Question

You have received an order of $ 1 million for export of capital goods to USA. What are the different ways of ensuring that there

You have received an order of $ 1 million for export of capital goods to USA. What are the different ways of ensuring that there is no risk of default in export proceeds to be received? Q2. You have received an export order from USA for value of USD 800,000 for supply of handicrafts. In terms of the market practice, buyer wants 90 days credit. Analyse various options for covering your commercial risk on the buyer and also in raising finance from any of the financial institutions. Following options are available to you. Find out the best option out of the following three options.

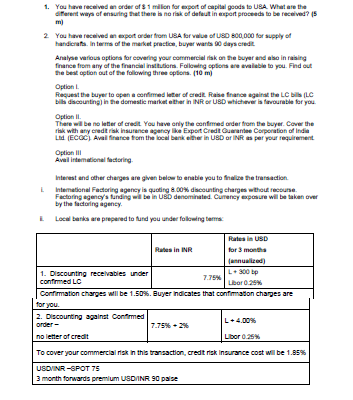

Option I. Request the buyer to open a confirmed letter of credit. Raise finance against the LC bills (LC bills discounting) in the domestic market either in INR or USD whichever is favourable for you. Option II. There will be no letter of credit. You have only the confirmed order from the buyer. Cover the risk with any credit risk insurance agency like Export Credit Guarantee Corporation of India Ltd. (ECGC). Avail finance from the local bank either in USD or INR as per your requirement. Option III Avail international factoring. Interest and other charges are given below to enable you to finalize the transaction. i. International Factoring agency is quoting 8.00% discounting charges without recourse. Factoring agency's funding will be in USD denominated. Currency exposure will be taken over by the factoring agency. ii. Local banks are prepared to fund you under following terms: Rates in INR Rates in USD for 3 months (annualized) 1. Discounting receivables under confirmed LC 7.75% L + 300 bp Libor 0.25% Confirmation charges will be 1.50%. Buyer indicates that confirmation charges are for you. 2. Discounting against Confirmed order - 7.75% + 2% L + 4.00% no letter of credit Libor 0.25% To cover your commercial risk in this transaction, credit risk insurance cost will be 1.85% USD/INR -SPOT 75 3 month forwards premium USD/INR 90 paise

1. You have received an order of $1 million for export of capital goods to USA. What are the different ways of ensuring that there is no risk of default in export proceeds to be received? (5 m) 2. You have received an export order from USA for value of USD 800,000 for supply of handicrafts. In terms of the market practice, buyer wants 90 days credit Analyse various options for covering your commercial risk on the buyer and also in raising finance from any of the financial institutions. Following options are available to you. Find out the best option out of the following three options. (10m) Option I Request the buyer to open a confirmed letter of credit. Raise france against the LC bills (LC bills discounting) in the domestic market either in INR or USD whichever is favourable for you. Option II. There will be no letter of credit. You have only the confirmed order from the buyer. Cover the risk with any credit risk insurance agency like Export Credit Guarantee Corporation of India Ltd (ECOC) Aval finance from the local bank either in USD or INR as per your requirement Option III Avail international factoring. Interest and other charges are given below to enable you to finalize the transaction. International Factoring agency is quoting 8.00% discounting charges without recourse. Factoring agency's funding will be in USD denominated. Cumency exposure will be taken over by the factoring agency. Local banks are prepared to fund you under following terms: Rates in USD Rates in INR for 3 months (annualized) 1. Discounting receivables under L+300 bp 7.75% confirmed LC Libor 0.25% Confirmation charges will be 1.50%. Buyer indicates that confirmation charges are 2. Discounting against Confirmed for you. order- no letter of credit 7.75%+2% L+4.00% Libor 0.25% To cover your commercial risk in this transaction, credit risk Insurance cost will be 1.85% USD/INR-SPOT 75 3 month forwards premium USD/INR 90 paise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started