To ensure efficiency of its accounting procedures, the company uses the following Special Journals to maintain its accounting records:

Sales Journal (SJ): to record all sales of Inventory on credit

Purchases Journal (PJ): to record all Purchases of Inventory on credit

Cash Receipts Journal (CRJ): to record all Cash Receipts

Cash Payments Journal (CPJ): to record all Cash Payments

General Journal (GJ): to record all transactions other than the above.

Business transactions are recorded for Premier Ovens Pty Ltd on a daily basis in one of these five journals in the accounts.

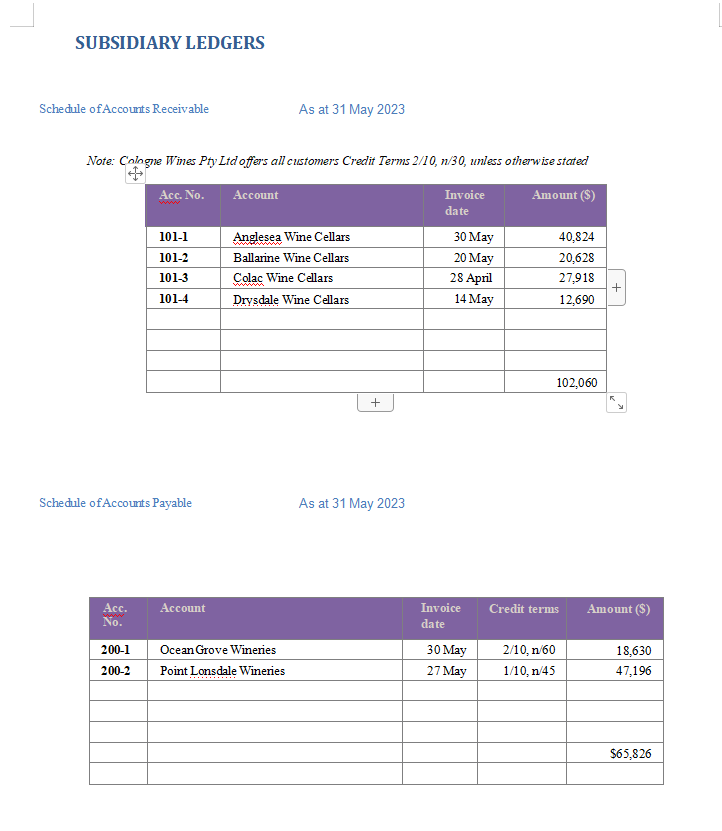

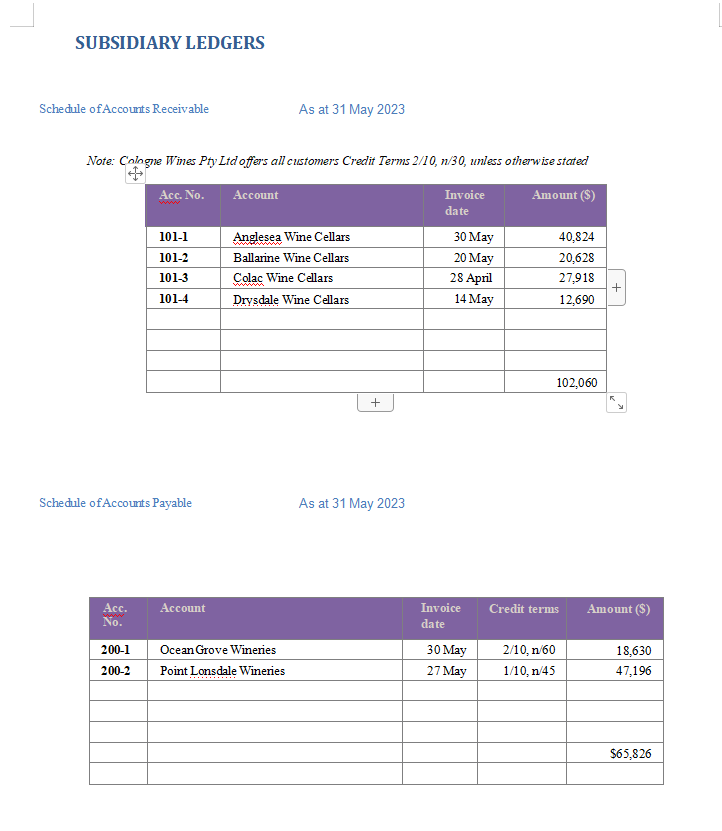

Additionally, the company maintains a general ledger to record postings from the journals. Subsidiary Ledgers are used to record the separate details of Accounts Receivable and Accounts Payable. Transactions are posted immediately to the relevant ledger account if they are entered into the general journal, the "other" column of the Cash Receipts Journal or Cash Payments Journal, or if they affect any of the Accounts Receivable or Accounts Payable subsidiary ledger accounts. Apart from these transactions, totals of the special journals are taken at the end of the month and then posted to the appropriate accounts.

The company uses a periodic inventory system.

GST has been excluded.

Please Note: All amounts in this practice set should be rounded off to the nearest dollar.

ADJUSTING ENTRIES

- The Showroom Fittings were installed on 1 July, 2022. They have a useful life of 9 years and no salvage value.

The Straight-Line method is used to depreciate the Showroom Fittings.

