Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pick the financial statements of any five firms listed on the Ghana Stock Exchange. The financial statements should be for the years 2017, 2018,

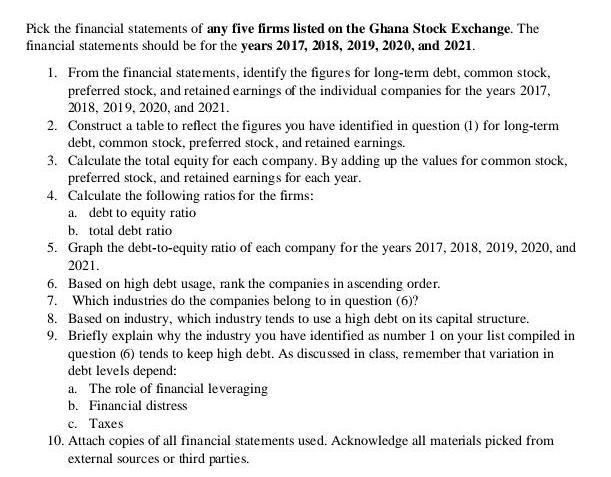

Pick the financial statements of any five firms listed on the Ghana Stock Exchange. The financial statements should be for the years 2017, 2018, 2019, 2020, and 2021. 1. From the financial statements, identify the figures for long-term debt, common stock, preferred stock, and retained earnings of the individual companies for the years 2017, 2018, 2019, 2020, and 2021. 2. Construct a table to reflect the figures you have identified in question (1) for long-term debt, common stock, preferred stock, and retained earnings. 3. Calculate the total equity for each company. By adding up the values for common stock, preferred stock, and retained earnings for each year. 4. Calculate the following ratios for the firms: a. debt to equity ratio b. total debt ratio 5. Graph the debt-to-equity ratio of each company for the years 2017, 2018, 2019, 2020, and 2021. 6. Based on high debt usage, rank the companies in ascending order. 7. Which industries do the companies belong to in question (6)? 8. Based on industry, which industry tends to use a high debt on its capital structure. 9. Briefly explain why the industry you have identified as number 1 on your list compiled in question (6) tends to keep high debt. As discussed in class, remember that variation in debt levels depend: a. The role of financial leveraging b. Financial distress c. Taxes 10. Attach copies of all financial statements used. Acknowledge all materials picked from external sources or third parties.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started