Answered step by step

Verified Expert Solution

Question

1 Approved Answer

to clarify- part a of the question is: what is the NPV of replacement? part b of the question is: should your company replace it's

to clarify-

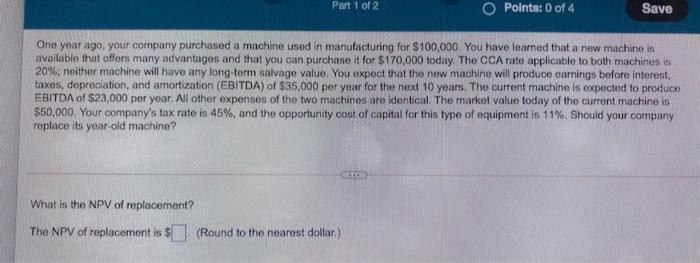

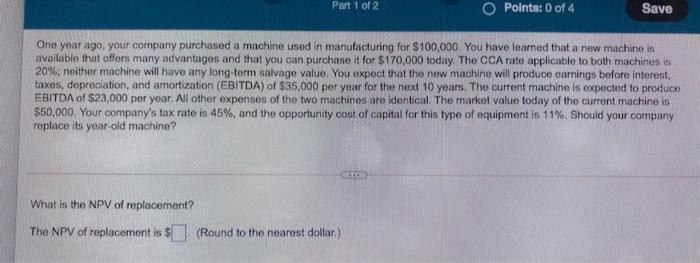

Part 1 of 2 O Points: 0 of 4 Save One year ago, your company purchased a machine used in manufacturing for $100,000. You have learned that a new machine is available that offors many advantages and that you can purchase it for $170,000 today. The CCA rate applicable to both machines is 20%, neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest taxes, depreciation, and amortization (EBITDA) of $35,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $23,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 45%, and the opportunity cost of capital for this type of equipment is 11%. Should your company replace its year-old machine? What is the NPV of replacement? The NPV of replacement is $(Round to the nearest dollar) part a of the question is:

what is the NPV of replacement?

part b of the question is:

should your company replace it's a year old machine?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started