- The Equipment was installed on 1 July, 2017. They have a useful life of 10 years and estimated salvage value of $1,350. The Straight-Line method is used to depreciate the Equipment.

- Twelve months of Rent was prepaid on 1 March, 2023. Of the original prepaid amount, $105,660 worth of Rent has now expired.

- A count of Stationery Supplies indicates that $36,585 still remain on hand at year end.

- A one-year Insurance policy was purchased on 1 November 2022 for $4,860.

- Interest on the NABBank Mortgage Loan is charged at 7% per annum and is paid annually on 1 August (the interest expense should be rounded up to the nearest dollar). The NAB Bank Mortgage Loan was originally taken out on the 1 August, 2022.

- The company has been informed that Drysdale Wine Cellars has been declared bankrupt and Cologne Wines

Pty Ltd has agreed to write off the amount owing as a Bad Debt. The company uses the direct write-off method to account for any Bad Debts in the books.

- A telephone bill for $2,754 for June was received on 5 July, 2023. The amount has not yet been recorded. The company records them as a Utilities Expense.

- Office Staff are paid once per month, $31,482. The Office Staff were last paid on the 15 June, 2023. Exactly half of one month Office Staff wages are still owing.

- Sales Staff are paid fortnightly and work 7 days per week. The sales staff were last paid on the 29 June, 2023. One day of the wages bill is still owed to the Sales Staff.

- The Accountant of the company has estimated that Tax Payable for the year ended 30 June, 2023 will only be $37,029. This amount is to be paid on 31 October, 2023.

- QUESTIONS:

-

Please refer to the attached images for information on data, figures and material to answer the questions.

