Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To finance the project, the company would need to take a one-million dollar loan at 8% interest rate p.a. from HSBC over the life of

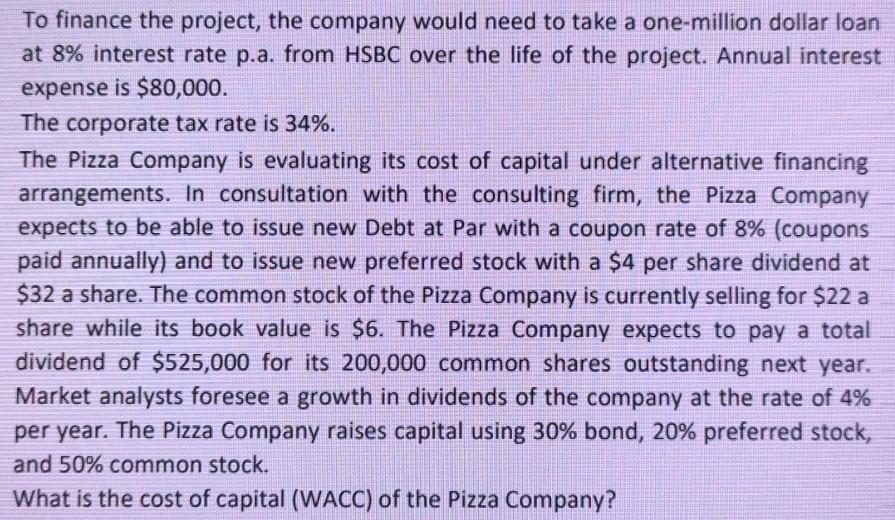

To finance the project, the company would need to take a one-million dollar loan at 8% interest rate p.a. from HSBC over the life of the project. Annual interest expense is $80,000. The corporate tax rate is 34%. The Pizza Company is evaluating its cost of capital under alternative financing arrangements. In consultation with the consulting firm, the Pizza Company expects to be able to issue new Debt at Par with a coupon rate of 8% (coupons paid annually) and to issue new preferred stock with a $4 per share dividend at $32 a share. The common stock of the Pizza Company is currently selling for $22 a share while its book value is $6. The Pizza Company expects to pay a total dividend of $525,000 for its 200,000 common shares outstanding next year. Market analysts foresee a growth in dividends of the company at the rate of 4% per year. The Pizza Company raises capital using 30% bond, 20% preferred stock, and 50% common stock. What is the cost of capital (WACC) of the Pizza Company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started