Answered step by step

Verified Expert Solution

Question

1 Approved Answer

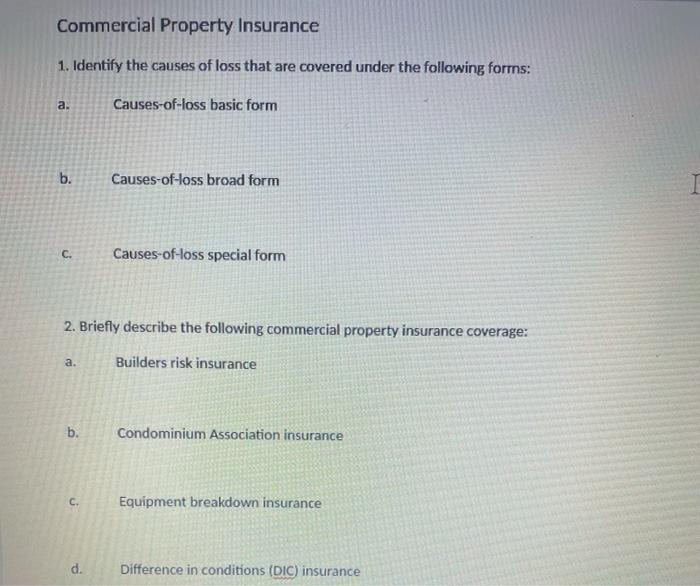

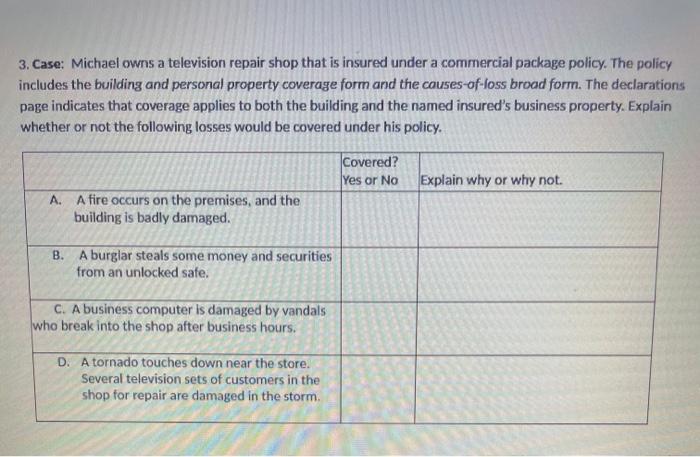

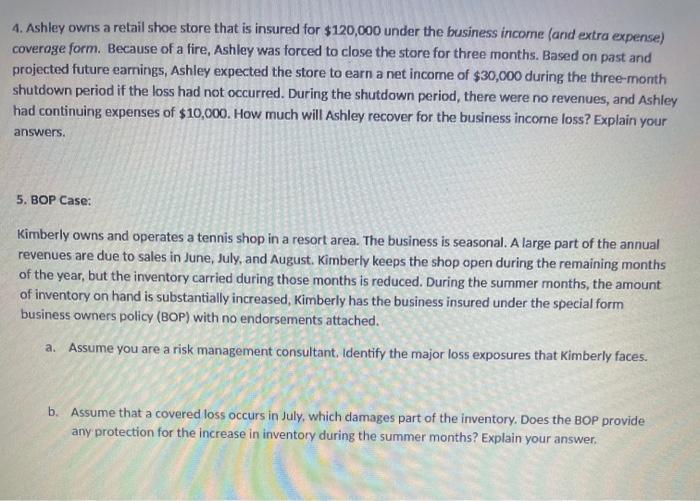

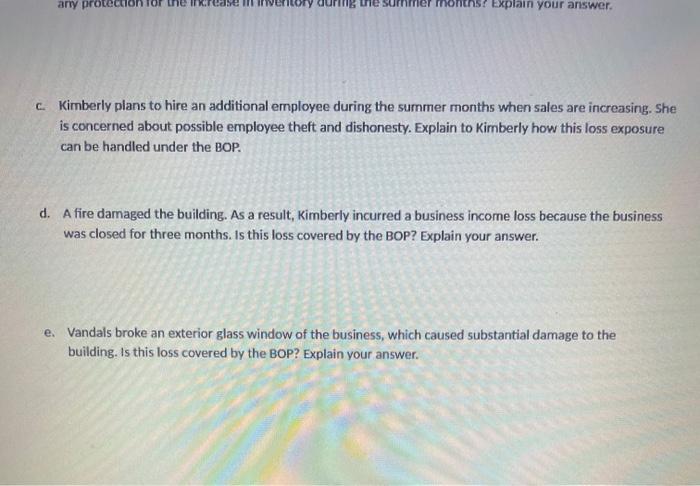

Commercial Property Insurance 1. Identify the causes of loss that are covered under the following forms: Causes-of-loss basic form a. b. C. a. 2.

Commercial Property Insurance 1. Identify the causes of loss that are covered under the following forms: Causes-of-loss basic form a. b. C. a. 2. Briefly describe the following commercial property insurance coverage: Builders risk insurance b. C. Causes-of-loss broad form d. Causes-of-loss special form Condominium Association insurance Equipment breakdown insurance Difference in conditions (DIC) insurance 3. Case: Michael owns a television repair shop that is insured under a commercial package policy. The policy includes the building and personal property coverage form and the causes-of-loss broad form. The declarations page indicates that coverage applies to both the building and the named insured's business property. Explain whether or not the following losses would be covered under his policy. A. A fire occurs on the premises, and the building is badly damaged. B. A burglar steals some money and securities from an unlocked safe. C. A business computer is damaged by vandals who break into the shop after business hours. D. A tornado touches down near the store. Several television sets of customers in the shop for repair are damaged in the storm. Covered? Yes or No Explain why or why not. 4. Ashley owns a retail shoe store that is insured for $120,000 under the business income (and extra expense) coverage form. Because of a fire, Ashley was forced to close the store for three months. Based on past and projected future earnings, Ashley expected the store to earn a net income of $30,000 during the three-month shutdown period if the loss had not occurred. During the shutdown period, there were no revenues, and Ashley had continuing expenses of $10,000. How much will Ashley recover for the business income loss? Explain your answers. 5. BOP Case: Kimberly owns and operates a tennis shop in a resort area. The business is seasonal. A large part of the annual revenues are due to sales in June, July, and August. Kimberly keeps the shop open during the remaining months of the year, but the inventory carried during those months is reduced. During the summer months, the amount of inventory on hand is substantially increased, Kimberly has the business insured under the special form business owners policy (BOP) with no endorsements attached. a. Assume you are a risk management consultant. Identify the major loss exposures that Kimberly faces. b. Assume that a covered loss occurs in July, which damages part of the inventory. Does the BOP provide any protection for the increase in inventory during the summer months? Explain your answer. any protectio months? Explain your answer. c. Kimberly plans to hire an additional employee during the summer months when sales are increasing. She is concerned about possible employee theft and dishonesty. Explain to Kimberly how this loss exposure can be handled under the BOP. d. A fire damaged the building. As a result, Kimberly incurred a business income loss because the business was closed for three months. Is this loss covered by the BOP? Explain your answer. e. Vandals broke an exterior glass window of the business, which caused substantial damage to the building. Is this loss covered by the BOP? Explain your answer.

Step by Step Solution

★★★★★

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Identify the causes of loss that are covered under the following forms a Causesofloss basic form The causes of loss that are covered include fire lightning explosion smoke and vandalism b Causesoflo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started