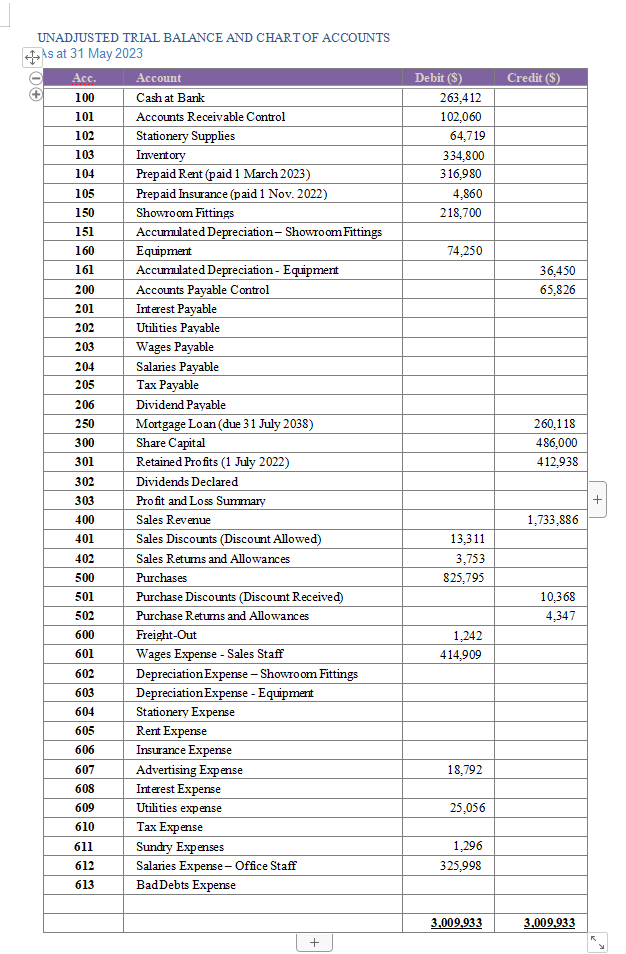

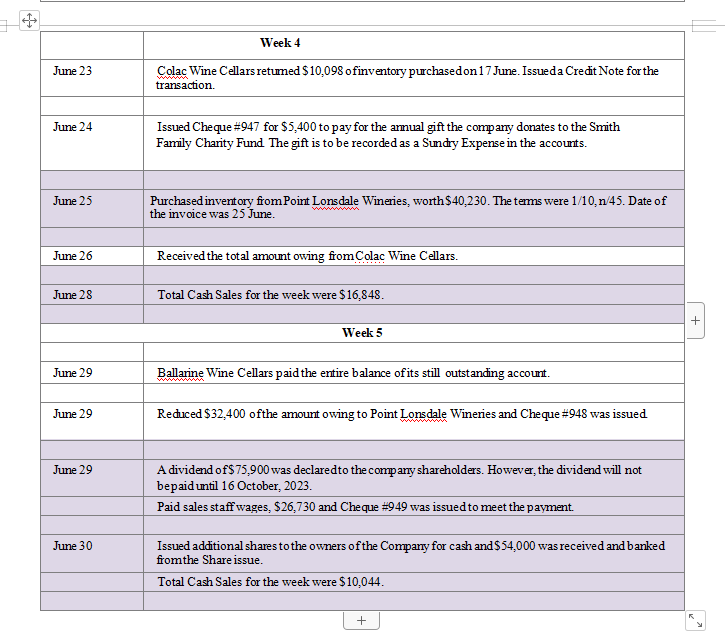

- Prepare the unadjusted Trial Balance as at 30 June 2023 on the Worksheet provided.

- Prepare the adjusting entries shown on page 10 in the General Journal and post to the relevant ledger accounts. Now enter the adjustments in the relevant worksheet columns and prepare an adjusted Trial Balance.

- A Stocktake on 30 June 2023 indicates that the balance of Closing Inventory is $607,068. Use this information to complete the remaining columns of the worksheet.

