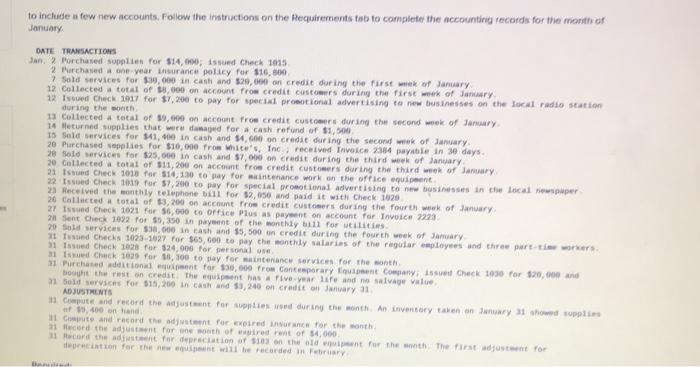

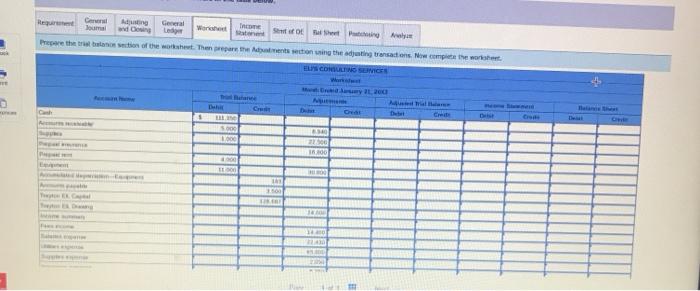

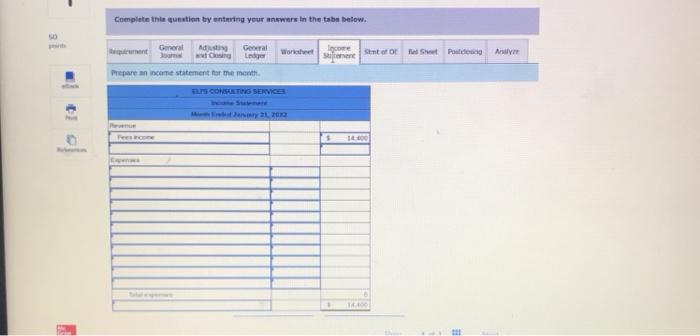

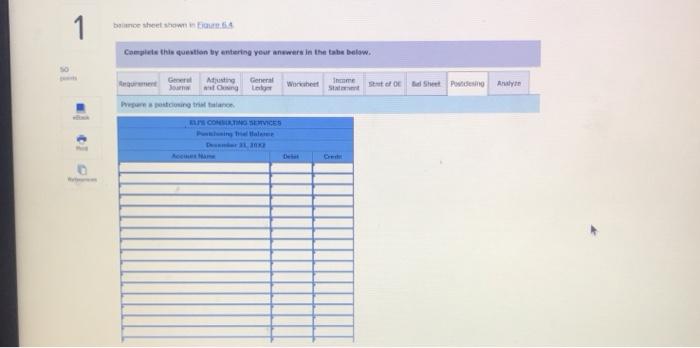

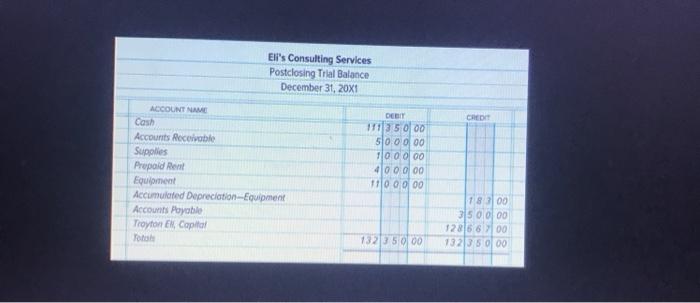

to include a few new accounts. Follow the instructions on the Requirements tab to complete the accounting records for the month of January DATE TRANSACTIONS Jan.2 Purchased supplies for $14,000, issued Check 2015 2 Purchased one year insurance policy for $16,000 > Sold Services for $30,000 in cash and $20,000 on credit during the first of January 12 Collected a total of 35,000 on account from credit customer's during the first week of January 12 Issued Check 1917 for $7,200 to pay for special promotional advertising to new businesses on the local radio station during the month 13 Collected a total of 39,000 cc from credit cuts during the second week of January 14 Heturned supplies that were damaged for a cash refund of $1,500 15 Sold services for $11,00 in cash and 4,600 0 credit during the second week of January 20 Purchased applies for $10,000 from whites, Inc received invoice 2384 payable in 30 days 20 Sold Services for $25,000 in cash and 57,000 on credit during the third week of January 20. Collected a total of 311,200 on account froe credit customers during the third week of January 21 Issued Check 1018 for $14,130 to pay for maintenance work on the office equipent 22 Issued Check 1019 fur 57,200 to pay for special promotional advertising to new businesses in the local newspaper 23 Received the monthly telephone bill for $2,050 and paid it with Check 1020 26 Collected a total of 13,200 on account Pro credit customers during the fourth week of January 27 Issued Check 1021 for $6,000 to Office Plus payent on account for Invoice 7223 28 Sent Check 1992 for $5,350 in payment of the monthly bill for utilities 20 Sold Services for $3,000 in cash and $5,500 on credit during the fourth week of January 11 red Checks 1023 1027 for $65,600 to pay the monthly salaries of the regular employees and three part-time workers 31 Issued Check 1028 for $24,000 for personal use 31 med Chuck 1929 for $100 to pay for maintenance services for the month 11 Purchased attori piatto $30,000 from Contemporary Kelle company issot Clack 1000 for $20,000 and bought the rest on credit the equipment has Five-year life and no salvage value 21 Bold services for $15,200 in cash and $3,240 on credit on January 11 ADJUSTMENTS Computer and record the adjustment for supplies during the month An inventory taken on January 31 showed supplies 400 on and Compute and record the dent for cred in for the month 31 Record the adjust for one month of wardront of $4,000 cord the adjust for depreciation of the old want for the month The First adjust for preciation for the went will be recorded in February Requr Care Joumi Ang ing Geral Led Income Batanen Prepare the transition of the most. Then are the song the ingredosNo comment ECONO SENO Daher he 30 10 100 3500 Complete the constien by entering your wars in the tabu below. Bpment General Ad General Sent for Pad Am Prepare an income statement for me month ELIS CONSTING SERVICE 100 1 balance sheet snow Complete the question by entering your answers in the the below. & G Atesting General Theme It of the Po Any ugares para tener CONTINO SERVICES De fo 1 Analye: Aswer the questions on the Analyze toto compare the day 31 bolonce sheet you prepared with the December 31 bence sheet shown in Flore 64 50 18 Complete this question by entering your answers in the tabs below. Gew Adjusting General Jo Income Worksheet antong Stof Bol Set Posting Analyse 1. General Ledger tabe Enter the account balances for mary 1, 2012 from the outcosing trial balance prepared on 2. General Journal fabr Analyse each of the transactions listed for January