on Machinery 20,000 2. Salary due to Office Clerks 1,00,000 3. Received cash for Bad-Debts written off last year 5,000 Purchased goods from Ashok & Co. for 750,000 at 20% Trade Discount. Half the payment was made in cash. 5. Issued cheque to Ashok & Co. in full settlement 19,500 6. Paid Life Insurance Premium by cheque 6,000 7. Proprietor used goods for household purposes 20,000 8. Goods given free to a hospital out of business 10,000 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started