To implement the ABC system, ECSR divided indirect costs into 12 activity cost pools, and selected activity allocation bases for each of the activity pools. ECSR was careful to incorporate the four-level hierarchy of costs into their ABC system; the split of estimated 2020 indirect costs into the four-level hierarchy is below: Unit-level activities $3,460,000 Batch-level activities $2,990,000 Product-level activities $2,640,000 Facility-level (sustaining) activities $1,563,300 The ABC system was extended to customer-profitability analysis. Below is the Whale Chart prepared using estimated 2020 data: Customers, from best to worst 11.1 (10 points). What is the value A on the vertical axis of the whale chart? Provide the exact amount in dollars and an explanation. 11.2 [5 points]. The controller mentioned the "volume bias" in her report from the executive education seminar. Explain how the volume bias affects ECSR's traditional reporting system? What are the consequences of for ECSR, since it is selling services, not products? 1010.1 [5 points]. Explain to the consultant and the CFO why client profitability in the one-two-three plan worsens in 2020. 10.2 [10 points]. One issue that concerns our CFO is that our web designers have a lot of free time between client assignments. Compute the costs of web designers' excess capacity in 2019 and in 2020. 11. ECSR Legal Solutions provides legal services to large global firms. The company's controller attended an executive education seminar on internal reporting in January 2020. After the controller returned, she called a meeting of the top management team to convince them to enhance the company's internal reporting: We make so many decisions uninformed or misinformed about our company's economic reality. We price services; we bid on client requests; we evaluate performance of legal and other staff; we try to improve current client profitability; we determine the right level of service to clients; etc; etc. No surprise our income is so low. If we want to make good decisions, we must have good information. I also heard about "volume bias" at the seminar; I think that's an issue for us. The company's CFO, responsible for internal reporting, agreed: "One thing in particular that has bothered me over the years is that some of our clients are incredibly needy; they demand services and hand-holding for which they do not expect to pay. Other clients buy our services, and they don't bother us at all. Yet we do not differentiate between easy and needy clients. Let's develop the new system." The CFO and the controller led the new system development efforts. The company decided to put in place an activity-based-costing (ABC) system and to extend it to client-profitability analysis. The ABC system would follow all of the ABC best practices we discussed in class (it would not, however, incorporate practical capacity). For 2020, the new system would be used in parallel to the old traditional normal absorption costing system, which allocated indirect costs to client engagements using revenues as the allocation base. Below are ECSR's estimated 2020 income statement and a sample engagement profitability report using the traditional system. ECSR Legal Solutions, 2020 Estimated Income ABC Corp Engagement 2020-02 Revenues $18,690,000 Engagement revenue $640,000 Costs: Engagement costs: Legal professionals $7,460,000 Attributable professionals $220,000 Other professionals 2,990,000 Other attributable 48,000 Office rents 2,340,000 Allocation of indirect costs 364,800 Information technology 1,860,000 632,800 Other costs 3,660,000 Engagement income $7,200 18,310,000 Net operating income $380,000 Note: Most of the Legal Professionals costs are directly attributed to individual client engagements; most of the other costs are indirect.