and record it in the general journal 3. General Ledger tab: Post the transactions to the general ledger account 4. Wer wheet tabi Worksheet tabs Prepare the Adjustments section of the worksheet using the adjusting transactions 7. Income Statement tab Prepare an income statement for the month, 8. stmt or or tabr Prepare a statement of owner's equity 10. Adjusting and closing tab: Record the adjusting entries and the desing entries in the general puma 11. General Ledger tab: Post the dating entries and the closing entries to the general per accounts 12. Port Closing the prepare a posting a balance Eli's Consulting Services Postclosing Trial Balance December 31, 20x1 CREDIT ACCOUNT NAME Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Equipment Accounts Payable Troyton El Capital Foto DEBIT 171 35 000 510.0 000 100 000 400.000 11100 000 1 8300 315 00 00 12815 600 132135 000 13235 000 Required: 1. General Ledger tab Enter the account balances for January 1, 20x2 from the postclosing tro tance prepared on December 31 2. General Journal tats. Analyze each of the transactions listed for January and record it in the general joumai. 3. General Ledger tats: Post the transactions to the general ledger accounts. 4. Worksheettab: Prepare the trial Balance section of the worksheet s. Worksheet tab: Prepare the Adjustments section of the worksheet using the adjusting transactions 6. Worksheet tab: Complete the worksheet 7. Income Statement to Prepare an income statement for the months 3. Som of Olta Prepare a statement of owner's equity 9. Balance Sheetab Prepare a balance sheet 10. Adjusting and closing the Record the adjusting entries and the closing entries in the general joumat 11. General Ledger tab Post the adjusting entries and the closing entries to the general ledger accounts 12. Post Closing tab Prepare a postclosing the balance Analye: Answer the questions on the Analyze tab to compare the January 31 balance sheet you prepared with the December 31 balance sheet shown in UGG to include a few new accounts. Follow the instructions on the Requirements tab to complete the accounting records for the month of January DATE TRANSACTIONS Jan.2 Purchased supplies for $14,000, issued Check 2015 2 Purchased one year insurance policy for $16,000 > Sold Services for $30,000 in cash and $20,000 on credit during the first of January 12 Collected a total of 35,000 on account from credit customer's during the first week of January 12 Issued Check 1917 for $7,200 to pay for special promotional advertising to new businesses on the local radio station during the month 13 Collected a total of 39,000 cc from credit cuts during the second week of January 14 Heturned supplies that were damaged for a cash refund of $1,500 15 Sold services for $11,00 in cash and 4,600 0 credit during the second week of January 20 Purchased applies for $10,000 from whites, Inc received invoice 2384 payable in 30 days 20 Sold Services for $25,000 in cash and 57,000 on credit during the third week of January 20. Collected a total of 311,200 on account froe credit customers during the third week of January 21 Issued Check 1018 for $14,130 to pay for maintenance work on the office equipent 22 Issued Check 1019 fur 57,200 to pay for special promotional advertising to new businesses in the local newspaper 23 Received the monthly telephone bill for $2,050 and paid it with Check 1020 26 Collected a total of 13,200 on account Pro credit customers during the fourth week of January 27 Issued Check 1021 for $6,000 to Office Plus payent on account for Invoice 7223 28 Sent Check 1992 for $5,350 in payment of the monthly bill for utilities 20 Sold Services for $3,000 in cash and $5,500 on credit during the fourth week of January 11 red Checks 1023 1027 for $65,600 to pay the monthly salaries of