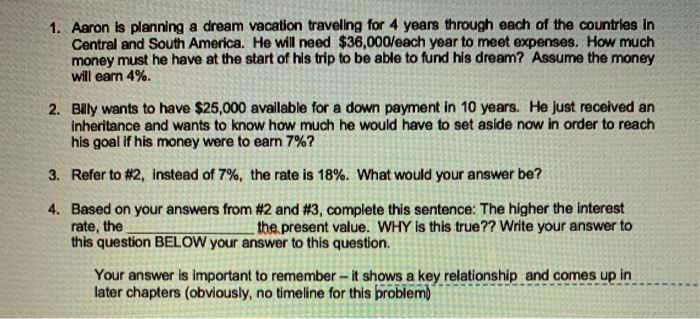

Question

To complete the problems below, You MUST: a. Draw a time line using Word with question(s) marks and all the relevant data. b. Write the

To complete the problems below, You MUST:

a. Draw a time line using Word with question(s) marks and all the relevant data.

b. Write the identity of the type of TVM problem you are looking at. Use the following identifications:

PVLS, PVA, FVLS, FVA, PVA Payments, or FVA Payments.

c. Show STEP-BY-STEP how you are calculating your answers using the format below. I will deduct points this step is not included (see below for format). To solve your problems you can use EXCEL to solve, BUT you must set up the problem using the format below

d. Label your factor from the Tables with the correct rate and time period (make sure your rate and period correspond to the time frame in the problem). See below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started