Question

To date, Airbnb is 100% equity financed since its founding in 2007 the Company raised funds from renowned venture capital firms such as Sequoia

To date, Airbnb is 100% equity financed – since its founding in 2007 the Company raised funds from renowned venture capital firms such as Sequoia Capital, Andreessen Horrowitz and Founders Fund.1 During its upcoming December IPO, the Company is expected to achieve a valuation between $18 and $30 billion. Its most recent internal valuation, in the spring of 2020, was approximately $18bn.

a) Assuming that Airbnb’s expected free cash flow in 2021 will equal its 2019 cashflow (i.e. that the Company will recover from the COVID-19 pandemic by 2021), what is the constant growth rate that Airbnb’s free cash flows would need to grow at in perpetuity, for the Company to achieve an $18 billion dollar valuation when it goes public?

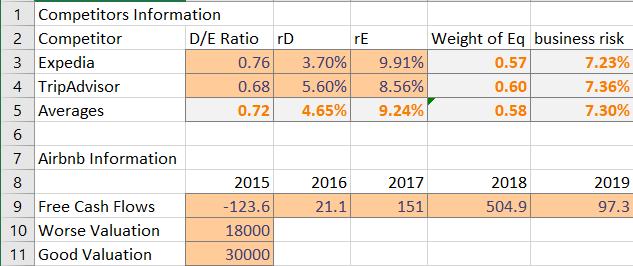

i. Given that Airbnb is 100% equity-financed, the relevant discount rate for its free cash flows equals its business risk. Use the data provided for the peer companies (above) to estimate Airbnb’s business risk (as the average of the estimated business risk of the two peer companies), taking into account that both companies keep constant D/E ratios.

1 Competitors Information 2 Competitor 3 Expedia D/E Ratio rD rE Weight of Eq business risk 0.76 3.70% 9.91% 0.57 7.23% 0.60 4 TripAdvisor 5 Averages 0.68 5.60% 8.56% 7.36% 0.72 4.65% 9.24% 0.58 7.30% 7 Airbnb Information 8 2015 2016 2017 2018 2019 9 Free Cash Flows -123.6 21.1 151 504.9 97.3 10 Worse Valuation 18000 11 Good Valuation 30000

Step by Step Solution

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Solution CF1 ie 2021 973 mln Discount rate Av Business ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started