Question: To determine the stock value using the discounted cash flow method: Forecast the free cash flows. Start by using the historical data from the financial

- To determine the stock value using the discounted cash flow method:

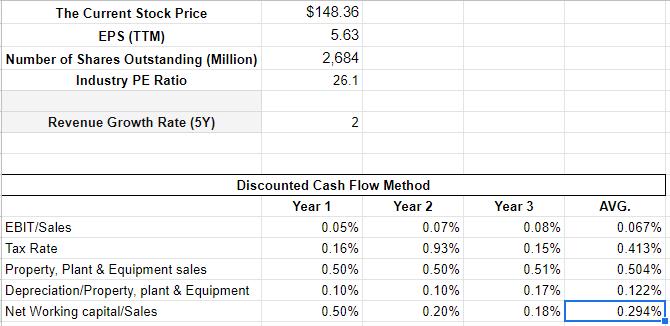

- Forecast the free cash flows. Start by using the historical data from the financial statements downloaded from Morningstar to compute the three-year average of the following ratios:

- EBIT/Sales

- Tax Rate (income tax expense/income before sales)

- Property, plant & equipment/Sales

- Depreciation/property, plant & equipment

- Networking capital/sales

- Create an empty timeline for the next five years

- Forecast future sales based on the most recent year’s total revenue growing at the LT growth rate (5Y average) from Reuters for the first five years of the forecast.

- Use the average ratios from step 5. a. above to forecast EBIT, property plant & equipment, depreciation, and net working capital for the next five years.

- Forecast the free cash flow for the next five years.

- Determine the horizon enterprise value for year 5 using a long-term growth rate of 4% and a cost of capital of 11% for JNJ.

- Determine the enterprise value of the firm as the present value of the free cash flows.

- Determine the stock price. Note: your enterprise value is in thousands of dollars and the number of shares outstanding Is in billions.

- Forecast the free cash flows. Start by using the historical data from the financial statements downloaded from Morningstar to compute the three-year average of the following ratios:

- To calculate an estimate of the JNJ price based on a comparable P/E Ratio, multiply the industry average P/E ratio by JNJ EPS.

- Compare the stock values from both methods to the actual stock price.

The Current Stock Price $148.36 EPS (TTM) 5.63 Number of Shares Outstanding (Million) 2,684 Industry PE Ratio 26.1 Revenue Growth Rate (5Y) 2 Discounted Cash Flow Method Year 1 Year 2 Year 3 AVG. EBIT/Sales 0.05% 0.07% 0.08% 0.067% Tax Rate 0.16% 0.93% 0.15% 0.413% Property, Plant & Equipment sales 0.50% 0.50% 0.51% 0.504% Depreciation/Property, plant & Equipment Net Working capital/Sales 0.10% 0.10% 0.17% 0.122% 0.50% 0.20% 0.18% 0.294%

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

The calculated stock value from the discounted cash flow method is equal to the prese... View full answer

Get step-by-step solutions from verified subject matter experts