To exchange for the required amount of U.S. dollars, what is the number of Venezuelan bolivars required if:

- Santiago makes an official exchange with CADIVI?

- Santiago makes the exchange with CANTV shares on the New York Stock Exchange?

- Santiago makes the exchange on the black market?

- Santiago makes the exchange with Vebono (Venezuelan government bond)?

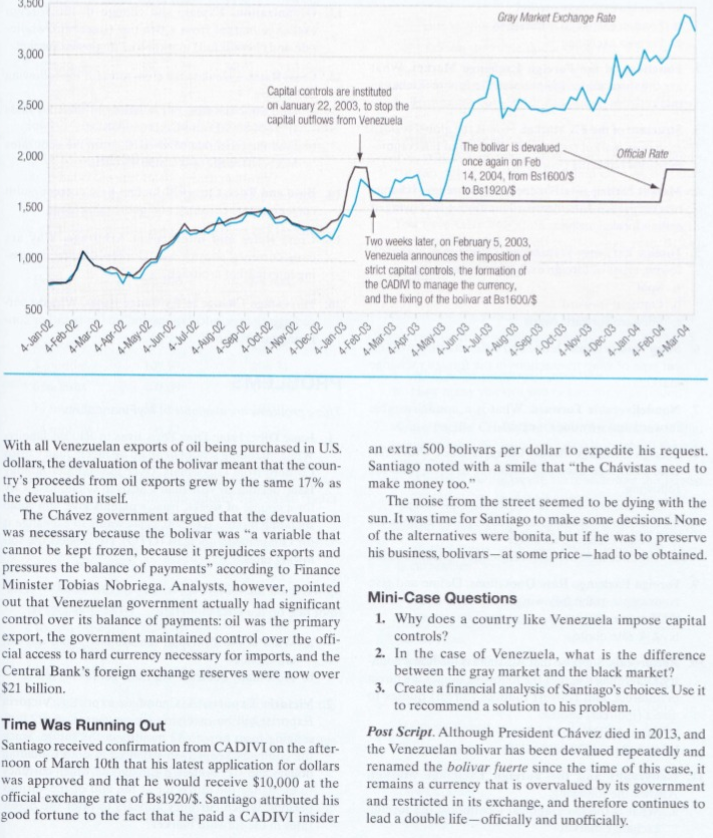

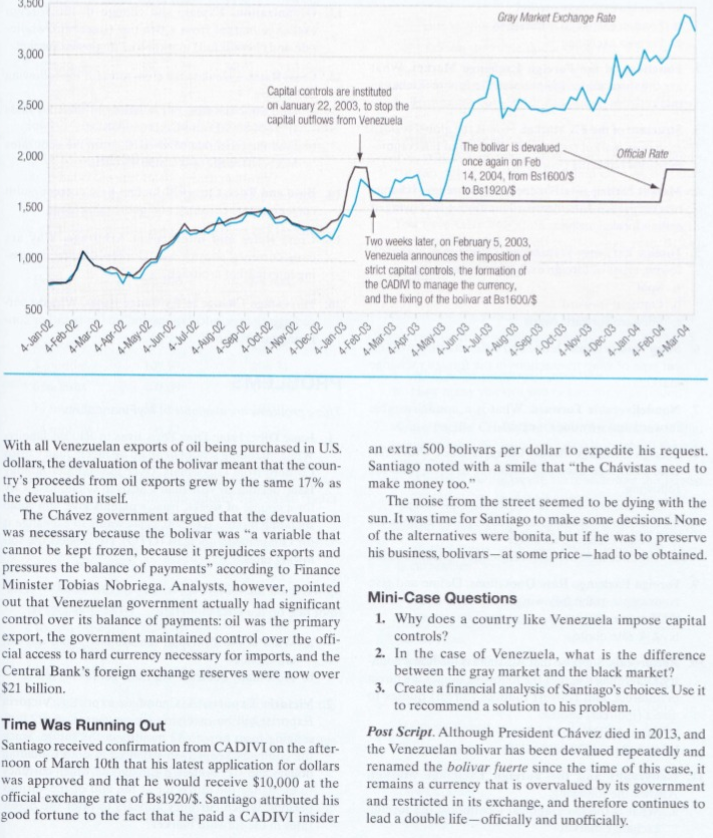

MINI-CASE The Venezuelan Bolivar Black Market Santiago), the escalating capital flight caused the black mar- It's late afternoon on March 10th, 2004, and Santiago opens ket value of the bolivar to plummet to Bs2500/$ in weeks. As the window of his office in Caracas, Venezuela. Immedi- markets collapsed and exchange values fell, the Venezuelan ately he is hit with the sounds rising from the plaza-cars inflation rate soared to more than 30% per annum. honking, protesters banging their pots and pans, street ven- dors hawking their goods. Since the imposition of a new set Capital Controls and CADIVI of economic policies by President Hugo Chvez in 2002, To combat the downward pressures on the bolivar, the such sights and sounds had become a fixture of city life in Venezuelan government announced on February 5th, 2003, Caracas, Santiago sighed as he yearned for the simplicity the passage of the 2003 Exchange Regulations Decree. The of life in the old Caracas. Decree took the following actions: Santiago's once-thriving pharmaceutical distribution business had hit hard times. Since capital controls were 1. Set the official exchange rate at Bs1596/$ for purchase implemented in February of 2003, dollars had been hard to (bid) and Bs1600/$ for sale (ask); come by. He had been forced to pursue various methods- methods that were more expensive and not always legal --- 2. Established the Comisin de Administracin de Divi- to obtain dollars, causing his margins to decrease by 50%. sas (CADIVI) to control the distribution of foreign Adding to the strain, the Venezuelan currency, the boli- exchange; and var (Bs), had been recently devalued (repeatedly). This 3. Implemented strict price controls to stem inflation trig- had instantly squeezed his margins as his costs had risen gered by the weaker bolivar and the exchange control- directly with the exchange rate. He could not find anyone induced contraction of imports. to sell him dollars. His customers needed supplies and they needed them quickly, but how was he going to come up CADIVI was both the official means and the cheap- with the $30,000 -- the hard currency -to pay for his most est means by which Venezuelan citizens could obtain for- recent order? eign currency. In order to receive an authorization from CADIVI to obtain dollars, an applicant was required to Political Chaos complete a series of forms. The applicant was then required Hugo Chvez's tenure as President of Venezuela had been to prove that they had paid taxes the previous three years, tumultuous at best since his election in 1998. After repeated provide proof of business and asset ownership and lease recalls, resignations, coups, and reappointments, the politi- agreements for company property, and document the cur cal turmoil had taken its toll on the Venezuelan economy as rent payment of Social Security. a whole, and its currency in particular. The short-lived suc- Unofficially, however, there was an additional unstated cess of the anti-Chvez coup in 2001, and his nearly imme- requirement for permission to obtain foreign currency: diate return to office, had set the stage for a retrenchment authorizations would be reserved for Chvez support of his isolationist economic and financial policies. ers. In August 2003 an anti-Chvez petition had gained On January 21st, 2003, the bolivar closed at a record low - widespread circulation. One million signatures had been Bs1853/6. The next day President