-

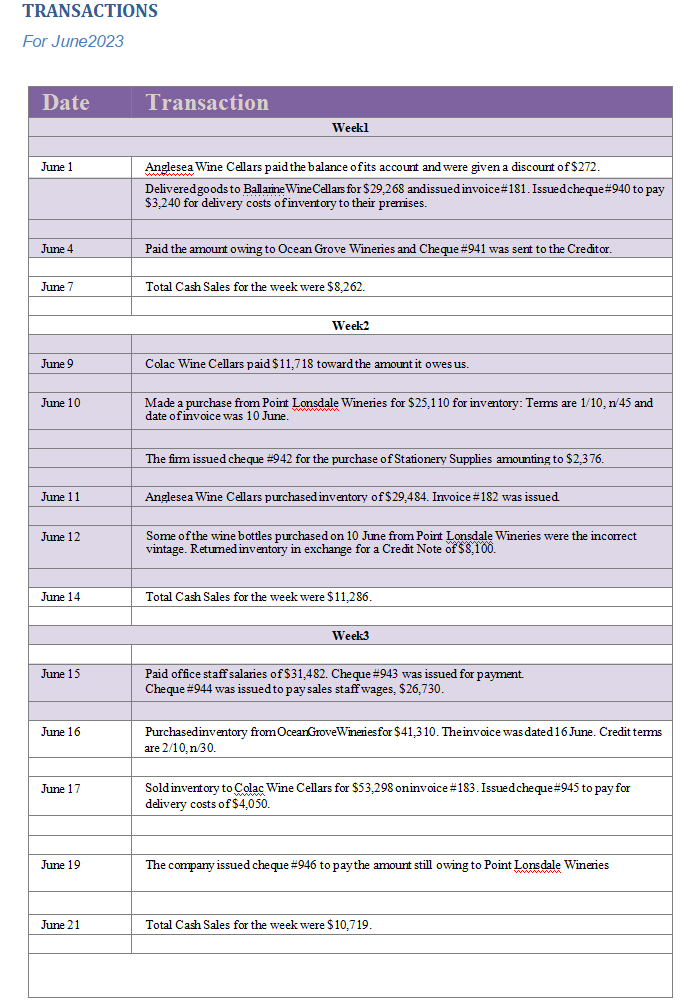

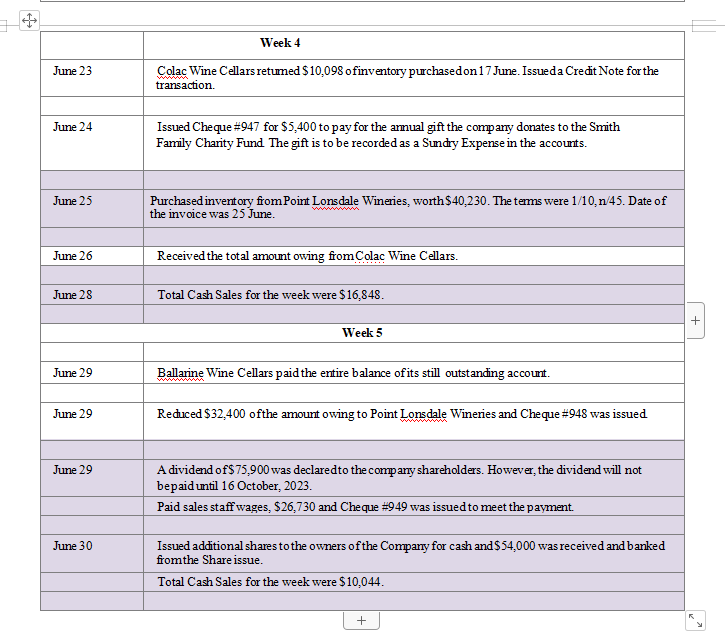

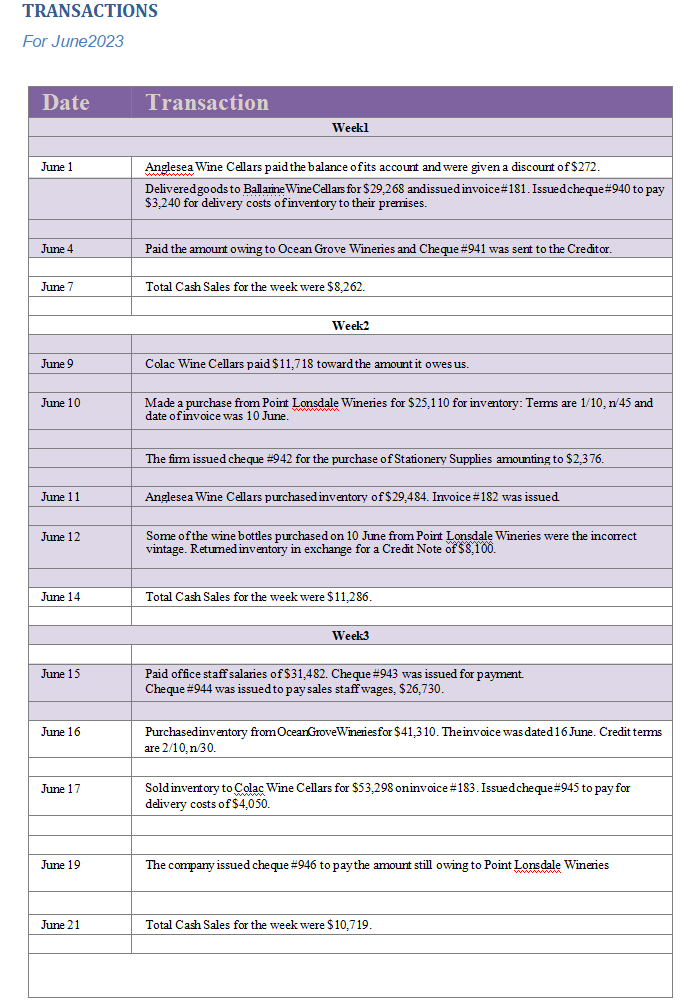

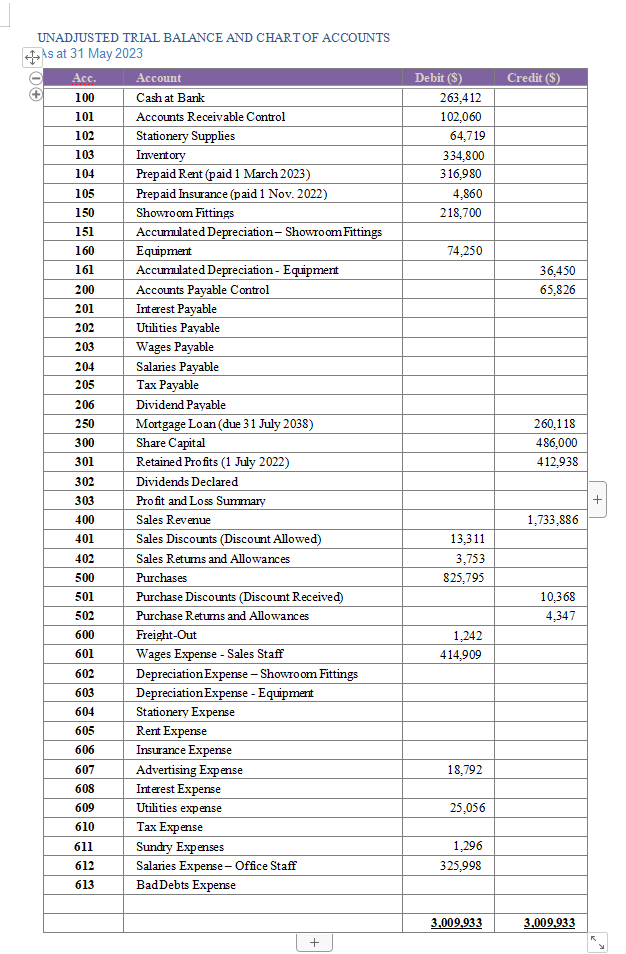

TRANSACTIONS For June 2023 Date Transaction Weekl June 1 Anglesea Wine Cellars paid the balance of its account and were given a discount of $272. Delivered goods to Balame Wine Cellars for $29,268 andissued invoice#181. Issued cheque #940 to pay $3,240 for delivery costs of inventory to their premises. June 4 Paid the amount owing to Ocean Grove Wineries and Cheque #941 was sent to the Creditor. June 7 Total Cash Sales for the week were $8,262. Week2 June 9 Colac Wine Cellars paid $11,718 toward the amount it owes us. June 10 Made a purchase from Point Lonsdale Wineries for $25.110 for inventory: Terms are 1/10, 1/45 and date of invoice was 10 June. The fimm issued cheque #942 for the purchase of Stationery Supplies amounting to $2,376. June 11 Anglesea Wine Cellars purchased inventory of $29,484. Invoice #182 was issued June 12 Some of the wine bottles purchased on 10 June from Point Lonsdale Wineries were the incorrect vintage. Retumed inventory in exchange for a Credit Note of $8,100. June 14 Total Cash Sales for the week were $11,286. Week3 June 15 Paid office staff salaries of $31,482. Cheque #943 was issued for payment. Cheque #944 was issued to pay sales staff wages, $26,730. June 16 Purchasedinventory from OceanGroveWineriesfor $41,310. The invoice was dated 16 June. Credit tems are 2/10,n30. June 17 Soldinventory to Colac Wine Cellars for $53,298 oninvoice #183. Issued cheque #945 to pay for delivery costs of $4,050. June 19 The company issued cheque #946 to pay the amount still owing to Point Lonsdale Wineries June 21 Total Cash Sales for the week were $10,719. Week 4 June 23 Colac Wine Cellars retumed $10,098 ofinventory purchasedon 17 June. Issueda Credit Note for the transaction June 24 Issued Cheque #947 for $5,400 to pay for the annual gift the comparty donates to the Smith Family Charity Fund The gift is to be recorded as a Sundy Expense in the accounts. June 25 Purchased inventory from Point Lonsdale Wineries, worth $40,230. The terms were 1/10,n/45. Date of the invoice was 25 June. June 26 Received the total amount owing from Colac Wine Cellars. June 28 Total Cash Sales for the week were $16,848. + Week 5 June 29 Ballarine Wine Cellars paid the entire balance of its still outstanding account. June 