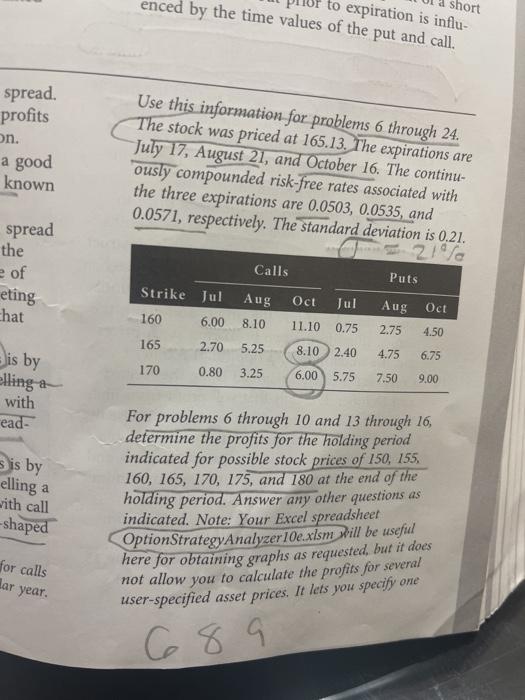

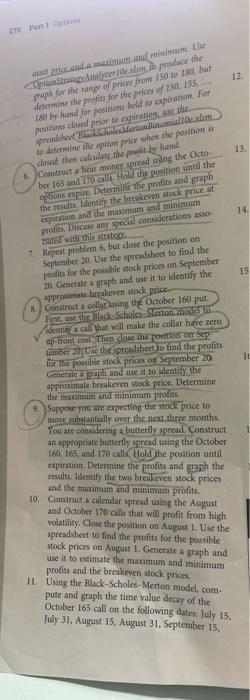

to expiration is influ- enced by the time values of the put and call. Short spread. profits on. a good known Use this information for problems 6 through 24. The stock was priced at 165.13. The expirations are July 17, August 21, and October 16. The continu- ously compounded risk-free rates associated with the three expirations are 0.0503, 0.0535, and 0.0571, respectively. The standard deviation is 0.21. spread the e of eting 21/0 Calls Puts Strike Jul Aug Oct Jul Aug Oct Chat 160 6.00 8.10 11.10 0.75 2.75 4.50 165 2.70 5.25 8.10 is by 2.40 4.75 6.75 170 0.80 3.25 6.00 5.75 7.50 9.00 elling a with ead- s is by elling a with call -shaped For problems 6 through 10 and 13 through 16, determine the profits for the holding period indicated for possible stock prices of 150, 155 160, 165, 170, 175, and 180 at the end of the holding period. Answer any other questions as indicated. Note: Your Excel spreadsheet OptionStrategy Analyzer10e.xlsm will be useful here for obtaining graphs as requested, but it does not allow you to calculate the profits for several user-specified asset prices. It lets you specify one C for calls dar year. 20 O 12 12 Optic Salomelerde.com produce the rapt for the range of prices from 150 to 180 but determine the profils for the price of 12 135... 180 by hand for position held to expiration. For positions dod prior to expiration the praefertainemexom to determine the option price when the position deset then cawlate the profit by hand. & Construct a sur money spread using the Octo- ber 165 and 70call Hold the position until the options expire. Determine the profits and graph the results Identify the breakeven stock price at exploration and the maximum and minimum prot Discuss any special considerations asse 14. 15 with this strategy 7. Repeat problem & but dose the position on September 20. Use the spreadsheet to find the profits for the possible stock prices on September 20 Generate a graph and use it to identify the approximate bakeven stock price & Construct a callausing the October 160 put First, the Black-Schole-Martender to identir a call that will make the collar have zero ofront cost. Then close the rositore e 20 Use the spreadsheet lo find the profits for the possible stock prices of September 20 Generate a graph and use it to identify the approximate breakeven stock price. Determine the minimum and minimum prodits. 9. Suppose you are aspecting the stock price to move obstantially over the next three months You are considering a butterfly spread. Construct an appropriate butterfly spread using the October 160, 165, and 170 calls. Hold the position until 10 expiration Determine the profits and graph the results. Identify the two breakeven stock prices and the maximum and minimum profits. 10. Construct a calendar spread using the August and October 170 calls that will profit from high volatility. Close the position on August 1. Use the spreadsheet to find the profits for the possible stock prices on August 1. Generate a graph and use it to estimate the maximum and minimum profits and the breakeven stock prices 11. Using the Black-Scholes-Merton model, com pute and graph the time value decay of the October 165 call on the following dates: July 15, July 31. August 15, August 31. September 15, to expiration is influ- enced by the time values of the put and call. Short spread. profits on. a good known Use this information for problems 6 through 24. The stock was priced at 165.13. The expirations are July 17, August 21, and October 16. The continu- ously compounded risk-free rates associated with the three expirations are 0.0503, 0.0535, and 0.0571, respectively. The standard deviation is 0.21. spread the e of eting 21/0 Calls Puts Strike Jul Aug Oct Jul Aug Oct Chat 160 6.00 8.10 11.10 0.75 2.75 4.50 165 2.70 5.25 8.10 is by 2.40 4.75 6.75 170 0.80 3.25 6.00 5.75 7.50 9.00 elling a with ead- s is by elling a with call -shaped For problems 6 through 10 and 13 through 16, determine the profits for the holding period indicated for possible stock prices of 150, 155 160, 165, 170, 175, and 180 at the end of the holding period. Answer any other questions as indicated. Note: Your Excel spreadsheet OptionStrategy Analyzer10e.xlsm will be useful here for obtaining graphs as requested, but it does not allow you to calculate the profits for several user-specified asset prices. It lets you specify one C for calls dar year. 20 O 12 12 Optic Salomelerde.com produce the rapt for the range of prices from 150 to 180 but determine the profils for the price of 12 135... 180 by hand for position held to expiration. For positions dod prior to expiration the praefertainemexom to determine the option price when the position deset then cawlate the profit by hand. & Construct a sur money spread using the Octo- ber 165 and 70call Hold the position until the options expire. Determine the profits and graph the results Identify the breakeven stock price at exploration and the maximum and minimum prot Discuss any special considerations asse 14. 15 with this strategy 7. Repeat problem & but dose the position on September 20. Use the spreadsheet to find the profits for the possible stock prices on September 20 Generate a graph and use it to identify the approximate bakeven stock price & Construct a callausing the October 160 put First, the Black-Schole-Martender to identir a call that will make the collar have zero ofront cost. Then close the rositore e 20 Use the spreadsheet lo find the profits for the possible stock prices of September 20 Generate a graph and use it to identify the approximate breakeven stock price. Determine the minimum and minimum prodits. 9. Suppose you are aspecting the stock price to move obstantially over the next three months You are considering a butterfly spread. Construct an appropriate butterfly spread using the October 160, 165, and 170 calls. Hold the position until 10 expiration Determine the profits and graph the results. Identify the two breakeven stock prices and the maximum and minimum profits. 10. Construct a calendar spread using the August and October 170 calls that will profit from high volatility. Close the position on August 1. Use the spreadsheet to find the profits for the possible stock prices on August 1. Generate a graph and use it to estimate the maximum and minimum profits and the breakeven stock prices 11. Using the Black-Scholes-Merton model, com pute and graph the time value decay of the October 165 call on the following dates: July 15, July 31. August 15, August 31. September 15