Hugo Chvez suspended collected. Although the government ruled that the peti- the sale of dollars for two weeks. Nearly instantaneously, tion was invalid, it had used the list of signatures to cre- an unofficial or black market for the exchange of Venezu- ate a database of names and social security numbers that elan bolivars for foreign currencies (primarily U.S. dollars) CADIVI utilized to cross-check identities on hard currency sprouted. As investors of all kinds sought ways to exit the Ven- requests. President Chvez was quoted as saying "Not one ezuelan market, or simply obtain the hard-currency needed more dollar for the putschits; the bolivars belong to the to continue to conduct their businesses (as was the case for people." Santiago's Alternatives Santiago had little luck obtaining dollars via CADIVI to pay for his imports. Because he had signed the petition call- ing for President Chvez's removal, he had been listed in the CADIVI database as anti-Chvez, and now could not obtain permission to exchange bolivar for dollars. The transaction in question was an invoice for $30,000 in pharmaceutical products from his U.S.-based supplier. Santiago intended to resell these products to a large Ven- ezuelan customer who would distribute the products. This transaction was not the first time that Santiago had been forced to search out alternative sources for meeting his U.S. dollar obligations. Since the imposition of capital con- trols, his search for dollars had become a weekly activity for Santiago. In addition to the official process -- through CADIVI - he could also obtain dollars through the gray or black markets. The Gray Market: CANTV Shares In May 2003, three months following the implementation of the exchange controls, a window of opportunity had opened up for Venezuelans- an opportunity that allowed investors in the Caracas stock exchange to avoid the tight foreign exchange curbs. This loophole circumvented the government-imposed restrictions by allowing investors to purchase local shares of the leading telecommunications company CANTV on the Caracas' bourse, and to then convert those shares into dollar-denominated American Depositary Receipts (ADR) traded on the NYSE. The sponsor for CANTV ADRs on the NYSE was the Bank of New York, the leader in ADR sponsorship and management in the U.S. The Bank of New York had sus- pended trading in CANTV ADRs in February after the passage of the Decree, wishing to determine the legality of trading under the new Venezuelan currency controls. On May 26th, after concluding that trading was indeed legal under the Decree, trading resumed in CANTV shares. CANTV's share price and trading volume both soared in the following week. The share price of CANTV quickly became the primary method of calculating the implicit gray market exchange rate. For example, CANTV shares closed at Bs7945/share on the Caracas bourse on February 6, 2004. That same day, CANTV ADRs closed in New York at $18.84/ADR. Each New York ADR was equal to seven shares of CANTV in Caracas. The implied gray market exchange rate was then calculated as follows: Implicit Gray _ 7 x Bs7945/Share Bs2952/$ Market Rate $18.84/ADR The official exchange rate on that same day was Bs1598/$. This meant that the gray market rate was quoting the bolivar about 46% weaker against the dollar than what the Venezuelan government officially declared its currency to be worth. Exhibit A illustrates both the official exchange rate and the gray market rate (calculated using CANTV shares) for the January 2002 to March 2004 period. The divergence between the official and gray market rates beginning in February 2003 coincided with the imposition of capital controls. The Black Market A third method of obtaining hard currency by Venezuelans was through the rapidly expanding black market. The black market was, as is the case with black markets all over the