the regular employees and three part-time workers 31 Issued Check 1028 for $24,000 for personal use 31 med Chuck 1929 for $100 to pay for maintenance services for the month 11 Purchased attori piatto $30,000 from Contemporary Kelle company issot Clack 1000 for $20,000 and bought the rest on credit the equipment has Five-year life and no salvage value 21 Bold services for $15,200 in cash and $3,240 on credit on January 11 ADJUSTMENTS Computer and record the adjustment for supplies during the month An inventory taken on January 31 showed supplies 400 on and Compute and record the dent for cred in for the month 31 Record the adjust for one month of wardront of $4,000 cord the adjust for depreciation of the old want for the month The First adjust for preciation for the went will be recorded in February Requr Care Joumi Ang ing Geral Led Income Batanen Prepare the transition of the most. Then are the song the ingredosNo comment ECONO SENO Daher he 30 10 100 3500 Complete the constien by entering your wars in the tabu below. Bpment General Ad General Sent for Pad Am Prepare an income statement for me month ELIS CONSTING SERVICE 100 1 balance sheet snow Complete the question by entering your answers in the the below. & G Atesting General Theme It of the Po Any ugares para tener CONTINO SERVICES De fo 1 Analye: Aswer the questions on the Analyze toto compare the day 31 bolonce sheet you prepared with the December 31 bence sheet shown in Flore 64 50 18 Complete this question by entering your answers in the tabs below. Gew Adjusting General Jo Income Worksheet antong Stof Bol Set Posting Analyse 1. General Ledger tabe Enter the account balances for mary 1, 2012 from the outcosing trial balance prepared on 2. General Journal fabr Analyse each of the transactions listed for January and record it in the general journal 3. General Ledger tab: Post the transactions to the general ledger account 4. Wer wheet tabi Worksheet tabs Prepare the Adjustments section of the worksheet using the adjusting transactions 7. Income Statement tab Prepare an income statement for the month, 8. stmt or or tabr Prepare a statement of owner's equity 10. Adjusting and closing tab: Record the adjusting entries and the desing entries in the general puma 11. General Ledger tab: Post the dating entries and the closing entries to the general per accounts 12. Port Closing the prepare a posting a balance Eli's Consulting Services Postclosing Trial Balance December 31, 20x1 CREDIT ACCOUNT NAME Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Equipment Accounts Payable Troyton El Capital Foto DEBIT 171 35 000 510.0 000 100 000 400.000 11100 000 1 8300 315 00 00 12815 600 132135 000 13235 000 Required: 1. General Ledger tab Enter the account balances for January 1, 20x2 from the postclosing tro tance prepared on December 31 2. General Journal tats. Analyze each of the transactions listed for January and record it in the general joumai. 3. General Ledger tats: Post the transactions to the general ledger accounts. 4. Worksheettab: Prepare the trial Balance section of the worksheet s. Worksheet tab: Prepare the Adjustments section of the worksheet using the adjusting transactions 6. Worksheet tab: Complete the worksheet 7. Income Statement to Prepare an income statement for the months 3. Som of Olta Prepare a statement of owner's equity 9. Balance Sheetab Prepare a balance sheet 10. Adjusting and closing the Record the adjusting entries and the closing entries in the general joumat 11. General Ledger tab Post the adjusting entries and the closing entries to the general ledger accounts 12. Post Closing tab Prepare a postclosing the balance Analye: Answer the questions on the Analyze tab to compare the January 31 balance sheet you prepared with the December 31 balance sheet shown in UGG