Answered step by step

Verified Expert Solution

Question

1 Approved Answer

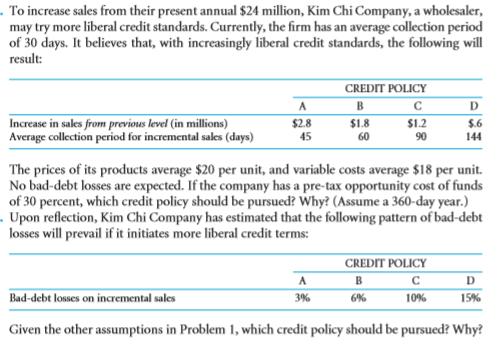

.To increase sales from their present annual $24 million, Kim Chi Company, a wholesaler, may try more liberal credit standards. Currently, the firm has

.To increase sales from their present annual $24 million, Kim Chi Company, a wholesaler, may try more liberal credit standards. Currently, the firm has an average collection period of 30 days. It believes that, with increasingly liberal credit standards, the following will result: Increase in sales from previous level (in millions) Average collection period for incremental sales (days) A $2.8 45 Bad-debt losses on incremental sales CREDIT POLICY B $1.8 60 $1.2 90 The prices of its products average $20 per unit, and variable costs average $18 per unit. No bad-debt losses are expected. If the company has a pre-tax opportunity cost of funds of 30 percent, which credit policy should be pursued? Why? (Assume a 360-day year.) Upon reflection, Kim Chi Company has estimated that the following pattern of bad-debt losses will prevail if it initiates more liberal credit terms: A 3% D $.6 144 CREDIT POLICY B 6% 10% Given the other assumptions in Problem 1, which credit policy should be pursued? Why? D 15%

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets think through this stepbystep Kim Chis current annual sales are 24 million They are considering ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started