world, essentially unseen and illegal. It was, however, quite sophisticated, using the services of a stockbroker or banker in Venezuela who simultaneously held U.S. dollar accounts offshore. The choice of a black market broker was a critical one; in the event of a failure to complete the transaction properly there was no legal recourse. If Santiago wished to purchase dollars on the black mar- ket, he would deposit bolivars in his broker's account in Venezuela. The agreed upon black market exchange rate was determined on the day of the deposit, and usually was within a 20% band of the gray market rate derived from the CANTV share price. Santiago would then be given access to a dollar-denominated bank account outside of Venezu- ela in the agreed amount. The transaction took, on average, two business days to settle. The unofficial black market rate was Bs3300/$. In early 2004 President Chvez had asked Venezuela's Central Bank to give him a little billion" millardito - of its $21 billion in foreign exchange reserves. Chvez argued that the money was actually the people's, and he wished to invest some of it in the agricultural sector. The Central Bank refused. Not to be thwarted in its search for funds, the Chvez government announced on February 9, 2004, another devaluation. The bolivar was devalued 17%, falling in official value from Bs1600/$ to Bs1920$ (see Exhibit A). 3.500 Gray Market Exchange Rate 3,000 2,500 Capital controls are instituted on January 22, 2003, to stop the capital outflows from Venezuela 2,000 Official Rate The bolivar is devalued once again on Feb 14.2004, from Es1600/$ to Bs1920/5 1,500 1,000 Two weeks later, on February 5, 2003, Venezuela announces the imposition of strict capital controls, the formation of the CADIVI to manage the currency and the fixing of the bolivar at Bs1600/$ 500 4-Jan-02 4-Aug-03 4-Sep-03 4-Dec-03 4-Jan-04 4-Oct-03 4-Nov-03 4-Feb-04 4-Mar-04 With all Venezuelan exports of oil being purchased in U.S. dollars, the devaluation of the bolivar meant that the coun- try's proceeds from oil exports grew by the same 17% as the devaluation itself. The Chvez government argued that the devaluation was necessary because the bolivar was a variable that cannot be kept frozen, because it prejudices exports and pressures the balance of payments" according to Finance Minister Tobias Nobriega. Analysts, however, pointed out that Venezuelan government actually had significant control over its balance of payments: oil was the primary export, the government maintained control over the offi cial access to hard currency necessary for imports, and the Central Bank's foreign exchange reserves were now over $21 billion 4-Feb-02 4-Mar-02 4-Apr-02 4-May-02 4-Jun-02 4-Jul-02 4-Aug-02 4-Sep-02 4-Oct-02 4-Nov-02 4-Dec-02 4-Jan-03 4-Feb-03 4-Mar-03 4-Apr-03 4-May-03 4-Jun-03 4-Jul-03 an extra 500 bolivars per dollar to expedite his request. Santiago noted with a smile that "the Chvistas need to make money too." The noise from the street seemed to be dying with the sun. It was time for Santiago to make some decisions. None of the alternatives were bonita, but if he was to preserve his business, bolivars-at some price -- had to be obtained. Mini-Case Questions 1. Why does a country like Venezuela impose capital controls? 2. In the case of Venezuela, what is the difference between the gray market and the black market? 