Question

To complete the required items below, refer to the following: The financial statements of American Eagle Outfitters for the year ended January 31, 2015 provided

To complete the required items below, refer to the following:

The financial statements of American Eagle Outfitters for the year ended January 31, 2015 provided on D2L.

The financial statements of Urban Outfitters for the year ended January 31, 2015 provided on D2L.

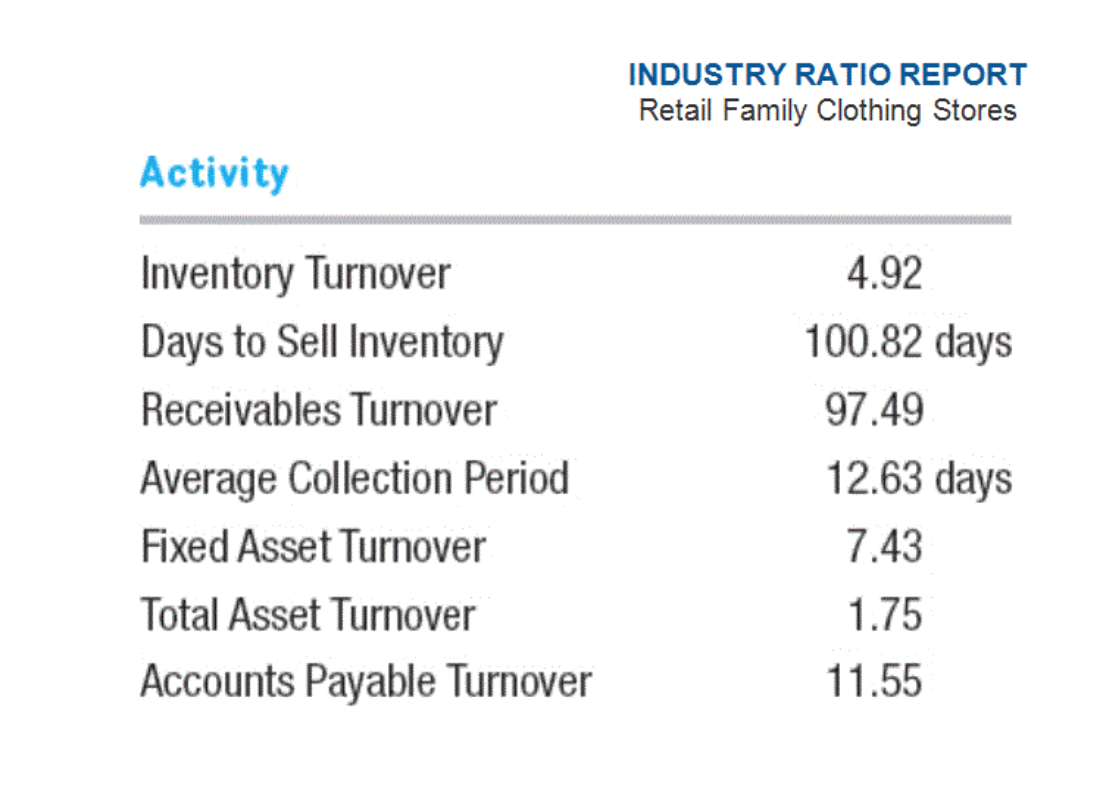

The Industry Ratio Report provided in Appendix D at the end of the text (and also provided on D2L).

Required:

