Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To explain personal consumption (CONS) measured in dollars, data is collected for INC: personal income in dollars CRDTLIM: $1 plus the credit limit in

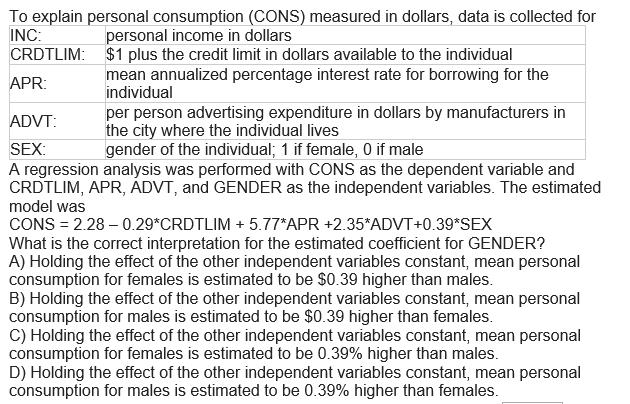

To explain personal consumption (CONS) measured in dollars, data is collected for INC: personal income in dollars CRDTLIM: $1 plus the credit limit in dollars available to the individual APR: mean annualized percentage interest rate for borrowing for the individual ADVT: per person advertising expenditure in dollars by manufacturers in the city where the individual lives SEX: gender of the individual; 1 if female, 0 if male A regression analysis was performed with CONS as the dependent variable and CRDTLIM, APR, ADVT, and GENDER as the independent variables. The estimated model was CONS = 2.28-0.29* CRDTLIM +5.77*APR +2.35*ADVT+0.39*SEX What is the correct interpretation for the estimated coefficient for GENDER? A) Holding the effect of the other independent variables constant, mean personal consumption for females is estimated to be $0.39 higher than males. B) Holding the effect of the other independent variables constant, mean personal consumption for males is estimated to be $0.39 higher than females. C) Holding the effect of the other independent variables constant, mean personal consumption for females is estimated to be 0.39% higher than males. D) Holding the effect of the other independent variables constant, mean personal consumption for males is estimated to be 0.39% higher than females.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

As we can see from the equation CONS 228 029CRDTLIM 577APR 235ADVT039SEX Consumption in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started