3. Create a financial analysis of Santiago's choices. Use it to recommend a solution to his problem. Post Script. Although President Chvez died in 2013, and the Venezuelan bolivar has been devalued repeatedly and renamed the bolivar fuerte since the time of this case, it remains a currency that is overvalued by its government and restricted in its exchange, and therefore continues to lead a double life-officially and unofficially. Time Was Running Out Santiago received confirmation from CADIVI on the after noon of March 10th that his latest application for dollars was approved and that he would receive $10,000 at the official exchange rate of Bs 1920/$. Santiago attributed his good fortune to the fact that he paid a CADIVI insider MINI-CASE The Venezuelan Bolivar Black Market Santiago), the escalating capital flight caused the black mar- It's late afternoon on March 10th, 2004, and Santiago opens ket value of the bolivar to plummet to Bs2500/$ in weeks. As the window of his office in Caracas, Venezuela. Immedi- markets collapsed and exchange values fell, the Venezuelan ately he is hit with the sounds rising from the plaza-cars inflation rate soared to more than 30% per annum. honking, protesters banging their pots and pans, street ven- dors hawking their goods. Since the imposition of a new set Capital Controls and CADIVI of economic policies by President Hugo Chvez in 2002, To combat the downward pressures on the bolivar, the such sights and sounds had become a fixture of city life in Venezuelan government announced on February 5th, 2003, Caracas, Santiago sighed as he yearned for the simplicity the passage of the 2003 Exchange Regulations Decree. The of life in the old Caracas. Decree took the following actions: Santiago's once-thriving pharmaceutical distribution business had hit hard times. Since capital controls were 1. Set the official exchange rate at Bs1596/$ for purchase implemented in February of 2003, dollars had been hard to (bid) and Bs1600/$ for sale (ask); come by. He had been forced to pursue various methods- methods that were more expensive and not always legal --- 2. Established the Comisin de Administracin de Divi- to obtain dollars, causing his margins to decrease by 50%. sas (CADIVI) to control the distribution of foreign Adding to the strain, the Venezuelan currency, the boli- exchange; and var (Bs), had been recently devalued (repeatedly). This 3. Implemented strict price controls to stem inflation trig- had instantly squeezed his margins as his costs had risen gered by the weaker bolivar and the exchange control- directly with the exchange rate. He could not find anyone induced contraction of imports. to sell him dollars. His customers needed supplies and they needed them quickly, but how was he going to come up CADIVI was both the official means and the cheap- with the $30,000 -- the hard currency -to pay for his most est means by which Venezuelan citizens could obtain for- recent order? eign currency. In order to receive an authorization from CADIVI to obtain dollars, an applicant was required to Political Chaos complete a series of forms. The applicant was then required Hugo Chvez's tenure as President of Venezuela had been to prove that they had paid taxes the previous three years, tumultuous at best since his election in 1998. After repeated provide proof of business and asset ownership and lease recalls, resignations, coups, and reappointments, the politi- agreements for company property, and document the cur cal turmoil had taken its toll on the Venezuelan economy as rent payment of Social Security. a whole, and its currency in particular. The short-lived suc- Unofficially, however, there was an additional unstated cess of the anti-Chvez coup in 2001, and his nearly imme- requirement for permission to obtain foreign currency: diate return to office, had set the stage for a retrenchment authorizations would be reserved for Chvez support of his isolationist economic and financial policies. ers. In August 2003 an anti-Chvez petition had gained On January 21st, 2003, the bolivar closed at a record low - widespread circulation. One million signatures had been Bs1853/6. The next day President Hugo Chvez suspended collected. Although the government ruled that the peti- the sale of dollars for two weeks. Nearly instantaneously, tion was invalid, it had used the list of signatures to cre- an unofficial or black