29 Reduced $32,400 ofthe amount owing to Point Lonsdale Wineries and Cheque #948 was issued June 29 A dividend of$ 75,900 was declared to the comparty shareholders. However, the dividend will not bepaid until 16 October, 2023. Paid sales staff wages, $26,730 and Cheque #949 was issued to meet the payment. June 30 Issued additional shares to the owners of the Conparty for cash and $54,000 was received and banked from the Share issue. Total Cash Sales for the week were $ 10,044. + 0 Credit ($) Debit ($) 263,412 102,060 64,719 334,800 316,980 4,860 218,700 74,250 36,450 65,826 203 UNADJUSTED TRIAL BALANCE AND CHART OF ACCOUNTS As at 31 May 2023 Acc. Account 100 Cash at Bank 101 Accounts Receivable Control 102 Stationery Supplies 103 Inventory 104 Prepaid Rent (paid 1 March 2023) 105 Prepaid Insurance (paid 1 Nov. 2022) 150 Showroom Fittings 151 Accumulated Depreciation - Showroom Fittings 160 Equipment 161 Accumulated Depreciation - Equipment 200 Accounts Payable Control 201 Interest Payable 202 Utilities Payable Wages Payable 204 Salaries Payable 205 Tax Payable 206 Dividend Payable 250 Mortgage Loan (due 31 July 2038) 300 Share Capital 301 Retained Profits (1 July 2022) 302 Dividends Declared 303 Profit and Loss Summary 400 Sales Revenue 401 Sales Discounts (Discount Allowed) 402 Sales Retums and Allowances 500 Purchases 501 Purchase Discounts (Discount Received) 502 Purchase Retums and Allowances 600 Freight-Out 601 Wages Expense - Sales Staff 602 Depreciation Expense - Showroom Fittings 603 Depreciation Expense - Equipment 604 Stationery Expense 605 Rent Expense 606 Insurance Expense 607 Advertising Expense 608 Interest Expense 609 Utilities expense 610 Tax Expense 611 Sundry Expenses 612 Salaries Expense - Office Staff 613 Bad Debts Expense 260,118 486,000 412,938 + 1,733,886 13,311 3,753 825,795 10,368 4,347 1,242 414,909 18,792 25,056 1.296 325,998 3,009,933 3.009.933 R + SUBSIDIARY LEDGERS Schedule of Accounts Receivable As at 31 May 2023 Note: Cologne Wines Pty Ltd offers all customers Credit Terms 2/10, 1/30, unless otherwise stated Acc. No. Account Invoice date Amount ($) 101-1 101-2 101-3 101-4 Anglesea Wine Cellars Ballarine Wine Cellars Colac Wine Cellars Drysdale Wine Cellars 30 May 20 May 28 April 14 May 40,824 20,628 27,918 12,690 + 102,060 + Schedule of Accounts Payable As at 31 May 2023 Acc. No. Account Credit terms Amount ($) Invoice date 30 May 27 May 200-1 200-2 