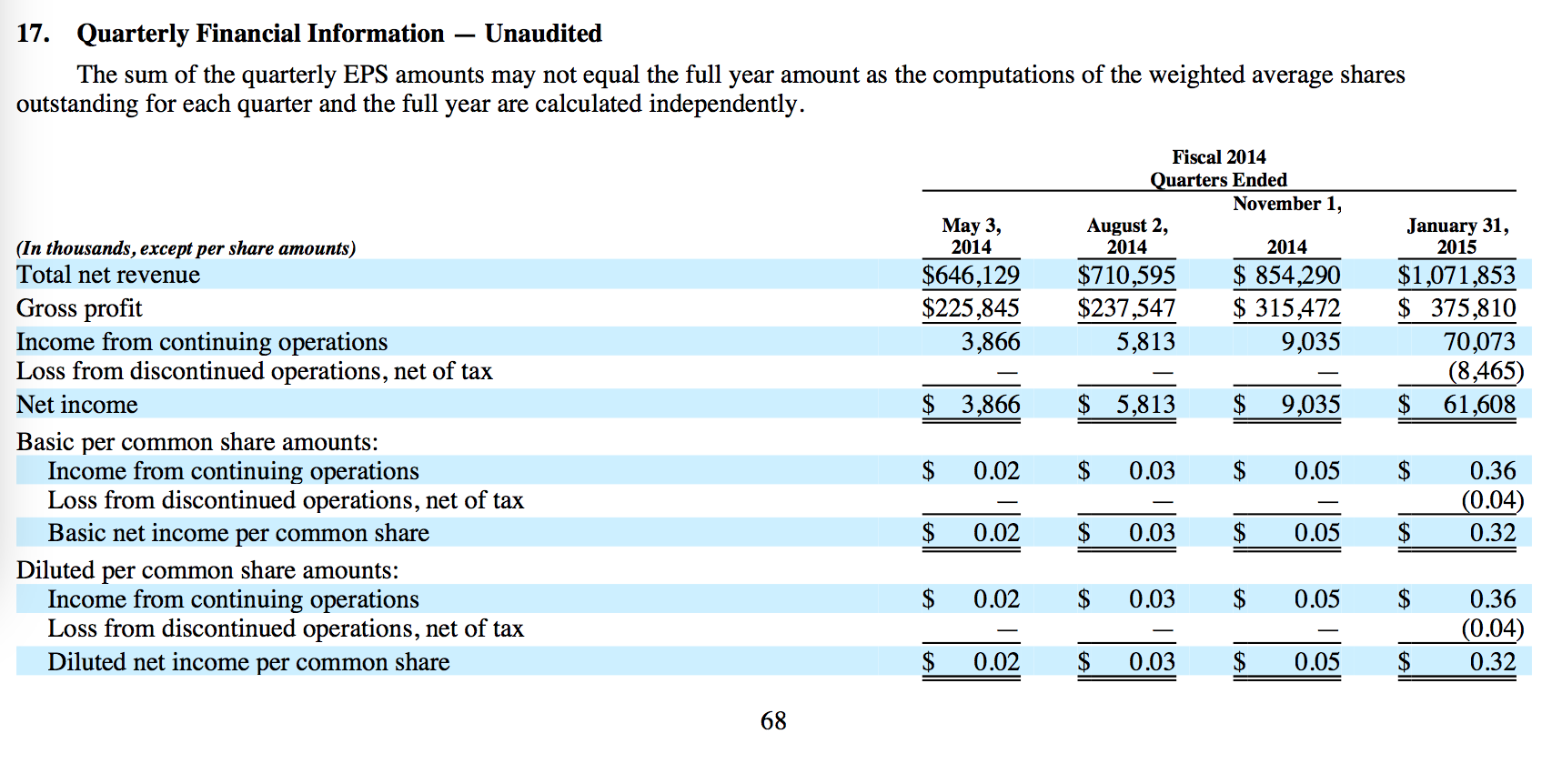

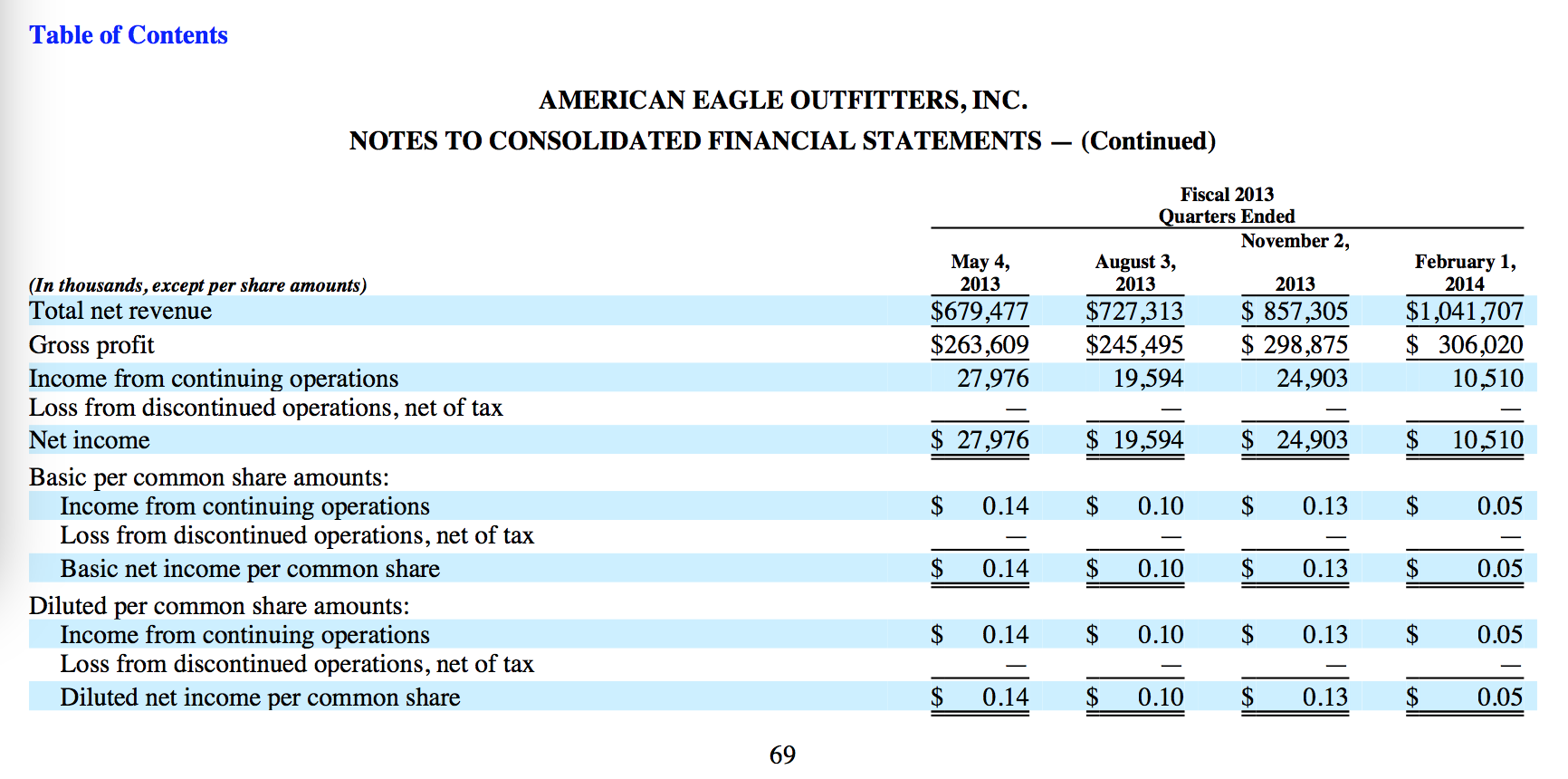

How much inventory does American Eagle hold at the end of the most recent period (January 31, 2015)?

Estimate the amount of merchandise that American Eagle purchased during the year ended January 31, 2015 (Hint: Use the cost of goods sold equation and consider costs of goods sold to include certain buying, occupancy, and warehousing expenses).

What method does American Eagle use to determine the cost of its inventory?