market for the exchange of Venezu- ate a database of names and social security numbers that elan bolivars for foreign currencies (primarily U.S. dollars) CADIVI utilized to cross-check identities on hard currency sprouted. As investors of all kinds sought ways to exit the Ven- requests. President Chvez was quoted as saying "Not one ezuelan market, or simply obtain the hard-currency needed more dollar for the putschits; the bolivars belong to the to continue to conduct their businesses (as was the case for people." Santiago's Alternatives Santiago had little luck obtaining dollars via CADIVI to pay for his imports. Because he had signed the petition call- ing for President Chvez's removal, he had been listed in the CADIVI database as anti-Chvez, and now could not obtain permission to exchange bolivar for dollars. The transaction in question was an invoice for $30,000 in pharmaceutical products from his U.S.-based supplier. Santiago intended to resell these products to a large Ven- ezuelan customer who would distribute the products. This transaction was not the first time that Santiago had been forced to search out alternative sources for meeting his U.S. dollar obligations. Since the imposition of capital con- trols, his search for dollars had become a weekly activity for Santiago. In addition to the official process -- through CADIVI - he could also obtain dollars through the gray or black markets. The Gray Market: CANTV Shares In May 2003, three months following the implementation of the exchange controls, a window of opportunity had opened up for Venezuelans- an opportunity that allowed investors in the Caracas stock exchange to avoid the tight foreign exchange curbs. This loophole circumvented the government-imposed restrictions by allowing investors to purchase local shares of the leading telecommunications company CANTV on the Caracas' bourse, and to then convert those shares into dollar-denominated American Depositary Receipts (ADR) traded on the NYSE. The sponsor for CANTV ADRs on the NYSE was the Bank of New York, the leader in ADR sponsorship and management in the U.S. The Bank of New York had sus- pended trading in CANTV ADRs in February after the passage of the Decree, wishing to determine the legality of trading under the new Venezuelan currency controls. On May 26th, after concluding that trading was indeed legal under the Decree, trading resumed in CANTV shares. CANTV's share price and trading volume both soared in the following week. The share price of CANTV quickly became the primary method of calculating the implicit gray market exchange rate. For example, CANTV shares closed at Bs7945/share on the Caracas bourse on February 6, 2004. That same day, CANTV ADRs closed in New York at $18.84/ADR. Each New York ADR was equal to seven shares of CANTV in Caracas. The implied gray market exchange rate was then calculated as follows: Implicit Gray _ 7 x Bs7945/Share Bs2952/$ Market Rate $18.84/ADR The official exchange rate on that same day was Bs1598/$. This meant that the gray market rate was quoting the bolivar about 46% weaker against the dollar than what the Venezuelan government officially declared its currency to be worth. Exhibit A illustrates both the official exchange rate and the gray market rate (calculated using CANTV shares) for the January 2002 to March 2004 period. The divergence between the official and gray market rates beginning in February 2003 coincided with the imposition of capital controls. The Black Market A third method of obtaining hard currency by Venezuelans was through the rapidly expanding black market. The black market was, as is the case with black markets all over the world, essentially unseen and illegal. It was, however, quite sophisticated, using the services of a stockbroker or banker in Venezuela who simultaneously held U.S. dollar accounts offshore. The choice of a black market broker