Ocean Grove Wineries Point Lonsdale Wineries 2/10, n 60 1/10, n45 18,630 47.196 $65,826 TRANSACTIONS For June 2023 Date Transaction Weekl June 1 Anglesea Wine Cellars paid the balance of its account and were given a discount of $272. Delivered goods to Balame Wine Cellars for $29,268 andissued invoice#181. Issued cheque #940 to pay $3,240 for delivery costs of inventory to their premises. June 4 Paid the amount owing to Ocean Grove Wineries and Cheque #941 was sent to the Creditor. June 7 Total Cash Sales for the week were $8,262. Week2 June 9 Colac Wine Cellars paid $11,718 toward the amount it owes us. June 10 Made a purchase from Point Lonsdale Wineries for $25.110 for inventory: Terms are 1/10, 1/45 and date of invoice was 10 June. The fimm issued cheque #942 for the purchase of Stationery Supplies amounting to $2,376. June 11 Anglesea Wine Cellars purchased inventory of $29,484. Invoice #182 was issued June 12 Some of the wine bottles purchased on 10 June from Point Lonsdale Wineries were the incorrect vintage. Retumed inventory in exchange for a Credit Note of $8,100. June 14 Total Cash Sales for the week were $11,286. Week3 June 15 Paid office staff salaries of $31,482. Cheque #943 was issued for payment. Cheque #944 was issued to pay sales staff wages, $26,730. June 16 Purchasedinventory from OceanGroveWineriesfor $41,310. The invoice was dated 16 June. Credit tems are 2/10,n30. June 17 Soldinventory to Colac Wine Cellars for $53,298 oninvoice #183. Issued cheque #945 to pay for delivery costs of $4,050. June 19 The company issued cheque #946 to pay the amount still owing to Point Lonsdale Wineries June 21 Total Cash Sales for the week were $10,719. Week 4 June 23 Colac Wine Cellars retumed $10,098 ofinventory purchasedon 17 June. Issueda Credit Note for the transaction June 24 Issued Cheque #947 for $5,400 to pay for the annual gift the comparty donates to the Smith Family Charity Fund The gift is to be recorded as a Sundy Expense in the accounts. June 25 Purchased inventory from Point Lonsdale Wineries, worth $40,230. The terms were 1/10,n/45. Date of the invoice was 25 June. June 26 Received the total amount owing from Colac Wine Cellars. June 28 Total Cash Sales for the week were $16,848. + Week 5 June 29 Ballarine Wine Cellars paid the entire balance of its still outstanding account. June 29 Reduced $32,400 ofthe amount owing to Point Lonsdale Wineries and Cheque #948 was