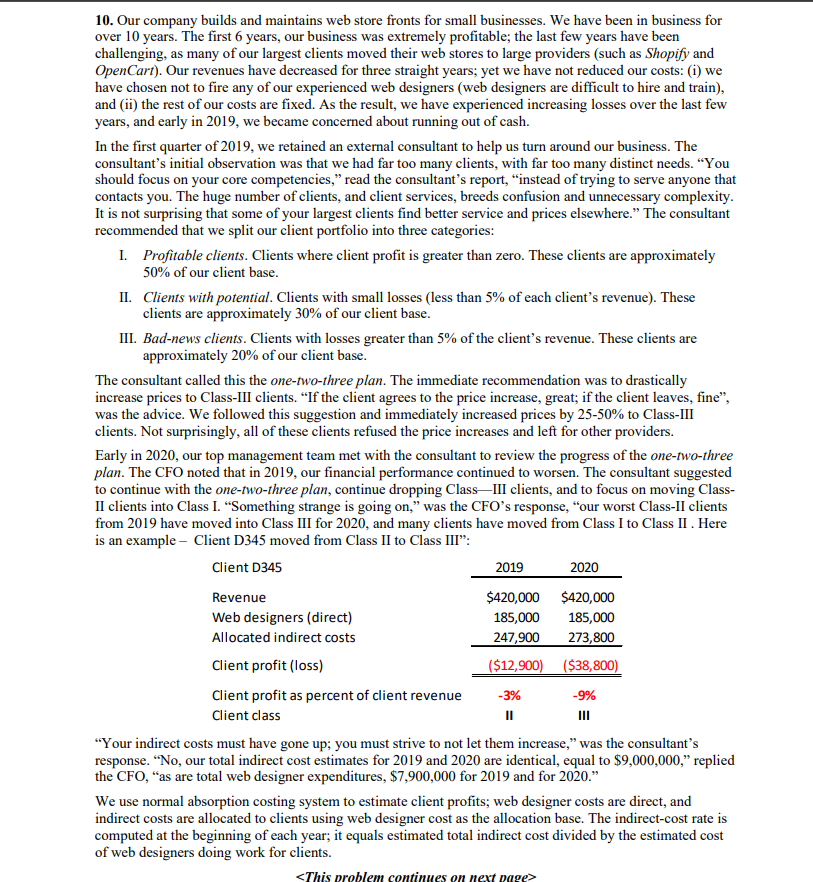

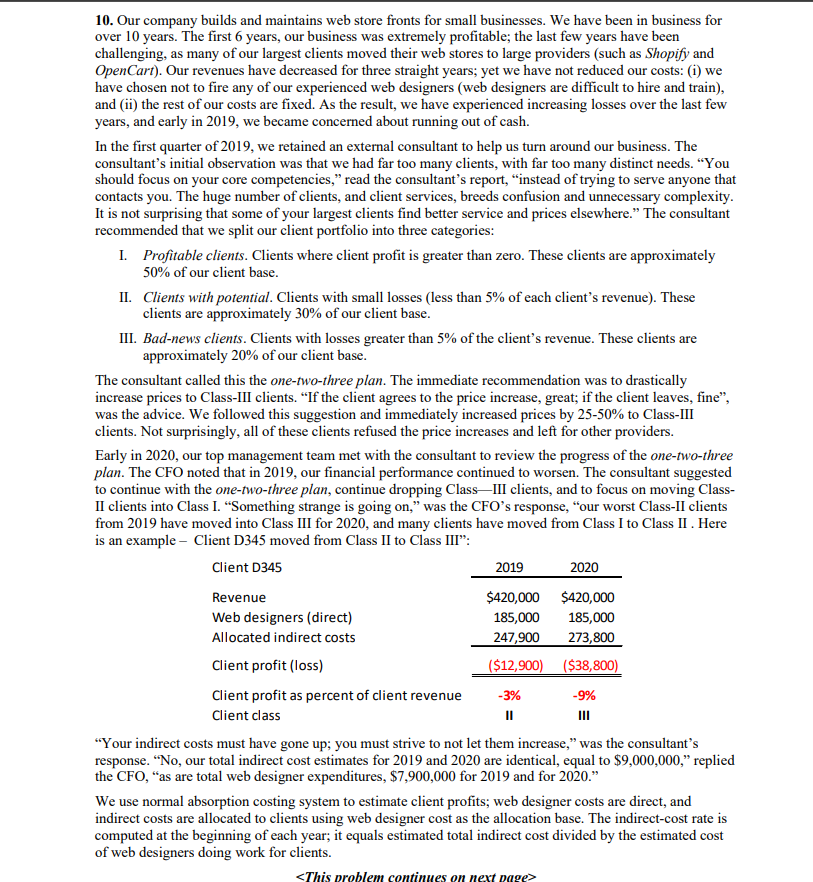

10. Our company builds and maintains web store fronts for small businesses. We have been in business for over 10 years. The first 6 years, our business was extremely profitable; the last few years have been challenging, as many of our largest clients moved their web stores to large providers (such as Shopify and OpenCart). Our revenues have decreased for three straight years; yet we have not reduced our costs: (i) we have chosen not to fire any of our experienced web designers (web designers are difficult to hire and train), and (ii) the rest of our costs are fixed. As the result, we have experienced increasing losses over the last few years, and early in 2019, we became concerned about running out of cash. In the first quarter of 2019, we retained an external consultant to help us turn around our business. The consultant's initial observation was that we had far too many clients, with far too many distinct needs. "You should focus on your core competencies, " read the consultant's report, "instead of trying to serve anyone that contacts you. The huge number of clients, and client services, breeds confusion and unnecessary complexity. It is not surprising that some of your largest clients find better service and prices elsewhere." The consultant recommended that we split our client portfolio into three categories: I. Profitable clients. Clients where client profit is greater than zero. These clients are approximately 50% of our client base. II. Clients with potential. Clients with small losses (less than 5% of each client's revenue). These clients are approximately 30% of our client base. III. Bad-news clients. Clients with losses greater than 5% of the client's revenue. These clients are approximately 20% of our client base. The consultant called this the one-two-three plan. The immediate recommendation was to drastically increase prices to Class-III clients. "If the client agrees to the price increase, great; if the client leaves, fine", was the advice. We followed this suggestion and immediately increased prices by 25-50% to Class-III clients. Not surprisingly, all of these clients refused the price increases and left for other providers. Early in 2020, our top management team met with the consultant to review the progress of the one-two-three plan. The CFO noted that in 2019, our financial performance continued to worsen. The consultant suggested to continue with the one-two-three plan, continue dropping Class-III clients, and to focus on moving Class- II clients into Class I. "Something strange is going on," was the CFO's response, "our worst Class-II clients from 2019 have moved into Class III for 2020, and many clients have moved from Class I to Class II . Here is an example - Client D345 moved from Class II to Class III": Client D345 2019 2020 Revenue $420,000 $420,000 Web designers (direct) 185,000 185,000 Allocated indirect costs 247,900 273,800 Client profit (loss) ($12,900) ($38,800) Client profit as percent of client revenue -3% -9% Client class III "Your indirect costs must have gone up; you must strive to not let them increase," was the consultant's response. "No, our total indirect cost estimates for 2019 and 2020 are identical, equal to $9,000,000," replied the CFO, "as are total web designer expenditures, $7,900,000 for 2019 and for 2020." We use normal absorption costing system to estimate client profits; web designer costs are direct, and indirect costs are allocated to clients using web designer cost as the allocation base. The indirect-cost rate is computed at the beginning of each year; it equals estimated total indirect cost divided by the estimated cost of web designers doing work for clients