was a critical one; in the event of a failure to complete the transaction properly there was no legal recourse. If Santiago wished to purchase dollars on the black mar- ket, he would deposit bolivars in his broker's account in Venezuela. The agreed upon black market exchange rate was determined on the day of the deposit, and usually was within a 20% band of the gray market rate derived from the CANTV share price. Santiago would then be given access to a dollar-denominated bank account outside of Venezu- ela in the agreed amount. The transaction took, on average, two business days to settle. The unofficial black market rate was Bs3300/$. In early 2004 President Chvez had asked Venezuela's Central Bank to give him a little billion" millardito - of its $21 billion in foreign exchange reserves. Chvez argued that the money was actually the people's, and he wished to invest some of it in the agricultural sector. The Central Bank refused. Not to be thwarted in its search for funds, the Chvez government announced on February 9, 2004, another devaluation. The bolivar was devalued 17%, falling in official value from Bs1600/$ to Bs1920$ (see Exhibit A). 3.500 Gray Market Exchange Rate 3,000 2,500 Capital controls are instituted on January 22, 2003, to stop the capital outflows from Venezuela 2,000 Official Rate The bolivar is devalued once again on Feb 14.2004, from Es1600/$ to Bs1920/5 1,500 1,000 Two weeks later, on February 5, 2003, Venezuela announces the imposition of strict capital controls, the formation of the CADIVI to manage the currency and the fixing of the bolivar at Bs1600/$ 500 4-Jan-02 4-Aug-03 4-Sep-03 4-Dec-03 4-Jan-04 4-Oct-03 4-Nov-03 4-Feb-04 4-Mar-04 With all Venezuelan exports of oil being purchased in U.S. dollars, the devaluation of the bolivar meant that the coun- try's proceeds from oil exports grew by the same 17% as the devaluation itself. The Chvez government argued that the devaluation was necessary because the bolivar was a variable that cannot be kept frozen, because it prejudices exports and pressures the balance of payments" according to Finance Minister Tobias Nobriega. Analysts, however, pointed out that Venezuelan government actually had significant control over its balance of payments: oil was the primary export, the government maintained control over the offi cial access to hard currency necessary for imports, and the Central Bank's foreign exchange reserves were now over $21 billion 4-Feb-02 4-Mar-02 4-Apr-02 4-May-02 4-Jun-02 4-Jul-02 4-Aug-02 4-Sep-02 4-Oct-02 4-Nov-02 4-Dec-02 4-Jan-03 4-Feb-03 4-Mar-03 4-Apr-03 4-May-03 4-Jun-03 4-Jul-03 an extra 500 bolivars per dollar to expedite his request. Santiago noted with a smile that "the Chvistas need to make money too." The noise from the street seemed to be dying with the sun. It was time for Santiago to make some decisions. None of the alternatives were bonita, but if he was to preserve his business, bolivars-at some price -- had to be obtained. Mini-Case Questions 1. Why does a country like Venezuela impose capital controls? 2. In the case of Venezuela, what is the difference between the gray market and the black market? 3. Create a financial analysis of Santiago's choices. Use it to recommend a solution to his problem. Post Script. Although President Chvez died in 2013, and the Venezuelan bolivar has been devalued repeatedly and renamed the bolivar fuerte since the time of this case, it remains a currency that is overvalued by its government and restricted in its exchange, and therefore continues to lead a double life-officially and unofficially. Time Was Running Out Santiago received confirmation from CADIVI on the after noon of March 10th that his latest application for dollars was approved and that he would receive $10,000 at the official exchange rate of Bs 1920/$. Santiago attributed his good fortune to the fact that he paid a CADIVI insider