issued June 29 A dividend of$ 75,900 was declared to the comparty shareholders. However, the dividend will not bepaid until 16 October, 2023. Paid sales staff wages, $26,730 and Cheque #949 was issued to meet the payment. June 30 Issued additional shares to the owners of the Conparty for cash and $54,000 was received and banked from the Share issue. Total Cash Sales for the week were $ 10,044. + 0 Credit ($) Debit ($) 263,412 102,060 64,719 334,800 316,980 4,860 218,700 74,250 36,450 65,826 203 UNADJUSTED TRIAL BALANCE AND CHART OF ACCOUNTS As at 31 May 2023 Acc. Account 100 Cash at Bank 101 Accounts Receivable Control 102 Stationery Supplies 103 Inventory 104 Prepaid Rent (paid 1 March 2023) 105 Prepaid Insurance (paid 1 Nov. 2022) 150 Showroom Fittings 151 Accumulated Depreciation - Showroom Fittings 160 Equipment 161 Accumulated Depreciation - Equipment 200 Accounts Payable Control 201 Interest Payable 202 Utilities Payable Wages Payable 204 Salaries Payable 205 Tax Payable 206 Dividend Payable 250 Mortgage Loan (due 31 July 2038) 300 Share Capital 301 Retained Profits (1 July 2022) 302 Dividends Declared 303 Profit and Loss Summary 400 Sales Revenue 401 Sales Discounts (Discount Allowed) 402 Sales Retums and Allowances 500 Purchases 501 Purchase Discounts (Discount Received) 502 Purchase Retums and Allowances 600 Freight-Out 601 Wages Expense - Sales Staff 602 Depreciation Expense - Showroom Fittings 603 Depreciation Expense - Equipment 604 Stationery Expense 605 Rent Expense 606 Insurance Expense 607 Advertising Expense 608 Interest Expense 609 Utilities expense 610 Tax Expense 611 Sundry Expenses 612 Salaries Expense - Office Staff 613 Bad Debts Expense 260,118 486,000 412,938 + 1,733,886 13,311 3,753 825,795 10,368 4,347 1,242 414,909 18,792 25,056 1.296 325,998 3,009,933 3.009.933 R + SUBSIDIARY LEDGERS Schedule of Accounts Receivable As at 31 May 2023 Note: Cologne Wines Pty Ltd offers all customers Credit Terms 2/10, 1/30, unless otherwise stated Acc. No. Account Invoice date Amount ($) 101-1 101-2 101-3 101-4 Anglesea Wine Cellars Ballarine Wine Cellars Colac Wine Cellars Drysdale Wine Cellars 30 May 20 May 28 April 14 May 40,824 20,628 27,918 12,690 + 102,060 + Schedule of Accounts Payable As at 31 May 2023 Acc. No. Account Credit terms Amount ($) Invoice date 30 May 27 May 200-1 200-2 Ocean Grove Wineries Point Lonsdale Wineries 2/10, n 60 1/10, n45 18,630 47.196 $65,826