Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TO DO: Calculate the crossover rate between proj. H & K based on the cash flow data. Show the range of required rates for which

TO DO:

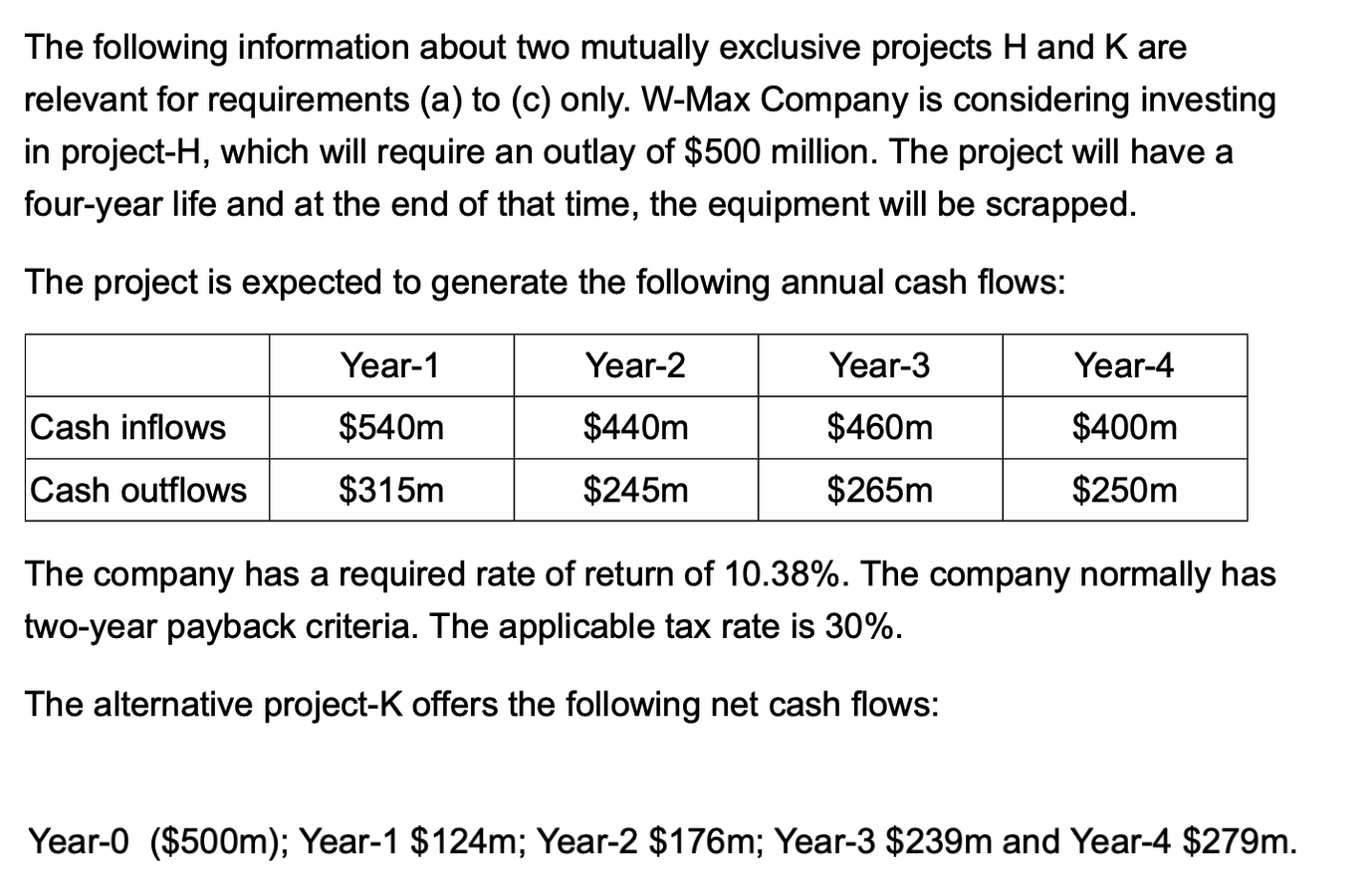

Calculate the crossover rate between proj. H & K based on the cash flow data. Show the range of required rates for which either project-H or project-K would be preferred. Based on your findingsm what would be the decision of selection of a project (when the required rate of return is 10.38%)?

The following information about two mutually exclusive projects Hand K are relevant for requirements (a) to (c) only. W-Max Company is considering investing in project-H, which will require an outlay of $500 million. The project will have a four-year life and at the end of that time, the equipment will be scrapped. The project is expected to generate the following annual cash flows: Year-1 Year-2 Year-3 Year-4 Cash inflows $540m $440m $400m $460m $265m Cash outflows $315m $245m $250m The company has a required rate of return of 10.38%. The company normally has two-year payback criteria. The applicable tax rate is 30%. The alternative project-K offers the following net cash flows: Year-O ($500m); Year-1 $124m; Year-2 $176m; Year-3 $239m and Year-4 $279m

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started