Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To compare the net present value of a project using the methods discussed above, the following example is considered. A new company is considering a

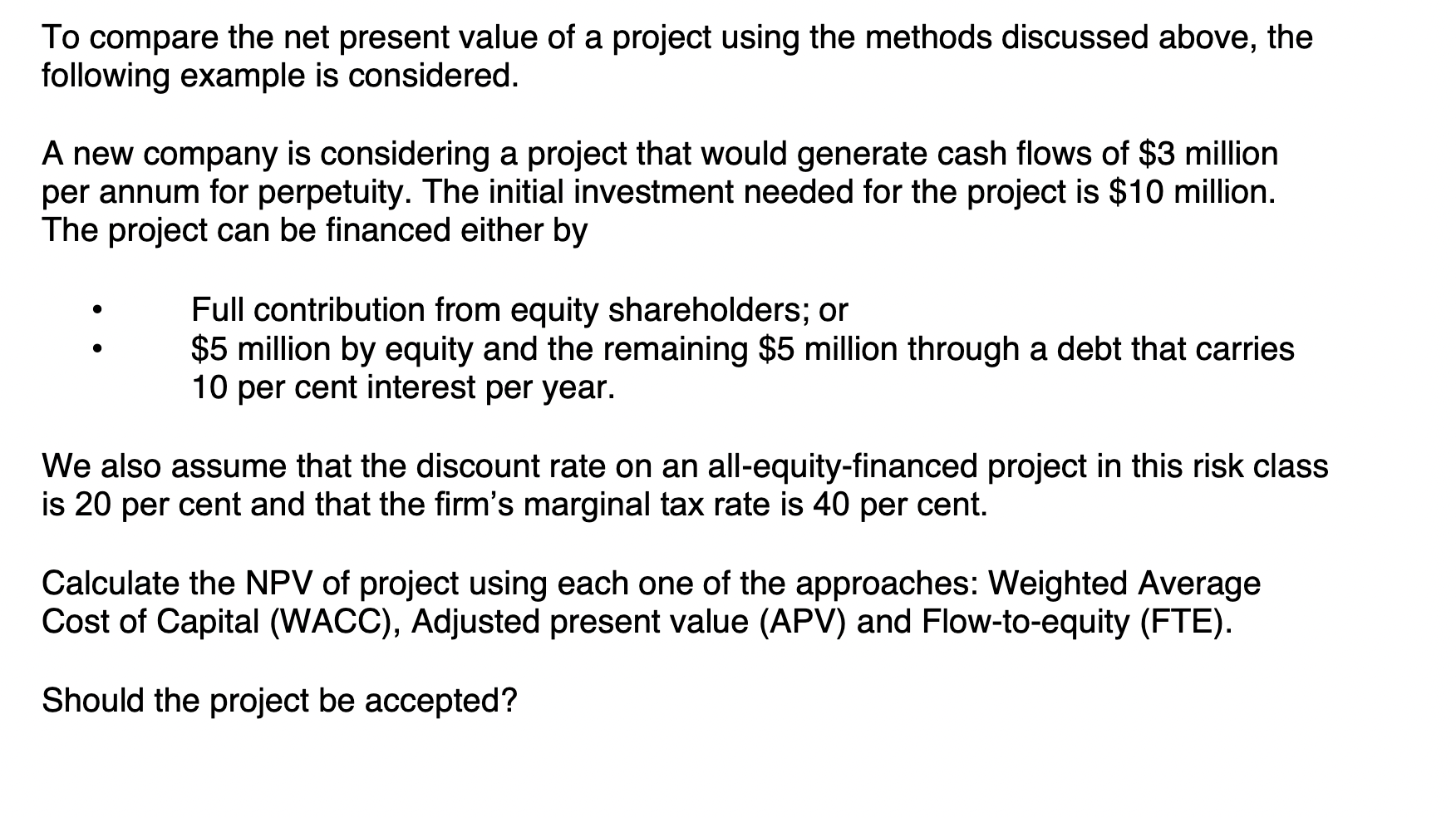

To compare the net present value of a project using the methods discussed above, the following example is considered. A new company is considering a project that would generate cash flows of $3 million per annum for perpetuity. The initial investment needed for the project is $10 million. The project can be financed either by - Full contribution from equity shareholders; or - $5 million by equity and the remaining $5 million through a debt that carries 10 per cent interest per year. We also assume that the discount rate on an all-equity-financed project in this risk class is 20 per cent and that the firm's marginal tax rate is 40 per cent. Calculate the NPV of project using each one of the approaches: Weighted Average Cost of Capital (WACC), Adjusted present value (APV) and Flow-to-equity (FTE). Should the project be accepted

To compare the net present value of a project using the methods discussed above, the following example is considered. A new company is considering a project that would generate cash flows of $3 million per annum for perpetuity. The initial investment needed for the project is $10 million. The project can be financed either by - Full contribution from equity shareholders; or - $5 million by equity and the remaining $5 million through a debt that carries 10 per cent interest per year. We also assume that the discount rate on an all-equity-financed project in this risk class is 20 per cent and that the firm's marginal tax rate is 40 per cent. Calculate the NPV of project using each one of the approaches: Weighted Average Cost of Capital (WACC), Adjusted present value (APV) and Flow-to-equity (FTE). Should the project be accepted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started