Answered step by step

Verified Expert Solution

Question

1 Approved Answer

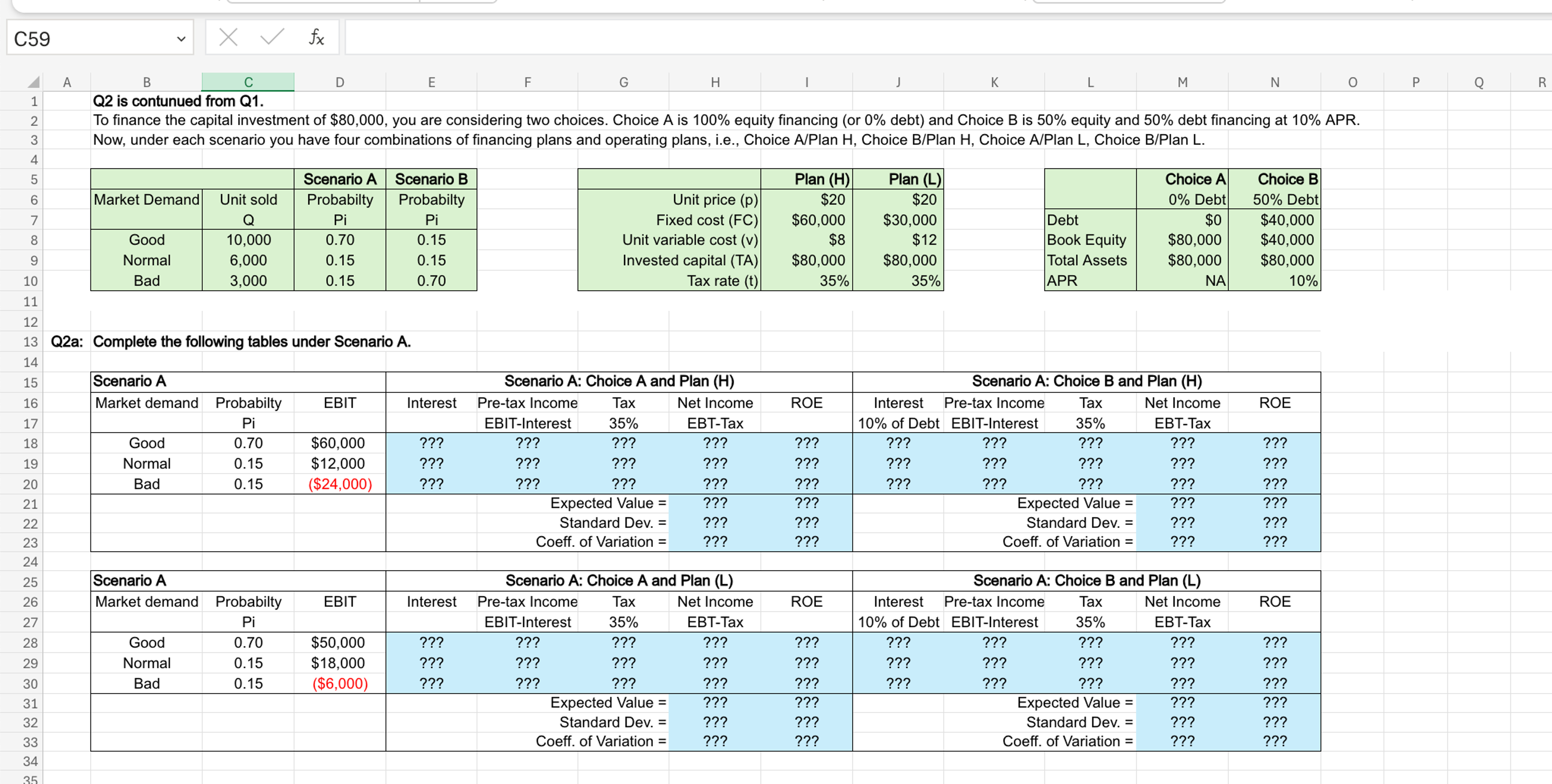

To finance the capital investment of $ 8 0 , 0 0 0 , you are considering two choices. Choice A is 1 0 0

To finance the capital investment of $ you are considering two choices. Choice A is equity financing or debt and Choice B is equity and debt financing at APR.

Qc: Suppose that you are relatively less riskaverse manager implying that you are willing to take more risk to get higher expected return.

Which combination of plans should be selected under Scenario A and why?

Qd: Suppose that you are relatively more riskaverse manager implying that your decision is more likely to be based on the CV

Which combination of plans should be selected under Scenario A and why?

Qe: Suppose that you are relatively less riskaverse manager implying that you are willing to take more risk to get higher expected return.

Which combination of plans should be selected under Scenario B and why?

Qf: Suppose that you are relatively more riskaverse manager implying that your decision is more likely to be based on the CV

Which combination of plans should NOT be selected under Scenario B and why? Qg: Compute the DFL of four combinations of plans and choices at different levels of EBIT.

Explain why all the DFL for Choice A are the same at and why all the DFLs are the same for Plans H&L

Now, under each scenario you have four combinations of financing plans and operating plans, ie Choice APlan H Choice BPlan H Choice APlan L Choice BPlan L

Qa: Complete the following tables under Scenario A

Qb: Complete the following tables under Scenario B

Qc: Suppose that you are relatively less riskaverse manager implying that you are willing to take more risk to get higher expected return.

Which combination of plans should be selected under Scenario A and why?

Qd: Suppose that you are relatively more riskaverse manager implying that your decision is more likely to be based on the CV

Which combination of plans should be selected under Scenario A and why?

Qe: Suppose that you are relatively less riskaverse manager implying that you are willing to take more risk to get higher expected return.

Which combination of plans should be selected under Scenario B and why?

Qf: Suppose that you are relatively more riskaverse manager implying that your decision is more likely to be based on the CV

Which combination of plans should NOT be selected under Scenario B and why?

Qg: Compute the DFL of four combinations of plans and choices at different levels of EBIT. Explain why all the DFL for Choice A are the same at and why all the DFLs are the same for Plans H&L

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started