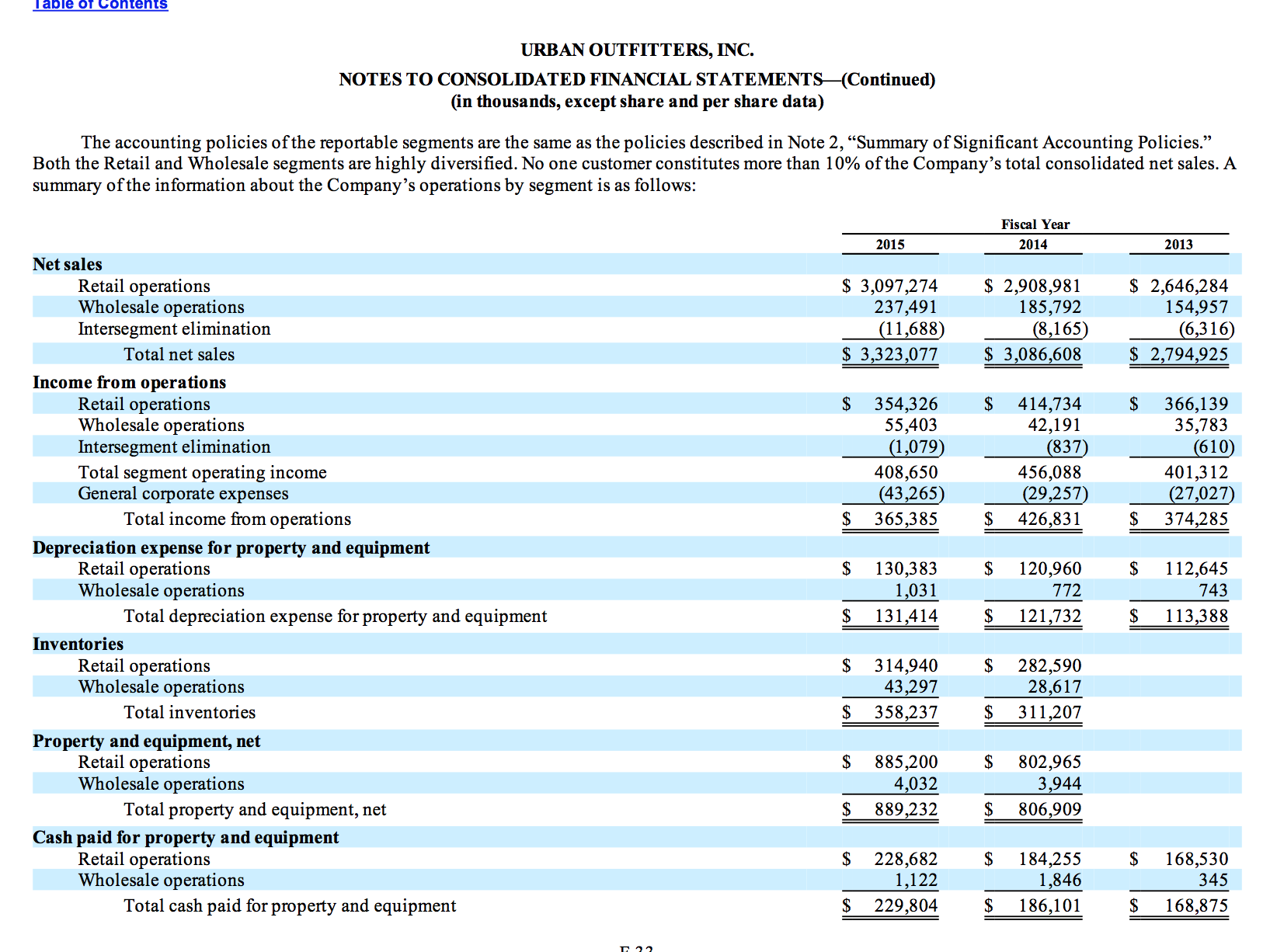

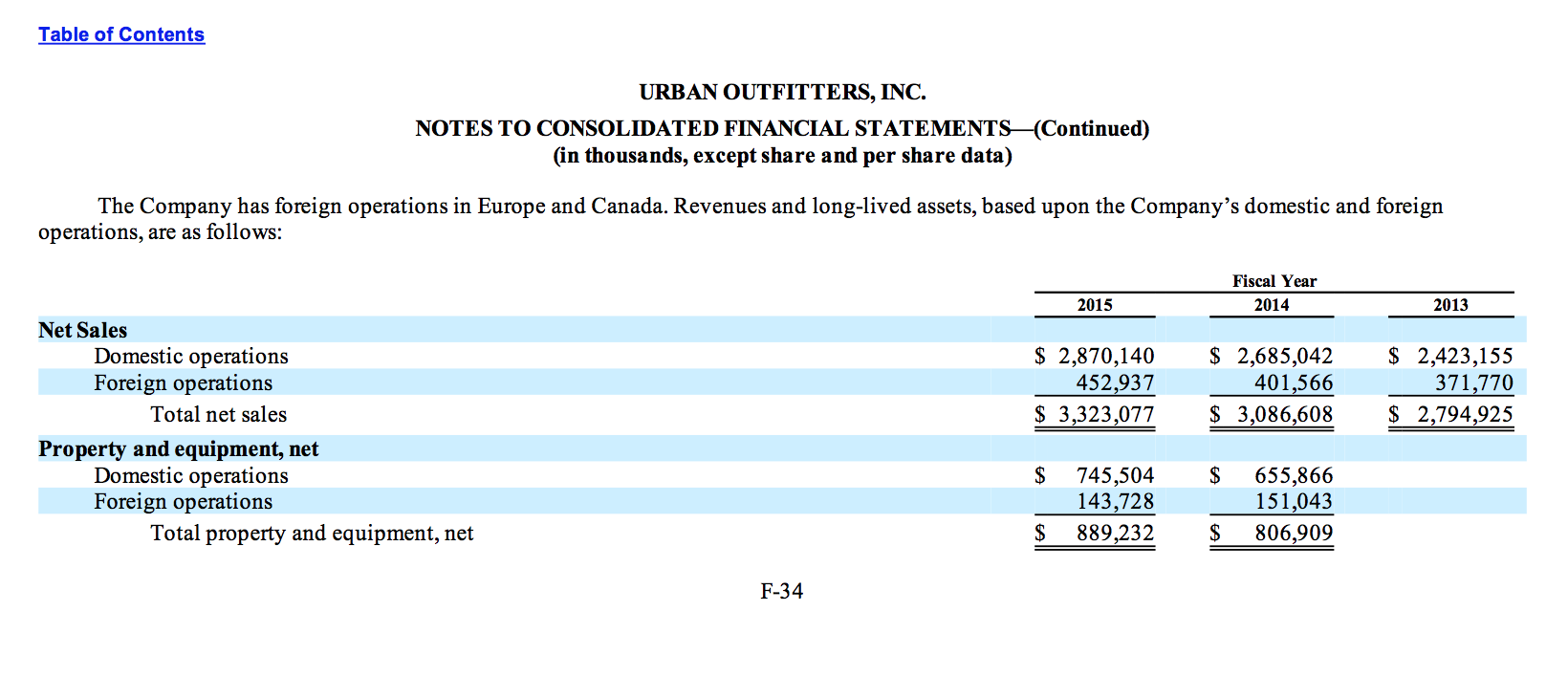

Compute the inventory turnover ratio for both American Eagle and Urban Outfitters for the year ending in January 2015. What do you infer from the difference?

Compare the inventory turnover ratio for both companies to the industry average. Are these two companies doing better or worse than the industry average in turning over their inventory?

https://drive.google.com/file/d/0B3ihUdn_-xWrNkZWV1dNN1NvMWc/view?usp=sharing https://drive.google.com/file/d/0B3ihUdn_-xWrZWhCYmFRakMtZTA/view?usp=sharing

https://drive.google.com/file/d/0B3ihUdn_-xWrNkZWV1dNN1NvMWc/view?usp=sharing https://drive.google.com/file/d/0B3ihUdn_-xWrZWhCYmFRakMtZTA/view?usp=sharing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started