Austin, Inc. began business on January 1st. 02MAY-Received a $30,000, 60-day, 10 % note on account from Haskins Company. 01JUL-Received payment from Haskins for

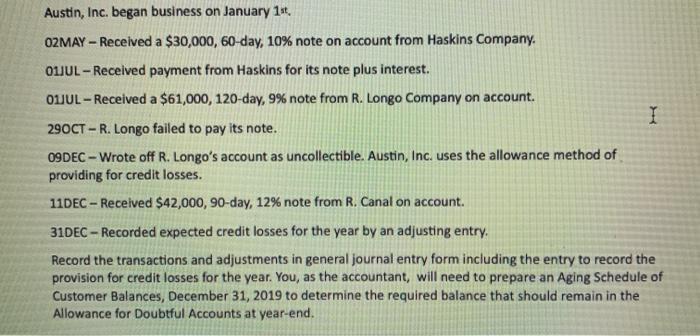

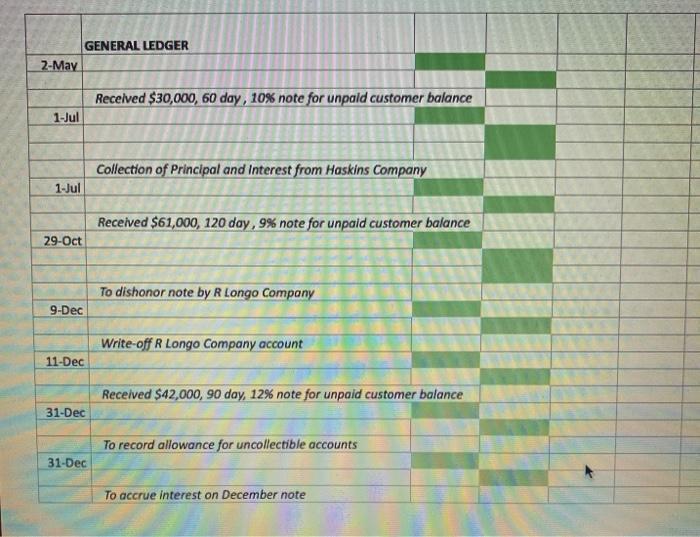

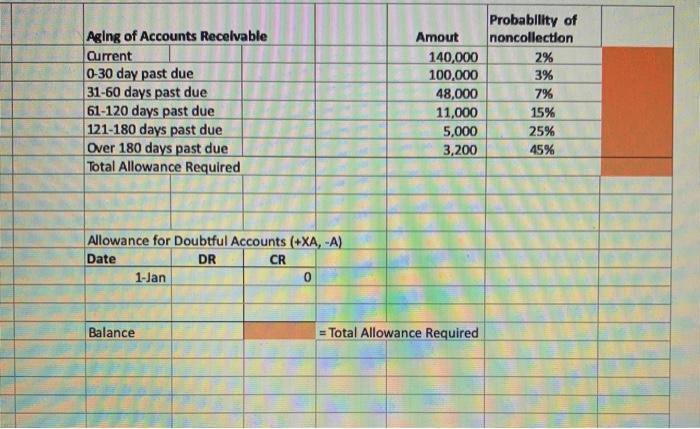

Austin, Inc. began business on January 1st. 02MAY-Received a $30,000, 60-day, 10 % note on account from Haskins Company. 01JUL-Received payment from Haskins for its note plus interest. 01JUL-Received a $61,000, 120-day, 9% note from R. Longo Company on account. 29OCT-R. Longo failed to pay its note. 09DEC - Wrote off R. Longo's account as uncollectible. Austin, Inc. uses the allowance method of providing for credit losses. 11DEC-Received $42,000, 90-day, 12% note from R. Canal on account. 31DEC-Recorded expected credit losses for the year by an adjusting entry. Record the transactions and adjustments in general journal entry form including the entry to record the provision for credit losses for the year. You, as the accountant, will need to prepare an Aging Schedule of Customer Balances, December 31, 2019 to determine the required balance that should remain in the Allowance for Doubtful Accounts at year-end. I 2-May 1-Jul 1-Jul 29-Oct 9-Dec 11-Dec GENERAL LEDGER 31-Dec 31-Dec Received $30,000, 60 day, 10% note for unpaid customer balance Collection of Principal and Interest from Haskins Company Received $61,000, 120 day, 9% note for unpaid customer balance To dishonor note by R Longo Company Write-off R Longo Company account Received $42,000, 90 day, 12% note for unpaid customer balance To record allowance for uncollectible accounts To accrue interest on December note Aging of Accounts Receivable Current 0-30 day past due 31-60 days past due 61-120 days past due 121-180 days past due Over 180 days past due Total Allowance Required Allowance for Doubtful Accounts (+XA, -A) Date DR CR 1-Jan Balance 0 Amout 140,000 100,000 48,000 11,000 5,000 3,200 = Total Allowance Required Probability of noncollection 2% 3% 7% 15% 25% 45%

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Allowance charged f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started